Why Understanding C Corporations Is Critical for Growing Startups

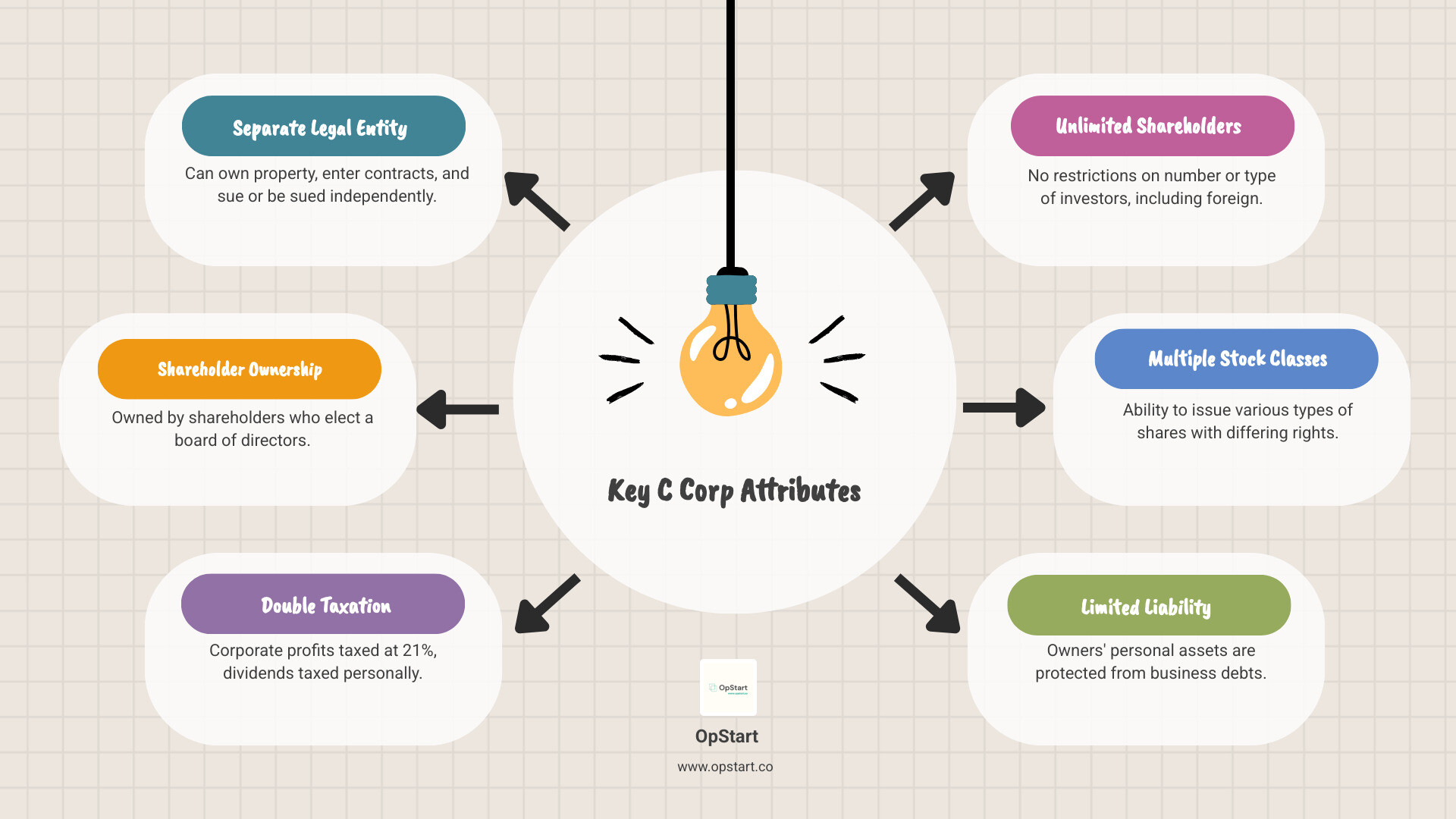

What is a c corporation – it’s a separate legal business entity owned by shareholders that faces double taxation but offers unlimited growth potential and investor appeal. Here’s what defines a C corp:

- Separate legal entity – Can own property, enter contracts, and sue or be sued independently

- Shareholder ownership – Owned by shareholders who elect a board of directors

- Double taxation – Corporation pays 21% tax on profits, shareholders pay personal tax on dividends

- Unlimited shareholders – No restrictions on number or type of investors, including foreigners

- Multiple stock classes – Can issue different types of shares with varying rights

- Limited liability – Owners’ personal assets are protected from business debts

Your choice of business structure shapes everything from your tax bill to your ability to raise capital. Many venture capitalists won’t even consider investing in anything other than a Delaware C corporation. As one startup founder noted, “Generally speaking, if you’re going to be raising venture capital, your investors will expect to invest in a Delaware C corp.”

