Why Your Startup Legal Entity Choice Matters More Than You Think

Startup legal entity selection is one of the first and most critical decisions you’ll make as a founder, directly impacting your personal liability, tax obligations, ability to raise capital, and growth potential.

Quick Answer for Startup Legal Entity Selection:

- C-Corporation: Best for VC funding, employee stock options, multiple investors

- LLC: Flexible, pass-through taxes, good for bootstrapped startups

- S-Corporation: Pass-through taxes with some liability protection, limited to 100 shareholders

- Sole Proprietorship: Simplest but offers no liability protection

- Partnership: For multiple founders, but personal liability risks

Over 70% of venture capital-backed startups choose C-Corporations, while the flexibility of LLCs leads to over 1 million new formations annually. Your entity affects how you pay taxes and whether investors will fund you. Think of it as your business’s foundation: get it wrong, and you’ll face costly repairs; get it right, and you’ll have a solid platform for scaling, protecting personal assets, and attracting talent.

As Maurina Venturelli, I’ve guided companies through this process while scaling businesses to IPO at companies like Sumo Logic. Understanding how your entity choice impacts fundraising and financial operations is crucial for success.

What is a Legal Entity and Why is it a Critical First Step?

A legal entity gives your business its own legal identity, creating a separate legal person that can sign contracts, own property, pay taxes, and be sued. This isn’t just paperwork; it’s a critical first step.

Timing is crucial. Many founders delay formation, but every day you operate without an entity, you risk your personal assets. That client contract or business-related car trip could put you personally on the hook for any debts or damages. A proper legal entity also signals credibility with investors and partners, showing you’re serious about building a lasting business.

Intellectual property protection is another key reason to act quickly. Your app, brand name, and unique processes need a legal owner. With an entity and proper IP assignment agreements in place from day one, there’s no question about who owns what. The SBA guide to choosing a structure breaks down these basics.

The Shield of Limited Liability

The right legal entity provides personal asset protection, creating a firewall between your business and personal finances. Without this, business debts and lawsuits can target your personal bank account, home, and savings. With a formal entity, your personal assets remain safe even if the business fails.

The key is maintaining separation between personal and business finances with separate bank accounts and credit cards. While courts can sometimes pierce the corporate veil if you mix funds or ignore corporate formalities, it’s powerful protection for founders who follow the rules.

Attracting Investment and Talent

If you plan to raise money, your entity choice is paramount. Investor preference is clear: over 70% of venture capital goes to C-Corporations.

Venture capital requirements are specific. VCs need the flexibility of C-Corporations and preferred stock structures, which allow for different classes of shares with specific rights. Proposing an LLC investment to a VC is often a non-starter.

The same applies to attracting talent. Employee stock options are a standard for startup compensation and work best within a corporate structure. While LLCs have alternatives, they are more complex and less attractive to potential hires. If you’re thinking big, a corporate structure saves headaches and legal fees down the road.

Comparing the Most Common Types of Startup Legal Entity Structures

Choosing the right startup legal entity is like picking the right foundation for a house—it must support your future plans. Each structure has unique benefits and drawbacks. Let’s break down the five most common options.

| Entity Type | Liability | Taxation | Ownership Limits | Investor Friendliness |

|---|---|---|---|---|

| Sole Proprietorship | Unlimited personal liability | Pass-through (owner’s personal tax) | One owner | Low |

| Partnership | Unlimited personal liability (General) | Pass-through (partners’ personal tax) | Two or more owners | Low |

| LLC | Limited personal liability | Pass-through (can elect corporate tax) | Flexible, no strict limit | Moderate (less for VC) |

| S-Corporation | Limited personal liability | Pass-through (avoids corporate tax) | Max 100 shareholders (US citizens/residents) | Moderate (limits for VC) |

| C-Corporation | Limited personal liability | Double taxation (corporate & shareholder) | Unlimited shareholders | High (preferred by VC) |

Sole Proprietorship

A sole proprietorship is the simplest structure, with no formal setup required. However, you and your business are legally the same person. This means every business debt is your personal debt, and any lawsuit puts your personal assets at risk.

For taxes, all income flows to your personal return, where you pay income tax plus a 15.3% self-employment tax. While simple, it’s a risky choice for any business with growth potential or liability concerns. The IRS guide on sole proprietorships has more details. This structure is best for very low-risk, single-person ventures.

Partnership (General & Limited)

A partnership forms when two or more people go into business together without creating a formal entity.

General partnerships make all partners personally liable for business debts, even those created by another partner. Limited partnerships have general partners who manage the business and assume liability, and limited partners who are passive investors with liability limited to their investment. Limited liability partnerships (LLPs) are common for professional groups (lawyers, accountants), protecting partners from each other’s malpractice.

All partnerships feature pass-through taxation, but a well-drafted partnership agreement is essential to define roles and prevent future conflicts.

Limited Liability Company (LLC)

The LLC is a popular, versatile choice, offering liability protection without corporate complexity. It’s a hybrid structure that has become a go-to for many entrepreneurs.

LLCs provide the best of both worlds: the personal asset protection of a corporation and the pass-through taxation of a sole proprietorship, avoiding double taxation. They are highly flexible in management and profit distribution.

