Why Smart Founders Choose the Right Bookkeeping Tools

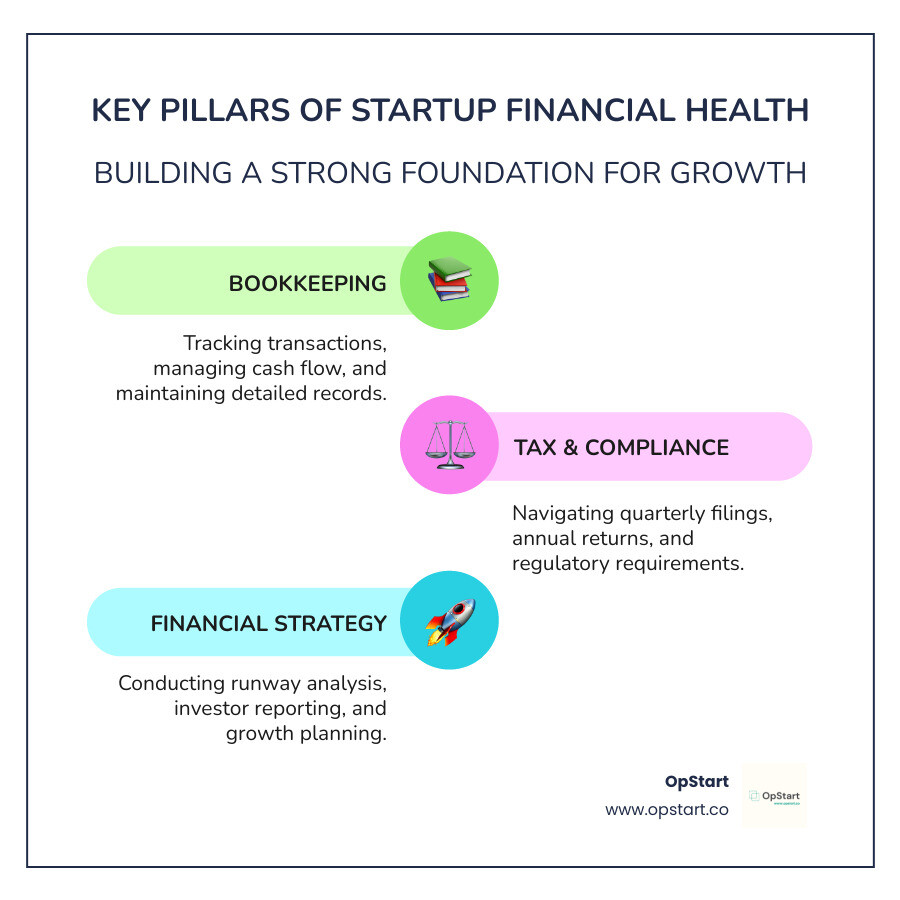

Bookkeeping for start-ups is the foundation that turns chaotic financial data into clear insights for growth. While you’re juggling product development, hiring, and fundraising, proper bookkeeping is your financial compass, helping you track burn rate, understand cash flow, and make data-driven decisions.

Essential bookkeeping for start-ups includes:

- Daily transaction recording

- Monthly financial statements (P&L, Balance Sheet, Cash Flow)

- Tax compliance and filings

- Investor reporting and due diligence preparation

- Cash flow management to monitor runway and burn rate

Research shows that 82% of failed ventures collapse due to cash flow problems, often because founders lack clear visibility into their finances. Without proper bookkeeping systems, you’re flying blind.

Yet most founders struggle with this function. As one founder put it: “Let’s face it, most founders don’t have time to keep their startups’ books in order.” The good news is that modern bookkeeping tools and services have evolved to meet the unique needs of fast-growing startups.

This guide breaks down the top bookkeeping solutions, from DIY software to full-service platforms. We’ll show you what to look for, when to upgrade, and how to choose the right approach for your startup.

I’m Maurina Venturelli, and I’ve helped scale companies from startup to IPO. Today I head Go-to-Market at OpStart, where I see how proper bookkeeping for start-ups transforms chaotic financial operations into strategic growth advantages.

Why Flawless Bookkeeping is a Startup’s Secret Weapon

For any startup founder, bookkeeping for start-ups can seem like a chore, but it’s your secret weapon for survival and success. Running a startup without meticulous bookkeeping is like navigating a jungle without a map. Accurate financial records provide the clarity to manage cash flow, the lifeblood of any business. It’s a harsh reality that nearly half of startups fail due to cash flow problems – a statistic that highlights the importance of knowing where every dollar goes.

Beyond survival, robust bookkeeping is crucial for investor relations. When seeking funding, investors scrutinize your financials. Clean books instill confidence and demonstrate financial discipline, making your startup a more attractive investment. This clarity also drives strategic decision-making. With clear financial data, you can identify profitable avenues, cut costs, and forecast future needs with precision, turning raw numbers into actionable insights. Is your bookkeeping good enough? Find out here: Is Your Bookkeeping Good Enough?

