Why Cash Flow Is More Critical Than You Think

What is cashflow might seem like a simple question, but the answer holds the key to your startup’s survival. According to CB Insights, running out of cash is the number one reason startups fail – not lack of customers, not product issues, but simply running out of money.

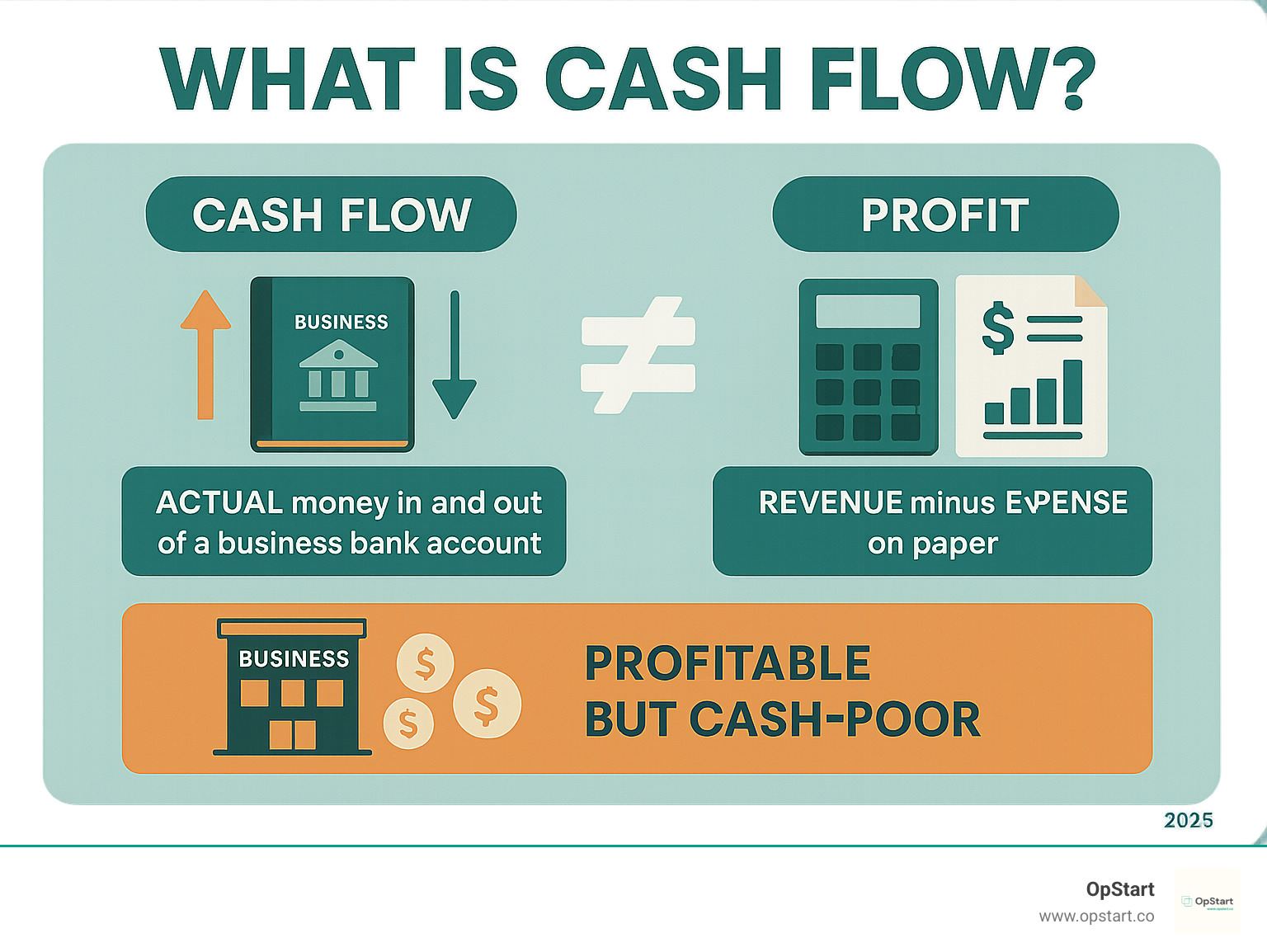

Cash flow is the net balance of money moving into and out of your business at a specific point in time. Here’s what you need to know:

- Cash flow = Money coming in – Money going out

- Positive cash flow = More money coming in than going out

- Negative cash flow = More money going out than coming in

- Cash flow ≠ Profit – You can be profitable on paper but still run out of cash

As one financial expert puts it: “Cash flow is the lifeblood of any company; in its absence, any business is likely to perish, even if profitable.”

