Why Small Businesses Need Professional Financial Management

Accountancy and bookkeeping services are essential for business success, yet many founders struggle to manage these complex financial tasks while growing their companies. Here are the core services you can expect:

- Bookkeeping: Daily transaction recording, bank reconciliation, accounts payable/receivable

- Tax Services: Preparation, filing, compliance, and strategic planning

- Financial Reporting: Monthly statements, cash flow analysis, and business insights

- Payroll Management: Employee payments, tax withholdings, and compliance

- Advisory Services: Strategic guidance, budgeting, and CFO-level support

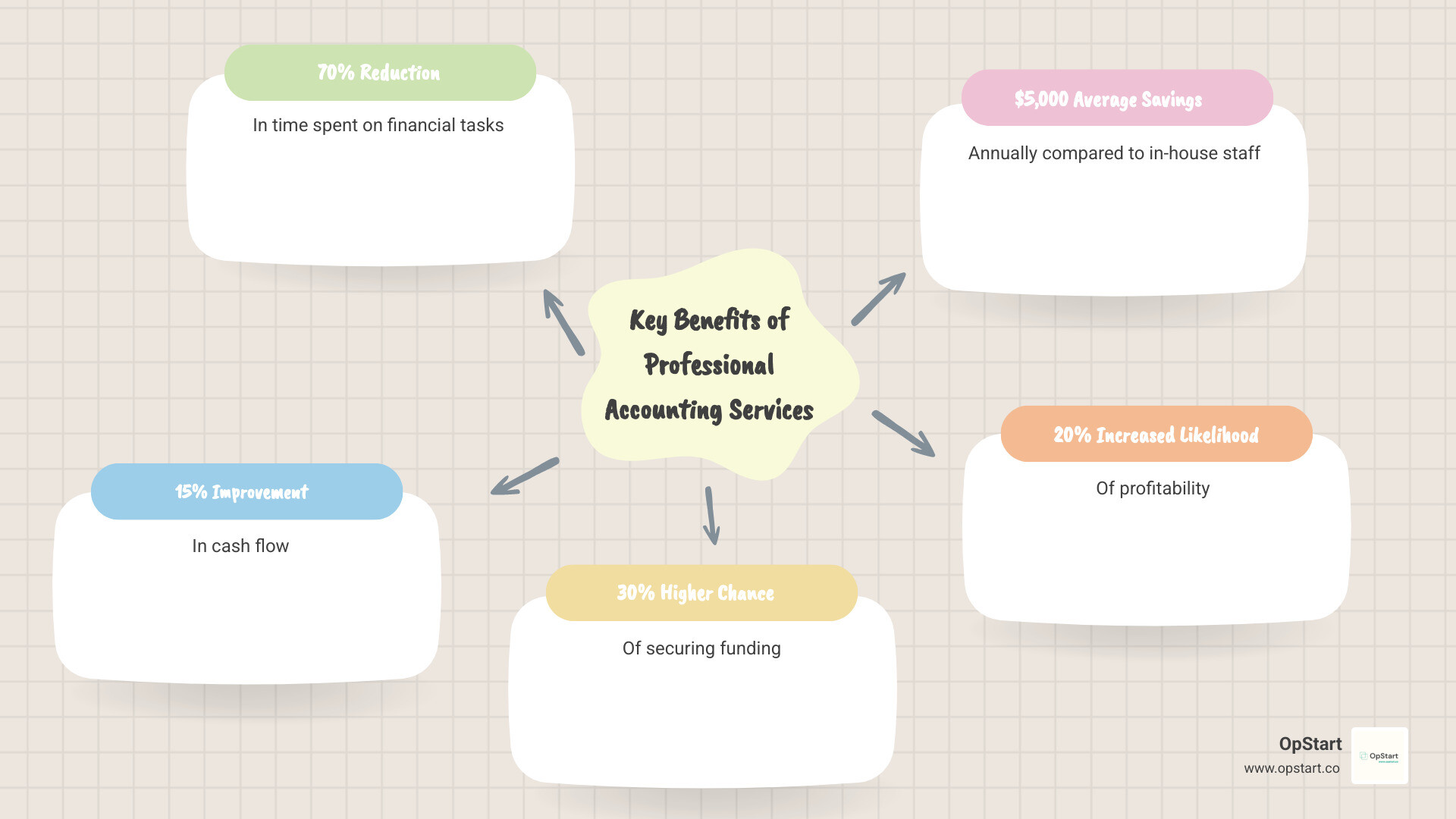

The stakes are high when it comes to financial management. Research shows that 70% of small businesses fail due to poor financial management, while companies with accurate bookkeeping can improve their cash flow by up to 15%. Businesses that work with professional accountants are 30% more likely to secure funding and 20% more likely to be profitable.

As Kate Beard, Head of Operations at Wendy, puts it: “The mental load OpStart has taken off our plates is immense. Plus, it’s up leveled our financial presentations for investors.”

Modern accounting services combine cloud-based technology with expert human support. This means you get real-time financial insights, automated data entry, and strategic guidance – all while saving an average of $5,000 per year compared to hiring in-house staff.

I’m Maurina Venturelli, and I’ve helped high-growth companies scale their financial operations at companies like Sumo Logic and LiveAction. Now as VP of Go-to-Market at OpStart, I work daily with founders who need expert accountancy and bookkeeping services to fuel their growth while staying compliant.

Simple guide to accountancy and bookkeeping services:

Understanding the Basics: Bookkeeping vs. Accounting

When you’re searching for accountancy and bookkeeping services, you’ll often hear these terms used together – but they’re actually quite different. Think of bookkeeping as the foundation of your house, while accounting is the beautiful structure you build on top of it.

Bookkeeping is all about recording. It’s the daily work of capturing every financial transaction that happens in your business. Every sale you make, every bill you pay, every expense you track – that’s bookkeeping. Your bookkeeper handles the essential transaction recording that keeps your financial records accurate and up-to-date.

