Why Choosing the Right Financial Partner Matters More Than You Think

A bookkeeping accounting firm can make or break your startup’s financial foundation, yet most founders struggle to choose the right type. The decision between a specialized bookkeeper, a full-service accounting firm, or a hybrid model isn’t just about cost—it’s about getting the financial insights needed to fuel growth.

Quick Answer: Bookkeeping vs. Accounting Firm Comparison

- Bookkeeping Firms: Focus on daily transaction recording, bank reconciliation, and basic financial statements.

- Accounting Firms: Provide tax planning, strategic analysis, compliance, and business advisory services.

- Full-Service Firms: Combine both but may compromise on specialization.

- Hybrid Models: Offer integrated technology platforms with expert oversight.

As one Reddit user put it: “I was told a long time ago your bookkeeper should be different from the accounting firm” – highlighting the debate over separating or bundling these functions.

The stakes are high. Poor bookkeeping creates “shitty books” with little value for decision-making. The wrong accounting partner can mean overpaying for services you don’t need while missing critical growth opportunities.

Your business stage, complexity, and growth goals should drive this decision. Understanding the distinctions will save you time, money, and headaches.

I’m Maurina Venturelli, and I’ve helped high-growth companies steer these financial challenges from startup to IPO. At OpStart, we’ve seen how the right bookkeeping accounting firm partnership accelerates growth, while the wrong one creates expensive bottlenecks.