The harsh reality? 82% of companies that fail do so because of poor cash flow management. Even profitable businesses can collapse if they can’t pay their bills when they’re due. This happens because profit (what’s left after expenses) and cash flow (actual money in your bank account) are completely different things.

Think of it this way: You might have $100,000 in outstanding invoices (profit on paper), but if customers haven’t paid yet, you still can’t cover payroll this week. That’s the difference between looking good on your income statement and having actual cash to operate.

I’m Maurina Venturelli, and throughout my career scaling companies like Sumo Logic to IPO and driving growth at LiveAction, I’ve seen how understanding what is cashflow can make or break a business. Now as VP of Go-to-Market at OpStart, I help founders steer these critical financial waters before cash flow problems become existential threats.

What is Cash Flow and Why Is It the Lifeblood of Your Business?

What is cashflow? At its heart, it’s the movement of money flowing into and out of your business during a specific time period. Think of it as your company’s pulse – it shows whether your business is breathing financially or gasping for air.

Here’s the thing that many founders don’t realize: cash flow is fundamentally about liquidity – your ability to pay bills, make payroll, and keep the lights on. According to industry research on small business failure, a staggering number of businesses don’t fail because they lack customers or have bad products. They fail because they run out of cash.

Your business might look fantastic on paper with strong sales and growing profits, but if you can’t access actual cash when rent is due, you’re in serious trouble. This is why understanding what is cashflow becomes critical for business viability and long-term financial health.

Cash flow powers everything your business does day-to-day. It’s what lets you fulfill payroll obligations, purchase inventory, pay suppliers, and handle those unexpected expenses that always seem to pop up. Without sufficient cash moving through your business, even profitable companies can find themselves unable to meet their daily obligations.

Leading business insights consistently show that cash flow problems are often the final nail in the coffin for struggling startups. It’s not just about having money on paper – it’s about having actual dollars you can spend.

The Critical Difference: Cash Flow vs. Profit vs. Revenue

Here’s where many entrepreneurs get tripped up. Revenue, profit, and cash flow might sound similar, but they tell completely different stories about your business.

Revenue is your top line – the total money your business earns from selling products or services. It’s great for measuring sales success, but it doesn’t tell you how much cash you actually have in the bank.

Profit is what remains after you subtract all expenses from your revenue. It shows up on your P&L statement and indicates whether your business model works financially. But here’s the catch: profit uses accrual accounting, which means you record transactions when they happen, not when cash actually changes hands.

Cash flow focuses purely on actual money movement. When a customer pays an invoice, that’s cash coming in. When you pay rent, that’s cash going out. It’s the most honest picture of your financial position.

The timing differences between these three can create serious problems. You might send a $50,000 invoice (revenue) and record it as profit, but if the customer takes 90 days to pay, you still can’t use that money for payroll next week.

Non-cash items make this even trickier. Depreciation reduces your profit on the P&L statement, but it doesn’t involve any actual cash leaving your business. Meanwhile, buying equipment requires immediate cash but might not fully impact profit until it’s depreciated over several years.

| Feature | Cash Flow | Profit | Revenue |

|---|---|---|---|

| Definition | Actual money moving in and out of the business | Revenue minus all expenses | Total income from sales of goods/services |

| Focus | Liquidity, actual cash position | Financial performance, profitability on paper | Sales volume, top-line growth |

| Accounting | Uses cash basis or adjusted accrual (cash flow statement) | Uses accrual accounting principles | Uses accrual accounting principles |

| Key Question | Do we have enough cash to pay bills? | Are we making money after all costs? | How much did we sell? |

| Timing | When money is received/paid | When revenue is earned/expenses are incurred | When sales are made |

| Non-cash items | Excludes (adjusts for) | Includes (e.g., depreciation) | N/A |

This distinction becomes crucial when you’re managing a growing business. Sales vs. available cash can create a dangerous gap that catches many founders off guard. For a deeper dive into these accounting concepts, check out our guide on More info about Cash vs. Accrual Accounting.

Positive vs. Negative: What is cashflow signaling?

When analyzing what is cashflow telling you about your business, the direction matters enormously.

