Why Your Company Needs More Than Just a Business Card

Best corporate business credit cards offer venture-funded startups and growing companies higher credit limits, no personal guarantees, and advanced expense management tools that traditional business cards simply can’t match. Unlike small business cards that tie liability to the founder’s personal credit, corporate cards are underwritten based on your company’s financial health and cash position.

Top Corporate Credit Cards for 2024:

- Brex Corporate Card – Best for funded startups with automated expense management and 1.5% cashback

- Ramp Corporate Card – Best for expense controls with real-time spending visibility and virtual cards

- American Express Corporate Platinum – Best for travel perks with lounge access and airline credits

- Capital One Venture X Business – Best for travel rewards with 2X miles on all purchases

- Float Corporate Card – Best for Canadian companies with multi-currency support

The key difference lies in liability and underwriting. Business cards require personal guarantees, making founders personally responsible for company debt. Corporate cards eliminate this risk by basing approval on business financials rather than personal credit scores. As one startup founder finded, “The mental load OpStart has taken off our plates is immense. Plus, it’s up leveled our financial presentations for investors.”

Modern corporate cards also provide features critical for scaling companies: unlimited virtual cards for subscriptions, real-time expense tracking, and seamless integration with accounting software like QuickBooks and Xero. With 57% of Canadians using credit cards primarily for rewards, choosing the right corporate card can significantly impact your bottom line through cashback and expense savings.

I’m Maurina Venturelli, and I’ve helped companies like Sumo Logic build financial operations that supported their path to IPO, including implementing best corporate business credit cards as part of comprehensive financial stacks. At OpStart, we see how the right corporate card choice can streamline financial operations for fast-growing companies.

How to Choose the Right Corporate Card Program

Choosing the right corporate card shouldn’t feel like solving a puzzle with missing pieces. When you’re running a growing business, you need financial tools that actually work with you, not against you. The best corporate business credit cards aren’t just about flashy rewards – they’re about finding the perfect balance between your company’s spending patterns, growth stage, and operational needs.

Here’s what makes this decision easier: corporate cards are issued based on your business’s financial health rather than the applicant’s personal credit. This is a game-changer for founders who want to keep their personal and business finances completely separate. Instead of worrying about your personal credit score, the focus shifts to how strong your business looks on paper.

The key factors we help our clients evaluate include their business size and revenue, typical spending habits, whether they prioritize rewards or spending controls, annual fees, and – this is crucial – how well the card plays with their existing software. For startups juggling rapid growth, this last point can make or break your financial operations.

That’s where our Fractional CFO Services become invaluable. We help you assess your financial position and choose a card that grows with your business, not one that holds you back.

