Why Business Credit Cards Are Essential for Growing Companies

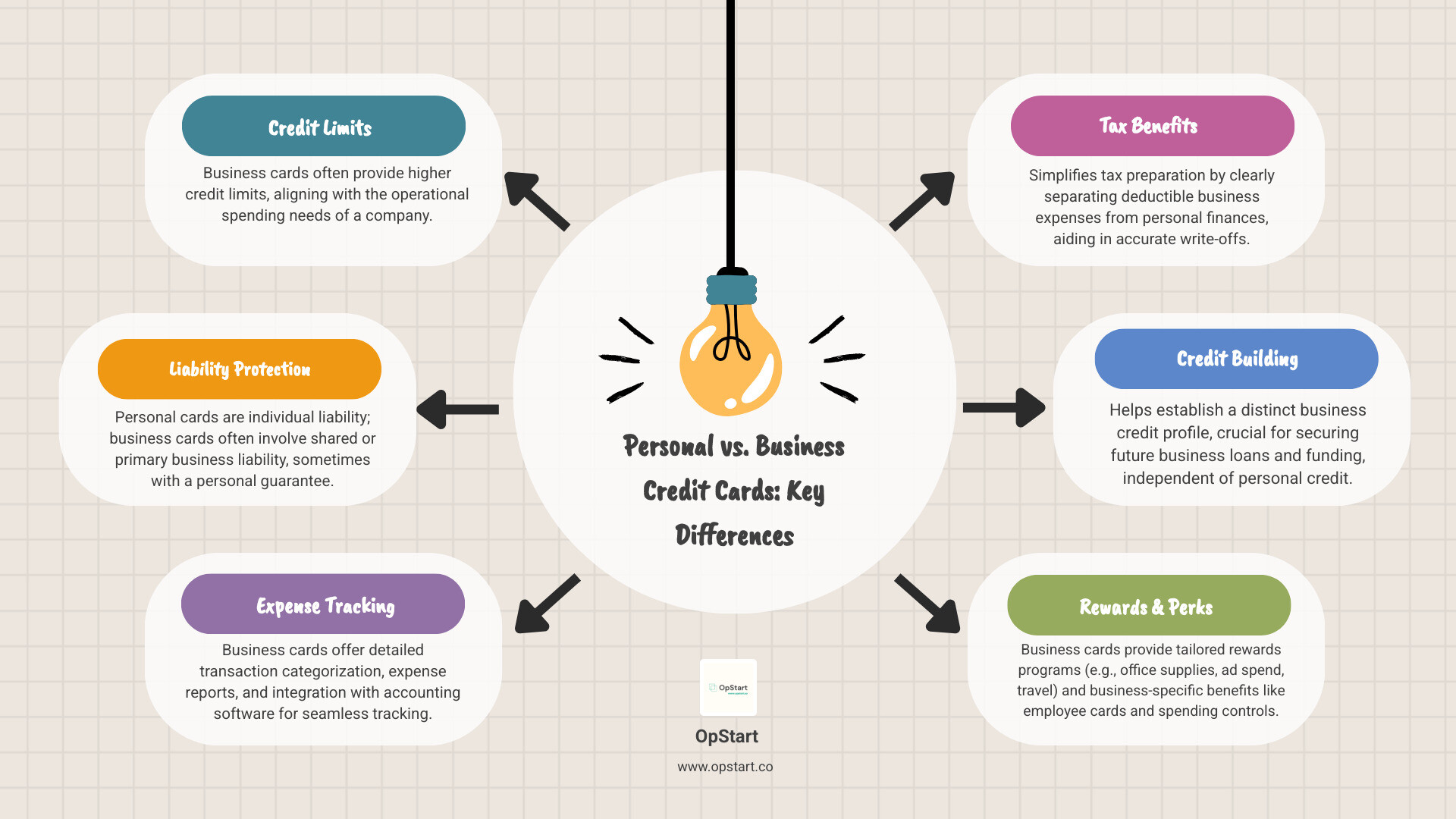

The best business credit cards can transform how your startup manages expenses, builds credit, and scales operations. They offer key benefits like separating business and personal finances, building business credit history, earning rewards, improving cash flow, and simplifying tax preparation.

Choosing the right card means finding a financial tool that grows with you. While many founders start with personal cards, this creates bookkeeping nightmares and misses out on higher credit limits and business-specific rewards. The right card, whether it’s for cash back, travel rewards, or 0% intro APR, can save you money and streamline operations.