The daily bookkeeping tasks include data entry (logging all those transactions), bank reconciliation (making sure your bank statements match your books), and invoicing (sending bills to customers and tracking payments). It’s detailed work that requires precision, but it’s absolutely crucial for your business.

Accounting takes a bigger picture view. Once your bookkeeper has recorded all those transactions, your accountant steps in to analyze what it all means. They dive into financial analysis to understand your profitability, identify trends, and spot opportunities. This is where strategic planning comes into play – using your financial data to make smart business decisions.

Accounting involves preparing comprehensive financial statements, planning for taxes, and providing the insights you need for budgeting and forecasting. While bookkeeping asks “what happened?”, accounting asks “what does this mean for my business?”

Modern accountancy and bookkeeping services have been transformed by cloud-based solutions and virtual services benefits. These tools work together seamlessly, with bookkeepers maintaining accurate records and accountants providing strategic guidance – all through secure, accessible platforms.

If you’re curious about how these roles fit into the bigger picture of financial management, check out our detailed comparison: Fractional CFO vs. Bookkeeper vs. CPA: What’s the Difference?

The Role of Cloud Technology in Modern Bookkeeping

Cloud technology has completely changed the game for accountancy and bookkeeping services. Gone are the days of manual spreadsheets and shoeboxes full of receipts. Today’s cloud accounting platforms bring automation, real-time data, and increased efficiency to businesses of all sizes.

Automation handles the busywork that used to eat up hours of your time. Your transactions get categorized automatically, bank feeds update in real-time, and reconciliation happens with just a few clicks. This means fewer errors and more time to focus on growing your business.

The beauty of real-time data can’t be overstated. When your financial information updates instantly, you always know exactly where your business stands. Need to check your cash flow before making a big purchase? It’s right there at your fingertips.

Software integration connects all your business tools together. Your e-commerce platform talks to your accounting software, which connects to your payment processor. Everything flows seamlessly, creating one unified view of your finances.

