Why Cash Flow Analysis Is Your Startup’s Financial Compass

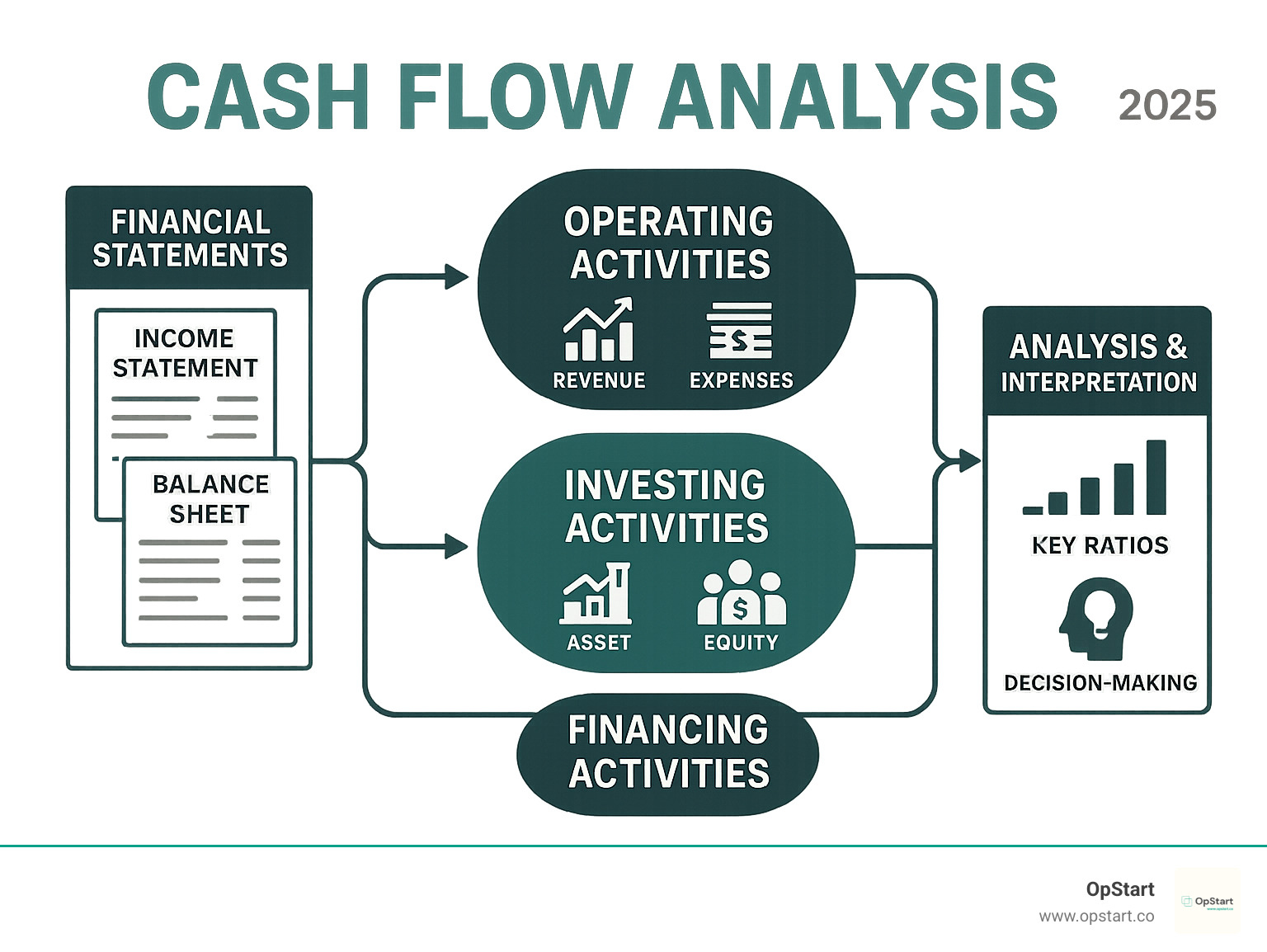

Cash flow analysis is the systematic examination of money moving in and out of your business across three key activities: operations, investing, and financing. Here’s what you need to know:

Essential Components:

- Operating Activities – Daily business operations (sales, expenses, working capital)

- Investing Activities – Long-term asset purchases and sales

- Financing Activities – Debt, equity, and investor transactions

Key Steps:

- Gather your income statement and balance sheet

- Calculate cash flows from each activity type

- Analyze trends and ratios (Free Cash Flow, Operating Cash Flow Margin)

- Interpret results for strategic decision-making

As the saying goes, “cash is king” – and the numbers back this up. 82% of business failures stem from cash flow challenges, not lack of profitability. Your startup might show impressive revenue growth on paper, but without positive cash flow, you can’t pay employees, invest in growth, or survive unexpected downturns.