I’m Maurina Venturelli, and through my work scaling companies at OpStart and beyond, I’ve seen how the right financial tools are critical. The best business credit cards can accelerate growth, while the wrong ones create unnecessary friction.

Why Your Business Needs a Dedicated Credit Card

Mixing personal and business expenses is a recipe for financial chaos. A dedicated business credit card is essential for any company that wants to grow.

Separating expenses is the most obvious benefit, protecting you legally and making tax season manageable. More importantly, building business credit creates a financial profile for your company that’s separate from your personal score. This helps you qualify for loans and better terms in the future. A business card also helps with cash flow management, bridging the gap between paying expenses and receiving client payments. Finally, features like employee cards with spending controls and improved reporting give you oversight and valuable insights without micromanagement. Our Bookkeeping for Startups guide covers the importance of proper expense separation.

Streamline Expense Management and Tracking

The best business credit cards have revolutionized expense management. Features like automated categorization sort purchases for you, while receipt capture technology lets you link a photo of a receipt directly to a transaction. The real magic is integration with accounting software like QuickBooks or Xero, which eliminates manual data entry. This seamless integration is a core part of our Startup Accounting Services: What Founders Need to Know approach. You can also set spending limits on employee cards and get real-time alerts, providing control without being controlling.

Build a Strong Business Credit History

Using a business credit card responsibly establishes a credit profile for your business, creating a financial reputation that opens doors. This separation from personal credit is crucial; if your business hits a rough patch, your personal score is protected (assuming no personal guarantee). This is vital for improving loan eligibility, as lenders will assess your company’s credit history. Business credit bureaus like Dun & Bradstreet track your payment history, so consistent, on-time payments build a strong profile over time. The connection between your business structure and credit is important, a topic we cover in our guide on Choosing Your Business Structure: C-Corp vs. LLC.

How to Choose the Right Business Credit Card

Finding the best business credit cards is about matching a card’s features to your company’s needs. Start by checking eligibility requirements, as some cards are aimed at established businesses while others welcome startups. Your personal credit score is usually a factor, even for business applications.

Consider the costs, such as annual fees and interest rates (APR). Paying an annual fee can be worthwhile if the rewards offset the cost. The APR matters most if you carry a balance—if you pay in full every month, it’s less of a concern. Also evaluate welcome offers, and confirm the rewards program aligns with where you spend the most. Finally, understand whether the card carries personal liability or offers strictly business liability. These strategic trade-offs are the kind of decisions we cover in Fractional CFO vs. Bookkeeper vs. CPA: What’s the Difference?.

Understanding Fees and Interest Rates

A clear picture of the card’s costs is critical. Annual fees range from $0 to several hundred dollars—worth it only if the perks exceed the price. Watch for foreign transaction fees if you have international vendors, and avoid late payment fees by setting up autopay. Many cards advertise a 0% introductory APR for a set period, which can be a smart way to finance large purchases, but be sure you understand the regular variable APR that kicks in later. Always review the issuer’s full rate and fee schedule before applying.

Evaluating Welcome Offers and Rewards

Rewards make everyday spending work harder for you. Sign-up bonuses can be lucrative, but only if your normal expenses will meet the spending thresholds. Decide whether you prefer simple cash back or more strategic points and miles programs. The value of points varies by program, so read the redemption rules carefully—terms and conditions for each rewards program apply. To maximize returns, choose a card with tiered rewards categories that match your heaviest spending areas.

Comparing the Best Business Credit Cards by Category

When selecting the best business credit cards, there’s no one-size-fits-all solution. The ideal card depends on your spending habits, business size, and industry needs. We’ve broken down the top contenders by category to help you choose.

| Feature Category | Cash Back Cards | Travel & Rewards Cards | Low/0% Intro APR Cards | Startup/Sole Prop Cards |

|---|---|---|---|---|

| Primary Benefit | Direct savings on purchases | Free/discounted travel, premium perks | Interest-free financing, cash flow | Flexible limits, no personal guarantee |

| Typical Annual Fee | $0 – $99 | $99 – $695+ | $0 – $99 | $0 – $300+ |

| Rewards Rate | 1.5% – 5% on categories | 1x – 10x points/miles | Low/no rewards | 1% – 2.5% flat cash back |

| Welcome Offer | $350 – $1,000 cash back | 60,000 – 200,000 points/miles | 0% APR for 9-18 months | $250 – $1,000 statement credit or points |

| Best For | Everyday spending, cost savings | Frequent travelers, large spenders | Large purchases, debt consolidation | New businesses, rapid growth |

For more custom advice, our Resources section offers additional guidance.