The High Cost of Poor Financial Management

The consequences of neglecting bookkeeping for start-ups can be catastrophic. The statistic about 82% of failed ventures collapsing due to cash flow problems represents countless dreams unfulfilled because financial clarity was absent.

Without a solid bookkeeping foundation, you risk:

- Tax compliance nightmares: Missed deadlines and incorrect filings can lead to hefty penalties and audits.

- Inability to secure funding: VCs and lenders are wary of startups with messy books, as it signals a lack of control.

- Missed growth opportunities: How can you capitalize on a surge in demand if you don’t know your true profit margins? Poor financial management means flying blind.

- Inaccurate financial statements: If your P&L, Balance Sheet, or Cash Flow Statement are unreliable, you’re making decisions based on faulty information. Learn how to read a P&L here: How to Read a P&L.

Beyond Compliance: Bookkeeping as a Strategic Tool

This is where bookkeeping for start-ups transcends compliance and becomes a powerful strategic tool. It’s about gaining the insights to guide your business.

- Financial Analysis: Good bookkeeping provides the raw material for deep financial analysis. You can track KPIs, identify trends, and understand the true health of your business.

- Calculating Runway: This critical metric tells you how long your business can survive before running out of cash. Knowing your runway helps you make informed decisions about hiring, spending, and fundraising.

- Identifying Top Customers/Vendors: Financial data can reveal your most valuable customers and highlight your top vendors, giving you leverage for negotiation.

- Vendor Negotiation: Understanding your spending patterns allows you to approach vendors for better terms or discounts, directly improving your bottom line.

Clean books empower you to confidently present your financial health to stakeholders. Learn more about understanding your How to Read a Balance Sheet and Statement of Cash Flows.

Setting Up for Success: A Startup’s First Accounting Steps

Think of setting up your bookkeeping for start-ups like building a house—you need a solid foundation. Skipping these first steps means fixing a wobbly structure later while you’re trying to scale.

The golden rule of startup finances is to keep your personal and business money completely separate. Commingling funds creates serious problems for tax purposes, financial analysis, and potential audits.

Your next big decision is choosing a business entity. Whether you select a Sole Proprietorship, Partnership, C Corporation, S Corporation, or LLC, this choice shapes your tax and payment structures. If you plan to seek venture capital, most investors prefer Delaware C-Corps.

Once your legal structure is sorted, set up your chart of accounts. This is a categorized list of all your revenue, expenses, assets, liabilities, and equity. An organized chart of accounts ensures your financial reports make sense from day one.

Finally, understand double-entry bookkeeping. In this system, every transaction affects at least two accounts, and debits always equal credits. This acts as a built-in error checker, keeping your books balanced and accurate. For a deeper dive, check out this resource: Basic bookkeeping – SK Startup Institute.

Building Your Financial Foundation

Let’s get practical. These steps are the difference between smooth sailing and financial chaos.

Opening a dedicated business bank account is your first move. Get a business checking account and credit card before you spend a single dollar. This simplifies everything from expense tracking to tax prep.

Next, choose your accounting method. Cash vs. Accrual Accounting each have their place. Cash basis records money when it’s received or paid. It’s simple and works for very early-stage startups. Accrual basis records income when earned and expenses when incurred, giving a clearer picture of financial health and is often required by investors.

Your business structure selection impacts liability and taxes. An LLC might work for a bootstrapped company, while a Delaware C-Corp is often preferred for venture-backed startups.

Understand your tax obligations early to avoid surprises. This includes federal, state, and local taxes, plus potential sales and payroll taxes. Knowing What Taxes Does My Startup Need to File This Year? is crucial.

Essential Financial Records and Fundamental Tasks

Good bookkeeping for start-ups requires obsessive organization.

You need to keep comprehensive records: invoices, receipts, bank and credit card statements, and payroll records. Your financial statements—the Income Statement, Balance Sheet, and Cash Flow Statement—tell your business’s financial story. Keep tax forms and supporting documents for at least three to six years, per IRS guidance: What kind of records you should keep.

Consistency is key. Weekly tasks should include entering and categorizing all transactions and digitizing receipts. Monthly tasks involve reconciling bank accounts, sending and following up on invoices, paying bills, and reviewing your overall financial position. These check-ins help you spot trends and make informed decisions.

Choosing Your Toolkit: Top Bookkeeping Solutions for Startups

Finding the right bookkeeping solution is critical. The right tools don’t just organize your finances; they empower you to make smarter business decisions.

