Why Smart Founders Choose Business Credit Cards from Day One

Best business credit cards for new businesses help separate your personal and business finances while building credit and earning rewards. Here are the top picks for 2025:

Top Business Credit Cards for New Businesses:

- Capital One Spark 1% Classic – Best for fair credit (no annual fee, 1% cash back)

- Ink Business Unlimited® – Best for simple cash back (1.5% on everything, $0 annual fee)

- Blue Business® Plus from Amex – Best for 0% intro APR (12 months on purchases)

- Brex Card – Best for no personal guarantee (EIN-only application)

- Bank of America® Secured – Best for building credit (secured card option)

Starting a business is hard enough without mixing your personal credit card bills with business expenses. In 2024, 59% of businesses applied for financing, but only 52% got fully approved for what they needed. The right business credit card gives you breathing room to grow.

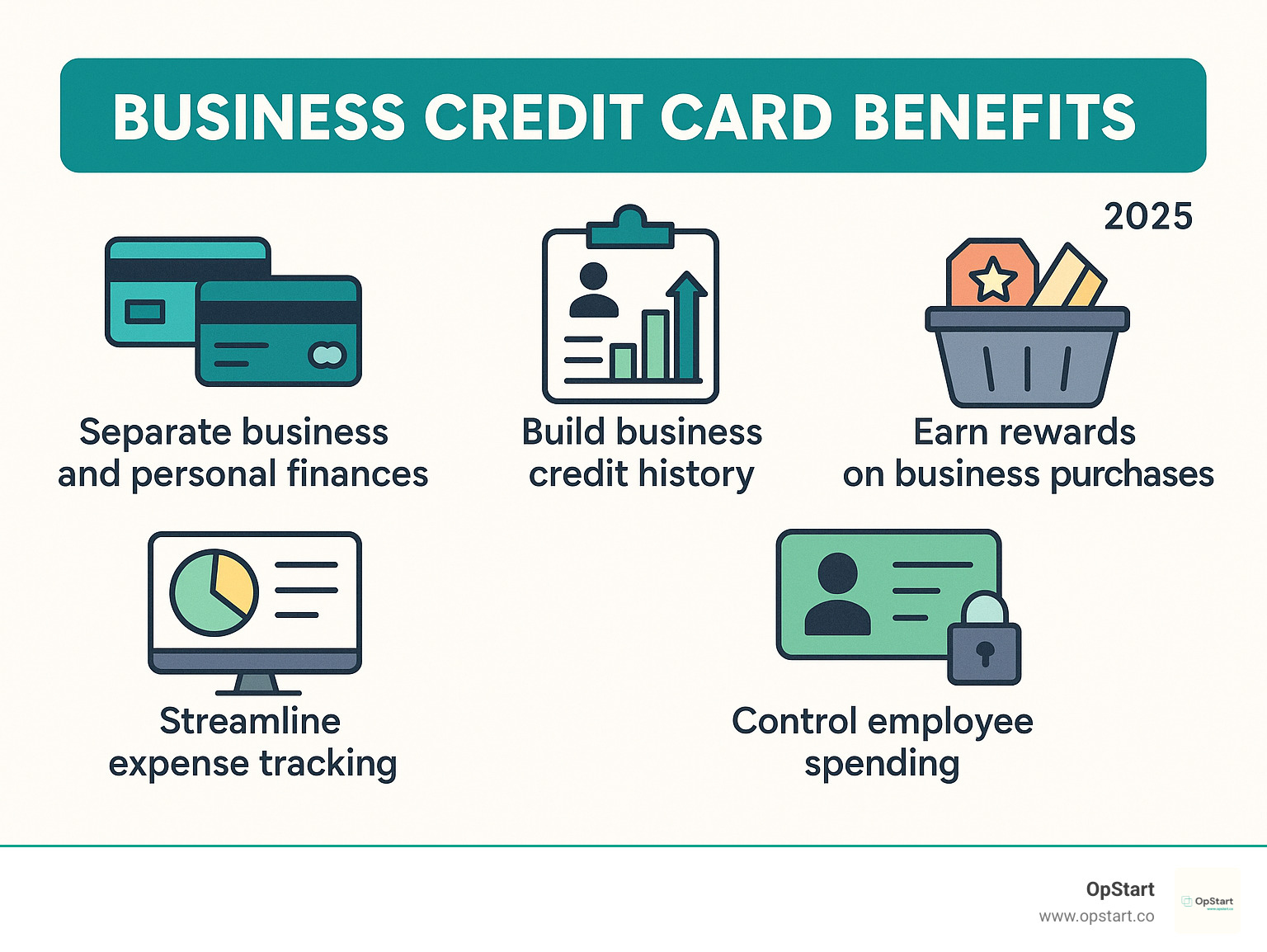

Many founders make the mistake of using personal cards for business spending. This creates a mess at tax time and puts your personal credit at risk. Business credit cards offer higher limits, better expense tracking, and rewards that actually help your bottom line.

I’m Maurina Venturelli, and I’ve helped companies like Sumo Logic and LiveAction steer growth financing and credit decisions that supported their path to market leadership. Through my work at OpStart, I’ve seen how choosing the best business credit cards for new businesses can make or break a startup’s financial foundation.

Why Your New Business Needs a Dedicated Credit Card

Look, I get it. When you’re launching a startup, using your personal credit card for business expenses feels like the path of least resistance. You’ve got a million decisions to make, and adding “get a business credit card” to your to-do list might seem unnecessary.

But here’s the thing – getting one of the best business credit cards for new businesses isn’t just about having another piece of plastic in your wallet. It’s about building a solid financial foundation that’ll serve you well as you grow.

Financial separation is absolutely crucial for your sanity and your business. When you mix personal and business expenses on the same card, you’re creating a bookkeeping nightmare. Picture this: you’re sitting down to do your taxes, staring at a credit card statement that shows charges for office supplies, your kid’s soccer cleats, software subscriptions, and last week’s grocery run. Not fun, right?

A dedicated business card creates a clean line between your personal life and your company. This makes expense tracking infinitely easier and gives you crystal-clear records if the IRS ever comes knocking. Trust me, your future self will thank you.