The harsh reality? A profitable company can still fail if it runs out of cash. This happens because profit includes non-cash items like depreciation and follows accrual accounting rules that don’t reflect actual money in your bank account. Cash flow analysis cuts through accounting complexity to show your true financial position.

For fast-growing startups, this analysis becomes even more critical. You’re burning through investor funds, scaling operations, and making strategic investments – all while trying to achieve sustainable growth. Without regular cash flow analysis, you’re essentially flying blind.

I’m Maurina Venturelli, and I’ve helped take companies like Sumo Logic public by building marketing programs that generated 20% of total ARR, requiring deep cash flow analysis to optimize spend and growth investments. At OpStart, I see how proper financial analysis transforms startup decision-making from guesswork into strategic advantage.

Why Cash Flow Is the Lifeblood of Your Startup

You’ve heard “cash is king,” and for a startup, it’s the literal truth. Cash flow is critical for survival. While profit looks good on paper, it’s cash that pays your team, keeps servers online, and funds your next product launch. The statistics are sobering: 82% of business failures stem from cash flow challenges. Most businesses fail not because of a bad product, but because they run out of money to operate—even when profitable. For startups, this reality is harsher. You’re burning investor funds while scaling, waiting for revenue to catch up. Without regular cash flow analysis, you’re driving blind.

Liquidity beats profitability for day-to-day survival. You can’t pay rent with accounts receivable. Investors know this; they scrutinize how you manage cash and your runway. Smart decisions about hiring, marketing, or fundraising depend on understanding your cash position. Cash flow analysis provides the real answers.

The Critical Difference: Cash Flow vs. Profit

Here’s where many founders get tripped up: profit and cash flow are not the same. You can be profitable on paper while your bank account drains. Conversely, you might show a loss while generating positive cash flow.

The main reason is Accrual accounting. This system records revenue when earned and expenses when incurred, regardless of when money actually changes hands. If you sell a product on 60-day payment terms, that revenue appears on your income statement immediately, but you won’t see the cash for two months.

Non-cash expenses add another layer of complexity. Depreciation and amortization are expenses on your profit and loss statement, but they don’t require a cash outlay. Your equipment might depreciate by $2,000, reducing your reported profit, but that money stays in your bank.

Timing differences between accounts receivable and payable are also critical. Imagine landing big clients who pay in 90 days while you pay suppliers upfront. Your sales are booming and your income statement looks great, but you’re hemorrhaging cash.

This is why successful startups master cash flow analysis. It cuts through accounting complexity to show what’s really happening with your money, enabling smarter decisions on everything from inventory to hiring.

Need help keeping track of all these moving pieces? Our bookkeeping services help you accurately track the difference between what you’ve earned and what’s actually in your bank account. More info about our Bookkeeping Services.

| Feature | Cash Flow | Net Income (Profit) |

|---|---|---|

| Definition | Actual movement of cash into and out of the business. | Revenue minus expenses over a period. |

| Accounting Method | Cash-basis (focus on actual cash transactions) | Accrual-basis (recognizes revenue when earned, expenses when incurred) |

| Non-Cash Items | Excludes non-cash items (e.g., depreciation, amortization) | Includes non-cash items |

| Timing | Reflects when cash is received or paid | Reflects when revenue is earned or expense is incurred |

| Purpose | Measures liquidity, solvency, ability to pay bills | Measures profitability, financial performance |

| Key Question | Do we have enough cash to operate and grow? | Are we generating more revenue than expenses? |

Deconstructing the Cash Flow Statement: The Three Core Activities

Think of your cash flow statement as a three-act play, where each act tells a different part of your startup’s financial story. Understanding these three sections is crucial for effective cash flow analysis – they work together to reveal exactly how money flows through your business and why your cash position changes from month to month.

Cash Flow from Operating Activities (CFO)

This is where the magic happens – or doesn’t. Operating activities represent the true engine of your business, showing how much cash your core operations actually generate. It’s the most important section for cash flow analysis because it reveals whether your fundamental business model works.