The best solutions offer automation benefits to handle tedious tasks like categorizing transactions, freeing you up to build your business. Scalability is also huge; choose a solution that grows with you to avoid a painful switch later. Your bookkeeping software shouldn’t live in isolation, so look for integration capabilities that connect with your payment processors, payroll systems, and expense apps.

Of course, none of this matters if the software isn’t user-friendly. And while cost-effectiveness is important, the cheapest option can cost more in the long run through wasted time and missed opportunities.

At OpStart, we’ve seen every type of bookkeeping setup. That’s why we integrate with any preferred software stack to provide comprehensive financial operations services. We recommend OpStart’s bookkeeping platform and services that work with whatever tools you choose.

Key Features to Look for in Startup Bookkeeping Tools

Some software capabilities are absolute must-haves for startups. Here’s what really matters:

| Feature | Description | Why it’s important for Startups |

|---|---|---|

| Invoicing | Create, send, and track professional invoices. | Ensures timely payment, professional appearance, and simplified receivables management. |

| Expense Tracking | Record and categorize all business expenses, often with receipt capture. | Crucial for accurate financial reporting, tax deductions, and budget management. |

| Bank Reconciliation | Automatically matches bank transactions with recorded entries. | Ensures accuracy, detects errors or fraud, and provides a clear picture of cash flow. |

| Financial Reporting | Generates P&L, Balance Sheet, Cash Flow statements, and custom reports. | Essential for understanding financial health, making informed decisions, and investor updates. |

| Payroll Integration | Links directly with payroll services to streamline expense recording. | Simplifies payroll processing, ensures compliance, and accurately tracks employee costs. |

| Scalability | Ability to handle increasing transaction volume and complexity. | Prevents the need for costly software changes as your business grows. |

Beyond these, cloud access is non-negotiable for accessing your finances from anywhere. Third-party integrations are game-changers, and a solid mobile app lets you manage tasks on the go.

Solutions for Early-Stage Founders

The bookkeeping software landscape has never been more startup-friendly. For founders just getting started, some platforms offer basic features at no cost, but most startups outgrow these free solutions quickly.

Cloud-based solutions are the gold standard. They automatically back up data, enable team collaboration, and update seamlessly. The key is finding software that matches your complexity level without being overwhelming.

What matters most is picking something you’ll use consistently. The fanciest software is useless if it’s too complicated for your workflow.

That’s why OpStart’s approach supports startups at every stage, working with the tools that make sense for your business. We know bookkeeping for start-ups isn’t one-size-fits-all. Learn more about OpStart’s bookkeeping services and how we customize our approach for each startup.

DIY vs. Pro Services: The Smart Way to Handle Bookkeeping for Start-ups

One of the trickiest decisions for a founder is whether to handle bookkeeping for start-ups in-house or hire a professional. The right choice depends on your time, budget, financial expertise, and your startup’s complexity.

Your time as a founder is your most valuable asset. Every moment spent on bookkeeping is a moment not spent building your product or landing sales. While a DIY approach seems cheaper, the hidden cost of your time can be huge. Plus, a lack of accounting expertise can lead to costly errors, missed tax breaks, or misreading your startup’s financial health. To understand the different finance roles, see: Fractional CFO vs. Bookkeeper vs. CPA: What’s the Difference?.

The DIY Approach to Bookkeeping for Start-ups

With the DIY approach, you or a non-finance team member handles all financial record-keeping. The biggest draw is cost savings on professional fees, with expenses limited to software subscriptions. You also get direct control over the books.

However, this approach is incredibly time-consuming. As one founder said, “Most founders don’t have time to keep their startups’ books in order.” Without accounting expertise, it’s also easy to make mistakes with complex items like SAFE notes, convertible debt, or R&D tax credits. This means you might miss strategic insights that a professional would spot.

Then there’s the scalability challenge. A system that’s manageable with ten transactions a month will break down at a thousand. Using basic tools like spreadsheets for a growing company is strongly discouraged as they lack the accuracy and efficiency required.

DIY can work for pre-revenue startups with very few transactions and less than $250,000 in funding. But you’ll want to graduate from this model as soon as possible.

Outsourcing: The Ultimate Solution for Bookkeeping for Start-ups

For most growing startups, outsourcing bookkeeping for start-ups is a smart, strategic move.

Here’s why outsourcing is a game-changer:

- Access to Expertise: You get seasoned professionals who understand startup finance, GAAP, and venture capital specifics, ensuring your books are accurate and compliant.

- Saving Time: Handing off bookkeeping frees up countless hours for you to focus on innovation, sales, and team building instead of receipts.

- Improved Accuracy: Professionals reduce errors, ensuring your books are always ready for an audit or investor due diligence. They are masters at handling complex transactions and proper revenue recognition.

- Scalability: Outsourced services flex with your business, handling increased transaction volume and complexity without the need to hire an in-house finance team.

