Why Office Start Up Bookkeeping Is Your Business Foundation

Office start up bookkeeping is the financial backbone that determines whether your startup thrives or struggles. Getting your books right from day one isn’t just about tracking money—it’s about building investor confidence, making smart decisions, and avoiding costly mistakes that could derail your growth.

Quick Setup Guide for Startups:

- Structure: Choose an LLC or C-Corp (for VC funding).

- Banking: Open a dedicated business bank account.

- Software: Select cloud-based accounting software like QuickBooks Online or Xero.

- Automation: Set up automated expense tracking and monthly reconciliation.

- Team: Decide whether to handle bookkeeping in-house or outsource.

As one startup CEO shared: “Now that I have professional bookkeeping, I feel better knowing that professionals are handling my books so I can spend more time growing my business instead of monitoring nickels.”

Around 70% of businesses outsource bookkeeping because founders start companies to solve problems, not to do data entry. Poor bookkeeping leads to cash flow surprises and investor distrust, while a solid financial foundation opens up funding rounds and enables smart growth.

I’m Maurina Venturelli, and I’ve helped high-growth companies steer the financial complexities of scaling. At OpStart, I’ve seen how proper office start up bookkeeping transforms chaotic financial operations into strategic growth engines.

Simple guide to office start up bookkeeping terms:

The Foundation: Why Your Startup Needs Impeccable Bookkeeping

If your product is the heart of your startup, office start up bookkeeping is the nervous system, transmitting vital information about your financial health. Neglecting it is like running a marathon blindfolded. For any startup aiming to thrive, solid books are essential for these reasons:

-

Financial Health: Accurate books provide a clear picture of your cash flow, profit margins, and overall financial standing. This understanding is key for making smart choices and avoiding the nightmare scenario of running out of money.