Perhaps best of all, cloud platforms offer accessibility from any device. Whether you’re at your desk, traveling, or working from your favorite coffee shop, your financial data is always available. This flexibility is especially valuable for virtual services that connect you with expert bookkeepers regardless of location.

For more details about how we leverage these technologies in our services, visit More info about our Bookkeeping Services.

Key Differences in Daily Tasks

The day-to-day work of bookkeepers and accountants looks quite different, even though they’re working toward the same goal of keeping your finances healthy.

Your bookkeeper focuses on the detailed daily tasks: data entry to record every transaction, bank reconciliation to ensure everything matches up, and invoicing to keep money flowing into your business. They’re also handling accounts payable and receivable, making sure bills get paid and customers pay what they owe.

Accountants tackle the bigger picture work. They prepare financial statement preparation that shows how your business is really performing. They dive into tax planning to minimize what you owe and ensure you’re compliant with all regulations. Budgeting and forecasting help you plan for the future based on solid financial data.

While bookkeepers are recording what happened yesterday, accountants are helping you understand what it means for tomorrow. Both roles are essential, and the best accountancy and bookkeeping services seamlessly blend these functions to give you complete financial management.

Why Your Business Needs Professional Financial Services

Picture this: You’re passionate about your business, but you’re drowning in spreadsheets at 11 PM instead of planning your next big move. Sound familiar? This is exactly why accountancy and bookkeeping services aren’t just nice to have – they’re absolutely essential for any business that wants to thrive, not just survive.

Let’s talk about improved decision-making first. When you have accurate, real-time financial data, you stop making business decisions based on gut feelings and start making them based on facts. Our research shows that 94% of businesses consider accurate financial reporting essential for decision-making. It’s like having a GPS for your business – you know exactly where you are and can confidently choose the best route forward.

One of the biggest game-changers is better cash flow management. Think of cash flow as the oxygen of your business – without it, everything stops. Professional services help you track every dollar coming in and going out, spot trends before they become problems, and optimize when you pay bills and collect payments. The result? Businesses typically see their cash flow improve by up to 15% when they work with experts.

This naturally leads to increased profitability. Here’s an interesting fact: businesses that use accounting software are 20% more likely to be profitable. When you combine software with professional expertise, that advantage grows even more. Experts help you find hidden costs, optimize expenses, and identify your most profitable revenue streams.

Tax compliance is another critical area where professional help pays dividends. Tax laws change constantly, and missing deadlines or deductions can cost you thousands. With experts handling your taxes, you’ll meet every deadline, claim every eligible deduction, and significantly reduce your risk of costly penalties or audits.

If you’re planning to raise funding, professional financial management becomes even more important. Investors and lenders want to see clean, accurate financial statements that tell a clear story about your business health. Companies that work with accountants are 30% more likely to secure funding – that’s not a coincidence.

Perhaps most importantly, outsourcing your financial tasks gives you back your most precious resource: time. Small businesses typically spend 10 hours per month on bookkeeping alone. Imagine what you could accomplish with those hours back. Plus, outsourcing can save you an average of $5,000 per year compared to hiring in-house staff.

To dive deeper into the value proposition, check out our detailed analysis: 8 Ways a Great Bookkeeper Pays for Themselves (and Then Some).

Enhancing Profitability and Cash Flow

Here’s where the magic really happens. Professional accountancy and bookkeeping services don’t just track your money – they help you make more of it and keep more of what you earn.

Expense tracking might sound boring, but it’s where businesses often find their biggest surprises. We’ve helped clients find they were wasting $2,000 per month on expenses they didn’t even realize they had. When every expense is properly categorized and tracked, patterns emerge that can save you serious money.

The real power comes from identifying savings opportunities across your entire operation. Maybe you’re paying for software subscriptions you forgot about, or there’s a better deal available with your current vendors. Professional services excel at spotting these opportunities and can save businesses an average of $5,000 per year through better financial management.