Positive cash flow means more money is flowing in than flowing out. This is generally what you want to see – it indicates your business can sustain operations, build reserves, and invest in growth opportunities. Positive cash flow gives you breathing room and options.

Negative cash flow tells a more complex story. Sometimes it’s a warning sign that your business is spending more than it’s bringing in from operations. But negative cash flow isn’t always bad news.

Many successful startups deliberately run negative cash flow while they’re in investment mode. They’re burning cash to build products, acquire customers, or expand into new markets. The key question is whether the negative flow comes from strategic investment or operational issues.

If you’re spending heavily on research and development, new equipment, or marketing campaigns that will drive future revenue, negative cash flow might be part of your growth strategy. But if cash is flowing out because customers aren’t paying, costs are spiraling, or your business model isn’t working, that signals serious operational problems.

The critical thing is understanding why your cash flow is positive or negative. A profitable business can still face a liquidity crisis if it runs out of actual cash to pay immediate obligations. This is why monitoring cash flow patterns becomes essential for any business owner who wants to avoid nasty financial surprises.

Understanding these cash flow signals helps you make better decisions about when to invest, when to conserve cash, and when to seek additional funding. For more insight into what happens when businesses run short on liquid assets, you can learn about What is a Liquidity Crisis?.

Decoding the Cash Flow Statement

Think of your cash flow statement as your business’s financial diary. While your income statement tells you if you’re profitable and your balance sheet shows what you own and owe, the cash flow statement reveals the most important story of all: what is cashflow actually doing in your business day by day.

This essential financial document tracks every dollar that flows in and out of your company during a specific period—usually a quarter or a year. It’s like having a detailed record of your business checking account, showing not just how much cash you have, but where it came from and where it went.

Why does this matter so much? Because the cash flow statement bridges the gap between your other financial statements. It explains why your bank balance changed from one period to the next, even when your profit and loss statement might tell a completely different story.

For investors, lenders, and even your own management team, this statement is pure gold. It reveals whether your business can actually sustain itself, fund growth, and pay its bills—regardless of what the profit numbers say. You can dive deeper into understanding your other key financial documents with our guides on How to Read a P&L and How to Read a Balance Sheet.

The Three Pillars: Operating, Investing, and Financing

Every cash flow statement tells its story through three distinct chapters. Understanding these sections helps you see exactly what is cashflow revealing about different aspects of your business.

Cash Flow from Operating Activities (CFO) is your business’s bread and butter. This section shows the cash your core business operations generate or consume. It includes money from customers, payments to suppliers, employee salaries, rent, and other day-to-day expenses. When this number is consistently positive, it’s like your business saying, “I can pay my own way!” If it’s negative, your core business needs help from outside sources to keep the lights on.

Cash Flow from Investing Activities (CFI) reveals how you’re betting on your future. This typically shows negative numbers for growing companies—and that’s often good news! It means you’re buying equipment, expanding facilities, or acquiring other businesses. When you see positive numbers here, it might mean you’re selling assets, which could signal smart portfolio management or, less optimally, a need to raise cash quickly.

Cash Flow from Financing Activities (CFF) shows your relationship with investors and lenders. Positive numbers often mean you’re raising capital through loans or selling equity stakes. Negative numbers might indicate you’re paying back loans, buying back stock, or paying dividends to shareholders.

The magic happens when you read these three sections together. They paint a complete picture of your business’s financial health and strategy. For a comprehensive walkthrough of interpreting these statements, check out our detailed guide on Understanding the Cash Flow Statement.

Direct vs. Indirect Method: Two Paths to the Same Number

Here’s where accounting gets interesting. There are actually two different ways to calculate your operating cash flow, but both methods arrive at the exact same final number. Think of them as two different routes to the same destination.

The direct method is the straightforward approach. It’s like looking at your business checking account and categorizing every transaction: “We collected $50,000 from customers, paid $20,000 to suppliers, and $15,000 in salaries.” This method is crystal clear and easy to understand, making it perfect for business owners who want to see exactly where their cash went. However, it requires meticulous tracking of every cash transaction, which can be time-consuming.

The indirect method takes a clever shortcut. It starts with your net income from your profit and loss statement, then makes adjustments to convert it from accrual accounting to actual cash flow. Since your P&L includes non-cash expenses like depreciation and records sales even when customers haven’t paid yet, these adjustments are necessary. For example, if you had $10,000 in depreciation expense, that reduced your profit but didn’t actually cost you any cash, so it gets added back.