However, C corps aren’t for everyone. The double taxation can reduce profits, and the regulatory requirements add complexity. Understanding these trade-offs is essential before committing to a structure that will impact your business for years.

I’m Maurina Venturelli. Having helped high-growth companies like Sumo Logic and LiveAction scale to IPO, I’ve seen why understanding what is a c corporation is a critical question when startups are ready to attract serious investment and scale rapidly.

Basic what is a c corporation glossary:

What is a C Corporation and How Does It Work?

A C corporation is a separate legal entity that can sign contracts, own property, and be sued, all independently of its owners. This independence creates a protective barrier known as limited liability protection. If the company faces financial trouble or legal issues, your personal assets—your house, car, and savings—typically remain safe.

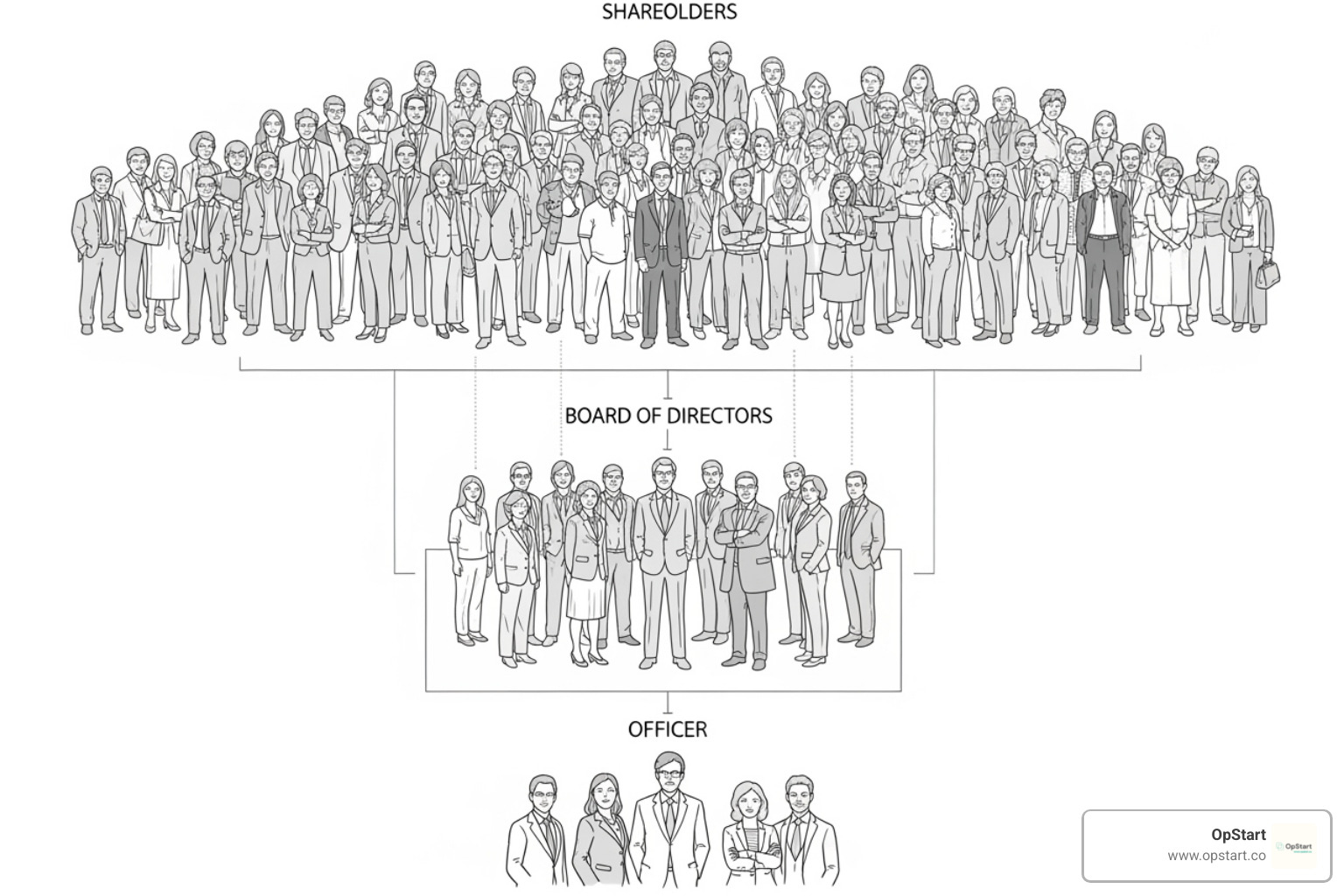

Unlike a sole proprietorship where you and your business are the same, a C corp stands on its own. The hierarchy is straightforward: Shareholders own the company through stock and elect a Board of Directors to make strategic decisions. The board then appoints Officers (like the CEO and CFO) to manage daily operations.