-

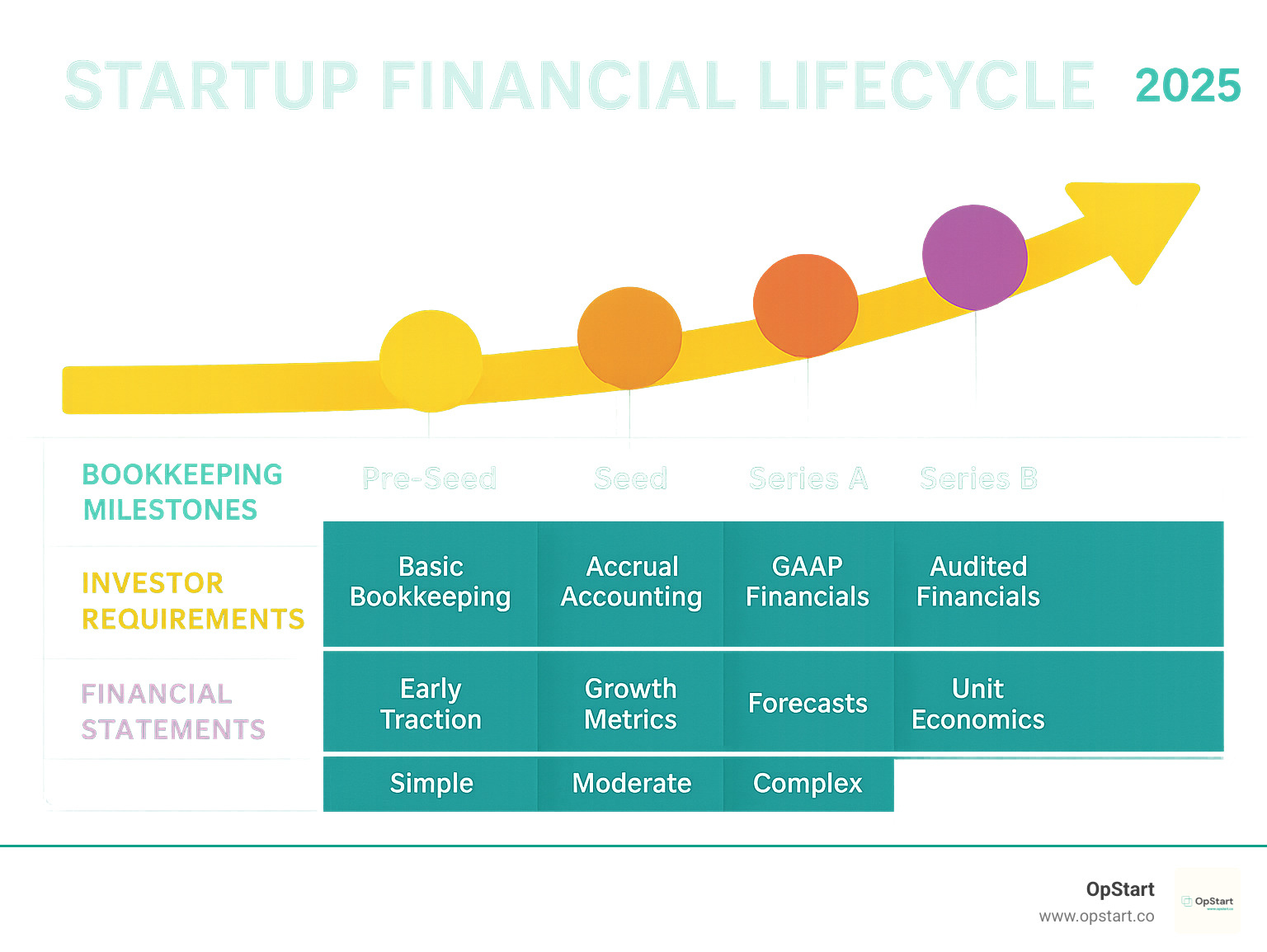

Investor Readiness: Investors scrutinize your finances. Clean, organized books demonstrate professionalism, transparency, and a deep understanding of your business, showing you’re ready to scale.

-

Tax Compliance: Impeccable bookkeeping makes tax season manageable. It ensures you correctly track all income, expenses, and deductions, helping you avoid fines and stay on the right side of federal and state rules.

-

Informed Decisions: With real-time financial data, you can make better decisions about hiring, product development, and pricing. This insight is pure gold for a founder.

-

Growth and Scalability: As your startup expands, its financial world gets more complex. Strong bookkeeping practices ensure your financial systems can grow with you, preventing slowdowns.

It’s no wonder that about 70% of businesses outsource their bookkeeping. Founders start companies to innovate, not to become data entry experts. This is where expert office start up bookkeeping services become a secret weapon.

Understanding Key Roles: Bookkeeper vs. Accountant

It’s easy to confuse bookkeepers and accountants, but they play different, vital roles.

The Bookkeeper handles the daily financial transactions. They are responsible for recording income and expenses, managing accounts payable and receivable, processing payroll, and reconciling bank accounts. They ensure the data is accurate and organized.

The Accountant analyzes the bigger picture. Using the data prepared by the bookkeeper, they analyze financial statements, prepare tax returns, create financial forecasts, and provide strategic business advice. They focus on the “why” and “what’s next” for your business.

For a startup, having both roles covered—whether in-house or by outsourcing to services like Fractional CFO Services—provides both meticulous record-keeping and high-level strategic guidance.

The Strategic Advantage of Virtual Bookkeeping for Startups

Gone are the days of in-office bookkeepers surrounded by paper. Virtual bookkeeping is a game-changer for nimble startups.

-

Cost-Effectiveness: Virtual services often have lower overhead, resulting in competitive pricing. You save money without sacrificing quality.

-

Access to Talent: Location is no longer a barrier. You can hire the best bookkeeper for your specific industry, regardless of geography.

-

Scalability: Virtual teams can easily scale up or down with your business needs, offering flexibility that in-house teams can’t match.

-

Real-Time Data: Cloud-based software provides instant access to your financial data, enabling quick, informed decisions anytime, anywhere.

-

Integration with Cloud Tools: Virtual bookkeepers are fluent in the cloud tools you already use, like Slack or Asana, making collaboration seamless.

-

Focus on Growth: Outsourcing bookkeeping frees up your time and mental energy to focus on what truly matters: building your product, finding customers, and scaling your business.

The Blueprint: Your Step-by-Step Guide to Launching a Bookkeeping Business

Whether you’re a founder evaluating potential bookkeeping partners or an aspiring entrepreneur, understanding the blueprint for a professional office start up bookkeeping service is crucial. This process reveals what separates a mere number-cruncher from a trusted financial partner.