Most businesses use the indirect method because it’s easier to prepare—you’re working with numbers you already have from your income statement and balance sheet. Both GAAP (the accounting rules used in the US) and IFRS (international accounting standards) accept this method, though IFRS has a slight preference for the direct method.

The beauty is that regardless of which method your accountant uses, the bottom line remains the same. The relationship between accruals and cash flow can get complex, and if you’re curious about the technical details, The Accruals-Cash Flow Relation provides an in-depth academic perspective.

How to Analyze and Manage Your Cash Flow

Understanding what is cashflow is the first step; managing it is the key to success. Cash flow analysis is about interpreting the story your money tells you to identify patterns, spot opportunities, and prevent crises before they start. It’s a crucial health checkup for your business’s financial wellbeing.

For many startups, this requires expertise beyond basic bookkeeping. Strategic financial guidance, like Fractional CFO Services, provides expert-level analysis without the cost of a full-time executive.

Key Metrics and Red Flags: What is cashflow analysis revealing?

Your cash flow statement holds a treasure trove of insights, but you need to know what to look for.

Free Cash Flow (FCF) is the cash left over after covering operating expenses and capital expenditures. It’s your business’s true discretionary cash for growth or reserves. Calculated as Operating Cash Flow – Capital Expenditures, a consistently positive FCF is a strong sign of health.

The Operating Cash Flow Ratio (Operating Cash Flow / Net Sales) shows how efficiently you convert sales into cash. A declining ratio may signal collection or operational issues.

For startups, burn rate is critical. It’s the rate you consume cash monthly, and it determines your runway—how long you can operate before needing more funds.

The cash-zero date is the projected date you’ll run out of money. This isn’t to scare you, but to motivate action on raising capital, cutting costs, or boosting revenue.

Now, let’s talk red flags. Declining operating cash flow signals something’s wrong with your core business. Excessive reliance on financing activities to cover basic operations suggests your business model might need adjustment. Finally, watch for frequent asset sales to generate cash, as this can indicate that operations aren’t self-sustaining.

For a deeper understanding of these analytical techniques, Cash Flow Analysis: The Basics provides excellent additional insights.

Practical Strategies to Optimize and Improve Cash Flow

Managing cash flow effectively can become a competitive advantage. Here are practical strategies to optimize it.

Managing receivables is often the fastest path to improved cash flow. Get paid faster by invoicing immediately, shortening payment terms, and offering early payment discounts. Automating follow-ups can dramatically improve collection rates.

On the flip side, managing payables strategically helps you hold onto cash longer. Negotiate favorable terms with suppliers and only take early payment discounts when they make financial sense.

Inventory control can free up surprising amounts of cash. Use just-in-time ordering and accurate demand forecasting to prevent overstocking.

The lease versus buy decision for major purchases deserves careful thought. Leasing preserves cash by avoiding large upfront costs, which is often critical for startups.

Forecasting and budgeting are the foundation of proactive management. Create detailed cash flow forecasts to identify potential problems while you still have time to solve them.

Building cash reserves is essential. Aim for one to three months of operating expenses in reserve to handle unexpected emergencies.

Proactive management turns cash flow into a strategic strength. If you want to experiment with projections, try this Example of Cash flow Calculator to model different scenarios.

Frequently Asked Questions about Cash Flow

I get these questions all the time from founders who are wrestling with their finances. Let’s tackle the most common ones about what is cashflow and how it affects your business.

Is cash flow more important than profit?

This question comes up in almost every conversation I have with startup founders, and honestly, it’s like asking whether your heart or your lungs are more important. You need both to survive.

Profit shows whether your business model actually works long-term. It proves you can generate more revenue than you spend over time. Without profit, you’ll struggle to attract investors or sustain growth. It’s your business’s report card on whether you’re building something economically viable.

But here’s the thing – cash flow determines whether you’ll live to see that long-term success. You can’t pay your team with profit margins. You can’t cover rent with accounting entries. You need actual cash in the bank.

I’ve seen profitable companies collapse because they couldn’t pay their bills. We call this “profitable failure,” and it’s heartbreaking to watch. A company might have $500,000 in outstanding invoices (showing healthy profit), but if customers take 90 days to pay and payroll is due tomorrow, that profit won’t save them.

The bottom line? Cash flow keeps you alive day-to-day, while profit ensures you’re building something sustainable. Early-stage startups often prioritize cash flow for survival, then shift focus to profitability as they mature. You need both, but timing matters.