Managing accounts receivable is crucial for maintaining healthy cash flow. Experts ensure your invoices go out promptly and accurately, then track down overdue payments before they become problems. This proactive approach means you get paid faster and have fewer bad debts eating into your profits.

On the flip side, optimizing payment cycles for what you owe helps you maintain good relationships with vendors while keeping cash in your business as long as possible. It’s a delicate balance that professionals handle expertly.

All of this comes together in powerful financial reporting insights. Monthly reports don’t just show you what happened – they help you understand why it happened and what to do next. These reports can answer critical questions like “Why are sales up but cash is tight?” or help you model scenarios like “What happens if we hire two more people?” With these insights, businesses typically see their cash flow improve by up to 15%.

Ensuring Tax Compliance and Strategic Planning

Tax season doesn’t have to be terrifying. With professional accountancy and bookkeeping services, it can actually become a strategic advantage for your business.

The foundation starts with accurate record-keeping throughout the year. When every transaction is properly documented and categorized, tax filing becomes straightforward instead of stressful. Mistakes in areas like VAT or sales tax are common problems that can lead to penalties, but professionals ensure your records are always audit-ready.

Maximizing deductions is where expertise really pays off. Tax laws are constantly changing, and professionals stay on top of every opportunity to reduce your tax burden legally. From business meals to R&D tax credits that could save your business up to $500,000 per year, experts make sure you’re not leaving money on the table.

Meeting filing deadlines might seem basic, but it’s surprisingly easy to miss important dates when you’re juggling everything else. Professionals handle all the paperwork – federal and state filings, 1099s, T4/W2 slips – ensuring everything gets submitted correctly and on time.

Navigating CRA/IRS regulations can feel like learning a foreign language. Having experts handle these complex regulations removes that burden from your shoulders and significantly reduces your audit risk. Clean, professional records make audits less likely, and if one does happen, your accountant can represent you through the process.

The biggest advantage comes from proactive tax strategy. This isn’t just about filing taxes once a year – it’s about year-round planning that legally minimizes your tax burden. This includes advice on business structure, compensation strategies, and investment decisions that align your tax obligations with your business goals.

For startups navigating their first tax seasons, we’ve created a comprehensive guide: More about Startup Tax Filing.

7 Essential Websites and Resources for Financial Management

Finding reliable financial information online can feel like searching for a needle in a haystack. While professional accountancy and bookkeeping services provide expert guidance, having a toolkit of trusted resources at your fingertips empowers you to make better business decisions. After working with hundreds of startups, I’ve compiled seven categories of websites that consistently deliver value to business owners.

1. Government Business & Financing Hubs

Government websites might not be the most exciting bookmarks in your browser, but they’re goldmines of official information. These sites offer business grants and loan information directly from the source, helping you steer funding opportunities without the guesswork.

For Canadian entrepreneurs, Business Grants and Financing through Innovation, Science and Economic Development Canada provides comprehensive funding options. US businesses can find similar resources through the Small Business Administration.

The tax regulations and compliance resources on these sites are particularly valuable. The Canada Revenue Agency and IRS offer detailed guidance on everything from payroll deductions to corporate tax filings. You’ll find specialized calculators for salary commissions, personal income tax, and even non-resident tax obligations – all free and updated with the latest regulations.

2. Non-Profit Mentorship Organizations

Sometimes the best business advice comes from someone who’s walked in your shoes. Non-profit mentorship organizations connect you with experienced professionals who genuinely want to see you succeed.

Free Business Advice from SCORE stands out as an exceptional resource, offering free business advice from experienced mentors across virtually every industry. Their volunteers are retired executives who’ve built successful businesses and now share their knowledge through one-on-one mentoring and educational workshops.

Canadian entrepreneurs have access to equally valuable resources through organizations that provide startup guidance and financial planning workshops. These mentors understand the unique challenges of building a business and offer practical, real-world advice that you simply can’t get from a textbook.