When we talk about operating cash flow, we’re looking at cash from your day-to-day business activities. This includes money coming in from customers who actually pay their bills, and money going out for essential expenses like salaries, rent, and supplies. But here’s where it gets interesting – this section also captures changes in your working capital.

Working capital changes can be tricky to understand, but they’re vital. If your accounts receivable increases (customers owe you more money), that actually reduces your operating cash flow because you haven’t collected that cash yet. Similarly, if you increase your inventory to meet growing demand, that ties up cash and shows as a negative in this section.

A consistently positive operating cash flow is like a green flag for your startup’s health. It means your business model is actually converting sales into real money you can use. If this number is consistently negative, it’s time to dig deeper and understand why your core operations aren’t generating cash.

At OpStart, we help startups make sense of these numbers with tools designed specifically for growing companies. You can generate cash statements with OpStart’s tools to get clear visibility into your operating performance.

Cash Flow from Investing Activities (CFI)

Don’t panic if this section shows negative numbers – for growing startups, that’s often exactly what you want to see. Investing activities capture cash flows related to your long-term assets and strategic investments, essentially showing how you’re building for the future.

This section includes capital expenditures (CapEx) like buying equipment, computers, or office furniture. It also covers bigger strategic moves like acquiring other companies, purchasing investment securities, or even selling off assets you no longer need.

For most startups in growth mode, investing cash flow will be negative because you’re constantly investing in assets that will help you scale. Buying that new server, upgrading your office space, or purchasing specialized equipment – these all show up as cash outflows in the investing section.

The key is understanding the story behind these numbers. Are you investing strategically in assets that will drive future growth? That’s positive, even though the cash flow is negative. Are you selling off core assets just to keep the lights on? That might signal trouble, even though it creates positive cash flow.

Cash Flow from Financing Activities (CFF)

This section tells the story of how you fund your business and what you do with excess cash. For startups, it’s often the most dramatic section because it captures those big funding rounds that can transform your cash position overnight.

Financing activities include raising money from investors, taking out loans, or issuing new shares. On the outflow side, it captures loan repayments, dividend payments, and share buybacks. For early-stage startups, this section is typically positive because you’re raising more money than you’re paying out.

The timing and size of financing cash flows can dramatically impact your overall cash position. That Series A funding round might create a massive positive spike, while regular loan payments create steady negative flows. Understanding these patterns helps you plan for future financing needs and manage your cash runway effectively.

As your startup matures, you might see this section shift from consistently positive to more mixed, especially as you start repaying debt or returning money to investors through dividends or buybacks.

Together, these three sections create a complete picture of your cash dynamics. Strong operating cash flow funds your growth investments, while strategic financing provides the capital needed to scale. When all three work in harmony, you’ve got a financially healthy startup ready for sustainable growth.

How to Conduct a Comprehensive Cash Flow Analysis

Now that we understand the components, let’s walk through the practical steps of conducting a thorough cash flow analysis for your startup. Think of this as your financial detective work – we’re not just crunching numbers, we’re uncovering the story of how money moves through your business and what that means for your future.

Step 1: Prepare Your Statement of Cash Flows

Creating your cash flow statement might seem daunting, but it’s more straightforward than you’d think. You’ll need two key documents: your income statement and balance sheet. These are the building blocks that help us trace where every dollar went.

Most businesses use what’s called the indirect method because it’s easier to prepare with the information you already have. Here’s how it works: we start with your net income from the income statement – that’s our baseline. But remember, net income includes things that didn’t actually involve cash changing hands.

Next, we adjust for non-cash items. The biggest culprits here are depreciation and amortization – these reduce your profit on paper but didn’t actually take cash out of your pocket this period. We add these back because we’re tracking real cash movement.

Then comes the trickier part: working capital changes. When your accounts receivable increases, it means customers owe you more money, but you haven’t collected that cash yet – so we subtract that increase. When accounts payable goes up, you’ve conserved cash by not paying suppliers immediately – so we add that increase. Inventory increases mean you spent cash to buy stock – another subtraction.

Finally, we incorporate your investing and financing activities to get the complete picture. If you’re feeling overwhelmed by the paperwork, our free financial statement templates can help you organize everything systematically.

At OpStart, we’ve designed our Startup Stack to integrate your financial data seamlessly, making this entire process much less painful than doing it manually.

Step 2: Interpret the Story Behind the Numbers

Here’s where cash flow analysis gets really interesting – the numbers start telling you a story about your business. It’s like being a financial detective, looking for clues about what’s really happening beneath the surface.

