Why Your Startup’s Survival Depends on a Financial Plan

Startup financial planning is the process of creating a strategic roadmap that forecasts your revenue, expenses, and cash flow to guide decision-making and ensure your business stays financially healthy. It’s your early warning system for navigating the high-stakes world of startups.

The numbers are sobering: nearly 20% of new businesses fail within 2 years, and 65% within 10 years. A staggering 82% of these failures stem from poor cash flow management. Running out of cash is consistently a top reason startups shut down.

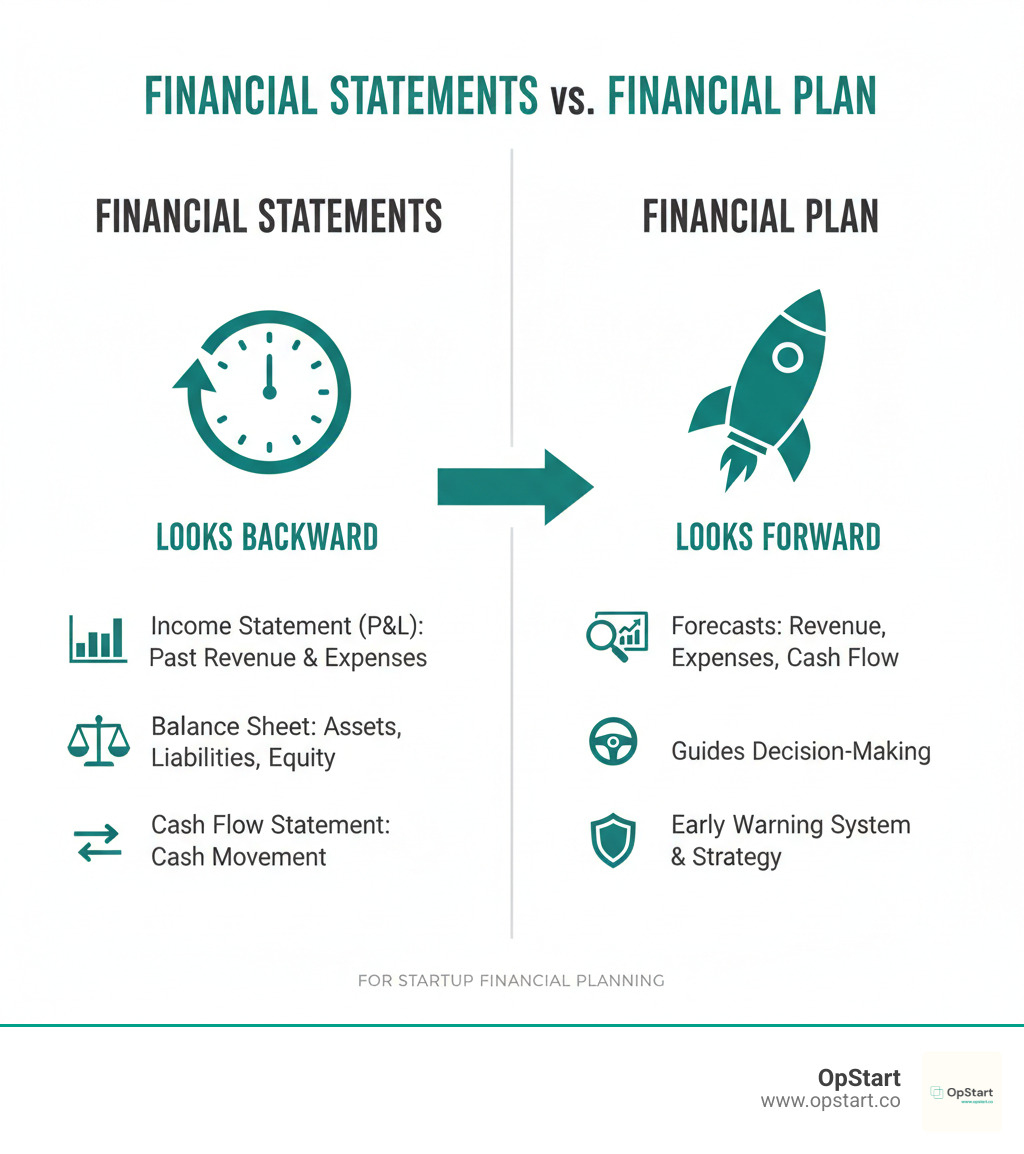

Many founders confuse financial plans with financial statements. Financial statements look backward, telling you what already happened. A financial plan looks forward, helping you spot cash flow dips before they become crises, identify funding needs, and time major investments. Without one, you’re flying blind, unable to answer basic questions about your unit economics or runway.

