Why Startup Tax Filing Doesn’t Have to Be Your Worst Nightmare

Startup tax filing can feel like navigating a maze. Between federal forms, state requirements, payroll taxes, and compliance deadlines, many founders drown in paperwork when they should be focusing on growth.

Here’s what every startup founder needs to know about tax filing:

- You must file even if you made no profit – Any business with an EIN has filing obligations.

- Your business structure determines your tax forms – C-Corps use Form 1120, S-Corps use Form 1120-S, Partnerships use Form 1065.

- Key deadlines vary by entity type – C-Corps are due April 15, while S-Corps and Partnerships are due March 15.

- Multiple tax types apply – These include income, payroll (FICA, FUTA), sales, and franchise taxes.

- Powerful credits can reduce your burden – The R&D tax credit can offset up to $250,000 in payroll taxes.

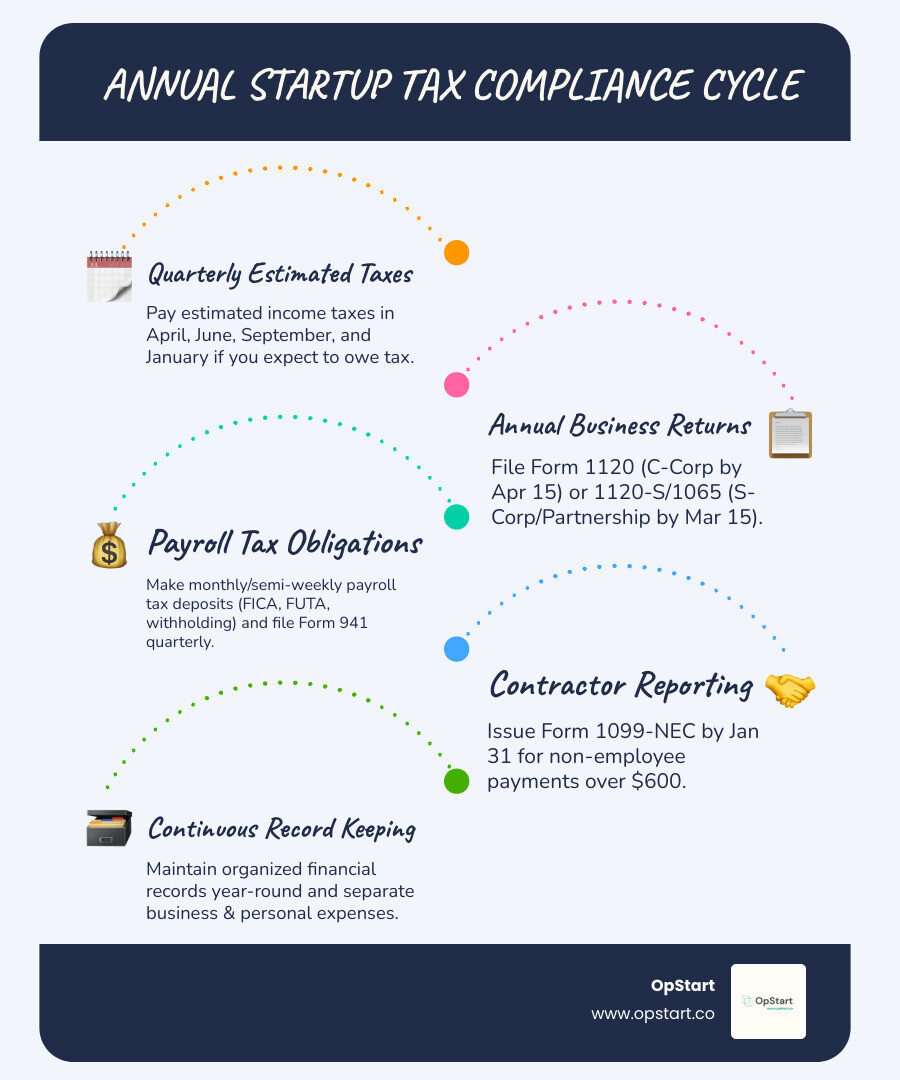

- Record-keeping is critical – Maintain organized financial records and separate business/personal expenses.

With the right approach, tax filing becomes manageable. As one startup founder put it: “The mental load OpStart has taken off our plates is immense. Plus, it’s up leveled our financial presentations for investors.”

The key is understanding your obligations, maximizing deductions and credits, and maintaining meticulous records.

I’m Maurina Venturelli of OpStart. I’ve scaled companies from startup to IPO and seen how a proper tax strategy can be the difference between cash flow stress and sustainable growth.