Positive cash flow usually makes us feel good, but context matters enormously. If your operating activities are generating consistent positive cash flow, that’s fantastic – it means your core business is actually making money in real terms. But if your positive cash flow is coming mainly from taking out big loans or selling off equipment, that’s a different story entirely. You might be masking some serious operational issues.

Negative cash flow often scares startup founders, but it’s not always the villain. If you’re in a growth phase and investing heavily in new equipment, hiring talented people, or expanding your market reach, negative cash flow can be completely normal and even healthy. You’re essentially trading current cash for future growth.

The real red flag is when your operating activities consistently show negative cash flow. This means your day-to-day business operations aren’t generating enough cash to sustain themselves – you’re burning through money faster than you’re making it from your core business.

For startups, the sweet spot often looks like this: slightly negative or improving operating cash flow (as you optimize your operations) combined with strategic negative investing cash flow (as you invest in growth). This pattern suggests you’re building something sustainable while investing in your future.

Step 3: Use Key Ratios for a Deeper Cash Flow Analysis

Raw numbers only tell part of the story. Cash flow ratios help us understand what those numbers really mean and how we compare to our past performance or industry standards.

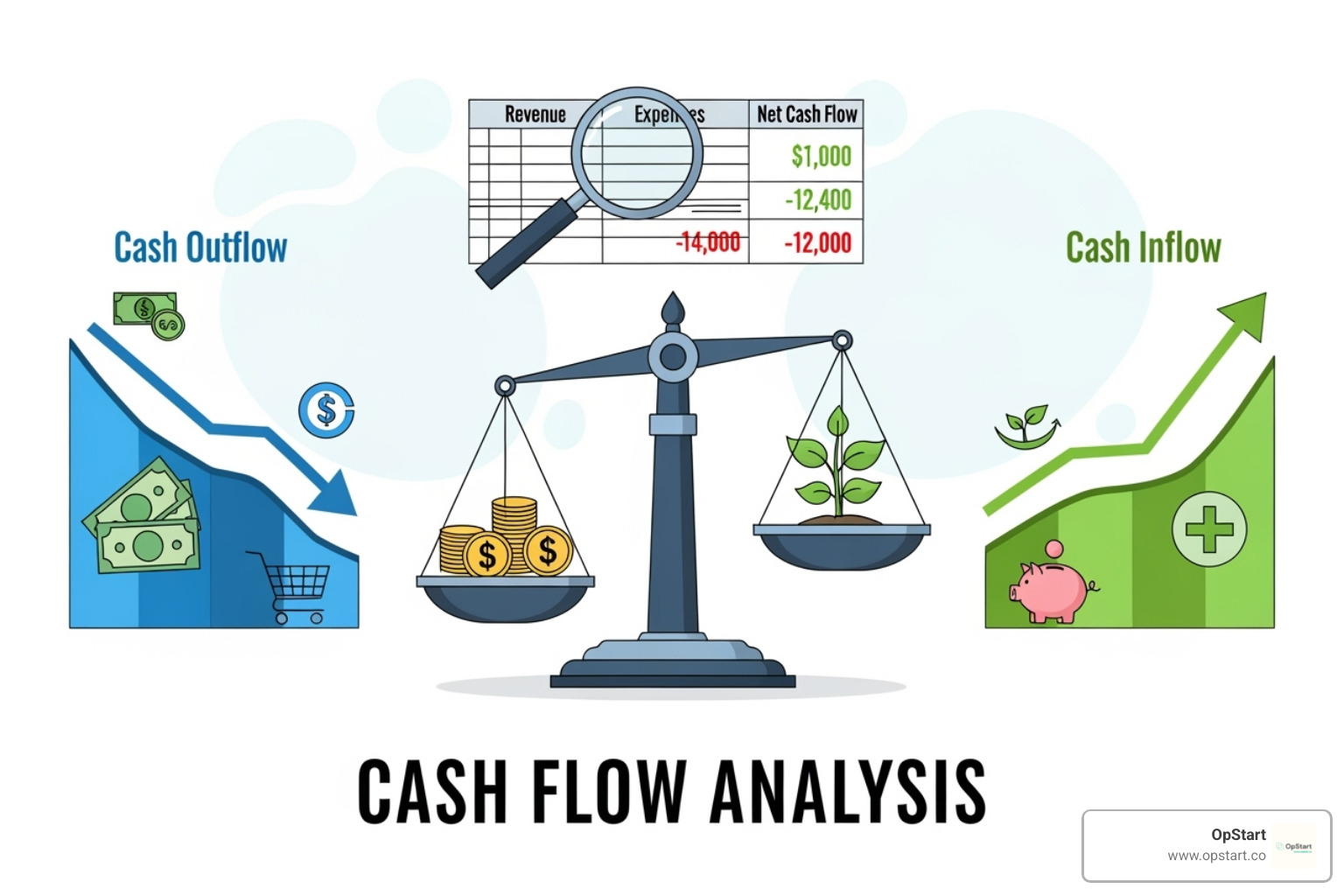

Free Cash Flow (FCF) is probably the most important metric for any startup founder to understand. This is the cash left over after you’ve paid for all your operating expenses and necessary capital investments. Think of it as your “breathing room” – money you can use for new opportunities, paying down debt, or just sleeping better at night knowing you have options.

The formula is simple: Free Cash Flow = Operating Cash Flow – Capital Expenditures. A strong FCF means you have flexibility and aren’t completely dependent on external funding for every decision.

Operating Cash Flow Margin tells you how efficiently you’re converting sales into actual cash. Calculate it by dividing your operating cash flow by your revenue. If you’re generating $100,000 in revenue but only $10,000 in operating cash flow, that’s a 10% margin. Higher is generally better, but what matters most is the trend – are you getting more efficient over time?

Cash Flow Coverage Ratio answers a crucial question: can you cover your debt payments with the cash your business generates? Divide your operating cash flow by your total debt payments. A ratio above 1.0 means you’re generating enough cash to handle your debt obligations, which is essential for long-term stability.

Here are the key cash flow formulas every startup should know:

- Free Cash Flow = Operating Cash Flow – Capital Expenditures (your financial flexibility)

- Operating Cash Flow Margin = Operating Cash Flow ÷ Revenue (your efficiency at converting sales to cash)