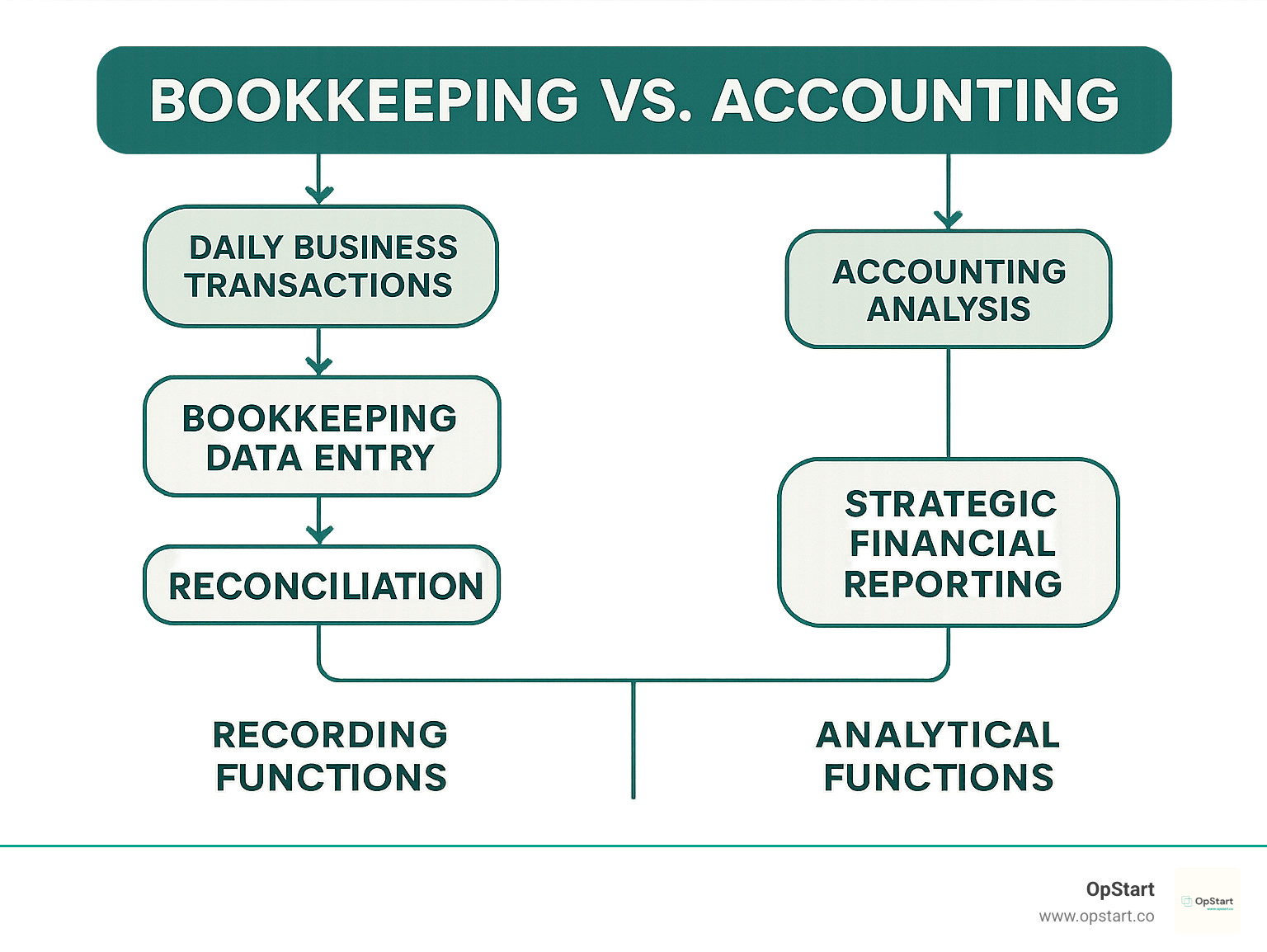

The Core Distinction: Recording vs. Interpreting Financial Data

Most business owners don’t realize that a bookkeeping accounting firm combines two distinct but complementary skill sets. Bookkeeping is the financial historian, carefully recording every transaction. Accounting is the financial detective, interpreting that data to tell you what it means for your future.

The distinction is critical. Bookkeeping is the foundation; without accurate records, an accountant is working blind. But raw data without analysis is like a library of books in a language you can’t read.

If you want to dive deeper into how these roles compare to other financial professionals, check out our detailed guide: More info about the differences.

Here’s how these two functions stack up:

| Feature | Bookkeeper | Accountant |

|---|---|---|

| Primary Focus | Recording daily financial transactions | Analyzing, interpreting, and reporting financial data |

| Main Function | Data entry, organization, and maintenance | Strategic planning, compliance, and advisory |

| Key Tasks | Posting debits/credits, invoices, payroll, bank reconciliation, general ledger maintenance, preparing basic financial statements | Preparing adjusting entries, reviewing financial statements, cost analysis, tax preparation, financial decision aid, forecasting, auditing |

| Deliverables | Clean, organized ledgers; basic financial statements (P&L, Balance Sheet) | Comprehensive financial reports; tax returns; strategic financial advice; budgets; forecasts |

| Perspective | Historical, transaction-level | Forward-looking, strategic, big-picture |

| Credentials | Typically no formal license required; accuracy and knowledge are key | Often requires a bachelor’s degree (or higher) in accounting/finance; CPA certification common for advisory roles |

The Role of a Bookkeeping Firm: The Daily Financial Record-Keepers

A specialized bookkeeping firm acts as your business’s financial memory, carefully recording every transaction. This detail-oriented work is crucial for maintaining accurate books.

These firms handle the nitty-gritty work. Data entry means recording every transaction, from a $5 coffee to a $50,000 equipment purchase. Bank reconciliation matches your bank statements with internal records, catching discrepancies early. They also manage accounts payable (paying vendors on time), accounts receivable (tracking who owes you money), and payroll processing.

The financial statements they produce—your Profit & Loss, Balance Sheet, and Cash Flow Statement—come directly from this data. They maintain your general ledger, the master record of all transactions. Most professional bookkeepers use single-entry and double-entry bookkeeping systems, with double-entry being the standard for growing businesses. The goal is to give you “clean books” that accurately reflect your financial reality.

The Role of an Accounting Firm: The Strategic Financial Analysts

While bookkeepers record what happened, accountants interpret that data, asking “what does this mean, and what’s next?” They turn clean books into actionable business intelligence.

Financial analysis is where they shine, spotting trends, identifying profitable revenue streams, and flagging cash flow issues. Tax planning develops strategies to legally minimize your tax burden throughout the year. For tax preparation, they handle the complexities, which is invaluable if you’re wondering What Taxes Does My Startup Need to File This Year?.

Budgeting and forecasting help you plan for the future. Compliance keeps you out of trouble with regulators, while audit support is there if you need to prove your numbers to investors or the IRS. The business advisory piece is where they add the most value, helping you make decisions that move your business forward.

When Your Needs Overlap: The Modern Hybrid Model

Technology has enabled a hybrid model where the smartest firms deliver both bookkeeping and accounting seamlessly.