The Foundations: When Does Your Startup’s Tax Clock Start Ticking?

Your startup’s tax obligations begin long before your first sale. Understanding this timing is key to avoiding costly mistakes.

The IRS considers your venture a business when you start operating with the intent to make a profit. This requires demonstrable actions showing you’re serious about building a profitable company.

Your tax clock starts ticking with significant business activities like setting up an office, ordering inventory, launching a website, or hiring an employee. Even substantial market research or product development can count. The Starting a business guide from the IRS provides detailed guidance on determining your official start date. This date is important because it affects how pre-launch expenses are treated.

Many founders transfer personal assets like laptops or equipment into their new business. These must be valued at their Fair Market Value (FMV) on the transfer date. This FMV establishes the basis for future depreciation deductions and can trigger a personal capital gains tax if the FMV is higher than your original cost.

How to Handle Assets Transferred to Your Business

A capital gain on an asset transfer can be an unexpected tax event for new founders. Once an asset is in your business, it becomes eligible for depreciation (in the U.S.), allowing you to deduct a portion of its value each year to reduce taxable income.

Tax-free transfers are possible when forming partnerships or corporations, but the rules are complex and require professional guidance.

Before anything else, get your Employee Identification Number (EIN). This nine-digit number is your business’s Social Security number, needed for banking, startup tax filing, and hiring.

Record keeping for assets is critical. Document the original cost, FMV at transfer, and depreciation schedule for every asset, and keep these records for at least seven years. Proper organization now will save you headaches during tax season or a potential audit.

Decoding Your Tax Obligations: Business Structure and Tax Types

Your startup’s legal structure fundamentally shapes your startup tax filing requirements, influencing everything from your tax bill to the forms you file.

How Business Structure Impacts Your Startup Tax Filing

Here’s a breakdown of common business structures and their tax implications:

- Sole Proprietorship: The simplest structure. You and the business are one for tax purposes. You report business income and expenses on your personal tax return using Schedule C and pay self-employment taxes. There is no liability protection for your personal assets.

- Partnerships: The default for businesses with two or more owners. Partnerships are “pass-through” entities; they don’t pay income tax themselves. Profits and losses flow to the partners’ personal returns. The partnership files an informational return on Form 1065 and issues K-1s to partners.

- Limited Liability Companies (LLCs): LLCs provide personal liability protection but are not a tax classification. By default, a single-member LLC is taxed like a sole proprietorship, and a multi-member LLC like a partnership. However, LLCs can elect to be taxed as an S-Corp or C-Corp, offering flexibility.

- S Corporations: Popular with self-funded startups for potential self-employment tax savings. S-Corps are pass-through entities, filing Form 1120-S. Owners can take income as both a reasonable salary (subject to payroll taxes) and distributions (not subject to self-employment tax).

- C Corporations: The standard for venture-backed startups due to robust liability protection and ease of raising capital. C-Corps are separate tax entities, paying a flat 21% federal corporate income tax. This can lead to “double taxation” when after-tax profits are distributed to shareholders as dividends. C-Corps file Form 1120.

Key Taxes Every Startup Founder Must Know

Beyond your structure, you’ll encounter several tax types:

- Income Tax: Federal and often state tax on your profits. The rate and filing method depend on your business structure. You may need to file in multiple states where you have employees, property, or significant revenue (a concept known as “nexus”).

- Payroll Taxes: Required once you hire employees. This includes FICA taxes (Social Security and Medicare), where you and your employee split the contribution, and FUTA taxes (federal unemployment), which are primarily paid by the employer. States also have their own unemployment tax systems. The IRS offers guidance on Understanding Employment Taxes.

- Sales Tax: Applies if you sell taxable goods or services. You must collect and remit sales tax in states where you have a physical or economic “nexus.” Rules vary significantly by state and product.

- Franchise Tax: A fee charged by some states for the privilege of doing business there. For example, the Delaware Franchise Tax is typically around $450 annually for new startups, while California’s is about $800.

- Estimated Taxes: Quarterly payments to cover income and self-employment taxes. Most sole proprietors, partners, S-Corp shareholders, and corporations are required to pay these to avoid a large year-end tax bill and penalties.

Maximizing Savings: Deductions and Credits for Your Startup

Tax deductions and credits are your startup’s secret weapons, working to keep more cash in your business. Understanding these opportunities can lead to tens of thousands of dollars in annual savings.

Claiming Your Startup Costs and Business Expenses

The IRS allows deductions for business expenses that are “ordinary and necessary” for your industry. An ordinary expense is common, while a necessary one is helpful for your business. See the IRS publication on “Ordinary and necessary” expenses for more details.