A solid financial plan gives you control. It transforms gut feelings into data-driven strategy, shows investors you understand your business, and helps you allocate resources wisely across best-case, realistic, and challenging scenarios.

I’m Maurina Venturelli. I’ve helped scale companies like Sumo Logic to IPO and now, as Head of Go-to-Market at OpStart, I help founders build the financial foundation their growth requires.

Financial Statements (Backward-Looking):

- Income Statement (P&L): Past revenue and expenses

- Balance Sheet: Historical assets, liabilities, equity

- Cash Flow Statement: Where cash came from and went

Financial Plan (Forward-Looking):

- Revenue projections and growth assumptions

- Expense budgets and hiring plans

- Cash flow forecasts and funding needs

- Scenario planning (best/worst/likely cases)

- Strategic goals and key milestones

Key startup financial planning vocabulary:

Laying the Foundation: Pre-Planning and Core Concepts

Before building elaborate financial models for your business, you must ensure you can survive the journey. Your personal financial foundation and your startup’s success are deeply intertwined, especially in the critical early years.

Evaluate Your Personal Finances First

Too many founders ignore a ticking time bomb in their personal finances. Start with an honest assessment of your personal budget to understand where your money goes. Calculate your personal runway: how long can you cover living expenses if your startup isn’t paying you? Many founders reduce their personal burn rate by 30-40% by cutting back on non-essential purchases.

Next, assess your debt-to-income ratio. High-interest debt is dangerous, so develop a plan to manage or reduce it before going all-in. Never borrow on credit cards to fund your business; the high interest will eat into your margins.

Building an emergency fund of three to six months of living expenses is not optional. This safety net lets you focus on your business instead of panicking about next month’s rent. Be cautious about raiding retirement funds like a 401(k) or IRA. Early-withdrawal penalties, taxes, and the loss of compound growth can be devastating in the long run.

Many successful founders develop their business plan while still employed. A day job provides financial stability while you validate your idea, build a prototype, and create your pitch deck. Transition to full-time entrepreneurship when you have a clear plan, not before.

Why a Financial Plan is Non-Negotiable for Success

A financial plan is the strategic tool that keeps you from becoming another failure statistic. It’s not a bureaucratic exercise; it’s your roadmap for survival and growth.

A solid startup financial planning strategy provides investor confidence. A well-researched plan demonstrates that you understand your business model, market, and path to profitability. It shows you know how to manage capital responsibly.

More importantly, it enables informed decision-making. Should you hire another engineer or attend a conference? Your financial plan provides data-driven answers, replacing gut feelings.

The plan also serves as a roadmap for growth, turning vague goals into concrete milestones. It helps you work backward to determine the necessary leads, marketing spend, and team scaling. Finally, it makes you proactive instead of reactive. By spotting a cash crunch months in advance, you have time to cut costs, accelerate collections, or secure a credit line before it becomes a crisis. Your financial plan ties all these elements into a coherent strategy that guides every decision.

The Core of Startup Financial Planning: Building Your Financial Blueprint

Now we transform theory into a practical tool. Your financial blueprint is the architectural plan for your business, built from realistic forecasts, careful budgets, and a firm grasp of your key assumptions.

At the heart of startup financial planning are three core financial statements. But first, we need the ingredients: sales forecasts, expense budgets, and an understanding of our capital requirements.