Building business credit is another game-changer that many new founders overlook. Just like you have a personal credit score, your business can develop its own credit history – completely separate from yours. This is huge for your company’s future.

When you use a business credit card responsibly and make payments on time, you’re actively building your business credit profile. A strong business credit score opens doors to better loan terms, higher credit limits, and more favorable vendor agreements down the road. It’s like planting seeds for your company’s financial future.

Simplified expense tracking becomes a breeze with business credit cards. Instead of digging through mixed statements trying to figure out what was business-related, you have everything neatly organized in one place. Many cards integrate directly with accounting software, which makes our work at OpStart’s bookkeeping services much smoother too.

As your team grows, employee spending controls become invaluable. You can issue company cards to team members with preset spending limits and category restrictions. This gives your employees the flexibility to make necessary purchases while keeping you in control of the budget.

Higher credit limits are another practical advantage. Business cards typically offer more generous credit limits than personal cards, giving you breathing room for larger purchases or unexpected expenses without maxing out your personal credit.

There’s also something to be said for the professional image factor. When you hand over a business card to pay vendors or suppliers, it signals that you’re serious about your company. It’s a small detail that contributes to your overall professional presence.

The bottom line? A dedicated business credit card isn’t just a nice-to-have – it’s a smart business move that pays dividends in organization, credit building, and peace of mind.

How to Choose: Key Factors for New Business Credit Cards

Choosing the best business credit cards for new businesses doesn’t have to feel overwhelming. Think of it like picking the right team member – you want someone who fits your needs, works within your budget, and helps you grow.

When I work with startup founders, I always tell them to start with the basics. Annual fees are usually the first thing that catches your eye, and for good reason. Some cards charge $95, $150, or even more per year, while others cost nothing. For new businesses watching every dollar, a $0 annual fee card often makes the most sense. But here’s the thing – sometimes paying a fee actually saves you money if the rewards are strong enough.

