Why Your Startup Can’t Survive Without a Budget

A business startup budget template google sheets is essential for tracking expenses, projecting revenue, and managing cash flow during your company’s crucial first year. Here’s what you need to get started:

- Revenue projections – estimate income from sales and other sources

- Expense categories – organize costs into fixed, variable, and one-time expenses

- Cash flow tracking – monitor money coming in and going out

- Burn rate calculator – determine how long your funding will last

- Budget vs. actuals – compare planned spending to real expenses

As one startup founder put it: “A comprehensive startup budget is essential for tracking and managing expenses during the crucial first year of business.” Without this financial roadmap, you’re flying blind – making it nearly impossible to secure funding, make strategic decisions, or avoid running out of cash.

Creating a solid budget isn’t just about spreadsheets and formulas. It’s about building the foundation that will either make or break your startup. Investors want to see you understand your numbers. Your team needs clear spending guidelines. And you need to know exactly how long your money will last.

I’m Maurina Venturelli, and I’ve helped scale multiple companies from startup to IPO, including leading the global demand engine at Sumo Logic that generated 20% of total ARR. Throughout my experience building business startup budget template google sheets for high-growth companies, I’ve seen how the right financial framework can accelerate growth and attract investors.

Business startup budget template google sheets helpful reading:

The Ultimate Checklist: 10 Essential Components for Your Budget Template

Creating a business startup budget template google sheets that actually works isn’t about cramming numbers into random cells. It’s about building a financial command center that tells the story of your startup’s money – where it comes from, where it goes, and most importantly, how long it will last.

Think of your budget template as your startup’s financial GPS. Just like you wouldn’t drive cross-country without knowing your route, you can’t build a successful business without understanding your financial journey. The good news? You don’t have to start from scratch. This section provides direct links to pre-made templates that you can copy and use immediately.

Here are the 10 essential components that separate amateur spreadsheets from professional budget templates that actually help you make smart decisions.

1. Detailed Startup Expense Categories

The devil is in the details when it comes to startup expenses. Founders often get blindsided by costs they never saw coming – like that $500 business license fee or the $200 monthly software subscription they forgot about.

Your template needs to capture both one-time costs and recurring costs. One-time expenses include legal fees for incorporation, permits, initial office furniture, and website development. Recurring costs are the monthly bills that keep your lights on, such as office rent, software subscriptions, utilities, insurance, and payroll. These expenses will make or break your cash flow, so don’t underestimate them.

Download a Startup Costs Template.

2. Fixed vs. Variable Cost Breakdown

Understanding the difference between fixed costs and variable costs is fundamental. Fixed costs are your financial constants – rent, insurance, and base salaries stay the same whether you sell one unit or one thousand. These costs form your baseline monthly burn rate.

Variable costs fluctuate with your business activity. When sales go up, so do raw materials, commissions, and shipping costs. When you launch a big marketing campaign, your advertising spend spikes. Understanding this relationship helps you predict how your costs will scale as you grow.

| Cost Type | Definition | Examples |

|---|---|---|

| Fixed | Costs that stay constant regardless of sales volume | Rent, insurance, administrative salaries, loan payments |

| Variable | Costs that fluctuate directly with business activity | Raw materials, sales commissions, shipping costs, marketing spend |

Smart founders use this breakdown to calculate their break-even point and understand how much revenue they need to cover fixed costs before they start making real profit.

3. Revenue & Sales Projections

Projecting revenue for a startup is part art, part science. But it’s absolutely essential for understanding whether your business model works on paper.

Your business startup budget template google sheets needs to account for different revenue streams. Recurring revenue from subscriptions provides predictable income, while one-time sales from individual purchases create revenue spikes but require constant effort to maintain.

The key is being realistic about your pricing models and market size assumptions. I’ve seen founders project hockey-stick growth, only to reality-check themselves into a more modest and achievable forecast. Start with industry benchmarks and work backward from your market size. If you’re targeting a $10 million market and think you can capture 1% in year one, that’s $100,000 in revenue.