Pre-launch expenses aren’t lost. You can deduct up to $5,000 in startup costs and another $5,000 in organizational costs in your first year. Any amount over this is amortized over 15 years.

Everyday business expenses provide significant savings. Common deductible expenses include:

- Software subscriptions

- Office rent

- Marketing campaigns

- Employee salaries

- Legal and professional fees

- Office supplies

- Business insurance

- 50% of business meals

If you use a part of your home exclusively for business, you may qualify for the home office deduction. Treating every receipt as potential savings is key to minimizing your tax burden.

Open uping Powerful Tax Credits

While deductions reduce taxable income, tax credits reduce your tax bill dollar-for-dollar, making them incredibly valuable.

| Feature | Tax Deduction | Tax Credit |

|---|---|---|

| Impact | Reduces your taxable income | Directly reduces your tax liability |

| Value | Varies based on your tax bracket (e.g., 21% of deduction) | Dollar-for-dollar reduction (e.g., $1 credit = $1 less tax) |

| Effect | Lowers the amount of income subject to tax | Lowers the actual amount of tax you owe |

The R&D Tax Credit is the most valuable credit for most tech startups. Even if you’re not yet profitable, you can use it to offset up to $250,000 in payroll taxes annually. To qualify, your activities must meet the IRS’s four-part test for qualified research, which often includes software development and product engineering. Review the Research Credit details from the IRS for requirements.

Other valuable credits include:

- Small Business Health Care Tax Credit: For providing health insurance to fewer than 25 employees.

- Credit for Small Employer Pension Plan Startup Costs: Offsets costs of setting up retirement plans.

- Work Opportunity Tax Credit: For hiring individuals from certain targeted groups.

Many startups miss out on these credits. Smart founders track expenses and document R&D activities to claim every legitimate benefit they’ve earned.

The Ultimate Startup Tax Filing Compliance Guide

Proper startup tax filing compliance is your financial immune system—it provides a rock-solid foundation that prevents crises and lets you focus on growth. With the right systems, compliance becomes routine.

Critical Deadlines and Key Tax Forms

Running a startup means juggling multiple tax deadlines. Missing one can result in costly penalties.

- Annual Income Tax Returns: The deadline is March 15 for S-Corps (Form 1120-S) and Partnerships (Form 1065). For C-Corps (Form 1120), the deadline is April 15.

- Extensions: You can get an automatic six-month filing extension with Form 7004. However, this is an extension to file, not to pay. You must still pay any estimated tax owed by the original deadline.

- Quarterly Estimated Taxes: If you expect to owe $500 or more in tax, you must make payments on April 15, June 15, September 15, and January 15.

- Payroll Taxes: Form 941, which reports wages and withholdings, is due quarterly on April 30, July 31, October 31, and January 31. See the IRS guide on Form 941.

- Year-End Forms: A major deadline is January 31 for issuing W-2s to employees and 1099-NECs to contractors paid over $600.

- State-Specific Deadlines: Don’t forget state requirements, like the Delaware Franchise Tax due March 1.

To stay organized, download our free tax deadline calendar and sync it with your own.

Mastering Record-Keeping for a Stress-Free Tax Season

Accurate records are a legal obligation and your best defense in an audit. They allow you to track performance, prepare financial statements, and support every deduction you claim.

The cardinal rule is to separate business and personal expenses. Open dedicated bank accounts and credit cards for your business from day one. Commingling funds is a major red flag for the IRS and makes justifying deductions nearly impossible.

What documents should you keep?

- Formation documents (EIN letter, articles of incorporation)

- All prior tax returns

- Financial statements (P&L, balance sheet)

- Bank and credit card statements

- Invoices and receipts

- Payroll data

- W-9 forms from all vendors

How long should you keep records? The IRS generally requires three years, but the gold standard is seven years. This covers longer statutes of limitations for certain items like asset depreciation or employment taxes.

As you grow, professional bookkeeping and accounting support becomes essential. While you can do it yourself, an expert ensures accuracy and helps you maximize deductions and credits. As one client noted, “OpStart has up-leveled our financial presentations for investors and freed us to focus on what we do best.” Good record-keeping provides the financial clarity needed to make smart business decisions.

Avoiding Pitfalls: Compliance, Consequences, and Professional Help

Startup tax filing mistakes can be expensive. While it’s tempting to cut corners, the cost of non-compliance—in penalties, lost time, and missed opportunities—far exceeds the investment in professional help.