One of the most appealing features of a C corp is its perpetual existence. It continues to operate even if a key owner leaves or passes away, offering stability that attracts investors. To maintain this protected status, C corps must follow strict corporate formalities. This includes drafting bylaws (the company’s rulebook), holding annual meetings for shareholders and directors, and keeping meticulous records of all major decisions.

Skipping these formalities risks “piercing the corporate veil,” a legal term for losing your personal asset protection. Our Startup Accounting Services can help you manage these requirements without the headache.

Defining What is a C Corporation

The “C” in C corporation comes from Subchapter C of the Internal Revenue Code. This part of the tax law treats C corps as separate taxpaying entities. The corporation files its own tax return and pays its own taxes. If it distributes profits to owners, those owners pay taxes again on their personal returns. This is the double taxation we’ll discuss later, but it also allows the business to retain earnings for growth without immediate personal tax consequences for owners.

Ownership in a C corp is represented by stock. When you start a C corp, you issue shares to the initial owners. These shares can be bought, sold, or transferred, making it easy to bring in new investors. C corps can accept investments from anyone, anywhere in the world, which is a major advantage for startups seeking venture capital.

For official information on business structures, the IRS provides comprehensive guidance.

Legal and Operational Requirements

Forming a C corp requires filing Articles of Incorporation with your chosen state’s Secretary of State. This document officially creates your corporation and includes basic information like your business name, purpose, and stock details.

Every C corp also needs a Registered Agent—a person or service designated to receive official legal and tax documents on behalf of the company during business hours.

Ongoing responsibilities include maintaining detailed corporate minutes for all board and shareholder meetings. These records prove you’re treating the corporation as a separate entity, which is essential for protecting your limited liability. You must also file annual reports and meet other state compliance requirements to avoid penalties or dissolution.

While the paperwork may seem tedious, these corporate formalities provide a clear framework for decision-making and are what separate successful C corps from those that lose their liability protection. The U.S. Small Business Administration offers excellent guidance on these requirements.

The C Corp Tax Dilemma: Understanding Double Taxation

Double taxation is a key financial reality for every C corporation. It means C corp profits are taxed twice: first at the corporate level, and again at the shareholder level when profits are distributed.

Here’s how it works. Your C corporation files Form 1120 and pays a flat 21% corporate income tax on its profits, a rate set by the Tax Cuts and Jobs Act of 2017.

When the corporation distributes after-tax profits to shareholders as dividends, those shareholders face personal income tax. Qualified dividends are typically taxed at 0%, 15%, or 20%, depending on the shareholder’s income. High earners may also face an additional 3.8% Net Investment Income Tax (NIIT).

However, if you are an owner actively working in the business, you can be paid a reasonable salary. This owner compensation is a tax-deductible expense for the corporation, reducing its taxable profit. The salaries vs. dividends decision is a crucial part of tax planning. For more insights, see our guide on startup tax issues.

How Double Taxation Works in Practice

Let’s use a simple example to show the impact of double taxation.

Imagine your C corporation has a $100 profit.

- First tax hit: The corporation pays 21% corporate income tax ($21), leaving $79 in after-tax profits.

- Second tax hit: If the company distributes the remaining $79 as dividends, shareholders pay personal income tax. Assuming a 23.8% rate (20% dividend tax + 3.8% NIIT), that’s another $18.80 in taxes.

The after-tax income that reaches the shareholders is just $60.20 from the original $100 profit. However, if the C corp uses those profits for reinvested profits instead of paying dividends, the second layer of tax is deferred. This is why growth-focused startups often prefer the C corp structure.

Can C Corp Losses or Deductions Benefit Shareholders?

Unlike pass-through entities, C corps have no pass-through losses. This means shareholders cannot deduct corporate losses on their personal tax returns. If your startup loses money, the loss stays at the corporate level and cannot be used to offset your personal income.

However, C corporations get some special deductions, such as for employee benefits. A particularly valuable feature is the net operating loss carryforward. If your C corp loses money in one year, those losses can be carried forward to offset profits in future years, reducing future tax bills. This is a significant advantage for startups that invest heavily in their early years.