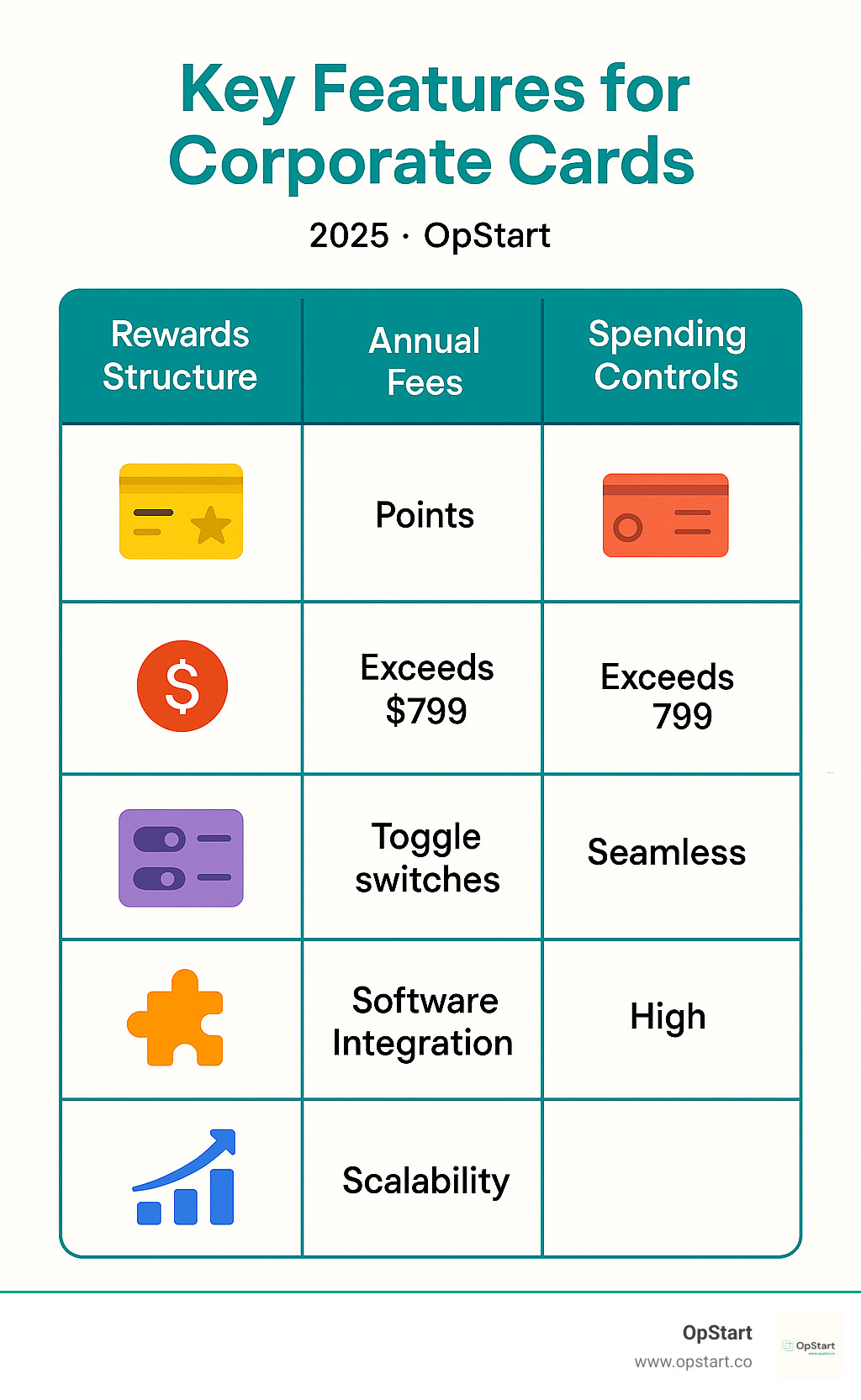

Key Factors for Evaluating Corporate Cards

Think of evaluating corporate cards like dating – you want someone who gets you and makes your life better, not more complicated. The same logic applies here.

Rewards structure is often the first thing people notice, but it shouldn’t be the only thing. Do you want simple cashback that automatically appears on your statement? Or are you more interested in travel points for that next team retreat? Some cards offer flat-rate cashback on everything, while others give you bonus points in specific categories like software subscriptions or travel expenses.

Annual fees can range from zero to nearly $800 for premium cards. Before you panic about high fees, the right card often pays for itself through rewards and operational savings. However, if you prefer keeping things simple, there are excellent no-fee options that still deliver solid value.

Spending controls are where modern corporate cards really shine. You can set spending limits by employee, category, or even specific merchants. Real-time alerts mean you know exactly where money goes as it’s being spent. No more surprise expenses at month-end.

Software integration might sound boring, but it’s actually magical. The best cards sync seamlessly with QuickBooks, Xero, and other accounting platforms. This means transactions automatically categorize themselves, expense reports practically write themselves, and reconciliation becomes a breeze instead of a nightmare.

Global acceptance and reporting capabilities round out the essentials. Your card should work wherever your business takes you, and the reporting should give you insights that actually help you make better financial decisions.

Understanding Eligibility Requirements

Here’s the good news about corporate card eligibility – it’s often easier than you think, especially if you’re coming from personal credit applications.

Business financial health takes center stage instead of your personal credit score. Lenders look at your company’s revenue, cash flow, and bank account balances. Many modern providers focus on cash balance requirements (think $25,000 to $50,000 in your business account) rather than demanding millions in annual revenue.

Annual revenue thresholds vary wildly between providers. Traditional banks might want to see over $3 million in annual revenue, while fintech companies are often more flexible with funded startups and growing businesses.

You’ll need standard business registration documents including your legal business name, address, industry type, and your Employer Identification Number (EIN). Receiving the EIN letter or number from the IRS is one of those crucial early business steps that pays dividends later.