The High Cost of Non-Compliance

Tax penalties and interest compound quickly. The IRS charges for both failure to file and failure to pay, with penalties reaching up to 25% of your tax liability.

Certain forms carry severe fixed penalties regardless of tax owed. For example, Form 5472 (for foreign-owned U.S. entities) has a $25,000 penalty, while Form 5471 (for U.S. persons with foreign corporation interests) is $10,000. Missing the 1099 filing deadline can cost you up to $290 per return.

Be wary of schemes promising massive refunds for things like the R&D credit; the IRS includes these in its annual IRS “dirty dozen” tax scams list.

Most importantly, non-compliance hurts fundraising. Sophisticated investors conduct thorough due diligence, and messy tax records are a massive red flag signaling operational immaturity and hidden liabilities. We’ve seen deals slow, valuations drop, and funding collapse over tax issues. As one client said after an acquisition, “The tax diligence was intense… Having our taxes professionally handled meant we sailed through.”

When and Why to Seek Professional Tax Support

Can you file your startup’s taxes yourself? For a simple sole proprietorship, perhaps. But for most growing startups, the risks outweigh the savings.

You need professional help if you have:

- Incorporated (especially as a C-Corp or S-Corp)

- Raised outside funding

- Hired employees

- Operations in multiple states

- R&D activities

The DIY vs. professional help decision comes down to opportunity cost. Every hour you spend on taxes is an hour not spent growing your business. If you’re losing sleep over deadlines or investors are asking tough tax questions, it’s time to hire an expert.

When choosing a tax advisor, find one who understands the startup lifecycle, not just general business taxes. They should have experience with companies at your stage and in your industry. A good advisor acts as a strategic partner, offering services like tax preparation, strategic planning, R&D credit studies, and audit support. This partnership allows you to focus on scaling your startup, knowing your financial compliance is handled expertly.

Frequently Asked Questions about Startup Tax Filing

Let’s tackle the most common questions we hear about startup tax filing.

Do I have to file taxes if my startup didn’t make any money?

Yes, absolutely! Any business with an Employee Identification Number (EIN) must file a tax return, regardless of profit or loss.

Filing when you’re unprofitable works in your favor. By reporting Net Operating Losses (NOLs), you can carry them forward to offset profits in future years, potentially saving you thousands in taxes. Think of it as an investment in your future tax strategy. Plus, staying compliant from day one helps you avoid state-level fees and penalties.

What’s the difference between a tax deduction and a tax credit?

This is a critical concept for every founder.

- Tax deductions reduce your taxable income. If your startup has $100,000 in income and $20,000 in deductions, you are only taxed on $80,000. The value of the deduction depends on your tax rate.

- Tax credits reduce your tax bill dollar-for-dollar. If you owe $10,000 in taxes and have a $1,000 credit, you now owe just $9,000.

This is why credits like the R&D tax credit are so powerful. Every dollar of credit is a dollar less you pay in taxes. The IRS provides more information on Business Tax Credits explained by the IRS.

How do I handle paying independent contractors?

Most startups rely on contractors. Handling payments correctly involves a few key steps:

- Collect a W-9: Before you pay any contractor, have them complete a W-9 form. This provides their Taxpayer Identification Number.

- Track Payments: Keep a record of all payments made to each contractor.

- Issue a 1099-NEC: If you pay an individual contractor $600 or more in a calendar year, you must send them and the IRS a Form 1099-NEC.

The firm deadline for sending 1099-NECs is January 31 of the following year. Following these simple steps ensures compliance and keeps everyone happy.

Conclusion

Congratulations! You’ve just steerd the roadmap for startup tax filing. What once seemed like a maze of forms and deadlines should now feel manageable.

You now understand when your tax clock starts, how your business structure defines your tax obligations, and how to handle income, payroll, and sales taxes. More importantly, you’ve uncovered the goldmine of deductions and credits available to startups, like the powerful R&D tax credit that can put cash back into your business.

Staying compliant isn’t just about avoiding penalties; it’s about building credibility with investors and creating systems that scale. Proactive planning always beats reactive scrambling. The startups that thrive treat tax compliance as a strategic advantage. They keep meticulous records, leverage every available credit, and partner with professionals who understand high-growth companies.

At OpStart, we’ve seen how expert financial operations accelerate startup success. When your startup tax filing and bookkeeping are handled professionally, you can stop worrying about compliance and focus on what you do best—building something incredible.

We take this burden off your shoulders, handling everything from daily bookkeeping to complex tax strategy for a predictable flat rate.

Ready to transform your relationship with startup finances?