Automation handles repetitive tasks like categorizing transactions and syncing bank feeds. Cloud software makes your financial data current and accessible from anywhere. With integrated services, your bookkeeper and tax strategist are in constant communication, making your financial operations a smooth, coordinated system.

The real benefit is scalability. The system adapts to your needs as you grow, without requiring you to switch providers. This hybrid model delivers the precision of dedicated bookkeeping with the strategic insight of professional accounting, all powered by modern technology.

The “One-Stop-Shop” Appeal: The All-in-One Accounting Firm

The appeal of a single bookkeeping accounting firm handling everything from daily transactions to year-end tax strategy is undeniable. For busy entrepreneurs, the promise of “set it and forget it” financial management is a powerful draw.

For more insights on how quality bookkeeping can benefit your business, check out our guide: 8 Ways a Great Bookkeeper Pays for Themselves.

The Allure of Simplicity and Integrated Tax Planning

The all-in-one model’s main appeal is seamless coordination. When your bookkeeper and tax preparer work for the same firm, they share a holistic view of your finances, enabling more strategic decisions year-round.

The time savings can be substantial, as you only have one point of contact. Some firms report helping businesses save over 25 hours during tax preparation alone. The most appealing aspect is often the coordinated strategy; with year-round tax advisory, every bookkeeping decision can be made with tax implications in mind. Plus, a one bill approach simplifies budgeting.

Potential Pitfalls: When Convenience Compromises Quality

However, convenience can compromise quality. A “jack of all trades” firm can end up being a master of none. The biggest red flag is when bookkeeping becomes an afterthought to tax and advisory work. This creates “compliance books” versus “actionable books.”

Compliance books get your taxes filed, but they don’t help you make smart business decisions. Actionable books, in contrast, provide the detailed insights needed to understand cash flow, identify profitable customers, and spot problems early.

A lack of specialization and divided focus are common challenges. If an accountant is brilliant at tax strategy but also juggling audits and daily transactions, bookkeeping quality often suffers. Many business owners also find larger firms to be impersonal, with slow response times when a quick answer is needed.

This is why we created our article Is Your Bookkeeping Good Enough?—to help business owners recognize when their financial foundation needs attention.

Who is the All-in-One Firm Best For?

Despite the pitfalls, the all-in-one model can work well for certain businesses. It’s a good fit for:

- Simple business models with straightforward revenue and predictable expenses.

- Established companies with mature financial processes and internal controls.

- Owners who prioritize convenience and prefer a hands-off approach to compliance.

- Businesses with predictable finances, like service companies with recurring revenue.

The key is to assess what your business needs most: compliance and tax filing, or detailed financial insights to guide daily operations and strategic decisions? Your answer will guide your choice.

The Case for Specialization and Collaboration

In contrast to the all-in-one model, specialization lets experts focus on what they do best. This approach of focused expertise and strategic collaboration suggests that separating bookkeeping from other accounting functions can deliver higher quality data, greater accuracy, and more valuable insights.

The Value of a Dedicated Bookkeeping Firm

When a firm dedicates 100% of its energy to maintaining your financial records, the quality improves dramatically. They live and breathe the art of meticulous records.

This focus translates into actionable insights because the underlying data is rock-solid. A dedicated bookkeeping firm provides clean books that help you make smart business decisions, not just numbers that satisfy the IRS. When you can trust your Cash Flow Statement, you’re no longer flying blind. Error reduction is a natural byproduct, as specialists catch mistakes before they snowball.

The “Checks and Balances” Advantage of Separation

Separating bookkeeping from tax preparation creates an automatic checks and balances system that can save you from costly mistakes and even fraud.

This independent review process, with two experts verifying work from different angles, catches errors that might otherwise slip through. The fraud detection benefit is also valuable, as it’s harder for manipulation to go unnoticed when multiple professionals are examining your books. This provides peace of mind.

The increased accuracy from two sets of expert eyes leads to higher quality financial data. Most importantly, this separation creates clear accountability: your bookkeeper owns the daily records, and your tax professional owns the tax strategy.

How Bookkeepers and Tax Pros Create a Power-Pairing

When a dedicated bookkeeping firm teams up with a skilled tax professional, you get the best of both worlds. This collaboration creates a powerful partnership.

The bookkeeper provides the tax pro with clean data for tax filing, which means no more paying your tax preparer to untangle messy records. This leads directly to cost savings and reduced tax prep time. This expert partnership allows each professional to play to their strengths: the bookkeeper masters daily accuracy, while the tax pro focuses on strategy and compliance. This often leads to mutual referrals, creating a network of support that benefits your business year-round.

