What Are R&D Tax Incentives and Why Do Governments Offer Them?

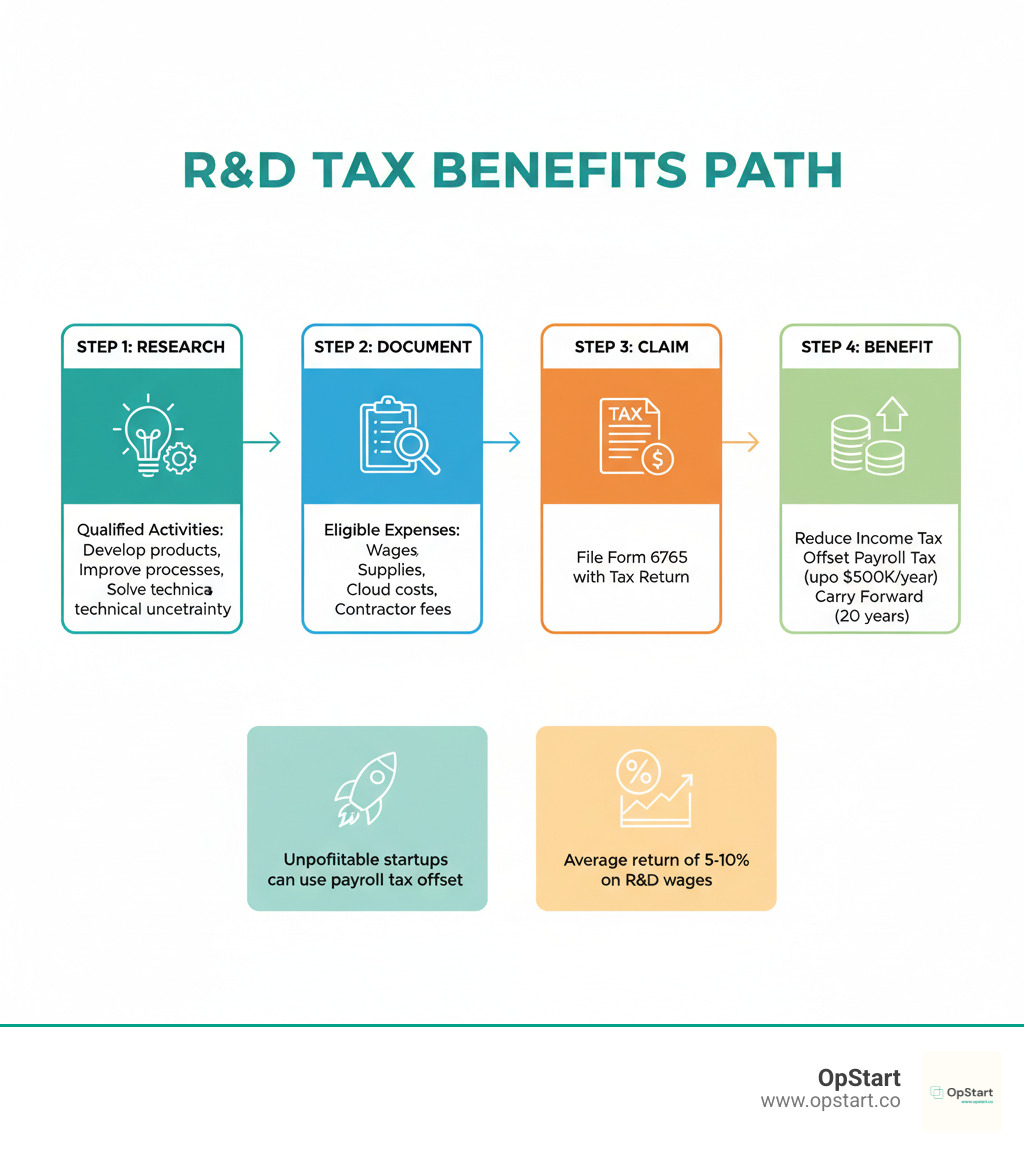

The research & development tax incentive is a government program that rewards companies for investing in innovation. It offers tax credits that directly reduce your tax liability or even provide cash refunds. For startups, this can mean offsetting up to $500,000 per year in payroll taxes, effectively extending your runway without diluting equity.