- Strategic Insights: Many providers offer more than just bookkeeping, providing financial analysis, budgeting, and virtual CFO services to turn data into actionable wisdom.

Outsourcing often pays for itself by preventing costly mistakes, optimizing tax strategy, and buying back your most valuable asset: your time. Learn more about Startup Accounting Services: What Founders Need to Know and find 8 Ways a Great Bookkeeper Pays for Themselves.

Frequently Asked Questions about Startup Bookkeeping

It’s normal to have questions about finances when building a startup. Here are some of the most common questions we get about bookkeeping for start-ups, with answers to help you steer your financial journey.

How much should a startup spend on bookkeeping?

The cost of bookkeeping for start-ups varies based on your stage, complexity, and approach. It’s not a one-size-fits-all expense.

If you take the DIY approach, your main cost is accounting software, which can range from $30 to over $250 per month. This doesn’t account for the value of your time or the potential cost of errors.

For outsourced bookkeeping services, prices vary. Basic services for transaction recording and reconciliation typically range from $100 to $500 per month. More comprehensive startup accounting services that include specialized support like investor reporting or tax assistance can cost anywhere from $249 to $1,500+ per month. Many firms offer dedicated packages starting around $499-$900 per month. Virtual CFO services for strategic planning and investor relations support typically range from $1,000 to $5,000 per month.

An in-house bookkeeper is a significant investment, with salaries often starting at $50,000 to $70,000+ annually, plus benefits. This option usually makes sense only for larger, well-funded startups. Many experts suggest that once a startup has raised over $250,000, outsourcing bookkeeping becomes a smart financial move.

What’s the difference between a bookkeeper and an accountant?

These two roles are distinct but complementary gears in your financial machine.

A bookkeeper is your daily record-keeper. They focus on accurately recording all financial transactions to maintain an orderly financial house. Their tasks include:

- Recording all income and expenses.

- Categorizing transactions.

- Reconciling bank and credit card statements.

- Managing accounts payable and receivable.

An accountant uses the data organized by the bookkeeper to provide valuable insights. They are the strategists who interpret financial information and ensure tax compliance. Their responsibilities include:

- Preparing and analyzing financial statements (P&L, Balance Sheet, etc.).

- Providing strategic financial advice and forecasting.

- Ensuring compliance with accounting standards like GAAP.

- Preparing and filing tax returns.

- Assisting with budgeting and investor relations.

In short, a bookkeeper records what happened, while an accountant explains what it means and advises on what to do next. For more details, see: More info about the differences.

When should I switch from cash to accrual accounting?

Deciding between cash and accrual accounting is a key step in bookkeeping for start-ups.

Cash basis accounting is simple: you record income when cash is received and expenses when they are paid. It’s often used by very small businesses for its straightforwardness.

Accrual basis accounting is more sophisticated. You recognize income when it’s earned and expenses when they’re incurred, regardless of cash flow. This method provides a more accurate picture of your company’s financial performance.

So, when should you switch to accrual? Key trigger points include:

- Seeking external funding: VCs and other investors almost always require accrual-based financial statements for a clear, standardized view of your financial health.

- Growing business complexity: As you manage more receivables, payables, or inventory, cash basis accounting can become misleading. Accrual provides necessary clarity.

- GAAP requirements: Generally Accepted Accounting Principles (GAAP) typically mandate accrual accounting for scaling businesses.

- Needing better financial analysis: For accurate forecasting, budgeting, and performance analysis, accrual accounting is essential.

While cash basis may work initially, the shift to accrual accounting is crucial as you seek investment or your operations grow. Learn more here: Learn more about Cash vs. Accrual Accounting.

Scale with Confidence: Your Next Financial Move

Your startup journey doesn’t have to be a financial guessing game. As we’ve shown, proper bookkeeping for start-ups transforms from a dreaded chore into a secret weapon for growth. With clear cash flow visibility and clean books that impress investors, you are positioned to thrive, not just survive.

The magic happens when your financial operations become invisible to you as a founder. Instead of scrambling over receipts or wondering if you can afford a new hire, you have reliable data at your fingertips. You can make strategic moves based on real numbers, not gut feelings.

This financial clarity frees you to focus on what you do best: building an incredible product, delighting customers, and scaling your vision. When your books are handled by experts who understand startup finance, you reclaim precious hours to work on your business, not in it.

At OpStart, we’ve built our platform around this philosophy. We handle your accounting, tax filings, CFO support, and back-office software setup so you can stay in your zone of genius. Our hands-free approach means you get expert-managed financial operations at a flat rate, integrated with your preferred software stack.

Ready to turn your financial operations into a competitive advantage? Your future self—and your investors—will thank you.

Get expert bookkeeping services for your startup

Or, if you’re looking for a comprehensive Bookkeeping & Accounting Firm that truly understands the startup journey, we’re here to help you scale with confidence.