The best part? Many corporate cards require no personal guarantee. This means your personal assets stay protected, and you’re not personally on the hook for business credit card debt. It’s a major reason we guide clients toward these options instead of traditional business cards.

For startups navigating these requirements, especially pre-revenue but well-funded companies, having your financials organized makes all the difference. Our Startup Accounting Services: What Founders Need to Know ensure your paperwork is application-ready and your chances of approval are as high as possible.

A Breakdown of the Best Corporate Business Credit Cards by Type

Finding the best corporate business credit cards isn’t about picking the most popular option. It’s about understanding what your business actually needs. A fast-growing tech startup has completely different priorities than an established consulting firm with frequent travel. This section breaks down cards by their strongest features, so you can match your needs with the right solution.

Best for High-Growth Startups: Cards with Built-in Expense Management

If you’re running a startup, you know that every dollar matters and cash flow visibility is everything. Traditional corporate cards often fall short because they’re designed for established businesses with predictable spending patterns. You need something that grows with your funding and gives you real control over where money goes.

Cards like Brex and Ramp were built specifically for this challenge. Instead of looking at your personal credit score or requiring years of revenue history, they base your credit limit on your company’s cash balance and funding. This means if you just closed a Series A, your spending power reflects that reality.

The automated expense reporting feature alone can save your team hours each week. Employees snap photos of receipts through the mobile app, and the system automatically categorizes everything and syncs with your accounting software. No more chasing down team members for expense reports or dealing with shoeboxes full of receipts.

Real-time spending visibility means you can spot unusual spending patterns immediately, not weeks later when the statement arrives. We’ve seen clients catch subscription renewals they forgot about or identify spending trends that helped them negotiate better vendor rates.

Virtual cards for subscriptions are particularly brilliant for startups. You can create a unique virtual card for each vendor with specific spending limits and expiration dates. This makes it incredibly easy to track spending by project or department, and you can instantly freeze a card if needed. No more worrying about that old SaaS subscription you forgot to cancel.

The integration with accounting software like QuickBooks and Xero means your bookkeeping practically handles itself. Transaction data flows directly into your accounting system with proper categorization, making month-end closes much smoother. This is especially valuable when you’re working with our Bookkeeping for Startups services, as it creates a seamless financial workflow.

Best for Travel Perks and Executive Teams

When your team is constantly on the road for client meetings, conferences, or investor pitches, travel perks stop being nice-to-haves and become genuine business necessities. The right travel-focused corporate card can turn exhausting business trips into more comfortable, productive experiences.

The American Express Corporate Platinum stands out in this category with genuinely useful benefits. The airport lounge access through The American Express Global Lounge Collection® includes over 1,400 lounges worldwide. This isn’t just about free snacks – it’s about having a quiet space to work between flights or decompress after a long day of meetings.

Airline fee credits might seem small, but they add up quickly when you’re dealing with baggage fees, seat upgrades, and in-flight purchases across multiple trips. The hotel status upgrades with major chains like Hilton and Marriott mean your team gets better rooms, late checkout, and other perks that make travel less stressful.

The points multipliers on flights and hotels can generate substantial savings over time. Some cards offer 5x points on airfare and prepaid hotels, which effectively gives you a significant discount on future travel when you redeem those points.

Global Entry and TSA PreCheck credits might be the most underrated benefit. Getting your entire executive team expedited security processing saves time and reduces travel stress significantly. When you’re flying frequently, those extra minutes in security lines really add up.

Cards like the Capital One Venture X Business offer similar benefits with unlimited 2x miles on all purchases, plus accelerated earning on travel bookings. The key is choosing a card where the annual fee makes sense based on your actual travel spending and usage patterns.

Best for Straightforward Rewards: Simple Cashback Cards

Sometimes the best solution is the simplest one. If your business has diverse spending that doesn’t fit neatly into travel or specific bonus categories, a flat-rate cashback card might be your best bet. These cards offer predictable returns without the complexity of points systems or category restrictions.

Flat-rate cashback on all purchases means you don’t have to think about which card to use for different expenses. Whether you’re buying office supplies, paying for software subscriptions, or covering client lunches, you earn the same percentage back on everything.

The beauty of automatic statement credits is that your cashback directly reduces your monthly bill without any action required on your part. No points to track, no redemption decisions to make, no expiration dates to worry about. It’s like getting a small discount on every business purchase.