Next, let’s talk about APR (Annual Percentage Rate). This is what you’ll pay in interest if you carry a balance from month to month. While we always aim to pay off balances in full, startup life can be unpredictable. A lower APR gives you breathing room when cash flow gets tight.

Even better than a low APR? An introductory 0% APR period. Cards like The Blue Business® Plus Credit Card from American Express offer 0% interest on purchases for your first 12 months. This is like getting a free loan to buy equipment, stock inventory, or invest in marketing without paying a penny in interest.

Rewards structures come in two main flavors: cash back and travel points. Cash back is beautifully simple – you earn a percentage back on every purchase. The Ink Business Unlimited® Credit Card gives you 1.5% cash back on everything, which directly reduces your expenses. Travel points work differently, letting you earn miles or points for flights and hotels. The Brex business credit card even offers up to 7x points on certain expenses.

Don’t overlook welcome bonuses either. Many cards offer substantial bonuses when you spend a certain amount in your first few months. The U.S. Bank Triple Cash Rewards Visa® Business Card gives you $500 cash back after spending $4,500 in the first 150 days – that’s real money back in your pocket.

Here’s where it gets tricky for new businesses: credit score requirements. Most of the best business credit cards for new businesses want to see a personal credit score of 700 or higher. If your credit isn’t there yet, don’t worry – secured cards and credit-building options exist.

Finally, understand that most business cards require a personal guarantee. This means you’re personally responsible if your business can’t pay the bill. It sounds scary, but it’s standard practice. Some newer corporate cards are changing this, but they usually require higher revenue or cash deposits.

Before you apply, take a moment to check your credit score so you know where you stand. This simple step can save you from unnecessary credit inquiries and help you target the right cards for your situation.

The Best Business Credit Cards for New Businesses in 2025

Now for the exciting part: let’s explore our top picks for the best business credit cards for new businesses in 2025. We’ve organized them by what matters most to startups, so you can quickly find the card that fits your specific situation.

Best for Building Credit with No History

Starting fresh with business credit can feel intimidating, but it’s actually an opportunity. When you’re building from the ground up, secured cards and credit-building options become your best friends. These cards are designed specifically for businesses without established credit history.

The Capital One Spark 1% Classic is like training wheels for business credit. It welcomes founders with limited credit history and charges no annual fee, making it accessible when every dollar counts. You’ll earn unlimited 1% cash back on all purchases. While that’s not the highest reward rate available, it’s consistent and reliable. Think of it as your credit-building foundation with a nice little bonus on top.

For those ready to put some skin in the game, the Bank of America® Business Advantage Unlimited Cash Rewards Secured Card offers a smart path forward. You’ll put down a security deposit between $1,000 and $10,000, which typically becomes your credit limit. In return, you earn 1.5% cash back on everything you buy. The beauty of secured cards is simple: your deposit reduces the bank’s risk, which means they’re much more likely to approve you. It’s like having a financial safety net that also builds your credit.

Best for Simple, Flat-Rate Cash Back

When you’re juggling product development, customer acquisition, and probably surviving on too much coffee, complicated reward structures are the last thing you need. These cards keep it beautifully simple: spend money, earn cash back, repeat.

The Ink Business Unlimited® Credit Card is our go-to recommendation for founders who want simplicity without sacrificing rewards. It delivers 1.5% cash back on every single purchase with no annual fee. No categories to track, no spending caps to worry about, no quarterly activations to remember. Every business expense earns you the same reliable return. Plus, new cardholders can earn a $750 welcome bonus after spending $6,000 in the first three months.

The Ramp Visa Corporate Card takes simple rewards and pairs them with powerful tools. You’ll earn 1.5% cashback on all purchases, but Ramp goes further by offering robust expense management software and virtual card capabilities. For growing teams that need both rewards and financial control, Ramp bridges the gap between simple cash back and comprehensive business tools. This integration approach aligns perfectly with what we see working for our clients who need streamlined Startup Accounting Support.

Best for 0% Intro APR on Purchases

Sometimes your business needs to make a big move before the cash flow catches up. Maybe it’s essential equipment, a major software investment, or a marketing push that can’t wait. Cards with introductory 0% APR periods give you breathing room to make these strategic investments without interest charges.