This guide to creating a business budget offers great tips on projecting revenue.

4. Automated Cash Flow Projections

Cash flow is the heartbeat of your startup. You can be profitable on paper and still go out of business if you run out of cash. That’s why your template needs automated cash flow projections that update themselves as you change other numbers.

Your cash flow tracker should monitor cash inflows from sales, funding rounds, and loans, while tracking cash outflows for all your expenses. The magic happens in calculating your net cash flow – the difference between what’s coming in and going out each month.

Most importantly, you need to see your ending cash balance for each month. This number tells you exactly how much money you’ll have in the bank, helping you spot potential cash crunches months before they happen.

Get a Cash Flow Forecast Template.

5. Burn Rate & Runway Calculator

Every startup founder needs to know two critical numbers: how fast you’re burning through cash and how long your money will last. These metrics can mean the difference between raising your next funding round and running out of money.

Your monthly burn rate is simply how much more you’re spending than you’re earning each month. If you’re bringing in $10,000 but spending $15,000, your burn rate is $5,000 per month. This number tells you how expensive it is to keep your startup alive.

Your runway calculation is even more important – it’s your total cash divided by your monthly burn rate. With $50,000 in the bank and a $5,000 monthly burn rate, you have 10 months of runway. That’s 10 months to either become profitable or raise more money.

Smart investors look at burn rate as a financial health indicator because it shows how efficiently you’re using capital.

6. Funding Sources Tracker

Money doesn’t just appear in your bank account – it comes from specific sources, each with their own expectations and requirements. Your budget template needs to track where every dollar comes from so you can plan future fundraising and manage investor relationships.

Investor capital from angels or VCs usually comes with equity stakes and growth expectations. Bank loans provide debt financing that needs to be repaid regardless of your success. Grants offer free money but often come with strings attached about how you can spend it.

Don’t forget about personal investment from founders and bootstrapping through revenue generation. Many successful startups start with friends and family funding before moving to professional investors.

Understanding your funding mix helps you plan for dilution, debt service, and future capital needs.

7. Hiring Plan & Payroll Calculator

For most startups, payroll becomes the biggest line item in the budget – often accounting for 40-60% of total expenses. Your template needs a hiring plan that projects both headcount and associated costs.

Your headcount projections should show when you plan to hire each role. Salaries are just the starting point – you also need to budget for benefits like health insurance and payroll taxes that add 20-30% to your base compensation costs. Don’t forget about contractor costs for freelancers and consultants. Breaking down costs by departmental budgets helps you see where you’re investing most heavily and whether it aligns with your growth strategy.

8. Capital Expenditures (CapEx) Schedule

Not every business expense hits your profit and loss statement immediately. Capital expenditures are investments in assets that benefit your business for more than a year – and they need their own section in your budget.

Equipment purchases like manufacturing machinery or specialized tools represent significant upfront investments. Computers and furniture for your office might seem small individually but add up quickly as you scale your team.

Long-term assets like property or vehicles require careful planning since they tie up substantial capital. Your template should also track depreciation – the accounting method that spreads these costs over the asset’s useful life.

Planning CapEx helps you understand your total funding needs and avoid cash flow surprises.

9. Budget vs. Actuals Variance Analysis

Here’s where your budget stops being a wishful thinking exercise and becomes a management tool. Comparing your projected numbers to actual results shows you where your assumptions were right, wrong, or wildly optimistic.

Your template needs three columns for every line item: what you planned to spend, what you actually spent, and the variance between them. This over/under spending analysis reveals patterns in your financial management and helps you make better projections.

Maybe you consistently underestimate marketing costs but overestimate office expenses. These insights help you adjust future budgets and spot problems before they become crises.

Use this template to track Budget vs. Actuals.