- Cash Flow Coverage Ratio = Operating Cash Flow ÷ Total Debt (your ability to service debt)

- Net Cash Flow = Total Cash Inflows – Total Cash Outflows (your overall cash movement)

For a deeper dive into applying these metrics strategically, check out our comprehensive guide on understanding cash flow analysis.

What Your Cash Flow Analysis Ultimately Tells You

Your cash flow analysis is like having a crystal ball for your business – it reveals truths that other financial statements simply can’t show you. Most importantly, it answers the fundamental question: can you pay your bills? This isn’t just about today or next week, but sustainably over time.

It also reveals your ability to fund growth internally. Maybe you’ve been dreaming about hiring that senior developer or expanding to a new market. Your cash flow analysis tells you whether you can afford these moves with your current cash generation, or if you need to seek external funding first.

Operational efficiency becomes crystal clear through this lens. You might be booking impressive sales, but if you’re not collecting that money efficiently or if your expenses are eating up too much cash, your analysis will expose these issues before they become critical.

The analysis also highlights your need for financing and helps you determine exactly how much you might need. Instead of guessing or asking for too little (or too much), you can approach investors or lenders with concrete data about your funding requirements.

Perhaps most valuable of all, cash flow analysis provides the foundation for accurate budgeting and forecasting. By understanding your historical patterns, you can predict future cash needs and plan accordingly. This means fewer surprises and more strategic decision-making.

When you’re ready to take your financial strategy to the next level, our Fractional CFO Services can help you turn these insights into actionable growth strategies. Because understanding your cash flow is just the beginning – using that knowledge to build a stronger business is where the real magic happens.

Frequently Asked Questions about Cash Flow Analysis

Let’s be honest – cash flow analysis can feel overwhelming when you’re juggling everything else as a startup founder. I get it. Between product development, hiring, and trying to secure your next round of funding, diving into financial statements isn’t exactly thrilling. But here’s the thing: understanding your cash flow could be the difference between thriving and becoming part of that dreaded 82% failure statistic.

These are the questions I hear most often from startup founders, and I want to give you straight answers that actually help.

What is the most significant difference between cash flow and profit?

Think of it this way: profit is a promise, cash flow is reality.

Profit is what your accountant calculates using fancy rules called accrual accounting. When you sell something on credit, boom – that sale shows up as profit immediately, even if your customer won’t pay you for three months. Your income statement might look fantastic, but your bank account? That’s a different story entirely.