Understanding these tax nuances is crucial for making smart financial decisions. For a deeper dive, explore our resource on Taxes for Startups.

C Corp vs. Other Business Structures: A Head-to-Head Comparison

Choosing the right business structure is a foundational decision for your startup. The three most popular choices are C corporations, S corporations, and Limited Liability Companies (LLCs). While all offer limited liability protection, they differ significantly in taxation, ownership rules, and operational flexibility.

Making the right choice upfront can save you from expensive restructuring later. Our guide on Choosing Your Business Structure: C-Corp vs. LLC can help you steer this critical decision.

Here’s how these structures compare:

| Feature | C Corporation | S Corporation | LLC (Limited Liability Company) |

|---|---|---|---|

| Taxation | Double taxation (corporate & shareholder levels) | Pass-through taxation (no corporate-level tax) | Pass-through taxation (default) |

| Ownership | Unlimited shareholders (any type, including foreign) | Max 100 shareholders (U.S. citizens/residents) | Unlimited members (any type, including foreign) |

| Stock Classes | Multiple classes (e.g., preferred, common) | Only one class of stock | No stock (ownership units/interests) |

| Liability | Limited liability for owners | Limited liability for owners | Limited liability for owners |

| Capital Raising | Excellent (IPO readiness, investor appeal) | Moderate (restrictions on shareholders/stock) | Difficult (no stock, less investor appeal) |

| Formalities | High (board, meetings, bylaws, minutes) | High (similar to C corp, but fewer tax rules) | Low (flexible, operating agreement) |

| Perpetual Existence | Yes | Yes | Often yes, depending on operating agreement |

Pass-through entities like S corps and LLCs avoid double taxation but have trade-offs that can limit growth.

C Corporation vs. S Corporation

The primary taxation difference between C corps and S corps is that S corps are pass-through entities. Their profits and losses flow directly to the owners’ personal tax returns, avoiding corporate-level income tax. This eliminates double taxation.

However, S corps have strict ownership restrictions that limit growth:

- 100 shareholder limit: You cannot have more than 100 owners.

- U.S. citizen/resident requirement: All shareholders must be U.S. citizens or residents, blocking foreign investment.

- Single class of stock: S corps can only issue one type of stock, meaning all shareholders have identical rights. You cannot issue preferred stock to investors.

This single stock class rule makes S corps unsuitable for most venture capital funding. For more details, the IRS provides comprehensive guidance on S Corporations.

C Corporation vs. LLC (Limited Liability Company)

The choice between a C corp and an LLC often comes down to flexibility versus growth potential. LLCs offer superior management flexibility, as they don’t require a formal board of directors. Owners (called “members”) can manage the company themselves or appoint managers, with rules defined in a customizable operating agreement.

By default, LLCs have pass-through taxation, but they can elect to be taxed as a C corp. The biggest difference for startups is that LLCs don’t issue stock; ownership is held in membership interests. Most venture capitalists and institutional investors strongly prefer the traditional stock structure of a C corp.

LLCs also require fewer formalities than C corps, meaning lower administrative costs and less paperwork. This makes them a great choice for smaller, privately-held businesses. However, if you plan to seek significant venture capital or go public, a C corp is almost always the better choice.

The Strategic Advantages and Disadvantages of a C Corp

Strategically, choosing a C corp is a trade-off between complexity and growth potential. The structure you choose will impact your taxes and ability to attract investors. Through our Fractional CFO Services, we help founders align their choice with their startup goals and growth strategy.

Advantages: Why C Corps Attract Investors

Investors prefer C corps for their predictability and flexibility. Here are the key advantages for startups seeking funding:

- Unlimited Shareholders: Unlike S corps, C corps have no limit on the number of shareholders, allowing you to raise money from a wide range of sources.

- International Investors: C corps can accept funding from anyone, anywhere, opening up global capital markets.

- Multiple Classes of Stock: C corps can issue different types of stock, such as preferred stock for investors and common stock for founders. This flexibility is essential for structuring venture capital deals.

- Venture Capital Appeal: Most venture capitalists will only invest in Delaware C corporations because the legal framework is familiar and optimized for growth and exit strategies.

- IPO Readiness: The formal governance structure of a C corp (board of directors, shareholder meetings) is a prerequisite for going public.

- Improved Credibility: Operating as a corporation signals a serious, long-term commitment, which can lead to better terms with vendors, banks, and partners.

Disadvantages: The Cost and Complexity

C corporations also come with significant disadvantages that can be challenging for new businesses.