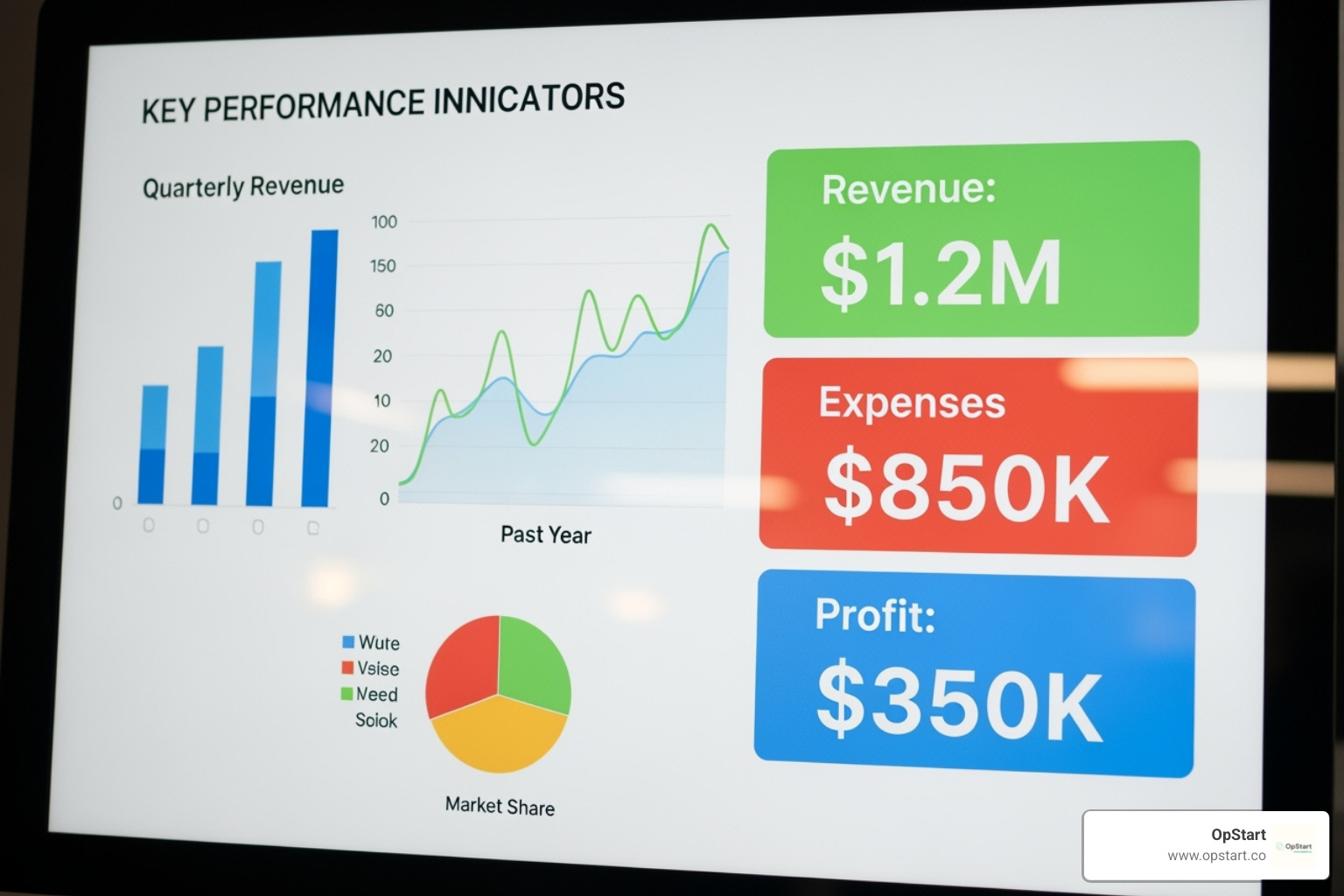

10. A Visual Summary Dashboard

Numbers in rows and columns tell a story, but charts and graphs make that story impossible to ignore. Your business startup budget template google sheets needs a visual dashboard that transforms complex data into clear insights.