Successful bookkeeping businesses are built on a foundation of low startup costs and high demand. They don’t just process transactions; they become strategic allies who understand their clients’ unique challenges and growth goals.

Step 1: Craft a Solid Business Plan and Define Your Niche

A solid business plan acts as a North Star. For a bookkeeping service, this means defining a niche. A generalist bookkeeper competes with everyone, but one who specializes in SaaS startups, e-commerce, or another specific industry becomes an invaluable expert. They understand industry-specific software, revenue recognition challenges, and key metrics. When evaluating a service, ask about their experience in your niche. This specialization is often a sign of deeper expertise and allows them to offer more strategic value beyond basic transaction recording.

Step 2: Handle the Legal and Financial Setup for Your Office Start Up Bookkeeping

Getting the legal and financial foundation right is non-negotiable for a professional service. This is a mark of credibility and protects both the provider and the client.

- Legal Structure: A legitimate bookkeeping business will operate as a formal entity like an LLC or corporation, not just an individual. This provides liability protection.

- Business Bank Account: They will always use a dedicated business bank account. Co-mingling business and personal funds is a major red flag.

- Insurance: Errors & Omissions (E&O) insurance is a must-have. This professional liability insurance protects you if their error costs your business money. Don’t be afraid to ask a potential provider if they carry it.

Step 3: The Importance of Bookkeeping Certifications

While not legally required, certifications are essential credibility badges in a field built on trust. They signal that a professional is serious about their craft and has verified expertise.

Look for professional designations like the Certified Bookkeeper (CB) from the American Institute of Professional Bookkeepers (AIPB) or the Certified Public Bookkeeper (CPB).

Equally important are software-specific certifications. A provider certified in QuickBooks Online or Xero demonstrates proven expertise with the tools your startup will likely use. These certifications often lead to higher quality service, better efficiency, and increased trust when handling your company’s sensitive financial data.

Building Your Tech Stack: Essential Software and Tools

In modern office start up bookkeeping, technology is the core of efficiency, accuracy, and scalability. The right tech stack transforms tedious manual tasks into streamlined, automated processes, freeing up time for more strategic work.

At OpStart, our Startup Stack prioritizes automation, seamless integration, and real-time data access. Cloud-based software is the undisputed champion, offering accessibility, robust security, and automatic updates.

Choosing the Right Office Start Up Bookkeeping Software

Your accounting software is the central hub of your financial operations. It must be robust, user-friendly, and capable of growing with your business.

| Feature | QuickBooks Online (QBO) | Xero |

|---|---|---|

| Target User | Small to medium businesses, freelancers | Small to medium businesses, tech-savvy users |

| Ease of Use | Intuitive, widely recognized, extensive tutorials | Modern interface, often praised for user experience |

| Bank Feeds | Excellent, highly automated | Strong, reliable |

| Mobile Access | Comprehensive mobile app | Comprehensive mobile app |

| Integrations | Vast ecosystem of third-party apps (payroll, CRM, etc.) | Strong integration with many business apps, especially for startups |

| Scalability | Multiple plans for growing businesses | Highly scalable, good for growing businesses |

| Reporting | Robust, highly customizable | Clean, easy-to-understand reports |

| Cost | Varies by plan, generally competitive | Vries by plan, generally competitive |

Both QuickBooks Online and Xero are industry leaders. They offer scalability, automated bank feeds to reduce manual entry, mobile access for on-the-go management, and vast integrations with other business tools. While software is powerful, it cannot replace a bookkeeper’s ability to interpret data and provide personalized service.

Essential Tools for Document and Expense Management

Beyond core accounting software, several specialized tools are invaluable for efficient office start up bookkeeping:

- Receipt Capture: Tools like HubDoc (part of Xero) and Dext let you capture receipts via phone or email. They use OCR to extract key data and push it into your accounting software, creating a digital audit trail.

- Bill Payment: Platforms like Bill.com automate the accounts payable process, from invoice receipt to approval and payment, all while syncing with your accounting system.

- Expense Tracking: For startups, tracking every business expense is vital for tax deductions and understanding burn rate. Dedicated tools integrate with bank accounts and credit cards for easy categorization and reporting.