Key Facts About R&D Tax Incentives:

- Credit Rate: 15% federal credit on qualified research expenses (varies by country)

- Payroll Tax Offset: Startups can offset employer FICA taxes up to $500,000 annually for five years

- Eligibility: Companies developing new or improved products, processes, or software using scientific principles

- No Profitability Required: Even unprofitable startups can claim the credit against payroll taxes

- Refundability: Some jurisdictions offer refundable credits for small businesses

- Documentation: Contemporaneous records of research activities and expenses are essential

Whether you’re building software or developing hardware, these incentives can significantly reduce your burn rate. The credit applies to wages for engineers, supplies, cloud computing costs, and 65% of qualified contract research expenses. Countries like Canada and Australia offer similar programs with rates from 15% to 35%.

I’m Maurina Venturelli. Having seen how R&D tax incentives fuel growth at companies like Sumo Logic and LiveAction, my team at OpStart now helps founders steer these programs to focus on building, not paperwork.

Governments worldwide use the research & development tax incentive to boost their economies and foster innovation for a few key reasons:

- Economic Growth: Innovation drives economic growth. By incentivizing R&D, governments foster new industries, jobs, and exports.

- Spurring Private Sector Innovation: Governments rely on the private sector to commercialize scientific breakthroughs. Tax incentives make the financial risks of innovation more manageable for businesses.

- Addressing Market Failure (Knowledge Spillovers): R&D creates societal benefits (“knowledge spillovers”) that the innovating firm can’t fully capture. Tax incentives encourage this investment by offsetting some of the cost, benefiting the wider economy.

- Global Competitiveness: Countries compete for technological leadership. Strong R&D incentives help domestic firms stay globally competitive and attract innovation.

- Ease of Administration: Unlike direct subsidies, tax incentives let companies choose their own projects, making them easier to administer and more compliant with international trade rules, as noted by the OECD.

The OECD confirms these incentives effectively raise business R&D investment, especially for small firms. Tax incentives now represent over half of all government support for business R&D in OECD and EU areas.

The Core Purpose: Encouraging Innovation

At its heart, the research & development tax incentive exists to encourage activities that involve a “systematic investigation” aimed at achieving “scientific or technological advancement.” Eligible R&D typically involves:

- Creating New or Improved Products: Developing entirely new offerings or significantly enhancing existing ones.

- Process Improvement: Innovating how things are made or delivered for greater efficiency, quality, or cost reduction.

- Technological Advancement: Generating new knowledge to overcome scientific or technological uncertainty.

- Reducing Financial Risk for Businesses: By offsetting some of the inherent costs and risks of R&D, governments foster a culture of experimentation.

R&D Tax Incentives vs. Government Grants

While both research & development tax incentives and government grants aim to stimulate R&D, they operate differently.

Tax Incentives:

- Broadly Available: Open to any company that meets the R&D criteria.

- Self-Assessed: Companies determine their own eligibility and claim the credit on their tax returns.

- Less Restrictive: Companies have more freedom to choose their R&D projects.

Government Grants:

- Highly Competitive: Applicants compete for a limited pool of funds.

- Specific Project Focus: Tied to particular government priorities or industries.

- Stricter Reporting: Involve detailed applications and stringent reporting requirements.

Both mechanisms have strengths. The OECD notes that tax incentives are effective for experimental development, while grants are often better for basic and applied research. Understanding both is key to maximizing funding. If you’re looking for More info about fundraising for startups, check out our guide.

How the Research & Development Tax Incentive Works

The research & development tax incentive turns your innovation efforts into tangible financial benefits. For every dollar you spend on qualified R&D, you can get a portion back through tax savings or even direct cash. It’s not a loan and it doesn’t dilute your equity.

