Credit cards can be a great tool for startups looking to earn rewards and defer cash payments by 30+ days for each purchase. When used correctly, a business credit card can be a great asset. When evaluating which provider to use, you can assess institutions that have been built with startups in mind or providers that are larger and more traditional.

Newer credit card providers that work mainly with startups tend to have an easier application process that doesn’t require a personal credit check or years of paperwork, offer no or low fees to use their platform, offer higher credit limits up-front and have digital platforms that have dozens of integrations.

More traditional credit card providers don’t offer these same perks which can be a turn off to newer companies however they do often offer travel rewards and other member benefits such as fraud protection.

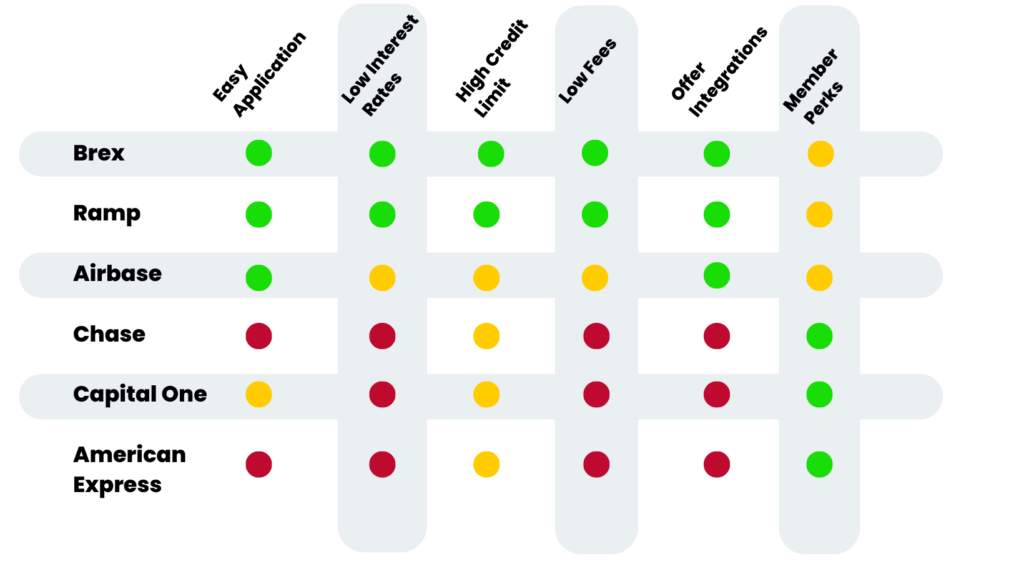

We’ve compiled a list of pros and cons for some of the most popular business credit cards from both startup-minded card providers and traditional ones.

Summary

- We recommend startups first look into applying for a business credit card through Ramp or Brex because of their higher acceptance rate, low fees and higher credit limits.

- If you can get approval for a business credit card through a more traditional provider, the travel benefits and rewards may be worth the high fees.

Providers Built for Startups

In general, these newer providers have more friendly policies for startups when compared to traditional institutions. They all have relatively easy sign-up and application processes that require less paperwork and credit history. All three also offer lower fees and higher credit rates than the bigger financial institutions. Read through their individual pros and cons below.

Ramp: With features designed for startups, Ramp is one of the top credit card providers preferred by emerging companies.

Ramp Pros:

- Almost No Fees: Ramp doesn’t charge annual fees, interest fees or foreign transaction fees.

- Real-time Spend Tracking: Ramp provides real-time insights into a business’s spending, which can help businesses better manage their finances and prevent overspending.

- Automated Expense Management: Ramp integrates with a variety of accounting and expense management software, making it easier for businesses to track and manage their expenses.

- Digital Cards: Ramp offers both digital and physical cards which allows their customers to quickly set up virtual cards as needed.

- High Credit Limit: Ramp offers relatively high credit limits when compared to more traditional card providers

Ramp Cons:

- Limited Rewards Categories: Ramp’s cashback rewards program is limited to certain categories, which may not align with all businesses’ spending habits.

Brex: As the other top provider preferred by startups, Brex continues to release new features and integrations.

Brex Pros:

- Easy Approval Process: Brex has a relatively easy application process, and it doesn’t require a personal guarantee or credit check. This makes it an attractive option for businesses that are just starting and may not have a strong credit history.

- High Credit Limits & Low Fees: Brex offers high credit limits, which can be helpful for businesses that need to make large purchases or have significant expenses.

- Flexible Rewards Program: Brex offers a unique rewards program that allows businesses to earn points on purchases, including travel, restaurants, software, and advertising. The rewards program is customizable and can be tailored to fit the business’s specific needs.

- Integrations & Spend Management: Brex caters to startups and small businesses, so it offers features such as expense management, receipt capture, and integrations with accounting software like QuickBooks and Xero in a user-friendly dashboard.