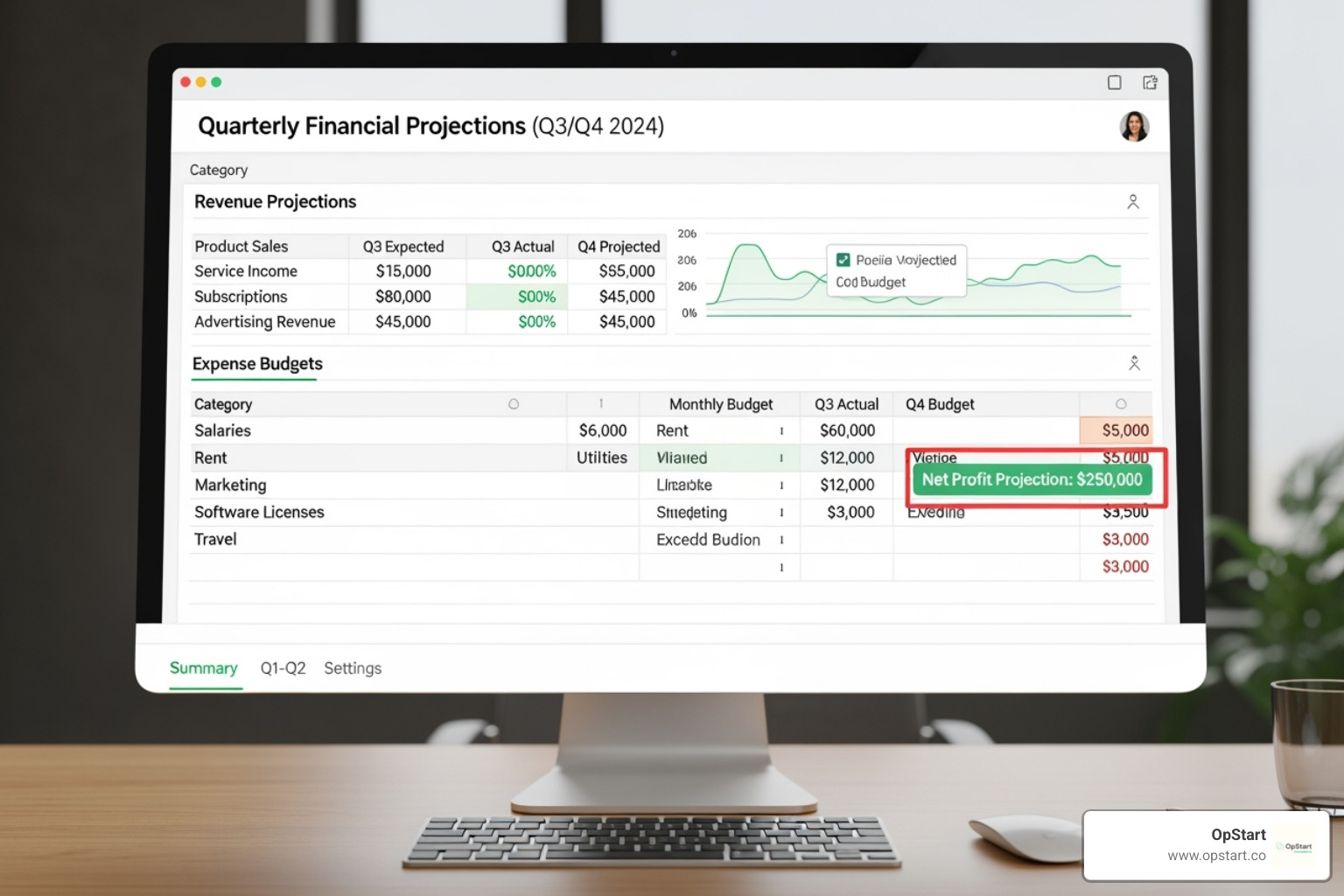

Projecting Startup Revenues Realistically

Revenue projections are where dreams meet reality. Investors can spot unrealistic optimism, so build credible forecasts using proven methods.

- Top-down forecasting starts with the total addressable market (TAM), narrows to your serviceable available market (SAM), and estimates your serviceable obtainable market (SOM). Back these numbers with solid market research.

- Bottom-up forecasting builds revenue from the ground up, based on specific actions like marketing campaigns and sales calls. For a SaaS company, this means customers x price, adjusted for churn.

Use both approaches: bottom-up for the first 1-2 years to show operational understanding, and top-down for years 3-5 to show market ambition. Also, factor in your pricing strategy, sales cycle, and conversion rates. It’s better to underestimate sales and overdeliver than to inflate projections.

Budgeting and Controlling Costs Effectively

Budgeting keeps us grounded. It’s about being strategic, not cheap. Start by understanding your cost structure:

- Fixed costs: Rent, insurance, and core software subscriptions.

- Variable costs: Raw materials, shipping, and sales commissions that scale with activity.

- One-time startup costs: Equipment, legal fees, and initial marketing campaigns.

Headcount planning is critical, as people are your biggest expense. Estimate the full cost: salary, benefits, taxes, and equipment. Capital expenditures (CapEx)—investments in long-term assets like equipment or patents—also require careful planning. Finally, build a contingency fund of 5-10% of your total budget for unexpected costs or opportunities. Our Startup Stack resource can help you make smart decisions on where to invest.

Creating Your Three Core Financial Statements

These three statements tell your complete financial story.

- The Profit & Loss (P&L) Statement (or Income Statement) shows if you’re making money by subtracting costs and expenses from revenue. It answers the question: “Are we profitable?”