From Launch to Growth: Marketing, Pricing, and Client Trust

You’ve built your foundation and chosen your tech. Now, it’s about finding clients and building a sustainable business around trust. Office start up bookkeeping services succeed or fail based on relationships. You’re not just crunching numbers; you’re a trusted partner helping founders sleep better at night.

Best Practices for Pricing Your Bookkeeping Services

Understanding pricing models helps you evaluate potential bookkeeping partners. If a price seems too good to be true, it probably is.

- Hourly rates are straightforward but can penalize efficiency and make costs unpredictable for your startup.

- Fixed-fee packages are increasingly popular. You get a set monthly price for defined services, which is great for budgeting. This model incentivizes the bookkeeper to be efficient.

- Value-based pricing is the most advanced model, where fees are based on the value delivered (e.g., helping secure funding or saving thousands in taxes). This requires a deep understanding of a client’s business.

When evaluating a service, look for transparent pricing that aligns with the value you expect to receive. For more on this, resources like Setting your fees offer valuable industry guidance.

Marketing Your Services and Building Client Relationships

For a founder, the way a bookkeeping service markets itself reveals its professionalism. The best providers build their business on expertise and relationships, not flashy ads.

- Demonstrated Expertise: Look for providers who share their knowledge through content marketing (blogs, webinars) and have strong professional networks with CPAs and financial advisors.

- Social Proof: Testimonials and case studies are powerful. Ask for references or look for examples of how they’ve helped similar startups succeed.

- Secure Communication: A professional service will use a secure client portal for sharing sensitive financial data. This is a critical sign they take data privacy seriously.

- Proactive Communication: Great bookkeepers don’t just record transactions; they communicate. They translate financial jargon into plain English, proactively flag potential issues, and act as a true advisor.

At OpStart, we know trust is earned. That’s why we have a Referral Program, because a strong reputation built on trust is the most valuable asset.

Frequently Asked Questions about Starting a Bookkeeping Business

Here are answers to common questions about the business of office start up bookkeeping, which can provide insight for founders evaluating a service.

What are the typical startup costs for a bookkeeping business?

Starting a bookkeeping business has remarkably low startup costs, often under $2,000. The primary expenses are a reliable computer, high-speed internet, and software subscriptions (e.g., QuickBooks, Xero). Other costs include business registration fees, professional insurance (Errors & Omissions), and optional certifications. This low barrier to entry means you should carefully vet a provider’s experience and professionalism, not just their price.

What are the most common challenges new bookkeepers face?

New bookkeepers often struggle with finding their first clients, setting appropriate prices, and managing their time effectively across multiple accounts. A significant challenge is dealing with disorganized client books, which requires patience and clear communication to establish order. The biggest hurdle is building trust, as clients are handing over sensitive financial data. A seasoned provider will have overcome these challenges and have established processes for each.

Can I start a bookkeeping business from home without being a CPA?

Yes. In the United States, you do not need a Certified Public Accountant (CPA) license to offer bookkeeping services. A CPA is required for specific tasks like performing audits, while a bookkeeper focuses on recording and reporting daily financial transactions. Modern cloud-based software makes remote, home-based bookkeeping ideal. While a CPA isn’t required, you should look for providers with relevant bookkeeping certifications (e.g., from AIPB or software vendors like QuickBooks) as a mark of credibility and expertise.

Conclusion: Your Next Step to Financial Mastery

We’ve journeyed through office start up bookkeeping, from its foundational importance to the nuts and bolts of professional service. The key takeaway is clear: for a startup, solid financial management isn’t optional—it’s a prerequisite for survival and growth.

Impeccable bookkeeping is your secret weapon for making smart cash-burn decisions, impressing investors, and truly understanding if your business model is working. Modern virtual solutions and the right tech stack make this expertise more accessible than ever. You started your company to innovate, not to become a QuickBooks expert.

At OpStart, we’ve built our practice around the unique financial challenges startups face. We provide more than just data entry; we offer strategic partnership. Our services integrate with your software stack to provide real-time insights and scale with your growth, all for a predictable flat rate.

The financial complexities only intensify as you scale. Don’t let bookkeeping headaches distract you from building the next big thing.

Ready to take control of your startup’s financial future? Contact Us to see how we can turn your financial operations into a competitive advantage, or Get started with expert Bookkeeping Services that deliver the financial mastery your startup deserves.