The Blue Business® Plus Credit Card from American Express offers something special: 12 months of 0% APR on purchases. That’s a full year to pay off significant startup expenses without interest. Beyond the intro period, you’ll earn 2X points on all purchases up to $50,000 per calendar year, then 1X points after that. American Express also offers “Expanded Buying Power,” which can adjust your spending ability based on your payment history and usage patterns. For startups with fluctuating needs, this flexibility can be invaluable. You can learn more about the Amex Blue Business Plus.

The U.S. Bank Triple Cash Rewards Visa® Business Card combines an attractive introductory APR period with solid rewards. New cardholders can earn $500 cash back after spending $4,500 in the first 150 days, and there’s no annual fee. This card helps you manage initial cash flow challenges while building a foundation for ongoing rewards.

Best for Startups Without a Personal Guarantee

Here’s where things get interesting. Most traditional business credit cards require you to personally guarantee the debt, putting your personal assets at risk. But a new generation of corporate cards is changing this game, especially for funded startups.

The Brex Card represents a fundamental shift in business credit. Instead of looking at your personal credit score, Brex evaluates your company’s cash balance and financial performance. No personal guarantee required, no personal credit check needed. They offer credit limits that can be 10-20 times higher than traditional cards, determined by your cash reserves and revenue. You’ll earn up to 7x points on common startup expenses like travel and software subscriptions. For venture-backed companies or those with strong cash positions, Brex removes the personal risk while providing substantial credit access. We’ve written extensively about how these newer options compare in our guide on Comparing Credit Cards for Startups.

Corporate cards like Brex are designed for the modern startup ecosystem. They understand that your business financials might be strong even if you’re personally just getting started. This approach aligns credit decisions with your business reality rather than your personal credit history.

Your Application Playbook: Getting Approved and Building Credit

So, you’ve picked out a few contenders for the best business credit cards for new businesses. Now comes the exciting part: getting approved and using your new card to build rock-solid business credit. Think of this as your roadmap to financial credibility.

Here’s the reality check: your personal credit score still matters when applying for business credit cards, especially as a new business owner. Most card issuers will peek at your personal credit history because, let’s face it, you’re the one they’re trusting to pay the bills. The good news? Many of the best business credit cards for new businesses are designed with this in mind.

Most premium business cards want to see a personal credit score of 700 or higher. But don’t panic if you’re not there yet. Cards like the Capital One Spark 1% Classic welcome founders with fair credit (think mid-600s), and secured cards are even more forgiving. Just remember that applying will trigger a hard inquiry on your personal credit report, which might ding your score by a few points temporarily.

You’ll definitely need an EIN (Employer Identification Number) for your application. Think of it as your business’s Social Security Number – the IRS uses it to identify your company. While some newer corporate cards like Brex focus heavily on your EIN and business financials, most traditional cards still want your SSN too. They’re not being nosy; they just want the full picture of who they’re lending to. If you don’t have an EIN yet, check out What is an EIN? from the IRS.

No business revenue yet? No problem. This is where many new founders get nervous, but card issuers understand that startups don’t always have immediate income. You can literally put $0 in the business revenue field if that’s your reality. The key is listing your personal income – this shows you have the capacity to make payments even if your business isn’t profitable yet.

Once you get approved, the real magic happens: building your business credit history. This is where patience pays off big time. Start by making every payment on time – this single habit is worth more than any fancy rewards program. Keep your spending well below your credit limit (aim for under 30% of your available credit). If you have a $10,000 limit, try to stay below $3,000 in balances.

Make sure your card issuer reports to the major business credit bureaus like Dun & Bradstreet, Experian Business, and Equifax Business. This is how your responsible card usage actually builds your business credit score. Without this reporting, you’re missing out on the credit-building benefits entirely.

The beautiful thing about building business credit is that it creates a financial identity separate from your personal credit. Over time, this opens doors to better loan terms, higher credit limits, and more financing options as your startup grows. It’s like planting seeds for your company’s financial future – a little effort now pays dividends later.