- The Balance Sheet is a snapshot of your financial health, showing what you own (Assets) and what you owe (Liabilities). It follows the equation: Assets = Liabilities + Equity.

- The Cash Flow Statement is the most critical for startups, tracking the actual movement of cash from operating, investing, and financing activities. You can be profitable on paper but run out of cash, which is a startup killer.

We strongly recommend using accrual accounting, which recognizes revenue when earned and expenses when incurred. This provides a more accurate picture of business performance than cash accounting and is what investors expect to see.

From Plan to Action: Managing Cash, Risk, and Performance

A financial plan is a living tool. It’s only useful if you check it and adjust your route. This means constantly monitoring performance against projections, a process called variance analysis. Spotting gaps between forecasts and reality—like lower sales or higher costs—isn’t a failure. It’s valuable data that helps you refine assumptions and make better decisions. The key is to be proactive, identifying potential problems while they are still small.

The Lifeblood of Your Startup: Cash Flow Management

82% of businesses fail due to poor cash flow management. Profit is not the same as cash. A profitable company can go bankrupt if it can’t pay its bills. Cash is what covers payroll and keeps the lights on.

To stay on top of cash flow, maintain a cash reserve of at least 3-6 months of operating expenses. This buffer protects you from unexpected dips. Next, focus on accelerating cash inflows by invoicing promptly and following up on overdue payments. On the flip side, strategically manage cash outflows by negotiating favorable payment terms with suppliers and scrutinizing every expense.

Working capital optimization is about managing the balance between incoming and outgoing cash. Finally, use dynamic cash flow forecasting, continuously updating your projections based on actual results. This rolling forecast helps you spot cash crunches months in advance.

Key Financial Metrics Every Founder Must Track

These vital signs show whether your startup is healthy or heading for trouble.

- Burn Rate: Your gross burn is your total monthly operating expenses. Your net burn is the total cash you are losing each month (expenses minus revenue).

- Runway: Your current cash balance divided by your net burn rate. This is how many months you have until the cash runs out.

- Customer Acquisition Cost (CAC): The average amount you spend to acquire a new customer (total sales and marketing spend / new customers).

- Customer Lifetime Value (LTV): The total revenue you expect from a single customer over their entire relationship with you.

- LTV:CAC Ratio: A healthy business model should have an LTV that is at least 3x its CAC.

- Gross Margin: The percentage of revenue left after subtracting the cost of goods sold (COGS). Higher margins give you more room to invest in growth.

- Monthly Recurring Revenue (MRR): The predictable revenue you can count on each month from subscriptions.

Planning for the Unexpected: Contingency and Risk Management

Even the best plan can’t predict everything. Scenario planning is your primary tool for managing uncertainty. Develop three projections: a best-case, worst-case, and most likely scenario. This prepares you for a range of outcomes.

Identify and plan for specific risks:

- Market risks: Changes in customer demand, new competitors, or economic downturns.

- Operational risks: Supply chain disruptions, technology failures, or losing a key team member.

- Financial risks: Difficulty accessing capital or unexpected expenses that blow your budget.

- Compliance risks: Failing to comply with changing regulations, like Beneficial Ownership Information Reporting, can lead to costly fines.

The goal isn’t to eliminate risk but to identify it, understand its impact, and have mitigation strategies ready.

Fueling Growth: Financial Planning for Fundraising and Scaling

Your product works, customers are responding, and now it’s time to grow. Growth requires capital, and this is where startup financial planning transforms from a survival tool into a growth engine. Scaling brings new challenges: determining your funding needs, understanding your company’s worth, and preparing for investor scrutiny.

Preparing Your Financials for Investor Due Diligence

Your financial model tells the story of your business in numbers. It demonstrates that you understand your market, unit economics, and path to profitability. A strong model is crucial for answering key investor questions about how much funding you need, when you’ll need it, and what milestones you’ll achieve.

Investors have seen it all. Your model must substantiate every assumption with clear logic, market research, or operational data. They are investing in your ability to manage money wisely. Be prepared with a well-organized virtual data room containing your financial statements, contracts, and cap table. When investors request materials, you should be able to respond in hours, not weeks. At OpStart, our CFO services for startups help founders build investor-ready financials that stand up to scrutiny.