The credit works in three powerful ways. First, it can directly reduce your income tax liability on a dollar-for-dollar basis. A $20,000 R&D credit reduces a $100,000 tax bill to $80,000. Second, you might be eligible for cash refunds if your credit exceeds your tax liability, which is a lifeline for startups. Third, and most importantly for early-stage companies, U.S. startups can use the payroll tax offset to apply R&D credits against employer-paid FICA taxes, meaning even unprofitable startups can benefit immediately.

Are You Eligible? The Four-Part Test

In the U.S., eligibility for the research & development tax incentive hinges on the “four-part test.” Your project must meet all four criteria.

The Permitted Purpose Test requires your work to be for a new or improved business component (product, process, software, etc.). The improvement must be functional or performance-related, not just cosmetic.

The Elimination of Uncertainty Test means you must have faced genuine scientific or technological uncertainty at the outset. If the outcome or method was not known beforehand, and you were trying to solve a problem without a clear solution, it qualifies.

The Process of Experimentation Test requires you to have evaluated one or more alternatives to eliminate the uncertainty. This can include modeling, simulation, systematic trial and error, or building prototypes.

The Technological in Nature Test ensures your process of experimentation relies on principles of the hard sciences, such as engineering, computer science, physics, or biology. Market research or routine testing does not qualify.

Importantly, your project doesn’t need to succeed to qualify. The credit rewards the attempt to innovate, not just the outcome. If you’re wondering whether your specific activities might qualify, we’ve put together a detailed guide: Do You Qualify for R&D Tax Credits?

What Expenses Qualify for the Credit?

Once you confirm your activities qualify, you can claim Qualified Research Expenses (QREs).

Employee wages are often the largest part of a claim. This includes taxable wages for employees directly performing, supervising, or supporting qualified research, such as engineers, developers, and their direct managers.

Supplies and materials include tangible items consumed during the research process, like prototype components or testing materials. It excludes equipment with a useful life beyond the project.

Cloud computing costs for tax years beginning after December 31, 2022, are now eligible. Costs for services like AWS, Google Cloud, or Azure used for development, testing, and experimentation can be included. This is a significant benefit for tech startups.

When you hire contractors to perform qualified research, you can typically claim 65% of what you pay them. This is common for outsourced development or specialized consulting.

Good record-keeping is essential to prove these expenses were for qualified research. For more guidance on managing your startup’s finances, check out our resource on Business Startup Tax Deductions.

How Startups Can Benefit: The Payroll Tax Offset

Most early-stage startups aren’t profitable, which makes it hard to use a traditional tax credit. This is where the payroll tax offset becomes transformative for U.S. startups. The PATH Act of 2015 allows eligible startups to apply their R&D tax credits against their employer-paid FICA payroll taxes instead of income tax. This provides real cash that stays in your bank account each quarter.

To qualify as a Qualified Small Business (QSB), you must meet two criteria: your gross receipts for the current tax year must be less than $5 million, and you must have no gross receipts in any tax year before the five-year lookback period (e.g., for a 2024 claim, no revenue before 2020).

If you qualify, you can offset up to $500,000 per year in employer FICA taxes for up to five years. This provides up to $2.5 million in non-dilutive capital over five years, directly extending your runway. For many startups, the payroll tax offset is the difference between reaching their next milestone and running out of cash. For more context on managing your startup’s tax strategy, see our guide on Taxes for Startups.