Choosing the Right Bookkeeping Accounting Firm for Your Startup

For startups, the right bookkeeping accounting firm is a strategic partner for growth. The choice must align with your specific trajectory and future ambitions, as startups often outgrow their initial financial setup quickly.

You need a partner who understands funding rounds, rapid scaling, and innovative business models. This is where comprehensive financial operations services are crucial. For more details, see our guide: Startup Accounting Services: What Founders Need to Know.

Key Services for Growth Beyond Basic Compliance

A growing startup needs services that fuel strategic decision-making, moving you from recording the past to shaping the future.

- Fractional CFO services provide high-level strategy (budgeting, forecasting, financial modeling) without the full-time cost, which is critical for fundraising and growth. Our Fractional CFO Services are designed to strengthen your decision-making.

- KPI tracking identifies and monitors the key performance indicators that drive your business, such as customer acquisition cost or monthly recurring revenue.

- Board reporting is essential for maintaining investor confidence and securing future funding with professional, insightful financial reports.

- Fundraising support is a game-changer when preparing for Series A or beyond, including help with financial projections and due diligence.

- R&D Tax Credit consultation can save your startup substantial amounts—sometimes hundreds of thousands of dollars per year—by rewarding your innovation.

- Financial modeling builds robust projections to assess new ventures, support strategic planning, and help you understand different growth scenarios.

The Critical Role of Technology and Software Integration

Modern financial operations depend on technology. The right bookkeeping accounting firm will use and integrate cutting-edge tools into a seamless ecosystem for your business.

Cloud accounting platforms like Quickbooks and Quickbooks Online enable real-time data access and collaboration. Automation tools for expenses, bill pay, and payroll reduce manual work and errors. Real-time dashboards provide at-a-glance visual reports for quick, informed decisions.

Custom tech stack integration is key, ensuring all your business systems (CRM, e-commerce, payment processors) feed data into your accounting system automatically via API integrations. The goal is to harness technology to streamline operations and boost your bottom line.

Questions to Ask Before You Hire a bookkeeping accounting firm

Asking the right questions before committing can save you from costly mistakes.

- Pricing model: Do they offer predictable flat-rate pricing or hourly billing that can spiral?

- Dedicated contact: Will you have a dedicated team that understands your business, or will you be passed around?

- Industry experience: Do they understand startup-specific needs like equity compensation and SaaS revenue recognition?

- Scalability: Can they support your business as it grows, or will you need to switch providers?

- Actionable insights: Do they provide “actionable books” that inform decisions or just “compliance books” for the IRS?

- Onboarding process: What does their transition process look like? A chaotic onboarding often predicts ongoing issues.

- Technology integration: Can they build a custom tech stack, or are you limited to their preferred software?

- Data security: How do they ensure the privacy and security of your financial data?

- Compliance understanding: Do they know that business transactions require supporting documents for regulatory compliance?

These questions will help you find a partner that actively contributes to your success.

Conclusion

Choosing the right bookkeeping accounting firm is about finding a financial partner who understands your journey. Whether you’re a startup or a scaling business, the right financial foundation is critical.

We’ve learned that bookkeeping is your financial backbone, recording every transaction, while accounting transforms that data into strategic insight. The full-service firm offers convenience, but you risk getting “compliance books” that don’t help you run your business.

The magic often happens when dedicated bookkeeping specialists team up with strategic accountants. This provides meticulous, clean books and the checks and balances of independent expert review.

Technology is a game-changer. The right firm will build a custom tech stack that turns your financial data into a competitive advantage. For startups, services like fractional CFO support, KPI tracking, and R&D tax credits are essential tools for growth.

Your business stage should drive this decision. Simple operations may thrive with an all-in-one approach. But if you have complex transactions or ambitious growth plans, you need partners who provide detailed insights for smart decision-making.

At OpStart, we’ve seen how the right financial partnership accelerates growth. That’s why we believe startups need comprehensive solutions that combine meticulous bookkeeping with strategic guidance, delivered through a modern, technology-forward approach.

Ready to see what hands-free, expert-managed financial operations can do for your startup? Explore comprehensive financial solutions for your startup and find how the right bookkeeping accounting firm partnership can become your secret weapon for scalable growth.