Key Performance Indicators (KPIs) like customer acquisition cost, lifetime value, and monthly recurring revenue should be prominently displayed. A Profit & Loss chart shows your path to profitability at a glance, while an expense breakdown pie chart reveals where your money actually goes.

This at-a-glance overview saves you from digging through spreadsheet tabs when you need to make quick decisions or update investors. The best dashboards update automatically as you change underlying data, ensuring your visual story always reflects your current financial reality.

How to Master Your Business Startup Budget Template Google Sheets

Creating a business startup budget template google sheets is just the beginning – the real magic happens when you learn to use it effectively. Google Sheets is perfect for startup budgeting. You can collaborate with your team in real-time, access your budget from anywhere, and the price is right – free!

The built-in formulas handle the heavy mathematical lifting, so you can focus on understanding your numbers and making smart decisions. But even the most sophisticated template won’t save you from classic startup budgeting mistakes like underestimating expenses or being wildly optimistic about revenue projections.

Estimating Costs Realistically

Estimating costs for a startup is challenging without historical data. Start by researching industry benchmarks for what similar businesses spend on marketing or salaries, adjusting for your location. Getting quotes from vendors is your next step; reach out to lawyers, accountants, and software providers for estimates. Online cost calculators can also help you spot expenses you hadn’t considered, like business insurance or payroll taxes. The golden rule: add a contingency fund of 10-20% to your total estimated costs. Unexpected expenses are guaranteed, and this buffer will be your safety net.

Check out this Startup Cost Calculator for common expenses.

Customizing Your Business Startup Budget Template Google Sheets

Pre-made templates are fantastic starting points, but your business startup budget template google sheets should fit your business like a custom suit, not a one-size-fits-all t-shirt.

Feel free to add or remove line items that make sense for your specific situation. A SaaS company needs detailed sections for cloud hosting and development tools, while a food truck startup will focus heavily on permits, equipment, and ingredient costs. Your budget should reflect your reality, not some generic business model.

Adjusting formulas might sound intimidating, but Google Sheets makes it surprisingly straightforward. If you’re combining categories or creating new ones, the formulas need to keep up. You can also tailor your budget to your industry and match your business model. A subscription business needs different tracking than a one-time product sale company.

The key is making the template work for you, not forcing your business into someone else’s financial framework.

Tracking and Reviewing Your Budget

A budget is a living document that guides your decisions. Set up a monthly review schedule and stick to it. Each month, compare your projections to what actually happened to understand patterns and catch problems early. Quarterly updates are for a bigger-picture review. Are your revenue assumptions holding up? Are you hiring on schedule? These reviews help you adjust forecasts. Involving your team makes the process more effective, as they provide context on spending. The goal is awareness, which leads to better, more confident decisions.

Beyond the Spreadsheet: How a Budget Fuels Growth and Attracts Investors

Your business startup budget template google sheets is more than just numbers; it’s your startup’s financial story. It shows investors, partners, and your team that you understand your business from the ground up.

A comprehensive budget demonstrates business viability by proving you’ve thought through all operational aspects, from rent and salaries to software subscriptions. This budget becomes your strategic compass. Should you hire another developer or invest more in marketing? Your budget shows how each choice impacts cash flow and runway, guiding resource allocation far better than gut feelings.

Setting growth targets becomes much more realistic when we have solid financial foundations. Instead of saying “we want to grow fast,” we can say “based on our budget, we can sustainably grow our team by 30% over the next six months while maintaining an 18-month runway.”

Why Use a Pre-Designed Business Startup Budget Template Google Sheets?

Building a financial model from scratch is time-consuming, especially when you’re juggling product development and customer acquisition. Pre-designed templates are absolute lifesavers because they save precious time. Instead of wondering if you’ve forgotten to include payroll taxes or equipment depreciation, you can download a professionally structured template and start filling in your numbers immediately.