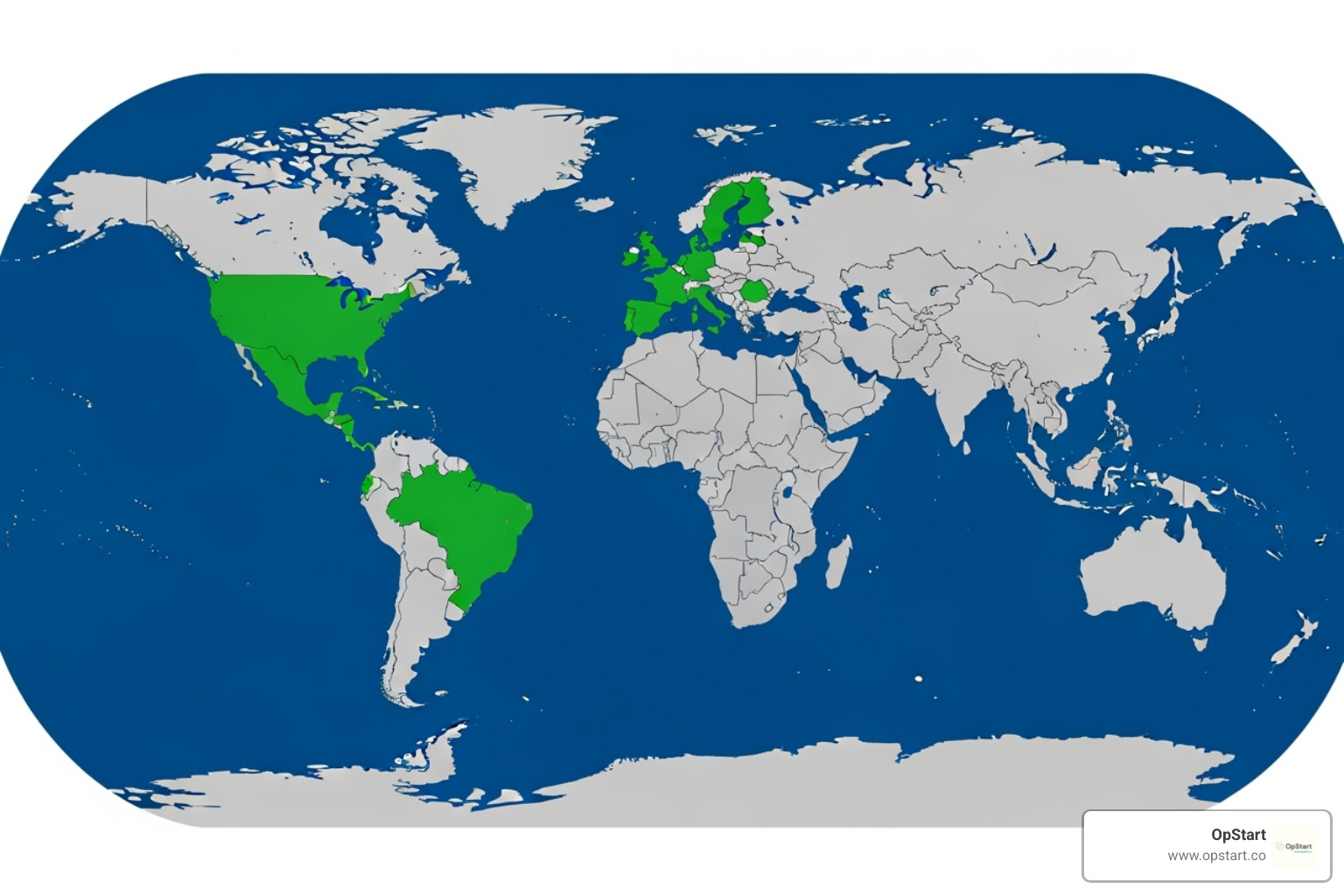

A Global Look at R&D Tax Incentives

The U.S. is not alone; countries worldwide use the research & development tax incentive to drive innovation. These programs are popular because they are flexible and let companies choose their own projects. However, the details—like credit rates, refundability, and eligibility—vary significantly by country.

Organizations like the OECD actively track these programs, analyzing their design and impact. Their research shows a persistent growth in government tax relief for R&D, highlighting a fundamental shift in how governments support innovation. If you’re curious about the full landscape, the OECD maintains a comprehensive R&D tax incentives database that covers dozens of countries.

