Why Business Startup Tax Deductions Can Transform Your Cash Flow

Business startup tax deductions can save your company thousands during its most cash-strapped period. Here’s what you need to know:

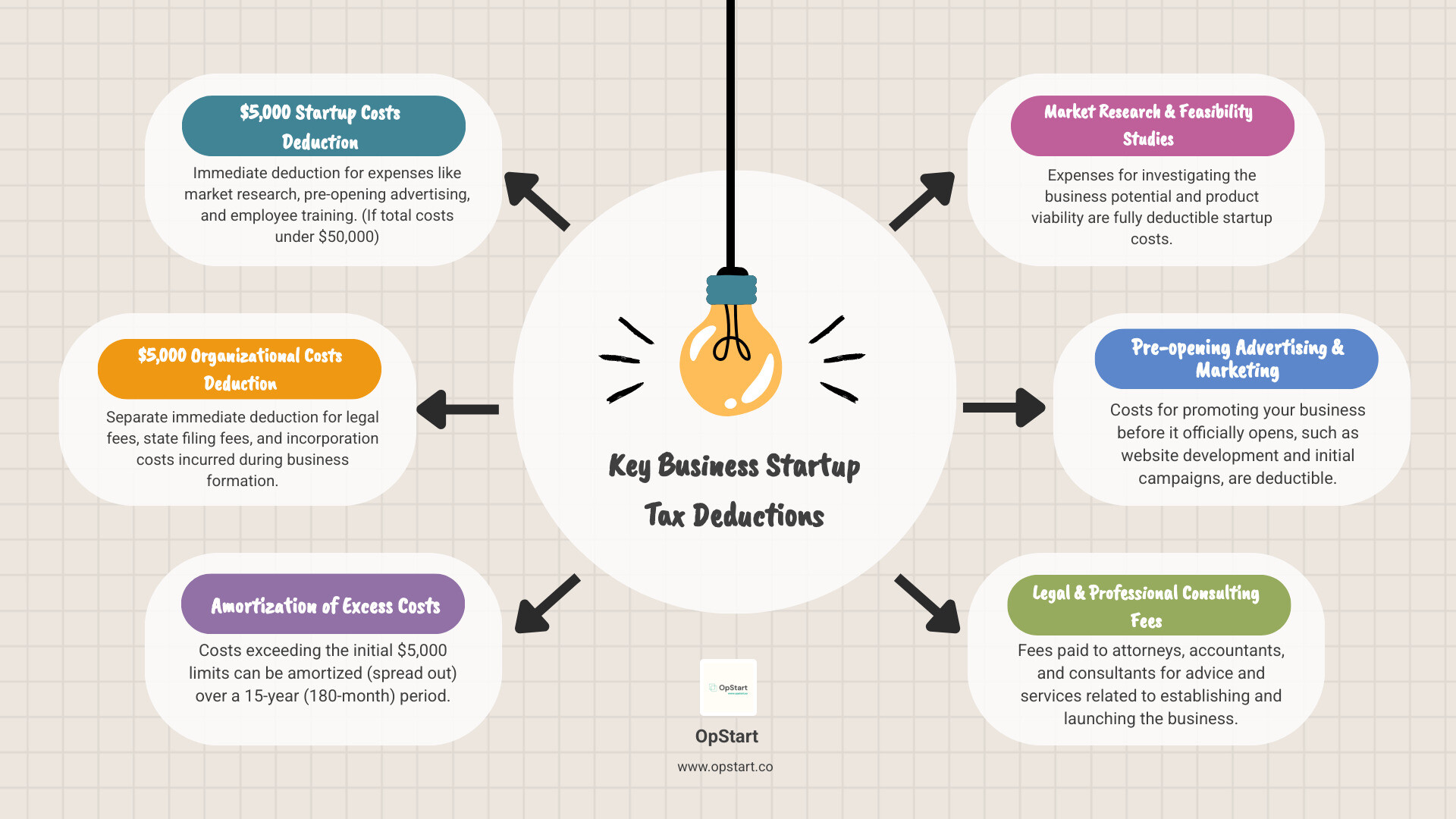

Key Startup Tax Deductions:

- $5,000 immediate deduction for startup costs (if total costs are under $50,000)

- $5,000 immediate deduction for organizational costs (separate limit)

- Market research and feasibility studies

- Pre-opening advertising and marketing

- Legal and accounting fees for business formation

- Employee training costs before opening

- Travel expenses to secure suppliers or customers

- Professional consulting fees for business launch

Important: Costs exceeding the $5,000 limits can be amortized over 15 years. To qualify, these expenses must be incurred before your business officially begins operations.