No annual fee options are particularly attractive for businesses that want to maximize their net savings. If you’re earning 1.5% back on all purchases with no annual fee, that’s pure profit on money you were going to spend anyway.

For Canadian businesses, cards like Float offer unlimited 1% cashback with multi-currency support, which is perfect for companies that operate across borders. The simplicity makes these cards ideal for businesses that prioritize direct savings over travel perks and want their rewards program to run on autopilot.

These straightforward cashback cards work especially well for businesses with steady, predictable spending patterns across multiple categories. They’re the financial equivalent of “set it and forget it” – just use the card for business expenses and watch your costs decrease through automatic cashback credits.

Implementing Your Program: Maximizing Benefits and Mitigating Risks

Congratulations! You’ve chosen one of the best corporate business credit cards for your company. Now comes the fun part – actually implementing it in a way that maximizes benefits while keeping your business safe. Think of this as setting up the guardrails that will help your team spend smart while you sleep soundly at night.

The truth is, even the most feature-rich corporate card won’t deliver value if it’s not properly implemented. We’ve seen companies leave thousands of dollars in rewards on the table simply because they didn’t take the time to set up their program correctly. On the flip side, we’ve watched our clients transform their financial operations overnight with the right setup and policies in place.

The Application and Setup Process

Let’s be honest – nobody gets excited about paperwork. But the good news is that applying for corporate cards has gotten much easier, especially with modern fintech providers. Many fintechs offer online applications, while traditional banks might require more paperwork and in-person appointments. We’re talking about applications that take 10-15 minutes versus processes that could drag on for weeks.

Gathering your business documents is usually the most time-consuming part. You’ll need your company’s legal name, business address, EIN, and often some financial statements or bank account information. The beauty of corporate cards is that they focus on your business’s financial health rather than your personal credit, so having clean business financials is what really matters here.

Once you’re approved (which can happen in as little as 24 hours with some providers), the real magic begins with issuing physical and virtual cards. Physical cards are great for in-person purchases and travel, while virtual cards are absolute game-changers for online vendors and subscriptions. You can generate virtual cards instantly, set specific spending limits, and even create single-use cards for one-time purchases. It’s like having a security guard for every online transaction.

The setup process is also when you’ll configure your spending controls and integration with your existing accounting software. This is where our expertise really shines – we help clients connect their new corporate cards seamlessly with QuickBooks, Xero, or whatever accounting system they’re using. This integration means transactions flow automatically into your books, saving hours of manual data entry each month.

Mitigating Risks Like Fraud and Overspending

Here’s a sobering statistic: Stats show Canadian businesses experience a higher rate of fraud (20%) than Canadian consumers (13%). But don’t let that scare you away from corporate cards – they actually provide better protection than traditional payment methods when used correctly.

Using virtual cards for online vendors is your first line of defense. Instead of giving your main corporate card number to every software subscription or online vendor, you create unique virtual cards for each. If one vendor gets hacked, only that specific virtual card is compromised, not your entire account. You can instantly cancel it and issue a new one without disrupting other payments.

Setting individual spending limits transforms your corporate card program from a free-for-all into a controlled spending environment. You can assign specific limits to each employee based on their role – maybe your sales team gets higher limits for client entertainment while your developers have smaller limits focused on software purchases. The beauty is that these controls are enforced automatically, so you don’t have to police every transaction manually.

Real-time transaction alerts and the ability to instantly freeze cards give you unprecedented control over your company spending. Get a suspicious transaction alert at 2 AM? You can freeze that card immediately from your phone. Employee reports a lost card? Frozen in seconds, new card issued the same day.

Beyond the technical safeguards, clear spending policies and employee training are essential. We help our clients create comprehensive guidelines that spell out exactly what corporate cards can and can’t be used for. This isn’t about being the spending police – it’s about giving your team clear boundaries so they can make smart decisions confidently.

The monitoring and reporting capabilities of modern corporate cards also make our Startup Tax Filing services much more efficient. Clean, categorized transaction data means less time sorting through receipts and more time focusing on strategic financial planning. It’s a win-win that makes everyone’s life easier.

Frequently Asked Questions about Corporate Credit Cards

We field quite a few questions about corporate cards from our clients, and honestly, it makes perfect sense! If you’ve only dealt with personal credit cards or traditional small business cards, corporate cards can feel like entering a whole new world. Let me walk you through the most common questions we hear, because understanding these basics can save you from some major headaches down the road.