Best Business Credit Cards for Cash Back

Cash-back cards are straightforward workhorses, turning purchases into direct savings. Some cards provide a flat rate—such as 1.5% back on all spending—while others offer higher, tiered rates (2-5%) on popular business categories like office supplies or internet services. A few leading options even offer 5% on select categories up to a yearly cap, with no annual fee.

Best Business Credit Cards for Travel and Rewards

If your team logs significant miles, travel-focused cards convert spending into airline miles, hotel points, and premium perks. Typical features include bonus earnings on travel, complimentary airport lounge access, and no foreign transaction fees. Generous welcome offers—sometimes 100,000 points or more—can cover multiple flights or hotel nights when redeemed strategically.

Cards with Low or 0% Intro APR

Businesses making large upfront investments may benefit from a 0% introductory APR period, often lasting 9-18 months. This can function as an interest-free loan for equipment or inventory, provided you pay the balance in full before the promotional rate expires. Some issuers also include 0% balance transfer offers, which can consolidate higher-interest debt under a single, interest-free umbrella.

Top Cards for Startups and Sole Proprietors

Startups and sole proprietors have unique needs. Several modern issuers now base credit limits on a company’s cash balance or revenue rather than the founder’s personal credit score, often removing the personal guarantee entirely. These cards frequently come with built-in expense management software, automated receipt capture, and scalable limits that rise alongside your growth. For sole proprietors, many traditional business cards approve applicants using personal credit, offering features like flat-rate cash back with no annual fee.

Frequently Asked Questions about Business Credit Cards

As founders explore their options, we hear the same questions come up again and again. Here are the straight answers you need to make smart decisions about the best business credit cards.

What are the typical eligibility requirements for a business credit card?

Requirements vary, but issuers typically look at a few key factors. Your personal credit score is often the starting point, with most lenders preferring a score of 690 or higher, especially for new businesses. They will also consider your business revenue and time in business. Your business structure (e.g., LLC, C-Corp, or sole proprietorship) matters as well. Corporations and LLCs will need an Employer Identification Number (EIN), which you can learn about from the More on EINs from the IRS page. Sole proprietors can often apply with their Social Security Number. Newer, startup-focused cards may weigh factors like your company’s bank balance more heavily than traditional credit metrics.

Will a business credit card affect my personal credit score?

Yes, in most cases, a business credit card can affect your personal credit. When you apply, the issuer will perform a hard inquiry on your personal credit report, which can cause a small, temporary dip in your score. More importantly, most small business cards require a personal guarantee, meaning you are personally liable for the debt if the business cannot pay. This default would be reported on your personal credit history. While some issuers only report negative activity to personal credit bureaus, others report all activity. The goal is to build a separate business credit history to protect your personal score, a lesson we emphasize in Five Lessons from Five Years of Managing Startup Finances.

Can I get a business credit card as a sole proprietor or with a new business?

Absolutely. It’s a common misconception that you need to be an established corporation to qualify. Sole proprietors are welcome to apply for most business credit cards, typically using their Social Security Number and personal credit history for the application. For new businesses, a strong personal credit history is key to getting approved, as issuers are betting on you as an individual before your business has a track record. If you’re just starting out, secured business credit cards are another option. These require a security deposit and are an excellent way to build business credit from the ground up.

Conclusion

Choosing the best business credit cards is about finding a financial partner that simplifies your operations and grows with you. The right card helps you separate expenses, build a strong business credit history, and make tax season easier.

When you match the right card to your business’s spending patterns, everyday purchases turn into valuable rewards, whether it’s cash back or travel miles. However, financial discipline is the foundation of success. Paying your balance in full and on time is what transforms a credit card from a potential debt trap into a powerful business tool.

Your card strategy can evolve as your business does, from a simple cash back card for a sole proprietor to a sophisticated expense management platform for a funded startup.

At OpStart, we see how financial complexity can overwhelm founders. We handle the complete financial operations for startups—from bookkeeping and tax to CFO-level strategy—so you can focus on building your company. Our flat-rate approach provides expert-managed finances without the headache.

Ready to simplify your financial life? Get your complete startup financial stack managed for you and let us handle the complexities. When tax season rolls around, we’ve got you covered with our comprehensive Taxes for Startups services.