Global differences in the research & development tax incentive

If you’re operating internationally, understanding how different countries approach the research & development tax incentive is critical. The differences can significantly impact your cash flow and growth strategy. Here’s how four major innovation hubs stack up:

| Feature | United States (Federal) | Canada (SR&ED) | Australia (R&DTI) | New Zealand (RDTI) |

|---|---|---|---|---|

| Credit Rate | Varies, often ~10-14% of QREs (incremental) | CCPCs: 35% on first CAD3M, 15% after. Others: 15%. Plus provincial credits. | Turnover <$20M: Corporate tax rate + 18.5% premium (refundable). Turnover >$20M: Corporate tax rate + incremental premium (non-refundable). | 15% |

| Refundability | Limited: Payroll tax offset for QSBs (up to $500k/yr). Otherwise non-refundable. | High for CCPCs: 35% is fully refundable. Others: Non-refundable. | High for <$20M Turnover: Refundable. >$20M Turnover: Non-refundable. | Refundable in some circumstances (e.g., wage intensity). |

| Eligibility Focus | Four-part test (purpose, uncertainty, experimentation, tech) | Scientific or technological uncertainty, systematic investigation, advancement | Core R&D (experimental activities), supporting R&D | Scientific or technological uncertainty |

| Expenditure Caps | No federal cap on QREs for credit calculation. | CAD3M for improved CCPC rate. | No cap on eligible expenditure, but offset linked to corporate tax. | Min $50k, Max $120M annual eligible expenditure. |

| Small Business Benefits | Payroll tax offset for QSBs. | Improved 35% refundable rate for Canadian-Controlled Private Corporations (CCPCs). | Refundable offset for aggregated turnover <$20M. | Wage intensity criteria for refundability (20% labour costs to R&D). |

| Carryforward/back | Carryforward 20 years, Carryback 1 year. | Carryforward 20 years, Carryback 3 years. | Carryforward 20 years. | Carryforward possible with shareholder continuity. |

Each country takes a different approach. The U.S. focuses on payroll tax offsets for early-stage companies, while Canada and Australia offer generous refundable credits for small businesses.

Country Spotlight: Canada, Australia, and New Zealand

Let’s dig deeper into how three startup-friendly countries structure their R&D incentives.

Canada’s SR&ED Program is one of the most generous globally. It offers a 35% refundable investment tax credit for small Canadian-controlled private corporations (CCPCs) on their first CAD $3 million of eligible R&D expenditures. “Refundable” means you can receive a cash refund even if you’re not profitable. Provincial credits can further increase the benefit.

Australia’s R&DTI offers a refundable offset for companies with aggregated turnover under AUD $20 million, equal to their corporate tax rate plus an 18.5% premium. This puts cash directly into the hands of smaller innovators. Larger companies receive a non-refundable offset tied to their R&D intensity—the proportion of their spending committed to research.

New Zealand’s RDTI offers a straightforward 15% tax credit on eligible R&D. The program has a unique refundability rule tied to wage intensity. If 20% or more of your labor costs relate to R&D, you may qualify for a refundable credit, making it attractive for pre-profit startups.

These programs are constantly evolving. Keeping up with Changes to the R&D Tax Credit: What Founders & CEOs Need to Know helps you maximize your benefits no matter where you’re operating.

Navigating Compliance and Maximizing Your Claim

Claiming the research & development tax incentive can be a game-changer, but compliance is non-negotiable. Meticulous record-keeping is essential to secure your claim and avoid audits, penalties, or losing the benefit entirely. A successful claim improves your financial statements, but a poorly documented one creates significant risk.

The Importance of Contemporaneous Documentation

Contemporaneous documentation—records created as the work happens—is the key to a successful claim. The burden of proof is on you to show your activities met the four-part test and that expenses were legitimate. You cannot effectively recreate this evidence months later.

Key documents include:

- Project plans detailing the technical uncertainties you aimed to resolve.

- Test records showing your process of experimentation, data, and analysis.

- Technical meeting notes where your team wrestled with R&D challenges.

- Time tracking for all personnel involved in R&D activities.

- Expense receipts, invoices, and payroll records related to R&D spending.

- Version control history (like Git commits) for software projects, which provides powerful, time-stamped evidence of development.

Solid Bookkeeping Needs for Start-ups are your best defense in an audit and ensure a smooth claim process.

How to File Your Claim

For U.S. startups, the claim process involves a few key forms filed with your annual corporate tax return.