Profit also includes expenses that never actually leave your bank account. Depreciation is a perfect example. Let’s say you bought a $10,000 piece of equipment that will last five years. Your accountant spreads that cost over five years, showing $2,000 in depreciation expense annually. But you only spent that cash once – when you actually bought the equipment.

Cash flow, on the other hand, shows exactly what happened in your bank account. Money came in when customers actually paid you. Money went out when you actually wrote checks or swiped your card. No accounting magic, no timing tricks – just cold, hard reality.

Here’s why this matters: I’ve seen profitable startups shut down because they couldn’t make payroll. Their customers were slow to pay, their inventory was eating up cash, and despite looking great on paper, they ran out of money. Cash flow analysis would have shown this problem months in advance.

What are the first steps to improve negative cash flow?

Before you panic about negative cash flow, take a deep breath and figure out why it’s happening. Not all negative cash flow is created equal.

If you’re investing heavily in inventory for a big product launch, or you just hired three new engineers to accelerate development, that’s strategic negative cash flow. It might be exactly what your business needs right now. But if you’re burning cash because customers aren’t paying or your expenses are out of control, that’s a different problem entirely.

Once you understand the cause, here’s your action plan: Speed up the money coming in and slow down the money going out. Start by calling customers who owe you money – seriously, pick up the phone today. Offer a small discount for immediate payment. Send invoices the moment you deliver your product or service, not a week later.

On the expense side, negotiate with your suppliers. Ask for 45-day payment terms instead of 30. Review every subscription and recurring expense – you’d be amazed how much money startups waste on software they barely use. And if you’re carrying inventory, get smarter about it. Don’t tie up cash in products that sit on shelves.

The fastest way to improve cash flow is always increasing revenue, but that takes time. While you’re working on sales, these other tactics can buy you breathing room.

How often should a startup perform a cash flow analysis?

Here’s my rule of thumb: The tighter your cash, the more often you need to check it.

If you’re an early-stage startup running on fumes, you should be looking at your cash position weekly – maybe even daily. Think of it like checking your phone battery when it’s at 10%. You wouldn’t ignore it for a week, right?

Every startup should do a formal cash flow analysis monthly, no exceptions. This isn’t just looking at your bank balance – it’s the full analysis we talked about earlier, breaking down operating, investing, and financing activities. This monthly deep dive helps you spot trends before they become problems.

As you grow and your cash position stabilizes, you might stretch the detailed analysis to quarterly. But even then, keep monitoring your daily cash balances. Cash flow problems don’t announce themselves with a formal invitation – they sneak up on you when you’re not paying attention.

The startups that survive and thrive are the ones that make cash flow analysis as routine as checking their email. It becomes second nature, and that’s when you start making truly strategic decisions instead of just reacting to crises.

Conclusion

Mastering cash flow analysis isn’t just helpful for startup success – it’s absolutely essential. Think of it as your financial GPS, guiding you through the often turbulent waters of early-stage business growth. While your income statement might paint a rosy picture of profitability, cash flow analysis cuts through the accounting complexity to show you the cold, hard truth: how much actual money you have to keep the lights on, pay your team, and fuel your next growth phase.

Throughout this guide, we’ve walked through the three core activities that make up your cash flow statement – operating activities that show your day-to-day cash generation, investing activities that reveal your growth investments, and financing activities that track your funding journey. We’ve also covered the practical steps to conduct your own analysis, from preparing your statement to interpreting what those numbers really mean for your business.

The reality is stark: with 82% of business failures stemming from cash flow challenges, you simply can’t afford to wing it. But here’s the good news – you don’t have to become a financial expert overnight. By regularly monitoring your cash flows, calculating key ratios like free cash flow and operating cash flow margin, and understanding the story behind your numbers, you’re already ahead of most startups.

For growing companies that need to master their finances without the overhead of building an entire finance team, this is where OpStart steps in. We handle all the complex financial operations – from bookkeeping and tax filings to CFO support and back-office software setup – so you can focus on what you do best: building an amazing product and growing your customer base.

Ready to take your financial analysis to the next level? Our detailed resource will walk you through every line item and help you become truly fluent in reading these critical financial documents. Learn How to Read a Cash Flow Statement in Detail and transform how you view your startup’s financial health.

Cash flow analysis isn’t just about survival – it’s about positioning your startup for sustainable, strategic growth. Master it, and you’ll have the confidence to make bold decisions backed by solid financial insights.