Frequently Asked Questions about the Best Business Credit Cards for New Businesses

As someone who’s guided countless startups through their early financial decisions, I hear the same questions over and over again. Let me share the answers to the most common concerns about getting your first business credit card.

Can I get a business credit card with a brand new LLC and no revenue?

Absolutely! This is probably the most common situation we see with new startups. Your shiny new LLC with zero revenue isn’t a deal-breaker at all.

Here’s what actually matters: your personal credit score and personal income. Even though you’re applying for a business card, credit card companies know that new businesses don’t have financial history yet. They’re really looking at you, the founder, to determine if you’re creditworthy.

You can literally put $0 in the business revenue field on your application. Just make sure you list your personal income accurately. The issuer wants to know that someone (you) has the ability to pay the bills if your business can’t.

That you’ll almost certainly need to provide a personal guarantee. This means you’re personally on the hook for any debt your LLC can’t repay. It’s standard practice for new businesses, so don’t let it scare you away.

What’s the difference between a business credit card and a corporate card?

These terms get thrown around a lot, and the lines are definitely blurring with newer fintech options.

Business credit cards are what most small businesses use. Think of cards like the Ink Business Unlimited or Capital One Spark cards. These typically require a personal guarantee from you as the business owner. Your approval and credit limit depend heavily on your personal credit score and income. The card company is essentially betting on you personally, not just your business.

Corporate cards work differently. They’re designed for larger companies or, increasingly, funded startups. Cards like Brex don’t require a personal guarantee at all. Instead, they base approval on your company’s financial health – things like cash reserves, revenue, and overall business performance.

For most new businesses, you’ll start with a traditional business credit card. But if you’re venture-backed or have significant cash reserves, corporate cards can offer higher limits and better terms without putting your personal assets at risk.

How do I build business credit with my new card?

Building business credit is like training for a marathon – it takes time and consistency, but your new card is the perfect training tool.

The most important thing is paying on time, every single time. I can’t stress this enough. Even one late payment can seriously damage your business credit score. Set up automatic payments if you need to.

Keep your credit utilization low – ideally under 30% of your limit. If you have a $10,000 limit, try to keep your balance below $3,000. This shows credit bureaus that you’re not desperately relying on credit to keep your business afloat.

Make sure you’re using your business card for all business expenses. This creates a clear paper trail and builds your business credit history. Don’t mix personal and business purchases – it defeats the purpose.

Here’s something many founders miss: not all credit card companies report to business credit bureaus. Make sure your issuer reports to Dun & Bradstreet, Experian Business, and Equifax Business. This is how your good payment habits actually get recorded and help build your score.

Building strong business credit opens doors to better financing terms down the road. And while you’re building that credit, don’t forget about staying compliant with your taxes for startups – it all works together to create a solid financial foundation.

Conclusion: Set Your Business Up for Financial Success

Picking the best business credit cards for new businesses goes way beyond just having plastic in your wallet. You’re actually building the financial backbone that’ll support your startup’s growth for years to come. Think of it as laying the foundation of a house – get it right now, and everything else becomes so much easier.

The card you choose today becomes your strategic growth tool. Whether you’re earning cash back on every software subscription, using a 0% intro APR to finance that crucial equipment purchase, or building business credit that’ll open up better loan terms down the road, your business credit card is working for you 24/7.

We’ve walked through options for every situation – from secured cards that help you build credit from nothing to corporate cards that don’t require a personal guarantee. The magic happens when you match your card to your actual needs, not just what sounds impressive on paper.

Expense management becomes a breeze when you have the right card in place. No more digging through personal statements trying to remember which charges were for business. No more scrambling at tax time. Just clean, organized financial records that make your life easier and your business look professional.

At OpStart, we see how smart financial decisions in the early days pay off massively later. That’s exactly why we focus on giving startups hands-free, expert-managed finance and accounting services. We know that when your financial foundation is solid, you can pour your energy into what really matters – building an amazing product and finding customers who love it.

Your business credit card is just one piece of your financial puzzle. When you’re ready to get the whole picture sorted out, we’re here to help you Get the complete financial stack for your startup. Because the sooner you get your financial house in order, the sooner you can focus on changing the world.