Why R and D Tax Services Are Essential for Growing Companies

R and d tax services help businesses claim federal and state tax incentives for innovation, potentially saving up to $500,000 annually. These services handle the entire process, from assessing qualification and calculating credits to preparing documentation, filing support, and providing audit protection.

The R&D tax credit is a significant domestic tax incentive, yet many companies don’t realize their everyday innovation work—like developing software or improving processes—qualifies for substantial tax savings.

The challenge lies in navigating complex IRS rules and maintaining meticulous documentation. Mistakes can lead to audits or missed savings, while success frees up capital for reinvestment. As Maurina Venturelli, head of Go-to-Market at OpStart, I’ve seen how these services transform startup finances. At OpStart, we help fast-growing companies capitalize on these opportunities as part of our comprehensive finance-as-a-service.

Understanding R&D Tax Incentives: A Powerful Tool for Innovators

The government’s goal with R&D tax incentives is to encourage U.S. businesses to invest in research and development, driving economic growth and global competitiveness. Made permanent by the PATH Act of 2015, the R&D tax credit rewards companies for increasing their research efforts, freeing up capital to reinvest in teams, products, and growth. That’s why we believe r and d tax services are essential—they help you access funding that’s already yours. For more guidance, check out our insights on Taxes for Startups.

Who is Eligible for R&D Tax Credits?

A common misconception is that R&D tax credits are only for large tech or biotech firms. In reality, eligibility is broad. Corporations, individuals, trusts, and partnerships can all claim these incentives. Startups and small businesses are especially good candidates, as their experimental development work often qualifies without needing a formal R&D department.

Qualifying industries include technology, manufacturing, biotech, engineering, architecture, and even e-commerce. If your business improves products or processes through experimentation, you could be eligible. Many companies are surprised their “everyday innovation” meets IRS criteria. To learn more, explore OpStart’s insights on eligibility.