3. Accounting Software Resource Hubs

Choosing accounting software is like picking a business partner – you’ll be working together for years to come. The best software providers offer extensive resource hubs that help you understand both their tools and broader accounting principles.

When evaluating options, focus on integrated apps and certified professional directories within each platform. Look for software that offers seamless automation capabilities for data entry and bank reconciliation, real-time data access from any device, and integration potential with your existing business tools.

Many platforms provide detailed user reviews and guidance to help you choose the right software for your specific business needs. The key is finding a solution that grows with you – what works for a solo entrepreneur might not scale when you have a team of twenty.

4. Specialized Startup Resource Centers

Startups face unique financial challenges that established businesses never encounter. Specialized resource centers understand the , high-growth environment where traditional financial advice often falls short.

These centers offer entrepreneur resources and startup-focused content that addresses real challenges like managing burn rate, preparing for funding rounds, and scaling financial operations. Many provide financial modeling tools specifically designed for startups, helping you create projections that investors actually want to see.

Networking opportunities through these platforms connect you with fellow founders facing similar challenges. Our own Resources for Startups section provides insights specifically custom to the financial journey that founders steer every day.

5. Financial Calculators and Tools

Quick financial estimates can save you hours of manual calculations and help you make faster decisions. Online financial calculators provide immediate insights for scenario planning and initial feasibility assessments.

Business loan calculators like the Business loan calculator help you understand the true cost of financing before you commit. Tax estimators give you ballpark figures for quarterly planning, while investment calculators help you evaluate potential returns on business investments.

Don’t overlook retirement planning tools – as a business owner, your retirement planning often looks different from traditional employees, and these calculators help you understand how much you need to set aside for your future.

6. Industry-Specific Accounting Guidance

Generic financial advice rarely addresses the nuances of your specific industry. E-commerce businesses need to track different metrics than SaaS companies, and tech startups face unique revenue recognition challenges that don’t apply to traditional retail.

Look for resources that offer niche expertise in your sector. SaaS businesses need to understand monthly recurring revenue and churn rates, while e-commerce companies must steer multi-currency transactions and inventory accounting. Creative agencies require project-based profit tracking that differs significantly from subscription-based models.

Our guide on Startup Accounting Services: What Founders Need to Know provides foundational insights for new businesses, while custom financial solutions address the specific needs of different industries.

7. Professional Association Directories

When you’re ready to hire professional help, verifying credentials becomes crucial. Professional associations maintain directories of certified experts who meet strict educational and ethical standards.

CPA directories through organizations like the American Institute of Certified Public Accountants (AICPA) in the US or CPA Canada help you find licensed Chartered Professional Accountants. These directories ensure you’re working with professionals who maintain their credentials and stay current with changing regulations.

Certified bookkeeper listings provide similar verification for bookkeeping professionals. Always check that any professional you hire maintains good standing with their professional association – it’s your assurance of quality and ethical standards.

The key to using these resources effectively is knowing when to seek help and when to rely on professional accountancy and bookkeeping services. While these websites provide valuable information, nothing replaces the personalized guidance of an expert who understands your specific business situation.

How to Choose the Right Accountancy and Bookkeeping Services

Finding the right accountancy and bookkeeping services provider isn’t just about finding someone who can crunch numbers. You’re looking for a strategic partner who will grow alongside your business and help you make smarter financial decisions. Think of it like choosing a co-pilot for your entrepreneurial journey – you want someone you can trust completely.

Scalability should be at the top of your list. Your business will hopefully grow (and grow fast!), which means your financial needs will evolve too. The last thing you want is to outgrow your accounting firm every couple of years. Look for a provider whose services can scale with you, from basic bookkeeping for your startup days to more complex CFO-level advisory services as you expand into new markets.

Industry specialization can make a huge difference in the quality of service you receive. A firm that understands the unique challenges of your specific industry will be familiar with things like payment gateway complexities for e-commerce businesses, or subscription revenue recognition for SaaS companies. They’ll know the metrics that matter most to your type of business and can provide insights that a generalist might miss.

The technology stack your provider uses is absolutely crucial in today’s business world. Look for someone who’s “highly tech-forward” and can integrate seamlessly with your existing software ecosystem. Whether you’re using Shopify, Xero, Stripe, or any other platforms, your accounting firm should be able to plug right in and create an efficient, automated data flow.

Pricing models matter more than you might think. Transparent and predictable pricing helps you budget effectively and avoid those dreaded surprise bills. Flat-rate pricing is particularly valuable because it gives you complete budget predictability – you know exactly what you’ll pay each month, regardless of how many hours your accountant spends on your books.

Don’t underestimate the importance of communication and support. You want a provider who’s responsive and offers personalized customer service. When you have urgent questions about your cash flow or need financial reports for an investor meeting, you need to know your accounting team will be there for you.

Finally, pay attention to client testimonials and reputation. Look for 5-star ratings and positive reviews that speak to reliability, expertise, and genuine commitment to client success. Real-world stories from other business owners can give you valuable insights into what it’s actually like to work with a particular firm.

If you’re wondering whether your current financial setup is meeting your needs, our guide Is Your Bookkeeping Good Enough? can help you evaluate where you stand.

Evaluating Core Accountancy and Bookkeeping Services

When you’re evaluating potential providers for accountancy and bookkeeping services, understand exactly what services they offer and how well those services align with your business needs. Not all accounting firms are created equal, and the range of services can vary significantly.

Bookkeeping services form the foundation of any good financial operation. This includes daily transaction recording, bank reconciliation, and managing your accounts payable and receivable. Your provider should handle invoice processing, expense tracking, and ensure every financial transaction is accurately categorized. The goal is to maintain clean, up-to-date records that give you a clear picture of your financial position at any time.

Payroll services become increasingly important as you hire employees. Look for providers who can handle payroll processing, direct deposits, payroll tax filings, and preparation of year-end forms like T4s or W2s. They should also track employee benefits and ensure compliance with federal, state, and local payroll regulations.

Tax preparation and planning services go far beyond just filing your annual returns. A good provider will handle corporate and personal income tax preparation, manage sales tax compliance (like GST/HST or VAT filings), and provide strategic tax planning throughout the year. They should also be able to represent you during tax audits and act as your liaison with tax authorities.

Financial reporting capabilities are where you really start to see the value of professional services. Monthly financial statements, custom management reports, budgeting and forecasting, and KPI tracking all help you understand your business’s financial health and make informed decisions.

Advisory services represent the highest level of financial support, including virtual CFO services, strategic financial planning, cash flow analysis, and even funding preparation for investor meetings. These services transform your accounting provider from a record-keeper into a true business advisor.

Assessing Technology and Integration

In today’s business environment, the technology your accountancy and bookkeeping services provider uses can make or break the efficiency of your financial operations. We’ve seen how the right tech stack can transform a business’s financial management from a time-consuming burden into a streamlined, automated process.

Software proficiency is non-negotiable. Your provider should be certified in leading cloud accounting platforms like QuickBooks, Xero, FreshBooks, or Sage. They should also be familiar with supporting tools like DEXT for receipt management, Bill.com for accounts payable, and Plooto for payment processing. This expertise ensures they can work efficiently within your existing systems or recommend the best setup for your needs.

Cloud accounting platforms and automation tools are where modern accounting really shines. The best providers leverage automation for data entry, bank reconciliation, and report generation. This not only saves time but dramatically reduces the risk of human error. When your transactions are automatically categorized and your bank accounts are reconciled in real-time, you get accurate financial insights without the manual work.

Data security protocols should be a top priority when you’re sharing sensitive financial information. Reputable firms use robust encryption, multi-factor authentication, and secure online portals to protect your data. They should be completely transparent about their security measures and willing to discuss how they safeguard your information.

The ability to provide seamless integration with your existing tools is what separates good providers from great ones. Whether you’re using e-commerce platforms like Shopify, payment processors like Stripe, or other business software, your accounting firm should be able to create a unified ecosystem where all your financial data flows automatically between systems.

Understanding Pricing: Flat-Rate vs. Hourly

One of the biggest decisions you’ll make when choosing accountancy and bookkeeping services is understanding their pricing model. This choice affects not just your budget, but also your peace of mind and ability to plan for the future.

Hourly billing might seem straightforward – you pay for the actual time spent on your books. However, this approach can lead to unpredictable monthly expenses, especially if your transaction volume fluctuates or unexpected issues arise. While reputable firms always work efficiently, the uncertainty of not knowing your exact monthly cost can make budgeting challenging.

Flat-rate packages offer something much more valuable: cost transparency and budget predictability. With a fixed monthly fee, you know exactly what you’ll pay regardless of how many hours are spent on your books. This predictability makes it much easier to budget for your financial services and removes the anxiety of surprise bills.

The financial benefits of outsourcing are significant. Research shows that businesses can save an average of $5,000 per year by outsourcing their bookkeeping compared to hiring in-house staff. When you combine these savings with the predictability of flat-rate pricing, professional outsourcing becomes not just convenient but financially smart.

Many providers offer transparent pricing with clear breakdowns of what’s included in each package. Some even offer discounts for new clients or for businesses using specific cloud accounting software. When evaluating providers, always ask for a detailed explanation of what’s included in their fees and make sure their pricing model aligns with your need for financial predictability.

The key is finding a provider whose pricing structure gives you confidence in your monthly expenses while delivering genuine value for money through expert service and time savings.

Frequently Asked Questions

When we talk to business owners about accountancy and bookkeeping services, we hear the same thoughtful questions over and over. It’s natural to want clarity before making such an important decision for your business. Let me walk you through the most common concerns we address.

What are the core services offered by accounting and bookkeeping firms?

Think of professional accountancy and bookkeeping services as your complete financial support system. We cover everything from the daily nitty-gritty to the big-picture strategy that keeps your business thriving.

Bookkeeping forms the foundation of everything we do. This means recording every single financial transaction – whether it’s a $5 coffee expense or a $50,000 client payment. We handle bank reconciliation to make sure your records match reality, manage your bills (accounts payable), and track who owes you money (accounts receivable). It’s meticulous work, but it’s what keeps your financial house in order.

Payroll services take the headache out of paying your team. We calculate wages, handle all those confusing deductions, process direct deposits, and deal with payroll taxes. Come tax season, we prepare all the year-end forms like T4s and W2 slips. Your employees get paid correctly and on time, while you stay compliant with all regulations.

When it comes to financial reporting, we transform all those numbers into meaningful insights. Monthly Profit & Loss statements show you how much money you’re actually making. Balance Sheets give you the full picture of what you own and owe. Cash Flow statements help you understand why you might have great sales but still feel cash-strapped.

Tax preparation and planning is where we really earn our keep. We prepare and file your corporate and personal returns, handle sales taxes, and most importantly, we plan strategically to minimize what you owe legally. If the tax authorities come knocking with questions, we’re your professional representatives.

For growing businesses, our CFO advisory services provide executive-level financial guidance without the executive-level salary. We help with cash flow forecasting, financial modeling for growth scenarios, and preparing for funding rounds.

How do accountancy and bookkeeping services help with tax compliance?

Tax compliance might sound boring, but it’s actually where professional accountancy and bookkeeping services can save you thousands of dollars and countless sleepless nights.

Everything starts with accurate record-keeping throughout the year. We make sure every expense is properly categorized and documented. This isn’t just about avoiding problems – it’s about being ready to claim every deduction you’re entitled to when tax time comes.