What is the main difference between a business credit card and a corporate credit card?

This question comes up in almost every consultation, and the answer really comes down to liability and scale. Think of it this way: business credit cards are like training wheels for small businesses and sole proprietors. They typically require you, as the owner, to put your personal credit on the line with a personal guarantee. If your business can’t pay the bill, guess who’s responsible? That’s right – you are, personally.

Best corporate business credit cards flip this script entirely. They’re designed for larger companies or well-funded startups that have established business credit profiles. The beautiful thing here is that liability stays with the business. Your personal assets aren’t on the hook if something goes wrong. The card approval is based on your company’s financial health, cash position, and EIN rather than your personal credit score.

This shift means you can access significantly higher credit limits and much more sophisticated expense management tools. We’ve seen clients go from $10,000 limits on business cards to six-figure limits on corporate cards, simply because the underwriting focuses on their company’s funding and cash flow rather than personal credit history.

Will a corporate credit card affect my personal credit score?

This is probably the question that brings the biggest sigh of relief from founders! The answer is no – corporate cards won’t touch your personal credit score. Since these cards are tied to your business’s credit profile and Employer Identification Number (EIN), they live in a completely separate world from your personal credit reports.

This separation is honestly one of the biggest advantages for entrepreneurs. You can scale your business spending without worrying about maxing out your personal credit utilization or having business expenses show up on your personal credit report. Even your employees who use corporate cards won’t see any impact on their personal credit scores.

We’ve had clients tell us this feature alone was worth making the switch. One founder mentioned how liberating it felt to know that her company’s growth spending wouldn’t interfere with her ability to get a personal mortgage. That’s the kind of financial separation every business owner should have.

What are the typical revenue requirements to qualify for a corporate card?

Here’s where things get really interesting, and frankly, much better for startups than they used to be. Traditional banks still play by the old rules – they often want to see annual revenues of several million dollars (think $3 million or more) and prefer companies that have been around for years. It’s the classic “you need money to get money” situation.

But the fintech revolution has completely changed this game. Modern providers focus on your company’s cash balance and financial health rather than just historical revenue. Some require as little as $25,000 to $50,000 in your business bank account. This is a game-changer for venture-backed startups that might be pre-revenue but sitting on substantial funding.

We’ve helped clients with minimal revenue but strong cash positions from funding rounds get approved for corporate cards with impressive limits. The key is working with providers who understand the startup ecosystem and don’t rely solely on traditional underwriting methods. Corporate cards are issued based on your business’s financial health rather than the applicant’s personal credit, which opens doors that were previously closed to early-stage companies.

The landscape has really shifted to support growing businesses, and we love seeing our clients take advantage of these more flexible requirements to get the financial tools they need to scale.

Make Your Next Financial Move the Right One

Picking the right corporate card isn’t just about getting another piece of plastic for your wallet. It’s actually a strategic financial decision that can transform how your company handles money. The best corporate business credit cards do three big things: they improve your cash flow by giving you more time to pay bills, they automate the headache of expense management, and they put valuable rewards back in your pocket.

But here’s the thing – there’s no one-size-fits-all answer. The best card for your company depends entirely on where you are in your journey. A scrappy startup that just raised their Series A will have completely different needs than a established company sending executives around the globe every month. That startup might care most about integrated expense management and avoiding personal guarantees, while the travel-heavy enterprise is probably more interested in airport lounge access and airline credits.

We’ve seen this play out countless times with our clients. The founder who chooses a card based on flashy rewards but ignores spending controls often ends up with a mess come tax season. Meanwhile, the CEO who picks a card that seamlessly integrates with their accounting software saves hours every month and has crystal-clear financial visibility.

At OpStart, we get that choosing the right corporate card is just one piece of a much larger puzzle. For startups and growing businesses, it’s not enough to just pick a good card – you need it to work perfectly with your entire financial operation. That’s where our expertise really shines. We don’t just help you choose tools; we make sure they all work together like a well-oiled machine.

Think of it this way: your corporate card should talk to your accounting software, which should feed into your financial reporting, which should inform your strategic decisions. When everything connects properly, you spend less time on administrative work and more time building your business.

Ready to get your financial operations running like clockwork? We’re here to help you choose the best corporate business credit cards and build a complete financial stack that actually works for your company.