Starting a business is expensive, with costs for research, legal fees, and marketing piling up before you see any revenue. The good news is the IRS offers tax breaks to help new businesses recover these investments.

Many founders leave money on the table by misunderstanding which expenses qualify or how the rules work. They might treat startup costs like regular expenses or miss critical timing requirements.

I’m Maurina Venturelli, and in my work at high-growth companies and my current role at OpStart, I’ve seen how managing business startup tax deductions frees up crucial cash flow. Understanding these deductions gives your startup the financial breathing room it needs to succeed.

Understanding the Basics: What Qualifies as a Startup Cost?

You’ve spent thousands getting your business ready to launch, but haven’t made your first sale. The good news? Many of these pre-launch expenses qualify as business startup tax deductions. The IRS created special rules for these costs—expenses you incur to investigate, create, or launch your new venture.

For an expense to qualify, it must meet two criteria: it would be deductible for an established business in your field, and you paid for it before your business officially began operations.

Business startup tax deductions fall into three main buckets: investigating a business, creating the business, and organizing its legal structure. However, not every pre-opening expense counts. Costs to acquire a specific existing business are typically treated as capital expenses. Only investigatory costs from a general search qualify for the startup deduction.

Defining Startup vs. Organizational Costs

The IRS splits startup expenses into two categories, each with its own $5,000 deduction limit. Understanding this can double your first-year tax savings.

Startup costs are the broader category covering most pre-launch expenses. This includes market research, feasibility studies, pre-opening advertising, employee training costs before you open, travel expenses to meet suppliers or customers, and professional fees for business planning.

Organizational costs are specific to forming your legal business entity. This includes legal fees for drafting corporate charters, state filing fees for incorporation, and costs of organizational meetings. If you’ve formed an LLC, corporation, or partnership, these expenses get their own separate $5,000 deduction limit. Sole proprietors typically do not have organizational costs.

The Critical Role of Your Business Start Date

Your business start date is crucial because it determines which expenses qualify. It’s not necessarily your first sale, but when you begin activities showing an intent to profit. This could be signing an office lease, launching a marketing campaign, or hiring employees.

Expenses incurred before your official start date are considered personal and non-deductible. Once your business has commenced, even preliminary expenses can qualify. Pre-opening activities like obtaining licenses or setting up vendor relationships can establish your start date. Keep detailed records of when you took each step, as this could be the difference between a deductible business expense and a non-deductible personal cost.

Capital Expenses vs. Current Expenses

Understanding this distinction can save you from costly mistakes when claiming business startup tax deductions.

Current expenses are costs used up quickly, like office supplies or utility bills. These are typically written off in the year you pay them.

Capital expenditures are purchases of assets that benefit your business for more than a year, such as a laptop, furniture, or equipment. Instead of an immediate deduction, these assets are recovered through depreciation, spreading the cost over the asset’s useful life. While you can deduct market research as a startup cost, the computer you bought is depreciated under normal business rules.

The good news is that many capital purchases qualify for bonus depreciation or Section 179 deductions, allowing you to write off more of the cost in the first year. These are separate tax benefits that work alongside your business startup tax deductions. For the most current guidance, the IRS provides detailed information at Here’s how businesses can deduct startup costs from their federal taxes | Internal Revenue Service.

The First-Year Advantage: Claiming Your Initial Business Startup Tax Deductions

The IRS created a special first-year deduction to put money back in your pocket when you need it most. Understanding how to claim your business startup tax deductions in year one can provide the breathing room to grow. Instead of spreading all your startup costs over many years, you can claim a significant chunk immediately.