However, active LLC owners must pay self-employment tax on their share of profits. While great for many businesses, LLCs can complicate venture capital investment. A strong operating agreement is crucial to define how the LLC runs, as state default rules may not fit your vision. The IRS LLC guide provides more details.

Corporation: C-Corp vs. S-Corp

Corporations are the most formal structure, offering the strongest liability protection and sophisticated options for raising capital. They require more administration, including a board of directors, bylaws, and regular meetings.

C-Corporations are the standard for the venture capital world. Chosen by over 70% of VC-backed startups, they can issue multiple classes of stock and have unlimited shareholders globally, which institutional investors expect. The main drawback is potential double taxation: the corporation pays taxes, and shareholders pay taxes on dividends. For high-growth startups reinvesting profits, this is often not an immediate issue.

S-Corporations offer a compromise: corporate liability protection with pass-through taxation, avoiding corporate-level taxes. Owners can also save on self-employment taxes. However, S-Corps have strict rules: no more than 100 shareholders (who must be U.S. citizens or residents) and only one class of stock. These limits make them unsuitable for startups planning major investment rounds. The IRS S-Corp requirements outline the eligibility details.

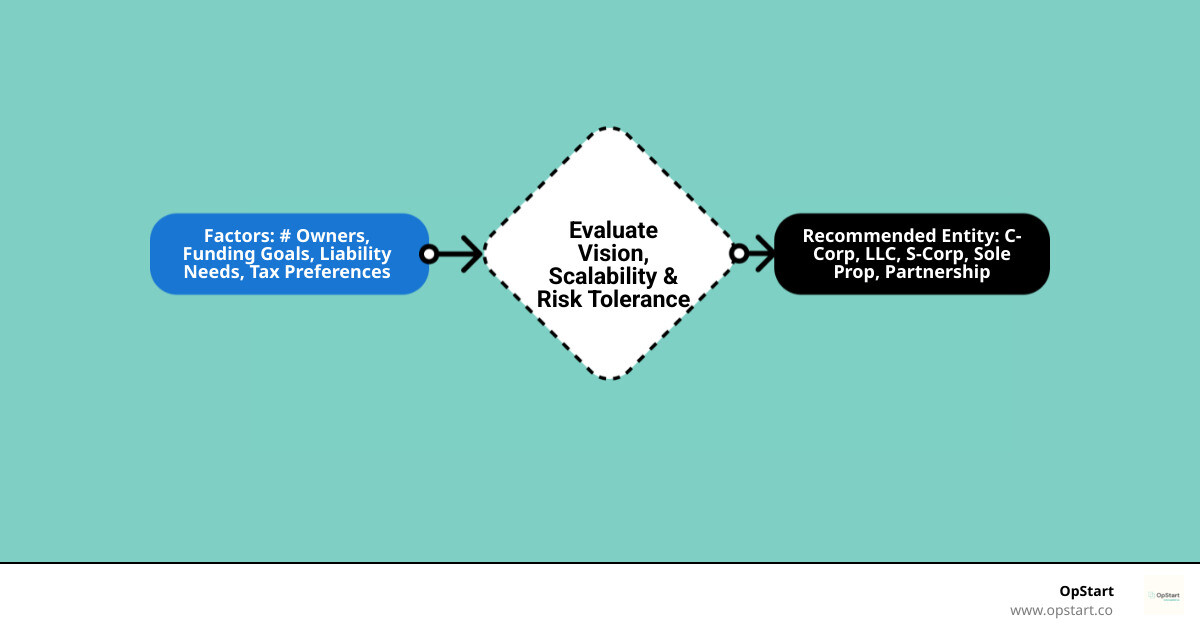

How to Choose the Right Structure for Your Venture

Choosing the right startup legal entity is a strategic decision that should align with your long-term vision. What works for a small consulting business may be wrong for a high-growth tech startup. The key is to honestly assess your business goals and risk tolerance.

Key Factors in Choosing Your Startup Legal Entity

When we work with founders at OpStart, these factors consistently drive the decision:

Your growth ambitions are paramount. Are you building a small, profitable business or the next unicorn? If you plan to raise venture capital, a C-Corporation is almost always required.

Personal risk tolerance is another crucial factor. If the thought of a business lawsuit threatening your personal assets is a concern, you need the liability protection of an LLC or Corporation. Sole proprietorships and general partnerships offer no such protection.

The number of people involved shapes your options. A solo founder has more choices, while co-founders need a structure that clarifies governance and profit-splitting. LLCs offer flexibility, while corporations have more formal rules.

Tax implications affect cash flow. Most entities are “pass-through,” meaning profits are taxed at the personal level. A key consideration is the self-employment tax—an extra 15.3% for sole proprietors and many LLC owners. C-Corps face potential double taxation, but this may not be an issue for years if you reinvest all profits.

Your funding strategy often dictates the choice. Bootstrapping or raising money from friends and family? An LLC or S-Corp can work well. If venture capital is in your future, start with a C-Corp or plan for an expensive and complex conversion later.