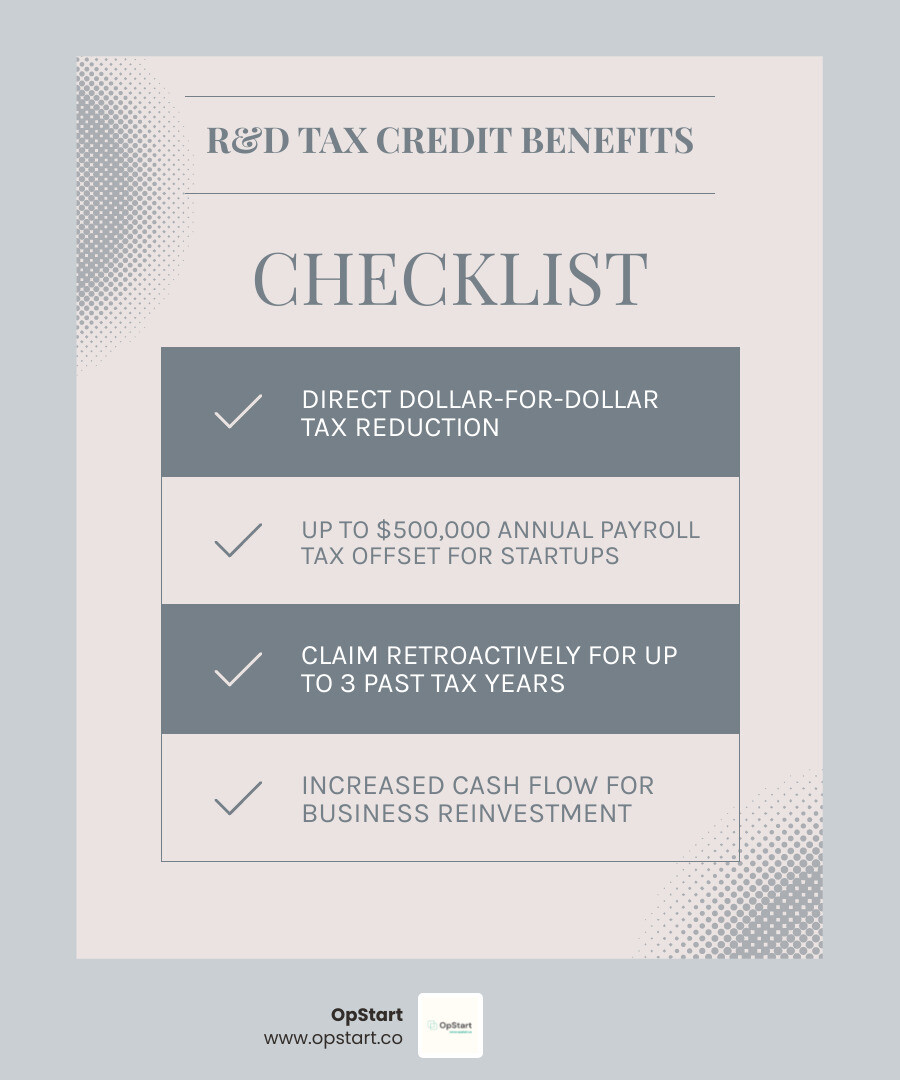

R&D Tax Credits vs. R&D Tax Deductions

Understanding the difference is crucial: credits are more valuable. A tax deduction reduces your taxable income, with savings dependent on your tax bracket. A tax credit is a dollar-for-dollar reduction of your tax liability. A $10,000 credit saves you $10,000.

| Aspect | R&D Tax Credit | R&D Tax Deduction |

|---|---|---|

| Value | Dollar-for-dollar reduction of tax liability | Reduces taxable income |

| Impact | Direct reduction of taxes owed | Lower tax bill (value depends on tax bracket) |

| Application | Can offset income tax; for startups, also payroll tax | Reduces income subject to tax |

Under I.R.C. §280C, you cannot claim both a credit and a deduction for the same expense, preventing “double-dipping.”

The Significant Benefits for Startups and Small Businesses

For startups, the R&D tax credit is a growth catalyst. The most powerful benefit is the payroll tax offset. Qualified startups—those with less than $5 million in gross receipts and no gross receipts for more than five years—can offset up to $500,000 in payroll taxes annually.

This is a game-changer for pre-profit companies, providing an immediate cash injection. This increased cash flow can be reinvested to hire talent, develop products, or extend your runway. It’s a strategic financial tool that directly fuels your ability to innovate. For comprehensive guidance, explore our Startup Accounting Support and learn about changes to the R&D Tax Credit.

The Anatomy of a Qualifying R&D Claim

You might be innovating daily, but does your work qualify for the R&D tax credit? The IRS has specific criteria, and understanding them is key to claiming potentially hundreds of thousands of dollars. Many companies are surprised to learn their everyday problem-solving qualifies.

The IRS evaluates your business components—products, processes, software, etc. The “shrink back rule” allows you to qualify specific features or components even if the entire project does not. For example, a novel algorithm within a larger app could qualify on its own.