How the $5,000 Startup Deduction Works

The IRS offers two separate $5,000 immediate deductions: one for startup costs and another for organizational costs.

Your startup costs bucket includes market research, pre-opening advertising, and employee training. Your organizational costs bucket covers legal and state filing fees for incorporation.

However, there’s a catch: if your total costs in either category exceed $50,000, your immediate deduction is reduced dollar-for-dollar. If you spend $53,000 on startup costs, your deduction drops to $2,000. At $55,000 or more, the immediate deduction is eliminated entirely.

For example, if you spent $48,000 on startup costs and $4,000 on organizational fees, you could deduct the full $5,000 for startup costs and the full $4,000 for organizational costs, for a total of $9,000 in first-year deductions. The IRS has detailed guidance on this: Deduct up to $5,000 of business start-up.

Amortizing Costs Above the Limit

Any startup or organizational costs that don’t qualify for the immediate deduction can be amortized over 15 years (180 months). This means you spread the remaining costs over 15 years, taking a small deduction each year using Form 4562. While not as immediate, it still reduces your long-term tax burden. This strategy can be beneficial if you expect losses in your first few years, saving deductions for when your business is profitable. This is where expert guidance, like our Fractional CFO Services, helps entrepreneurs make nuanced decisions to maximize business startup tax deductions.

What to Know About Claiming Your Business Startup Tax Deductions

How you claim these deductions depends on your business structure. Sole proprietors use Schedule C, partnerships use Form 1065, and corporations use Form 1120 or 1120-S.

Crucially, you must elect to deduct startup costs on your tax return for the first year your business is active. If you miss this deadline, you lose the immediate $5,000 deduction and must amortize all costs over 15 years. The election is made by claiming the deduction, but proper categorization and documentation are essential.

A Checklist of Common Deductible Startup Expenses

Let’s get practical about what you can claim as business startup tax deductions. These are the expenses that consistently qualify—and the ones founders often miss.

Investigating and Creating Your Business

The research phase is where many founders spend significantly, and these costs are what business startup tax deductions are designed to cover.

- Market research: Surveys to understand customer needs, focus groups to refine your product, and subscriptions to industry reports all qualify.

- Feasibility studies and product analysis: This includes hiring consultants to evaluate your business idea’s financial sense or analyze product offerings.

- Travel expenses: Trips to secure suppliers or pitch early clients before opening qualify. Keep good records showing the business purpose of these trips.

- Professional fees: Legal advice on business structure, accounting help to set up books, or consultant fees for business planning all qualify as startup costs.

Getting Ready to Launch

The pre-launch phase generates its own set of deductible expenses, where founders often see the biggest impact from business startup tax deductions.

- Pre-opening advertising: Social media campaigns, local ads, and promotional materials created before your launch are all deductible as startup costs.

- Employee training costs: Wages paid to staff during training periods before you officially opened are deductible, as are recruitment costs.

- Website development: Costs for a basic website may qualify for the startup deduction. More complex sites that function like software may need to be depreciated.

Handling Personal and Transferred Assets

Many founders use personal assets or work from home, and specific rules apply.

- Home office expenses: If your home office is used exclusively and regularly as your principal place of business, you can take a deduction. The IRS offers a simplified method or one based on actual expenses. See the IRS guide on deducting your home office from your taxes.

- Vehicle expenses: If you use your personal car for business, you can deduct the business-use portion. Keep detailed mileage logs.

- Transferred assets: When you bring personal assets like a computer into your business, you don’t get an immediate deduction. The business acquires them at their Fair Market Value on the transfer date, and this value becomes the basis for depreciation over the asset’s useful life.

The How-To: Record Keeping and Reporting Your Deductions

Getting your business startup tax deductions right isn’t just about knowing what to deduct—it’s about proving it. The IRS philosophy is simple: if you can’t document it, you can’t deduct it. Good record keeping is an investment in your peace of mind.

Best Practices for Tracking Expenses

The foundation of successful expense tracking is simple but crucial.

- Separate bank accounts: This is non-negotiable. Open dedicated business checking and credit card accounts before you spend anything. Mixing funds is a bookkeeping nightmare.

