Summary

- You need a 409A valuation to issue stock options to employees. Generally speaking, a lower 409A valuation is better than a high one – it typically has no impact on the valuation an investor will assign in your next financing round

- You have to get a new 409A valuation every 12 months, or after a new financing round closes. If you miss a deadline, you can get a 409A retroactively, but your board cannot approve employee options until this happens.

- If you use a cap table software platform like Carta, you may be able to get free 409As from them. Otherwise, each 409A typically costs $2,000+ for a startup.

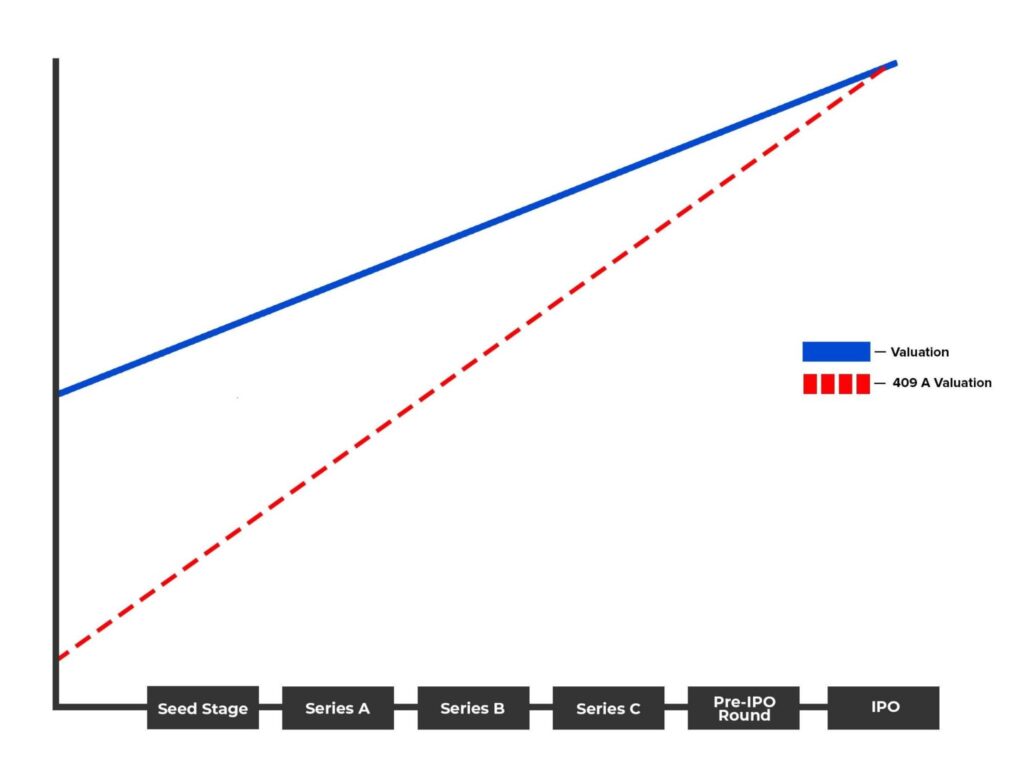

- Your first 409A will often produce a valuation that is, at most, ~20-30% of your last post-money valuation (dictated by investors in a financing round). After that, your 409A valuations will get closer and closer to your post-money valuation until the two are equal at the time of IPO

What is a 409A?

A 409A valuation is used by startups and other private companies to determine the price of stock options for their employees. It generally does not impact the valuation investors will assign to your business in a financing round. A lower 409A valuation means employees pay less to exercise their options and make more money when a successful exit occurs.

The difference between investor valuations and 409A valuations is largely due to the type of equity received by both parties. If you raise money from investors (VCs, angels, etc.), they are usually purchasing preferred equity. Employees and advisors, on the other hand, will typically receive options to purchase shares of common equity.

For various reasons, common equity is typically worth less than preferred equity while a company remains private. However, when a company exits (via M&A or IPO), preferred shares typically convert into common shares and are worth the same amount. For this reason, your 409A valuation should converge with your post-money valuation (assigned by investors in financing rounds) as your company gets closer and closer to an exit.

What is a fair benchmark for my company’s 409A?

There is no clear benchmark that applies to all 409As, but we can give anecdotal guidance. Often, the first 409A (at a pre-seed or seed stage) will be somewhere around 20-30% of your company’s post-money valuation, which is dictated by investors. With each subsequent 409A, the valuations should converge until they eventually are equal at the time of IPO.

When will my company need a 409A?

A 409A valuation needs to be performed when one of three things occurs:

- When your company issues stock options to employees for the first time

- Whenever you raise a new financing round, or another event occurs that affects the value of your company

- Annually, after the first valuation (409A share prices are only valid for 12 months)

How is a 409A valuation determined?

For most startups, 409As are determined based on the latest post-money valuation and the anticipated timing of an exit. The process for conducting a 409A valuation can be summarized as follows:

- Step 1: determine the value of the business as a whole (i.e., the “enterprise value”)

- For most startups, this is done using your latest financing round. If professional investors valued your business at $10M a few months ago, your 409A provider will take their word for it.

- Step 2: determine the value of the common stock by allocating the enterprise value across varying equity classes

- Step 3: apply a discount for lack of marketability, since employees generally cannot exercise and sell shares at their discretion

- This discount is larger for early-stage companies since they do not expect to exit for a long time

Other factors that can impact a 409A valuation include:

- How is the company performing relative to plan?

- If you raised money on the promise of hitting $10M ARR this year but are now on track for $5M ARR, you may be able to justify a 409A that is significantly lower than your latest post-money valuation. Alternatively, if you are forecasting $5M ARR for the year and are now on track to do $10M, you may need to plan for a higher-than-usual 409A valuation.

- How much dilution is likely to occur before an exit?

- If the company needs to raise continuously large rounds to fund its growth, the shares issued now will be diluted significantly by the time an exit takes place. That potential dilution will factor into a 409A analysis.

- Other less critical factors that may impact an analysis:

- Any company milestones

- Ratio of tangible to intangible company assets

- The book value of comparative companies

- Quality of the company’s management team

- A company’s investor base

- The competitive dynamics of the industry

- Net present value of future cash flow

How does the 409A process typically work for founders?

Most companies hire an outside firm to provide their 409A (recommendations below). You can expect to spend ~$2,000 or more for a basic 409A service, or $3,500+ for white glove boutique providers. Recently, Carta and other cap table software providers have offered free 409As to their subscribers – it’s worthwhile to look into this option before paying to engage a service provider. The turnaround time is typically ~2-4 weeks after you’ve provided all diligence documents (see below) and held a kickoff call with your providers.

What documents do I need for my 409A?

409A providers will likely request the following information before starting their analysis:

- Your company’s capitalization table

- The certification of incorporation

- Both historical and forecasted financial statements

- An estimate of how many options your company expects to issue over the next 12 months

- A recent business plan, board deck, or fundraising deck if available

- Your best guess as to when the company exits (# years) and how the company exits (M&A vs. IPO)

What firm should I use for my 409A?

To select the right 409A partner, you should consider the following:

- Look for a firm that has experience providing 409As for companies at your stage, and in your industry

- Make sure they are willing to move quickly enough and charge a fair rate ($2,000 is a decent goal)

- If you are using software like Carta or Shareworks to manage your cap table, you may be able to get a free 409A through this service

Our favorite providers include: