Why Comprehensive R&D Services Are Essential for Startup Growth

Comprehensive R&D services offer startups end-to-end support for innovation, from initial research and feasibility studies to prototyping, testing, and market launch. These services provide access to specialized expertise and infrastructure for:

- Basic and applied research

- Experimental development and prototyping

- Material and part development

- Production process design

- Documentation and IP protection

For founders, R&D can seem like a complex function requiring significant capital. Yet, companies that invest in R&D consistently outperform their peers. While giants like Amazon and Apple spend billions, you don’t need a massive budget to innovate.

By partnering with R&D services, your manufacturing projects can benefit from fresh perspectives and cutting-edge research—without the high upfront costs of an internal department. This streamlined approach reduces time-to-market while you focus on your core business.

Better yet, innovation can improve your cash flow. The IRS offers R&D tax credits that can offset up to $500,000 in payroll taxes annually for qualifying startups.

I’m Maurina Venturelli, and throughout my career scaling companies like Sumo Logic to IPO, I’ve seen how comprehensive R&D services paired with smart financial management accelerate growth. At OpStart, we help founders maximize R&D tax benefits while keeping financial operations running smoothly.

The Core Components of Research and Development

R&D is the systematic process of investigating, experimenting, and creating to bring new products to market or improve existing ones. Understanding its components helps you invest your resources wisely.

The Three Main Types of R&D

Comprehensive R&D services leverage three distinct types of research that form a complete innovation pathway.

- Basic research is pure, curiosity-driven exploration of fundamental principles without an immediate commercial goal. It creates the foundation for future breakthroughs.

- Applied research directs those fundamental insights toward solving specific, real-world problems, like using a new material property to create a more durable product.

- Experimental development transforms research findings into tangible products, processes, or services. This is the prototyping, testing, and refining stage that bridges the gap between concept and commercialization.

Understanding these distinctions is crucial, as the IRS recognizes them when evaluating R&D tax credits.

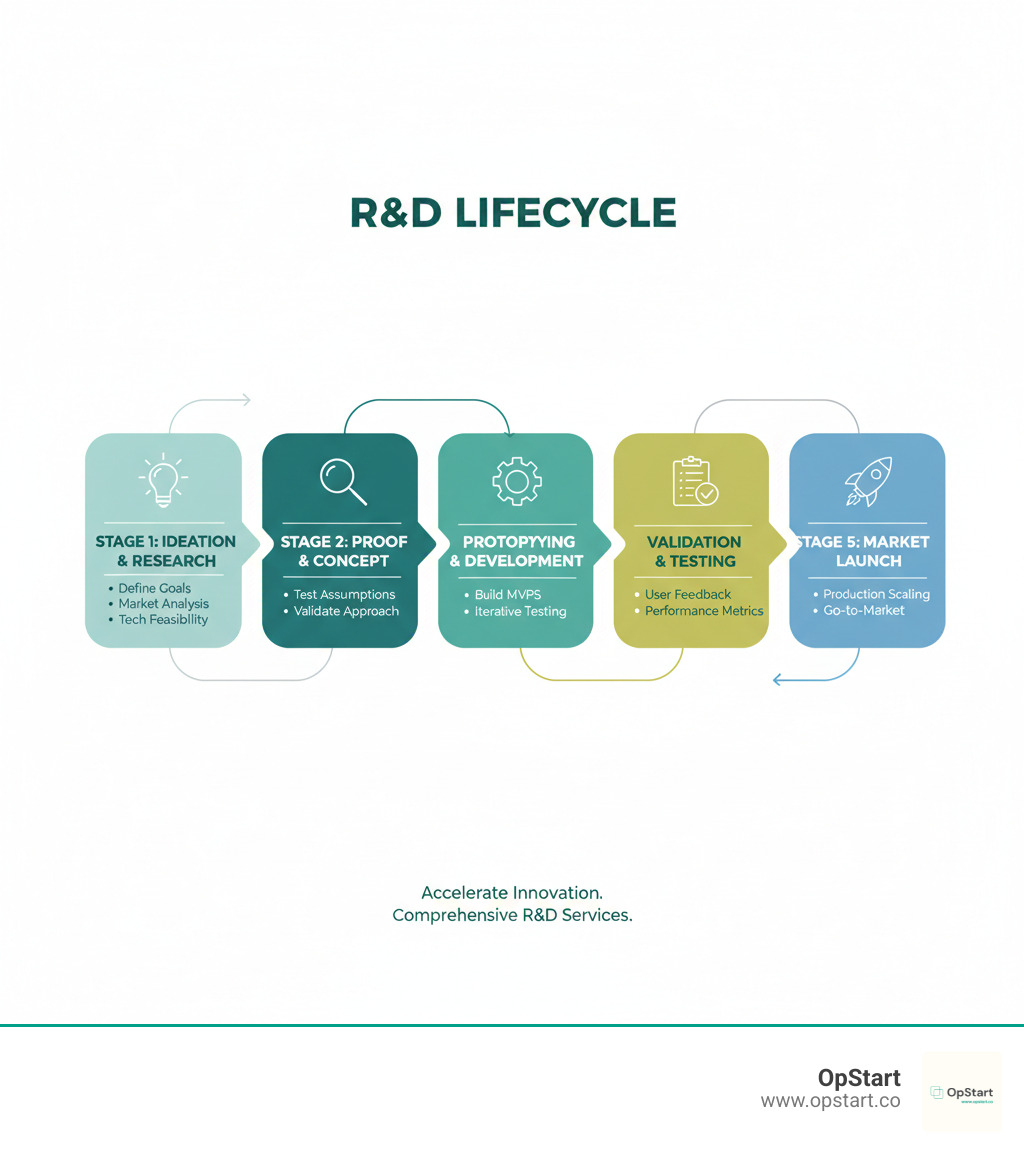

The R&D Project Lifecycle

A successful R&D project follows a structured lifecycle to reduce risk, though it’s often an iterative process.

- Ideation and Feasibility: It starts with a clear project brief (what you’re building and why) and a feasibility study to assess market, technical, and financial viability. This early research helps spot roadblocks when they are cheapest to solve.

- Proof of Concept (PoC): A small-scale experiment to answer the question: “Can this work?” A PoC validates core assumptions before you commit significant resources.

- Prototyping and MVP Development: This stage involves creating preliminary models and a Minimum Viable Product (MVP)—a basic version with enough features to gather user feedback. This “test first, invest later” approach is vital for startups.

- Testing and Validation: The product is tested in real or simulated environments to collect user feedback and measure performance. This iterative process continues until the product meets quality standards.

- Documentation and IP Protection: Throughout the process, meticulous documentation is key for team alignment, IP protection, and substantiating R&D tax credit claims. Protecting your innovations with patents and confidentiality agreements creates a valuable competitive asset.

Key Deliverables and Outcomes

Investing in comprehensive R&D services yields concrete outcomes that strengthen your market position. Key deliverables include:

- New products and services to open new revenue streams.

- Improved processes that cut costs, boost efficiency, and improve quality.

- Custom formulations and part development for optimized performance.

- Production process design for scaling innovative manufacturing methods.

- Patents and trademarks that create a competitive moat and increase company valuation.

- Market insights and strategic roadmaps to guide future business decisions.

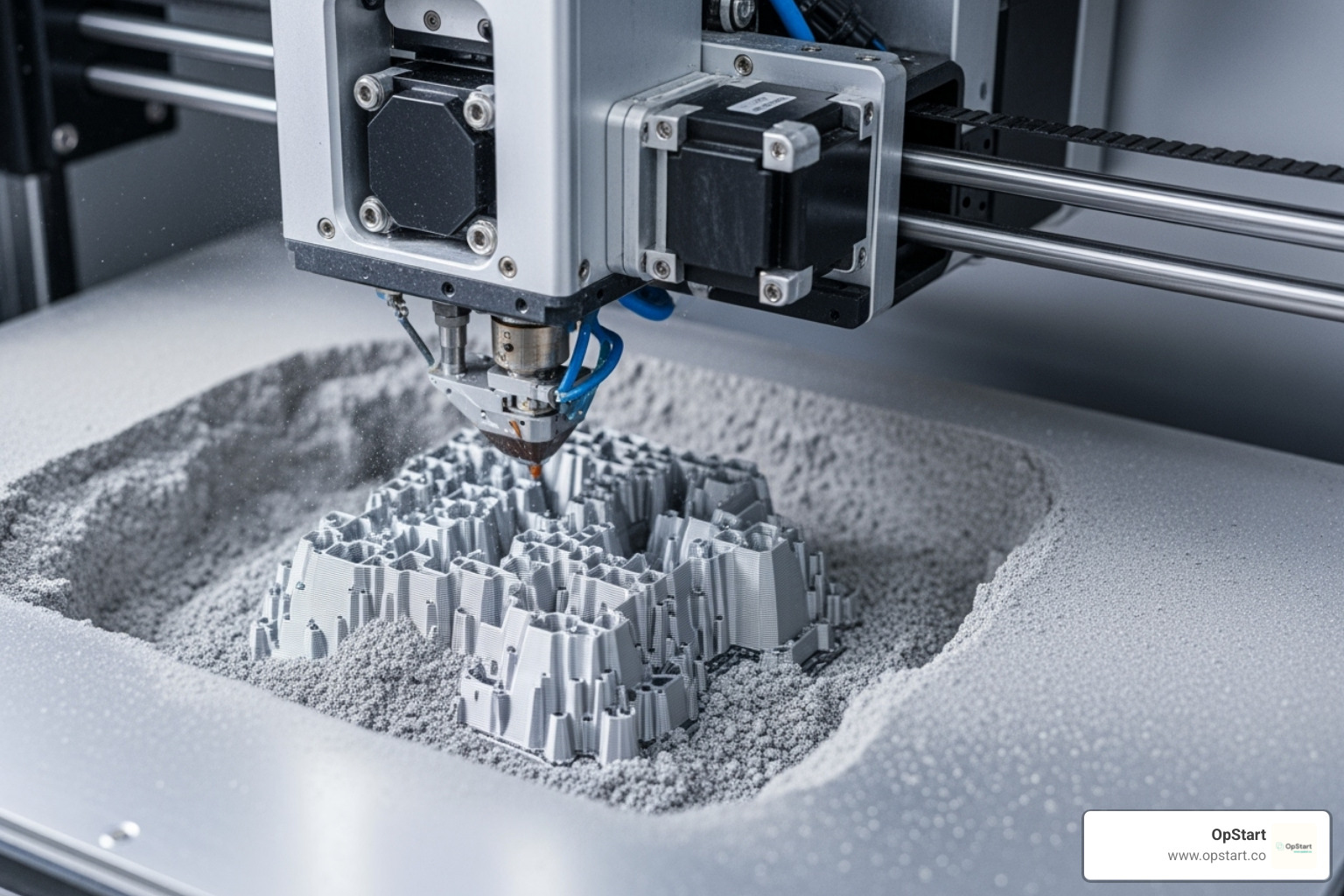

R&D in Action: Innovations in Advanced Manufacturing

Advanced manufacturing technologies like binder jet 3D printing are reshaping production in aerospace, automotive, medical, and energy sectors. This technology works with nearly any powder material, opening possibilities traditional manufacturing cannot match. For startups, comprehensive R&D services open up these technologies without the need for years of in-house development and millions in investment.

Material Development for Binder Jetting

The flexibility of binder jetting lies in its materials. R&D services help find the perfect “recipe” for your needs.

- Metal and sand powders are optimized for mechanical properties and casting applications.

- Ceramics are used for high-temperature environments where metals fail.

- Composite materials allow for unique combinations, like infiltrating aluminum with boron carbide (B4C) for specific performance characteristics.

R&D services also handle custom material qualification to meet industry standards and enable features like porosity control, which is critical for filters or biomedical implants.

Part Development and Production

Great materials need great design. R&D in additive manufacturing enables:

- Part consolidation: Redesigning an assembly of multiple components into a single 3D-printed part. This reduces manufacturing steps, waste, and weak points.

- Complex geometries: Creating intricate internal structures and lightweight designs that are impossible with traditional methods.

- Qualifying existing designs: Transitioning legacy parts to binder jet production by validating that they meet or exceed performance and cost targets.

- Production cell design: Optimizing workflows and equipment layouts for manufacturing at scale, with some providers offering turnkey services for a complete production setup.

Project timelines vary by complexity. Formulation projects may take 8-12 weeks, while part development often requires 8 weeks or more. Complex hardware can take considerably longer. Comprehensive R&D services guide you through these intricacies, letting you focus on your business while experts handle the technical work.

Strategic Benefits of Outsourcing R&D

For startups, building an in-house R&D department is a massive undertaking. Partnering with external comprehensive R&D services is a strategic alternative that provides an expert innovation team without the overhead of salaries, equipment, and facility costs. Key benefits include:

- Access to specialized expertise: Instantly tap into a deep pool of scientists and engineers with knowledge that would take years to build in-house.

- Cost-effectiveness: Avoid significant upfront capital investment and pay only for the services you need, preserving crucial runway.

- Reduced time-to-market: Leverage established processes and infrastructure to accelerate development and launch products faster.

- Risk mitigation: Identify potential pitfalls early through expert feasibility studies and testing, reducing expensive surprises.

- Scalability: Easily ramp R&D efforts up or down to match your business needs and funding cycles without being tied to fixed costs.

- Focus on core competencies: Allow your internal team to concentrate on sales, marketing, and operations while experts handle the R&D.

Gaining a Sustainable Competitive Advantage

Outsourcing R&D is a direct path to building a competitive advantage. By leveraging external experts for rigorous testing, you achieve improved product quality that builds brand loyalty. It allows your team to focus on what they do best, improving operational excellence across the organization. This partnership also fosters a culture of innovation by bringing fresh perspectives into your company, positioning you for long-term growth by adapting faster to market changes and leading with groundbreaking solutions.

Cost-Effectiveness and Financial Flexibility

For startups, cash flow is everything. Outsourcing R&D offers a financially savvy approach to innovation. You avoid the significant upfront capital costs of building a lab and hiring a full-time team. The scalable, pay-as-you-go model provides incredible versatility, allowing you to align R&D spending with your current business phase. This frees up capital for sales, marketing, or extending your runway. Our Fractional CFO services can help ensure every R&D dollar is strategically allocated for maximum impact and tax benefit.

Fueling Growth: The Financial Strategy Behind Comprehensive R&D Services

R&D is one of the most strategic financial decisions a founder can make. When funded smartly, it transforms from a cash drain into a growth engine.

Understanding R&D Investment and ROI

R&D is a long-term investment in market leadership. Industries like pharmaceuticals, semiconductors, and software lead in R&D spending because they know innovation is survival. It secures patents, builds a competitive moat, and defines the future of the market. For startups, the key is making every dollar count through rock-solid financial tracking. Our startup accounting services provide the visibility needed to make smart R&D investments and prepare for tax benefits.

Maximizing Your Return with R&D Tax Credits

The federal government wants to subsidize your R&D. The IRS R&D tax credit is one of the most valuable incentives for startups, delivering 6-8% of qualifying expenses back as a dollar-for-dollar tax reduction.

For early-stage companies, the PATH Act of 2016 is a game-changer. If your startup has less than $5 million in gross receipts and is under five years old, you can offset up to $500,000 in payroll taxes annually. This means even unprofitable startups can get cash back on Social Security taxes, significantly extending their runway.

Qualifying expenses include wages for research staff, supplies used in development, and certain contract research costs. The financial impact is too big to ignore, which is why our R&D Tax Edge service helps startups identify and claim every qualifying dollar.

Here’s how the two main credit options compare:

| Feature | Regular R&D Credit (against income taxes) | PATH Act R&D Credit (against payroll taxes) |

|---|---|---|

| Eligibility | Any business with qualifying R&D activities | Startups with < $5M annual revenue & < 5 years of sales |

| Benefit Type | Reduces income tax liability | Reduces Social Security payroll tax liability |

| Max Annual Credit | Unlimited (5-15% of qualifying costs) | Up to $500,000 |

| Profitability Required | Yes, to use against income taxes | No, can benefit unprofitable startups |

| Claim Method | Filed on income tax return (Form 6765) | Filed on income tax return (Form 6765) and payroll tax return (Form 8974, 941) |

| Retroactive Claims | Yes, up to 3 years via amended returns | No, cannot be claimed on an amended return |

Navigating the Four-Part Test for Comprehensive R&D Services

To qualify for the credit, your activities must pass the IRS’s Four-Part Test.

- Qualified Purpose: The goal must be to create a new or improved product or process.

- Technical Uncertainty: You must be trying to eliminate uncertainty about the capability, method, or design.

- Process of Experimentation: You must use a systematic process of testing and evaluation (e.g., modeling, simulation, trial and error).

- Technological in Nature: The work must rely on principles of engineering, computer science, or physical/biological sciences.

Proper documentation is essential to substantiate your claim, which is filed using IRS Form 6765. This is complex territory where mistakes can lead to audits. Our startup tax firm specializes in this process, ensuring your claims are bulletproof and maximized.

Frequently Asked Questions about R&D Services

Here are answers to common questions founders have about using comprehensive R&D services.

What industries benefit most from R&D services?

Any business that relies on innovation can benefit, but R&D is especially critical in fast-moving industries like:

- Aerospace and defense: Developing lighter, stronger materials and advanced electronics.

- Automotive: Innovating in electric vehicles, autonomous driving, and safety features.

- Medical and pharmaceutical: Creating new drugs, life-saving devices, and diagnostic tools.

- Energy: Researching renewable energy, battery technology, and efficient industrial processes.

- Software and technology: Building new algorithms, AI applications, and cybersecurity solutions.

- Manufacturing and consumer goods: Optimizing production lines, developing new materials, and creating innovative products from nutraceuticals to personal care.

If innovation is key to your survival, R&D services can provide a competitive edge.

What is the typical timeline for an R&D project?

Timelines vary based on complexity:

- Simple formulation projects (e.g., personal care, nutraceuticals) typically take 8-12 weeks.

- Binder jet 3D printing projects for material or part development usually require 8 weeks or more.

- Complex hardware or software development (e.g., a new medical device or AI platform) can take months or even years.

An initial consultation will provide a detailed timeline custom to your specific project and objectives.

How are R&D costs accounted for?

Generally, R&D costs are expensed on your income statement in the period they are incurred, which reduces your taxable income for that year. In some specific cases, such as for certain software development, costs may be capitalized as an asset and amortized over time.

Regardless of the method, proper documentation is absolutely critical. Meticulous records are necessary for accurate financial reporting and, most importantly, for substantiating your claims for R&D tax credits. These credits can provide up to $500,000 back in payroll tax offsets for qualifying startups.

Navigating these accounting complexities is what we do at OpStart. Our startup accounting services ensure your R&D spending is correctly categorized and documented, so you can maximize tax benefits and keep your financials investor-ready.

Conclusion

Innovation is no longer optional; it’s essential for survival and growth. Comprehensive R&D services provide the tools to transform bold ideas into market-winning products, turning your vision into reality. For startups, pairing expert R&D support with strategic financial planning is a powerful combination. It accelerates your time-to-market, mitigates risk, and controls costs, all while you focus on your core business.

A key advantage many founders overlook is that R&D tax credits can create a cash flow advantage. Qualifying startups can receive up to $500,000 annually in payroll tax offsets—capital you can reinvest in growth.

At OpStart, we handle the financial complexity of R&D—from accounting and documentation to tax strategy—so you can focus on building something remarkable. You started your company to innovate, not to wrestle with financial statements.

Your next breakthrough deserves a solid financial foundation. Find out if you qualify for R&D tax credits and learn how we can help you accelerate development while keeping your finances running smoothly.