- Discounts on Services: Brex has partnerships with various vendors, such as Amazon Web Services, Google Ads, and Slack, which can offer discounts on services that businesses may already use.

- No Personal Credit Checks: Because Brex does not require a personal guarantee or credit check to open an account.

Brex Cons:

- Limited Rewards Categories: Brex’s cashback rewards program is limited to certain categories, which may not align with all businesses’ spending habits.

Airbase: Continually making moves to acquire the business of more startups, Airbase has been a player in the space but doesn’t offer the same low fees and flexibility as its competitors.

Airbase Pros:

- Easy Expense Management: Airbase makes expense management easy by offering real-time tracking, receipt capture, and categorization of expenses. It also integrates with popular accounting software such as QuickBooks and Xero.

- Customizable Spend Controls: Airbase offers customizable spend controls that allow businesses to set spending limits for individual employees or departments. This feature can help businesses control costs and prevent overspending.

- Automated Approvals: Airbase streamlines the approval process by automating approvals for recurring expenses, such as subscriptions and software licenses.

Airbase Cons:

- Fees for Certain Features: Airbase charges fees for certain features such as additional cards, international wire transfers, and paper statements. These fees may add up and increase the overall cost of using the card.

- No Personal Credit Reporting: Airbase does not require a personal guarantee, which means it does not report to personal credit bureaus. This may not help build or improve a business owner’s personal credit score.

- Higher Interest Rates: Airbase’s interest rates are relatively high compared to other corporate credit cards, so it may not be an ideal option for businesses that carry a balance.

Larger Institutions & Traditional Providers

Although larger providers are not built to be “startup friendly”, they do offer better benefits in some areas than their newer competitors. Most of their member reward perks go beyond software discounts and offer airline club memberships, airline mile rewards, and hotel rewards, which can all be extremely beneficial for companies meeting with global investors and partners. They do have a longer, more difficult application process and come with higher fees and lower credit limits. Read about their individual pros and cons below.

Chase: A large name in the financial industry, Chase has proven to be a stable provider for businesses of all sizes. Becoming a Chase member is like joining an exclusive club.

Chase Pros:

- Generous Rewards Program: Chase offers a variety of rewards programs that can benefit businesses, including cashback, points, and miles, depending on the card.

- Fraud Protection: Chase offers robust fraud protection to its cardholders, including real-time fraud monitoring, zero-liability protection, and purchase protection.

- Built-in Perks: Some Chase business credit cards offer built-in perks such as airport lounge access, hotel and travel credits, and discounts on business services.

- Introductory Offers: Chase often offers introductory offers such as bonus rewards, 0% APR on purchases and balance transfers, and waived annual fees, which can help businesses save money.

Chase Cons:

- Annual Fees: Many Chase business credit cards have annual fees, which can add up and increase the overall cost of using the card.

- High-Interest Rates: Chase’s interest rates are relatively high, so businesses that carry a balance may incur significant interest charges.

- High Fees for Cash Advances: Chase charges a high fee for cash advances, so businesses should avoid using the card for cash advances if possible.

- Stringent Qualification Requirements: Chase may have strict qualification requirements, making it challenging for some businesses to obtain a business credit card from the issuer.

Capital One: Another large and established giant in the space, Capital One has cultivated a highly-recognizable brand and many great perks to go along with membership;

Capital One Pros:

- Rewards Program: Capital One offers a rewards program that allows businesses to earn cash back or miles on their purchases.

- No Foreign Transaction Fees: Capital One does not charge foreign transaction fees on purchases made outside of the US, which can be beneficial for businesses that frequently travel internationally.

- Fraud Protection: Capital One has a robust fraud protection program, which can help businesses avoid unauthorized charges and fraudulent activity.

Capital One Cons:

- Annual Fees: Some of Capital One’s business credit cards charge an annual fee, which can be a downside for businesses that want to avoid additional costs.

- Credit Score Requirements: Capital One may have strict credit score requirements for approval, which could be a barrier for some businesses.

- Cash advance fees: Capital One charges a fee for cash advances, which can be a downside for businesses that need access to cash quickly.

American Express: Better known as AmEx, this financial institution has some of the best travel perks on the market but also imposes some of the highest fees.

American Express Pros:

- Rewards Program: American Express offers a rewards program that allows businesses to earn cash back or points on their purchases.

- Travel Benefits: American Express offers a variety of travel-related benefits, including airport lounge access, travel credits, and travel insurance.

- Purchase Protection: American Express offers purchase protection, which can help businesses avoid losses due to theft or accidental damage to eligible items.

American Express Cons:

- Limited Acceptance: American Express is not accepted at as many merchants as Visa or Mastercard, which can be a downside for businesses that need to make purchases at a wide range of vendors.

- Annual Fees: Some of American Express’s business credit cards charge an annual fee, which can be a downside for businesses that want to avoid additional costs.

- High Credit Score Requirements: American Express may have strict credit score requirements for approval, which could be a barrier for some businesses.