These templates come with the peace of mind that comes from professional structure and built-in formulas. The math is handled for you, reducing errors and ensuring you’ve covered all the essential components. A well-designed template ensures you don’t miss crucial elements like business insurance or professional development costs.

Using Your Budget to Secure Funding

When you meet potential investors, your budget is your secret weapon. Investors see hundreds of pitches, and founders who clearly understand their numbers stand out. Your detailed budget demonstrates that you’ve done your homework on costs and have a realistic path to profitability, which builds investor confidence.

Your budget should justify your funding request with precision. Instead of saying, “we need $500K to grow,” you can show exactly how that money will be allocated across hiring, marketing, and operations. It provides the financial backbone that validates your vision, showing investors you’re a founder who understands the practical realities of building a sustainable business.

Frequently Asked Questions about Startup Budgeting

After helping countless founders create their first business startup budget template google sheets, I’ve noticed the same questions come up again and again. Let me share the most common concerns I hear from startup founders who are just getting started with financial planning.

How often should a startup review its budget?

Startup budgets are living documents that need regular attention. I always tell founders to review their budget monthly, no exceptions. In the startup world, things change fast. Customer acquisition costs might spike, a key hire might fall through, or you could land a big client earlier than expected.

During these monthly reviews, you’re tracking performance against your projections and catching any red flags. But don’t stop there – you also need deeper quarterly reviews. These are when you step back and look at the bigger picture, updating your assumptions and adjusting your forecasts based on what you’ve learned. Whenever something significant happens—like securing new funding or pivoting your business model—that’s your cue for an immediate budget review.

What is the biggest mistake to avoid when creating a startup budget?

The biggest mistake is being wildly optimistic about revenue while completely underestimating expenses. It’s like planning a road trip and assuming you’ll hit every green light while forgetting about gas money.

It’s easy to believe customers will be lining up on day one, but sales cycles are often longer than you think. On the flip side, expenses have a sneaky way of adding up faster than you’d expect. That “small” monthly software subscription or higher-than-expected legal fees can compound quickly.

My advice? Be conservative with revenue projections and add a 10-20% buffer to your expense estimates. This isn’t being pessimistic; it’s being prepared. Include a contingency fund as your financial safety net when reality doesn’t match your spreadsheet.

How does a startup budget differ from a budget for an established company?

This is a great question because the difference is huge. A business startup budget template google sheets is built on educated guesses and industry benchmarks because there’s no historical data. An established company, however, can look at last year’s numbers to make incremental adjustments.

Your startup budget is more of a strategic planning tool that helps you think through every aspect of your business and identify potential challenges. An established company’s budget is more operational, focused on optimizing existing processes. This uncertainty isn’t a weakness; it’s an opportunity to be more thoughtful and strategic about every dollar you spend. Just remember to revisit and refine your assumptions as you gather real data.

Conclusion: Your Budget is Built, What’s Next?

Congratulations! You’ve created a robust business startup budget template google sheets. But this is just the beginning. Your budget is a living document that should evolve with your business. The financial discipline you’ve built is valuable, but the real magic happens when you commit to regular reviews and updates.

Your budget is the foundation for success. As market conditions shift and your business model evolves, your budget should reflect these changes. This ongoing relationship with your numbers will help you make smarter decisions and spot opportunities before they become critical.

As your startup grows, managing finances becomes more complex than a single spreadsheet can handle. That’s where expert support becomes invaluable. At OpStart, we understand your time is better spent building your product. We provide comprehensive financial operations services, including accounting, tax filings, and CFO support.

Our hands-free, expert-managed finance and accounting services allow you to focus on what you do best: building your dream. We handle the financial complexity so you can concentrate on growth.

Ready to take your financial operations to the next level? More info about CFO services for startups.