Understanding Valuation and Funding Rounds

Valuation is one of the most critical aspects of fundraising. Understanding the difference between pre-money and post-money valuation is essential.

| Aspect | Pre-Money Valuation | Post-Money Valuation |

|---|---|---|

| Definition | The value of our company before an investment round. | The value of our company after an investment round, including the new investment. |

| Calculation | Derived from negotiation, market comparables, or financial projections. | Pre-Money Valuation + Investment Amount. |

| Significance | Determines the price per share for new investors. | Reflects the total value of the company after new capital infusion. |

| Impact on Dilution | A lower pre-money valuation means more equity given up. | Helps calculate the percentage ownership of each shareholder. |

Equity dilution is inevitable when you raise capital. As you sell new shares, your ownership percentage decreases. Modeling this helps you plan for future rounds. Different funding stages serve different purposes:

- Seed funding is for initial hires, building your MVP, and market research, often from angel investors (high-net-worth individuals).

- Venture Capital (VCs) comes later for rapid scaling, involving institutional money and larger stakes.

- Debt financing allows you to retain control but requires repayment regardless of revenue.

- Crowdfunding raises smaller amounts from many individuals and can also serve as market validation.

Your financial plan should model these scenarios to help you choose the right path.

Advanced Startup Financial Planning for Growth and Scaling

Securing funding is just the start. Now you must deploy that capital strategically.

- Hiring plans are critical, as headcount is your largest expense. Detail when you’ll hire, what roles you need, and their full cost.

- Technology upgrades will be necessary as you scale. Budget for better infrastructure and software to operate efficiently.

- Market expansion requires investment in research, localized marketing, and new operational hubs before it generates returns.

- Working capital needs become more complex. Higher sales can tie up cash in inventory and accounts receivable. Model these implications to avoid cash crunches during rapid growth.

Finally, always be planning for the next funding round. Set and achieve key milestones that will justify a higher valuation in 18-36 months.

Frequently Asked Questions about Startup Financial Planning

Here are answers to the most common questions I hear from founders wrestling with their finances.

What are the most common financial mistakes startups make?

Knowing what to watch for can save you from painful lessons. The most common mistakes include:

- Confusing revenue with profit. Revenue is exciting, but a path to profitability is what ensures survival.

- Ignoring unit economics. If your Customer Acquisition Cost (CAC) is higher than your Customer Lifetime Value (LTV), your business model is unsustainable.

- Underestimating cash needs. Always raise 10-20% more than you think you need to cover unexpected expenses and delays.

- Not updating the financial plan regularly. An outdated plan is useless. Your plan must evolve with your business.

- Making overly optimistic projections. Hockey-stick growth without solid, defensible assumptions damages your credibility with investors.

How often should I update my financial plan?

Think of your startup financial planning as a living conversation with your business.

- Monthly: Review actuals vs. projections. Did you hit your targets? Where are the variances? This helps you catch problems early.

- Quarterly: Update your forecasts and revisit your core assumptions based on what you’ve learned. This keeps your plan grounded in reality.

- Annually: Conduct a major strategic review, typically in Q4. Look at the big picture, adjust long-term projections, and align the team for the year ahead.

This regular rhythm transforms your plan from a static document into a dynamic tool.

What’s the difference between a budget and a financial plan?

Though often used interchangeably, they are different.

- A budget is tactical and short-term. It’s a detailed breakdown of expected income and expenses for a specific period, usually one year. It’s about controlling spending.

- A financial plan is strategic and long-term. It’s a comprehensive, 3-5 year document that includes budgets, financial statements, funding strategy, and risk analysis. It’s about setting the overall direction.

A budget lives inside the financial plan. The plan sets the strategy, and the budget details the near-term execution. You need both to succeed.

Conclusion: Take Control of Your Financial Future

You now understand that startup financial planning isn’t just about spreadsheets—it’s about empowering you to make smart, data-driven decisions.

We’ve covered why most startups fail (poor cash flow), the difference between a forward-looking plan and backward-looking statements, and the need to build your business on a solid financial foundation. We explored managing cash flow, tracking key metrics like burn rate and LTV:CAC, and planning for risks. Finally, we looked at how financial planning evolves for fundraising and scaling.

Your first financial plan won’t be perfect. What matters is that you start, update it regularly (monthly reviews, quarterly adjustments), and use it as a living tool to guide your business. The founders who succeed are the ones who understand their numbers. That financial literacy is within your reach, but you don’t have to achieve it alone.

At OpStart, we help founders master their finances. We provide hands-free, expert-managed finance and accounting at a flat rate, integrating with your preferred software stack. Think of us as your financial co-pilot, keeping your foundation rock-solid while you focus on building your product and growing your business.

The best time to take control of your financial future was yesterday. The second best time is now. Get expert Fractional CFO Services for your startup and let’s build something amazing together.