- Double Taxation: As discussed, profits are taxed at the corporate level and again at the shareholder level when distributed as dividends, potentially leading to a high effective tax rate.

- Higher Formation Costs: Incorporating as a C corp typically involves more legal work and higher state fees than forming an LLC, with costs often running into the thousands.

- Stricter Regulations: C corps face increased paperwork and regulatory problems, including holding annual meetings, keeping detailed corporate minutes, and filing complex tax returns. Failure to comply can result in losing limited liability protection.

- No Personal Deduction of Business Losses: If your C corp loses money, you cannot use those losses to offset other income on your personal tax return. The losses remain at the corporate level until the company becomes profitable.

Forming a C Corporation: A Step-by-Step Guide

Forming a C corp involves several key steps, but it’s a manageable process. The first decision is the state of incorporation. Delaware is the preferred choice for startups planning to raise venture capital or go public due to its business-friendly laws and specialized corporate court system. However, if you plan to operate only in your home state, incorporating locally may be simpler and more cost-effective.

Key Steps to Incorporate

Here are the essential steps to form your C corporation:

- Choose a business name. Your name must be unique in your state of incorporation. Conduct a name search with the Secretary of State and have backup options ready.

- File Articles of Incorporation. This legal document officially creates your corporation. It includes your company’s name, purpose, authorized shares, and registered agent information.

- Appoint a registered agent. This person or entity must have a physical address in the state of incorporation to receive official legal and tax documents.

- Draft corporate bylaws. This internal operating manual establishes rules for how your corporation will function, from board meetings to officer duties.

- Hold an initial board meeting. At this organizational meeting, the board adopts the bylaws, elects officers, authorizes a corporate bank account, and approves the issuance of stock to founders.

- Issue stock. This step formalizes the ownership stake for your initial shareholders.

- Obtain an EIN. The Employer Identification Number (EIN) is your business’s federal tax ID, needed for tax filings and opening a bank account. You can apply for an Employer Identification Number (EIN) online for free through the IRS.

- Apply for licenses and permits. Research and obtain any industry-specific licenses your business needs to operate legally.

Following these steps correctly provides a solid foundation for your business as it grows.

Frequently Asked Questions about C Corporations

When considering what is a c corporation, several common questions arise. Here are the answers to the most frequent ones we hear from founders.

When is a C Corporation the right choice for your business?

A C corp is the right choice when your startup has ambitious growth and funding goals. It is ideal for businesses that plan to:

- Seek venture capital

- Go public (IPO)

- Have a large or diverse number of shareholders, including foreign investors

- Offer multiple classes of stock to attract different types of investors

If your vision includes rapid growth and significant external funding, the C corp structure provides the framework that sophisticated investors demand.

How are C corporation owners compensated?

Owner compensation has significant tax implications. There are two primary methods:

- Reasonable Salary: Owners who work in the business can be paid a salary as employees. This salary is a deductible expense for the corporation, reducing its taxable income.

- Dividends: Owners can also receive dividends from the company’s after-tax profits. Dividends are not deductible for the business, which leads to the double taxation effect.

The strategic balance between salary and dividends is a key area for tax planning.

Can a C corporation have just one owner?

Yes, a single individual can own all the shares and hold all the officer and director positions in a C corporation. However, even a solo owner must maintain all corporate formalities—such as holding annual meetings and keeping minutes—to preserve limited liability protection.

Skipping these steps could lead to “piercing the corporate veil,” which would expose your personal assets to business liabilities. It’s crucial to follow these procedures from the start.

Conclusion: Is a C Corp the Right Move for Your Startup?

Deciding if a C corp is right for your startup depends entirely on your long-term goals. To recap, a C corp is a separate legal entity offering limited liability, unlimited shareholders, and multiple stock classes, making it ideal for investors. The main drawback is double taxation.

If you’re building a company with a serious growth and funding focus, planning to court venture capitalists, or dreaming of an IPO, the C corp structure is your best option. Investors insist on the Delaware C corp because it gives them the flexibility and exit opportunities they need.

However, this power comes with financial complexity. Managing corporate taxes, board minutes, and compliance requirements is a significant responsibility. For founders whose business goals center on a lifestyle business or avoiding formal governance, an LLC or S corp might be a better match.

Your business structure should be custom to your specific ambitions. At OpStart, we’ve seen how the right choice can accelerate growth. If you’re still weighing your options, our guide on choosing your business structure can help you think through the angles.

This isn’t a decision you have to make alone. We’re here to help you steer the choice of business structure and all the financial complexities that follow, so you can focus on what you do best—building something amazing.