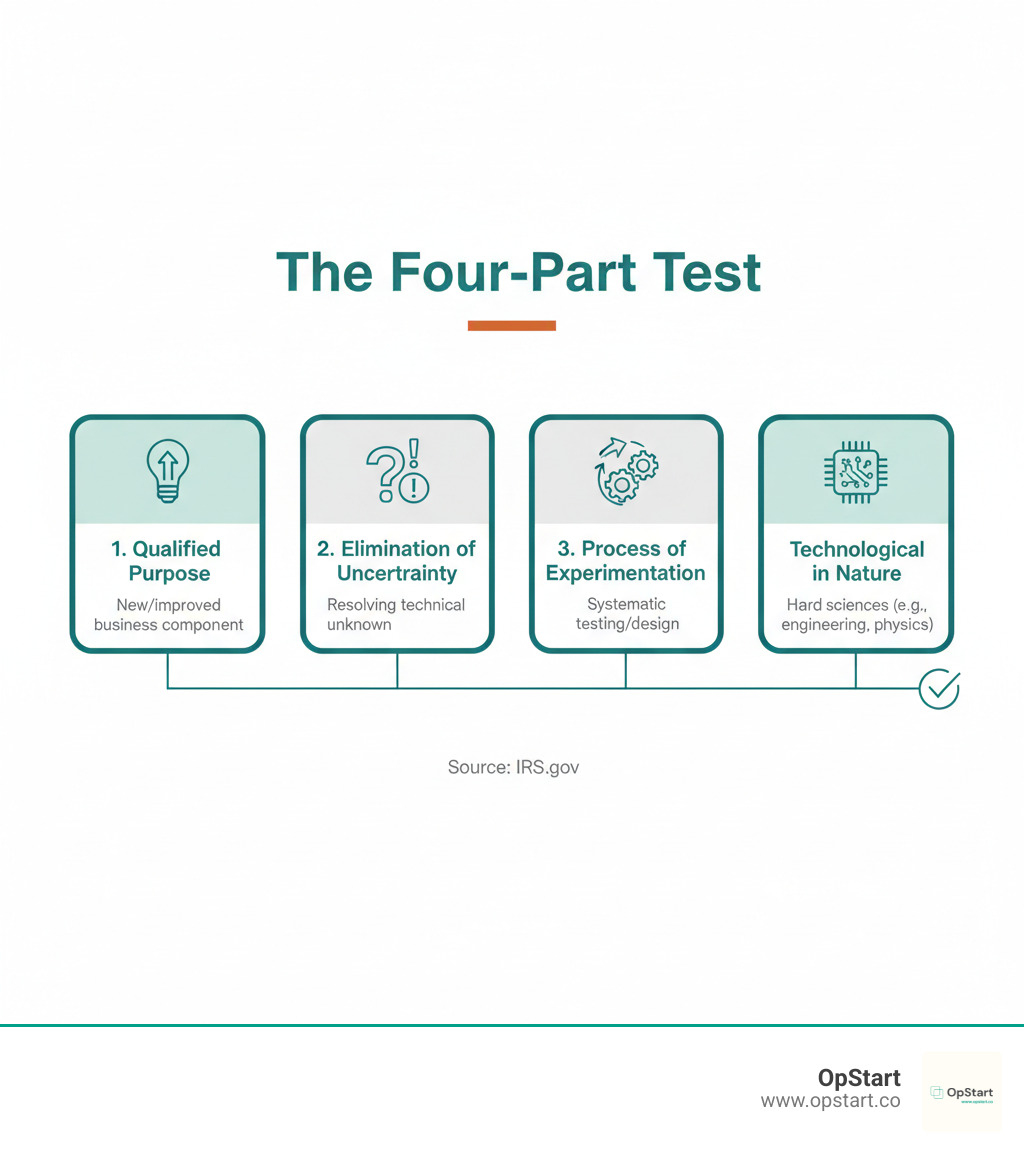

The IRS ‘Four-Part Test’: Your Gateway to Qualification

To claim R&D credits, your activities must pass all four parts of the IRS test. Professional r and d tax services apply this test to each business component to maximize your claim.

- Qualified Purpose: The work must aim to create a new or improved business component, enhancing its function, performance, or quality.

- Elimination of Uncertainty: The project must address technical uncertainty at the outset regarding the capability, method, or appropriate design.

- Process of Experimentation: You must use a systematic process, such as modeling, simulation, or prototyping, to evaluate alternatives and resolve the uncertainty.

- Technological in Nature: The work must rely on principles of hard sciences like engineering, computer science, or biological sciences.

All four criteria must be met. Most innovative companies already perform qualifying work without realizing it. Staying informed on rule changes is also crucial, as we discuss in Changes to the R&D Tax Credit: What Founders & CEOs Need to Know.

What Expenditures Can You Claim?

Once activities qualify, you must identify Qualified Research Expenses (QREs). These include:

- In-house research expenses: This is primarily employee wages for those directly conducting, supervising, or supporting qualified research. Under the 80% rule, if an employee spends at least 80% of their time on qualified activities, 100% of their wages can be claimed. This is a powerful but often overlooked provision.

- Supplies: This includes tangible items consumed during the R&D process, like raw materials and prototyping components.

- Computer costs: Rental or leasing costs for computers used in qualified research, such as cloud computing resources, may be eligible.

- Contract research expenses: Generally, 65% of payments to third parties who conduct qualified research on your behalf can be claimed.

Tracking these expenses is challenging, which is where professional r and d tax services prove invaluable. We help identify and categorize every eligible dollar. Proper documentation is essential for substantiation, as detailed in our guide on OpStart explains qualified research expenses.

Navigating the Claim Process with Expert R and D Tax Services

Claiming R&D tax incentives is a detailed process requiring deep knowledge of IRS regulations. The complexity, audit risk, and potential for missed savings make professional r and d tax services essential.

The Value of Professional R and D Tax Services

An expert partner does more than fill out forms. We dig into your operations, interview technical staff, and uncover qualifying activities you might miss. Our role is to maximize your claim by capturing all eligible expenses, like applying the 80% wage rule correctly.

Crucially, we minimize disruption by handling the detailed analysis and paperwork, letting your team focus on innovation. We also provide audit protection by preparing robust, audit-ready documentation from the start and representing you if the IRS has questions. Learn more about financial roles in our guide: Fractional CFO vs. Bookkeeper vs. CPA: What’s the Difference?

The Critical Importance of Documentation

Proper documentation is the foundation of a successful R&D claim. Without it, even legitimate activities can be disallowed. The IRS pays close attention to these credits, and poor records can trigger audits and penalties.