- Accounting software: Tools like QuickBooks Online or Xero can automatically import transactions and help you categorize expenses, saving you time and ensuring you capture all deductions.

- Digital receipt management: Photograph receipts immediately and store them digitally. Many accounting apps allow you to attach a photo directly to the transaction.

- Expense categorization: Be detailed. Understanding the difference between a startup cost, an ongoing expense, and a capital asset directly impacts your tax savings. “Market research survey” is better than “consulting.”

- Consistency: Set aside time weekly to manage your books. Reconstructing a year’s worth of expenses is difficult and leads to missed deductions.

At OpStart, we know your time is better spent building your business. That’s why we offer Professional Bookkeeping Services and help with the Essential Tools for Startups: The Startup Stack.

How to Handle Grants and Rebates

Government grants and rebates can be a great boost, but they have tax implications. The general rule is that you must reduce your deductible expenses by the amount of any assistance received for those specific costs. For example, if you buy a $3,000 laptop and get a $500 grant for it, your deductible expense is $2,500. A general grant not tied to specific expenses may be considered taxable income. Always check the terms of any assistance you receive.

The Importance of Accurate Documentation for Business Startup Tax Deductions

In an IRS audit, the burden of proof is on you. You must prove you were entitled to a deduction.

For business startup tax deductions, you need receipts and invoices showing the amount, date, vendor, and nature of each expense. A credit card statement alone is not enough. You also need bank statements, contracts, detailed mileage logs for vehicle expenses, and payroll records for pre-opening training costs.

The goal is confidence. Thorough documentation allows you to claim every deduction you’re entitled to without worrying about audit risk. For comprehensive guidance, refer to IRS Publication 535, Business Expenses.

Frequently Asked Questions about Startup Deductions

Starting a business comes with enough uncertainty. Let’s clear up some common questions about business startup tax deductions.

What happens if I investigate a business but never actually launch it?

Unfortunately, if you spend money researching a business idea but never launch it, those investigatory costs are generally considered personal expenses and are not deductible. The IRS requires that your business actually commences operations. There’s a small exception: if you investigated a specific business and the deal fell through, some costs might be treated as a personal capital loss. This is why establishing your official business start date is so critical.

Can I deduct startup expenses I paid for with my personal funds?

Absolutely. This is very common for new businesses. The source of the funds doesn’t matter, as long as the expense itself is a legitimate startup cost. You must handle the bookkeeping correctly by treating these payments as owner contributions to the business. You can reimburse yourself later when the business has cash flow. The key is clear documentation showing these were business expenses.

How are assets I owned personally and then transferred to the business treated?

When you transfer a personal asset like a laptop or car to your business, there’s no immediate deduction. The business “acquires” the asset at its Fair Market Value (FMV) on the transfer date. This FMV becomes the basis for depreciation over the asset’s useful life, just like any other business equipment. You’ll need to document the FMV at the time of transfer.

Can you deduct startup costs with no income?

Yes. Your ability to claim business startup tax deductions depends on when your business starts operating, not when it starts earning revenue. Most startups incur significant costs before their first sale. If your deductions create a business loss in your first year, that loss can often offset other personal income or be carried forward to reduce taxes in future profitable years. The $5,000 immediate deduction is available in your first year of operations, regardless of income. This is where strategic tax planning, like the guidance we provide with our Accounting and Finance Services, becomes invaluable.

Conclusion

Starting a business is expensive, but you shouldn’t leave money on the table at tax time. Business startup tax deductions provide critical financial breathing room when every penny counts.

The key is understanding the rules ahead of time. The $5,000 immediate deduction for startup costs and the separate $5,000 for organizational costs can put significant cash back in your pocket in year one. Even costs above the limit can be amortized over 15 years.

However, none of this matters without proper documentation. Set up systems from day one, organize receipts, and track your business start date carefully. The difference between a solid tax strategy and winging it can be thousands of dollars in cash flow—money for inventory, marketing, or your first hire.

Strategic tax planning starts the moment you decide to launch. At OpStart, we understand founders are busy building their companies. That’s why we offer comprehensive Accounting and Finance Services designed for startups. We handle the complexities of business startup tax deductions, filings, and financial planning so you can focus on growth.