Speaking of deductions, we’re like treasure hunters when it comes to maximizing what you can claim. Business meals, home office expenses, professional development, equipment purchases – we stay current on tax laws so you don’t miss out on legitimate savings. Some businesses find R&D tax credits worth hundreds of thousands of dollars they never knew existed.

Meeting filing deadlines is non-negotiable with tax authorities. We track all the important dates – quarterly remittances, annual filings, payroll submissions. Miss a deadline, and you’re looking at penalties and interest that add up fast.

If tax authorities like the CRA or IRS have questions about your returns, we handle all communication. We liaise with tax authorities on your behalf, provide documentation, and explain your financial records professionally. This representation alone can save you significant stress and potential complications.

Most importantly, proper bookkeeping reduces your audit risk. Clean, organized, compliant records make you a much less attractive target for tax audits. And if one does happen, you’re fully prepared.

What are the advantages of using virtual bookkeeping services?

Virtual accountancy and bookkeeping services have transformed how businesses manage their finances. The advantages go far beyond just convenience.

The cost savings are substantial – our research shows businesses save an average of $5,000 per year compared to hiring in-house staff. You avoid salary, benefits, office space, equipment, and training costs. Some virtual providers offer savings of up to 70% compared to traditional methods.

You also get access to a much wider talent pool. Instead of being limited to whoever happens to live in your city, you can work with specialists who understand your specific industry, whether that’s e-commerce, SaaS, or manufacturing.

Increased efficiency comes from leveraging cloud technology and automation. Virtual bookkeepers use the latest software to automate data entry, streamline bank reconciliation, and generate reports quickly. Businesses using cloud-based accounting software see a 25% increase in efficiency.

Real-time data access means your financial information is always current and available from any device. Need to check your cash flow before approving a large purchase? You can do that from anywhere, anytime.

Scalability is huge for growing businesses. As your transaction volume increases, virtual services easily adjust to match your needs. No hiring, training, or managing additional staff. If business slows down, you can scale back just as easily.

Finally, improved security often surprises business owners. Reputable virtual bookkeeping firms invest in advanced encryption, secure portals, and authentication protocols that most small businesses couldn’t implement on their own.

Virtual services give you professional expertise, cutting-edge technology, and significant cost savings – all while freeing you to focus on what you do best: growing your business.

Conclusion

Throughout this guide, we’ve walked through the essential world of accountancy and bookkeeping services and finded just how transformative they can be for your business. It’s been quite a journey – from understanding why bookkeeping forms the foundation while accounting builds the strategic insights on top, to seeing how cloud technology has revolutionized the entire industry.

The numbers don’t lie. When businesses accept professional financial management, they see improved decision-making backed by real data instead of guesswork. Their cash flow improves by up to 15%, and they become 20% more likely to be profitable. Perhaps most importantly, they’re 30% more likely to secure the funding they need to grow.

But here’s what really matters: you get your life back. Instead of spending countless hours wrestling with spreadsheets and trying to decode tax forms, you can focus on what you actually love about your business – whether that’s developing new products, serving customers, or building your team.

The magic happens when you combine cutting-edge technology with human expertise. Cloud-based solutions handle the heavy lifting of data entry and automation, while experienced professionals provide the strategic guidance that helps you make smart financial decisions. It’s like having a financial co-pilot who knows exactly where you’re going.

For startups looking for a truly hands-free, expert-managed solution, OpStart brings together everything we’ve discussed in this guide. We handle your daily bookkeeping, manage your tax compliance, provide CFO-level strategic support, and integrate seamlessly with whatever software you’re already using. Our flat-rate pricing means no surprise bills, and our expertise means you can sleep well knowing your finances are in capable hands.

The best part? You don’t have to figure this out alone. Professional accountancy and bookkeeping services aren’t just about keeping the lights on – they’re about lighting the path to your business’s brightest future.

Ready to see what expert financial management can do for your startup? Explore our Bookkeeping Services and find how we can help turn your financial operations from a headache into a competitive advantage.