Form 6765 (Credit for Increasing Research Activities) is used to calculate your credit based on your qualified research expenses. It’s filed with your corporate tax return (e.g., Form 1120).

To use the payroll tax offset, you must first make an election on Form 6765. The credit is then claimed quarterly against employer FICA taxes using Form 941, your Employer’s Quarterly Federal Tax Return. This provides immediate cash flow benefits throughout the year.

Deadlines are critical. The payroll tax offset election must be made on a timely filed original return (including extensions). Missing it means forfeiting the benefit for that year. You can generally amend a return to claim the R&D credit within three years, but not for the payroll offset election.

Navigating these forms is complex. Partnering with experts can make the difference between leaving money on the table and maximizing your claim. Our Startup Tax Filing services are designed to handle these complexities so you can focus on innovation.

Frequently Asked Questions about the R&D Tax Incentive

The research & development tax incentive is valuable but complex. Here are answers to the most common questions we hear from founders.

Can I claim the R&D tax credit if my startup isn’t profitable yet?

Yes. Unprofitable startups can benefit in several ways:

- Payroll Tax Offset: Qualified Small Businesses (QSBs) can apply up to $500,000 of the credit annually against employer-paid FICA taxes. This provides an immediate cash benefit.

- Carryforward: Federal credits can be carried forward for up to 20 years to offset future income tax liability once you become profitable.

- State Credits: Some states offer refundable credits, which can provide a cash refund regardless of profitability.

What is the difference between a research & development tax incentive and a deduction?

A tax credit is a dollar-for-dollar reduction of your tax liability, making it much more valuable than a tax deduction, which only reduces your taxable income. For example, a $5,000 credit saves you $5,000 in tax, while a $5,000 deduction might only save you $1,050 (at a 21% corporate tax rate). The R&D incentive is a credit, though you can often still deduct the underlying R&D expenses.

What are common mistakes to avoid when claiming the credit?

Brilliant founders often leave money on the table—or face an audit—due to preventable mistakes with the research & development tax incentive.

- Poor Documentation: Failing to keep detailed, contemporaneous records of your eligible activities and expenses is the most common reason claims are denied.

- Misinterpreting the Four-Part Test: Claiming activities that don’t involve resolving technological uncertainty through a process of experimentation (e.g., routine bug fixes, cosmetic changes).

- Overclaiming Expenses: Including costs not directly tied to qualified research activities can trigger an audit and penalties.

- Missing Filing Deadlines: The election for the payroll tax offset must be made on a timely filed original tax return. Missing this strict deadline means forfeiting hundreds of thousands of dollars in benefits for that year.

Other mistakes include ignoring state-level credits and trying to steer the complex rules without expert guidance. At OpStart, we help startups avoid these pitfalls. If you want to know Do You Qualify for R&D Tax Credits?, we can walk you through the process and ensure you’re maximizing every dollar available.

Open up Your Startup’s Potential with R&D Tax Credits

The research & development tax incentive is more than a tax break; it’s a strategic tool to accelerate your startup’s growth. You’re already doing the hard work of building something new—why not get rewarded for it?

The payroll tax offset can provide up to $500,000 in non-dilutive cash annually for qualified small businesses. This capital can extend your runway, fund new hires, and fuel further innovation. It’s real money that flows directly back into your operations.

Claiming the credit also signals to investors, partners, and potential hires that you are financially savvy and serious about innovation, effectively managing risk while pushing boundaries.

The challenge is that navigating the complexities of eligibility, documentation, and filing can be overwhelming. At OpStart, we believe founders should focus on building great companies, not wrestling with tax forms. Our hands-free, expert-managed finance and accounting services handle the entire R&D tax credit process for you—from assessing eligibility and gathering documentation to filing claims and ensuring compliance.

We’ve seen this incentive transform startups by providing a compounding competitive advantage. Don’t leave this opportunity on the table. Whether you’re a pre-revenue SaaS company or a growing hardware startup, there’s a good chance you qualify for significant R&D tax benefits.