Choosing Your Jurisdiction: Why Delaware is a Founder Favorite

You don’t have to incorporate in the state where you operate. For high-growth startups, Delaware is the standard for several reasons.

Delaware’s corporate law is highly developed and predictable. The state has a specialized Court of Chancery where expert judges handle only business cases, providing clear precedent when legal questions arise.

Investors love Delaware corporations because the structure is familiar. VCs don’t want to spend time and money analyzing an unfamiliar entity structure from another state. The numbers confirm this: over 65% of Fortune 500 companies are incorporated in Delaware.

While incorporating in Delaware requires registering as a “foreign corporation” in your home state (adding some paperwork and fees), the benefits of a predictable legal system and investor-friendly structure far outweigh the hassle for ambitious startups.

The Formation Checklist: From Decision to Official Entity

Once you’ve chosen your startup legal entity, it’s time to make it official. This process involves several straightforward steps to get your business properly registered with the government.

The Step-by-Step Process of Forming Your Startup Legal Entity

Choose your business name. Your name must be legally available in your state of incorporation. Search the state’s business registry and consider a trademark search. Have backups ready in case your first choice is taken.

File your articles of incorporation or organization. This is the official document that creates your entity. For corporations, it’s the “Articles of Incorporation”; for LLCs, it’s the “Articles of Organization.” You’ll file this with the Secretary of State for a fee that varies by state ($50-$500).

Appoint a registered agent. Every formal entity needs a registered agent with a physical address in the state of incorporation to receive legal documents. You can be your own agent, but many founders use a service for convenience and privacy.

Draft your key legal documents. For corporations, you’ll need bylaws outlining internal operations. LLCs need an operating agreement to cover ownership, roles, and profit distribution.

Create a founder’s agreement. If you have co-founders, this document is non-negotiable. It clarifies equity splits, vesting, roles, and what happens if a founder leaves. Settle these details early to avoid future conflict.

Obtain an Employer Identification Number (EIN). This is your business’s Social Security Number, needed for banking, taxes, and hiring. You can apply for an EIN online for free from the IRS.

Open a business bank account. With your EIN, you can open a dedicated bank account. This is critical for maintaining liability protection by keeping business and personal finances separate.

Issue founder stock. For corporations, you must formally issue stock to the founders according to your founder’s agreement, creating stock certificates and maintaining a record of ownership.

The entire process typically takes 2-4 weeks. This paperwork builds the legal foundation that will support your company’s growth for years.

Frequently Asked Questions about Startup Entities

After helping hundreds of founders with startup legal entity formation, we see the same questions repeatedly. Here are the most common concerns.

Can I change my legal entity later?

Yes, but it’s often complex and expensive. The most common change is an LLC to C-Corp conversion, usually done to prepare for venture capital funding. This process involves legal paperwork, potential tax consequences, and can be costly.

The IRS might treat the conversion as a taxable event, meaning you could owe taxes on your business’s appreciated value. While possible, these conversions require professional guidance. It’s almost always more efficient and cheaper to choose the right structure from the start.

How much does it cost to form a legal entity?

Costs vary based on your state, entity type, and how much help you get.

- State filing fees: These range from about $50 to several hundred dollars. Delaware’s fee for corporations is about $89.

- Registered agent fees: If you use a service, expect to pay $100-$300 annually.

- Legal or online service costs: Online services can cost a few hundred dollars, while a startup attorney may charge $1,500-$3,000. The attorney route costs more upfront but can prevent costly mistakes.

- Ongoing compliance costs: Don’t forget annual reports and franchise taxes. California, for example, has an $800 minimum annual franchise tax for LLCs and corporations.

When should I consult a lawyer or financial expert?

Our advice is early and often. While DIY is tempting to save money, certain situations demand professional guidance.

- Multiple founders: A lawyer is essential to draft a proper founder’s agreement that covers equity, vesting, and exit scenarios to prevent future disputes.

- Complex intellectual property: If your value is in proprietary technology or creative works, you need an expert to draft proper IP assignment agreements from day one.

- Outside investment plans: VCs and angel investors will scrutinize your legal structure. Any mistakes can derail a funding deal.

Even if these don’t apply now, an early consultation is like preventive maintenance for your business—a small investment that prevents expensive problems later.

Conclusion: Building a Solid Foundation for Growth

Your startup legal entity choice is the foundation upon which your business is built. Getting it right provides a solid platform for growth, while getting it wrong can lead to costly problems for years.

The structure you choose impacts your personal liability, tax obligations, and ability to attract talent and investment. It’s a decision that ripples through every aspect of your business journey. Aligning your structure with your long-term vision is crucial. A high-growth startup has different needs than a lifestyle business.

You don’t have to figure this out alone. Professional guidance in legal and financial matters is essential for making the right choice and avoiding common pitfalls.

Once your entity is formed, maintaining compliance is the next challenge. That’s where OpStart comes in. We provide expert-managed finance and accounting services for startups, handling everything from bookkeeping and tax filings to CFO-level strategy. Our flat-rate pricing lets you focus on building your business, not managing your back office.

Ready to build on a solid foundation? Learn more about choosing between a C-Corp vs. LLC and take the first step toward a structure that supports your dreams.