Strong documentation includes contemporaneous records like project plans, design iterations, and testing logs. You also need clear project tracking, detailed payroll records, and financial records for supplies and contractors. This is why our r and d tax services include meticulous documentation preparation, creating an audit-ready file that tells the story of your innovation. This attention to detail is also key for Business Startup Tax Deductions.

How to Claim Your Credits

The process centers on specific tax forms. For your federal claim, you’ll file Form 6765, Credit for Increasing Research Activities, with your income tax return. You can also amend returns for up to three past years to claim missed credits, potentially recovering significant funds.

Many of the 35+ states with R&D credits offer additional savings. For qualified startups offsetting payroll taxes, you’ll also file Form 8974 and coordinate with your payroll provider to apply the credit quarterly. We manage this entire process to meet all deadlines. For a full overview, see our Startup Tax Filing guide.

Maximizing Your Claim and Ensuring Long-Term Success

Claiming R&D tax credits isn’t a one-time event; it’s a year-over-year strategic opportunity. By building the credit into your financial planning, you create a virtuous cycle where today’s savings fund tomorrow’s innovations. Companies that succeed with r and d tax services treat it as a core part of their growth engine.

How Government Grants and Other Funding Affect Your Claim

If you’ve received government grants for research, you must account for them in your R&D tax credit claim. The government won’t pay twice for the same work. Any expenses covered by a grant cannot be included in your credit calculation. For example, a $50,000 grant for a $200,000 project reduces your claimable expenses to $150,000. This “no double-dipping” rule applies to various funding sources, like Canada’s NRC IRAP program. Professional r and d tax services ensure these interactions are reported correctly.

Choosing the Right Partner for Your R and D Tax Services

Not all providers are equal. Key factors to consider include:

- Fee Structures: Some firms charge contingent fees (20-30% of your credit). At OpStart, we use transparent, capped pricing so you keep more of your savings.

- Audit Support: Will your provider defend your claim if audited? We prepare every claim to be audit-ready and provide full representation if needed.

- Industry Expertise: A partner who understands your industry can identify more qualifying activities.

- Hands-Off Approach: The right partner handles the heavy lifting, letting your team focus on innovation.

- Integrated Services: For startups, coordinating R&D tax services with accounting and CFO support creates a seamless financial strategy. Our CFO Services for Startups ensure R&D credits are part of your broader financial plan.

Choosing the right partner is about building a long-term relationship that leverages R&D incentives for continuous growth.

Frequently Asked Questions about R&D Tax Credits

Here are answers to the most common questions we hear from founders about R&D tax credits.

Can I claim the R&D credit if my company isn’t profitable yet?

Yes. This is a major benefit for startups. Qualified businesses (less than $5 million in gross receipts and under five years old) can offset up to $500,000 in payroll taxes annually. This provides a direct cash-flow advantage even if you have no income tax liability. If you don’t qualify for the payroll offset, you can still claim the credit and carry it forward to offset future income taxes once you become profitable.

How far back can I claim R&D tax credits?

You can generally amend federal tax returns to claim the credit for the past three open tax years. This allows you to capture significant savings you may have missed, often resulting in a substantial lump-sum refund. This retroactive claim can provide a sudden infusion of capital to reinvest in your business. While the payroll tax offset is typically for current liabilities, the regular credit can be claimed retroactively against past income taxes.

What happens if my R&D claim is audited by the IRS?

An audit is simply a review by the IRS to verify your claim’s documentation. It’s a manageable process with proper preparation. A reputable r and d tax services provider prepares audit-ready documentation from the start, including technical reports and expense substantiation. If a review occurs, your provider should represent you and defend the claim. Statistics show that well-prepared claims are rarely audited, and when they are, the vast majority of the credit is recovered. An audit isn’t scary when you have expert support.

Conclusion

The R&D tax credit is a vital incentive for innovative companies of all sizes, not just large corporations. It offers a dollar-for-dollar tax reduction, a payroll tax offset of up to $500,000 for qualifying startups, and the ability to claim credits retroactively. These benefits provide capital that can be reinvested to hire talent, extend your runway, and accelerate growth.

However, navigating the IRS’s four-part test and complex documentation requirements is challenging. The risk of a failed claim or a stressful audit is real. This is why professional r and d tax services are a strategic investment. A good partner uncovers qualifying activities, prepares audit-ready documentation, and maximizes your claim without disrupting your team.

At OpStart, our flat-rate, hands-off model integrates r and d tax services into our comprehensive financial operations support. We handle the complexity so you can capture every dollar you’re entitled to and stay focused on your mission.

Don’t leave money on the table. Find out how your innovation can translate into immediate cash flow. Do You Qualify for R&D Tax Credits?