Can a company have positive cash flow but be unprofitable?

Absolutely, and it happens more often than you’d think, especially with startups. I see this scenario regularly, and it’s not necessarily a bad thing.

The most common reason is financing activities. When a startup raises venture capital or takes out a loan, that money flows directly into the bank account. Suddenly, you have millions in cash, but your core business operations might still be losing money every month. Your cash flow statement looks healthy because of that big injection, even though your profit and loss statement shows red ink.

Asset sales can create the same effect. If you sell equipment, real estate, or even intellectual property, you get a cash windfall that doesn’t reflect your operational profitability. This might look great short-term, but it’s not sustainable if your core business isn’t generating cash.

Here’s where it gets interesting: non-cash expenses like depreciation reduce your profit on paper but don’t actually take money out of your bank account. A manufacturing startup might show a loss due to heavy depreciation on equipment, but still have positive cash flow because that depreciation isn’t real money leaving the business.

Timing differences matter too. You might collect cash upfront for services you’ll deliver later, or defer expenses that haven’t hit your cash flow yet. This creates temporary mismatches between profit and cash.

The key is understanding where your positive cash flow comes from. If it’s mainly from investors or asset sales rather than your core business, you’re buying time, not proving sustainability.

How often should a startup review its cash flow?

For startups, monitoring what is cashflow isn’t a monthly luxury – it’s a daily survival skill. I tell founders that cash flow management should become as routine as checking your email.

Daily reviews are non-negotiable for early-stage startups. When you’re burning through limited cash and every expense matters, you need to know your position constantly. This isn’t paranoia; it’s smart business. Daily monitoring helps you catch problems before they become crises and make informed decisions about spending.

Weekly deep dives should be mandatory for everyone. This is where you analyze trends, update your burn rate calculations, and recalculate your runway. Your runway – how long your cash will last at current spending levels – is perhaps the most critical number for any startup. If you have $200,000 in the bank and you’re burning $25,000 per month, you have exactly eight months to either raise more money or become cash flow positive.

Monthly comprehensive reviews tie everything together. This is when you analyze the three pillars of your cash flow statement, identify patterns, and make strategic adjustments to your business model or spending.

The faster you spot cash flow trends, the more options you have. Waiting until month-end to find you’re burning cash faster than expected leaves you scrambling. But catching that trend in week one gives you time to adjust, negotiate with suppliers, accelerate collections, or even pivot your strategy.

Running out of cash is the number one reason startups fail. Don’t let poor monitoring be the reason your great idea never reaches its potential.

Conclusion: Taking Control of Your Financial Future

Understanding what is cashflow isn’t just another item on your business education checklist—it’s the difference between watching your startup thrive and watching it become another statistic. Throughout this guide, we’ve unpacked how cash flow serves as your business’s true lifeblood, operating independently from profit or revenue, and why mastering its management can save you from the cash-related failures that claim so many promising ventures.

Think back to where we started: 82% of failed companies cite poor cash flow management as their downfall. Now you’re equipped with the knowledge to avoid joining that statistic. You understand how to read the three pillars of your cash flow statement—operating, investing, and financing activities. You know the difference between direct and indirect methods of reporting. Most importantly, you can spot the red flags before they become existential threats.

The metrics we’ve covered, from Free Cash Flow to burn rate calculations, aren’t just numbers on a spreadsheet. They’re your early warning system and your growth compass rolled into one. When you’re tracking your cash-zero date weekly, optimizing your accounts receivable, and strategically managing payables, you’re not just keeping the lights on—you’re building the foundation for sustainable growth.

Proactive cash flow management transforms you from a reactive business owner into a strategic leader. Instead of scrambling to cover payroll, you’re making informed decisions about when to hire, when to invest in new equipment, and when to pursue that big opportunity. You’re building cash reserves that let you weather unexpected storms and capitalize on market shifts.

At OpStart, we’ve seen how proper financial operations support can transform a startup’s trajectory. When founders understand their cash position and have expert guidance managing their financial operations, they make better decisions, sleep better at night, and build more resilient businesses.

Your financial future doesn’t have to be a mystery wrapped in spreadsheets and accounting jargon. With the right knowledge and support, you can take control of your cash flow and steer your startup toward the success you’ve been working so hard to achieve.

Ready to dive even deeper into mastering your financial statements? Learn more by reading our guide on How to Read a Cash Flow Statement and take the next step in your financial education journey.