Why Understanding the Corporation Matters for Your Growing Business

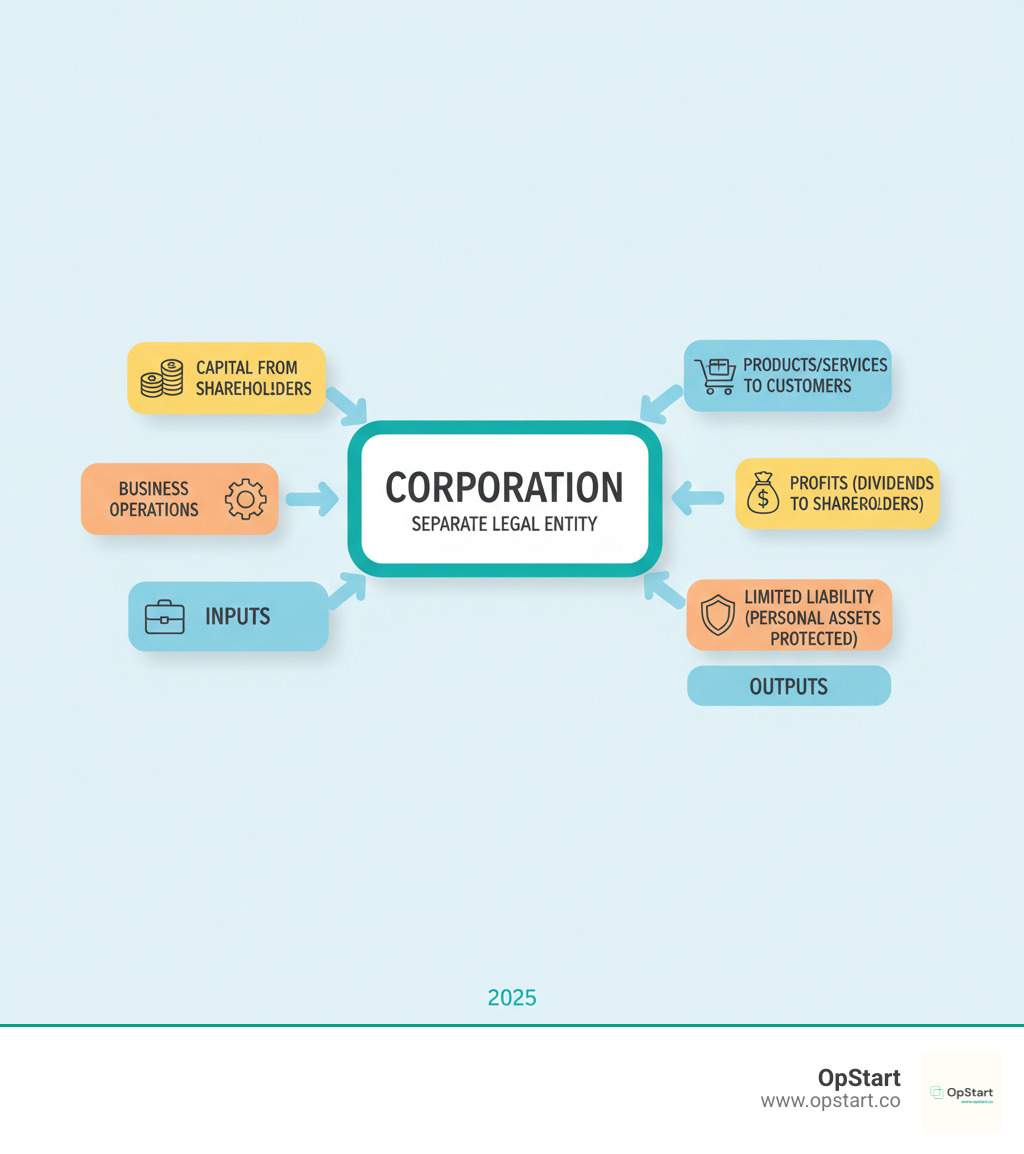

A corporation is a legal entity created by state filing, making it distinct from its owners (shareholders). This structure allows a business to own property, enter contracts, and be sued, all while offering limited liability protection to its investors. Key features include its status as a separate legal entity, perpetual existence beyond its owners, the ability to raise capital by issuing stock, and a formal structure with a board of directors and bylaws.

For startup founders, understanding incorporation is crucial. The term is common, but its practical implications are often lost in legal jargon. At its core, a corporation creates a protective wall between your personal and business finances. This separation is vital when raising money, signing leases, or hiring, but it also brings responsibilities like paperwork, tax filings, and state compliance.

Many founders incorporate because investors, especially in venture capital, expect it. A C Corporation, the standard for startups, supports complex equity structures like preferred stock and employee option pools. However, incorporation involves legal fees, filing costs, and administrative work that can be a burden for small teams.

I’m Maurina Venturelli, and I’ve guided high-growth companies like Sumo Logic through incorporation and IPO. My experience has shown that the right corporate and financial structure accelerates growth, while the wrong one creates drag on a founder’s time and focus.

Corporation terms made easy:

What is a Corporation? A Legal and Historical Overview

Think of a corporation as your business becoming its own legal person. The state recognizes it as having an identity separate from you, meaning the corporation can sign contracts, buy property, and even get sued under its own name. You don’t have to personally guarantee every business decision.

The concept dates back to Roman law and medieval chartered companies, which were granted legal status to pool resources from multiple investors while protecting them from total financial ruin. While you might see the historical term “body corporate,” we use “corporation” for clarity.

Understanding the Modern Corporation

A modern corporation is defined by its status as a separate legal entity. Unlike a sole proprietorship where you and the business are one, a corporation stands on its own. It can own property (offices, equipment, IP), enter contracts, and face legal consequences independently.

Another key feature is perpetual existence. A corporation can outlive its founders and shareholders, providing stability for long-term contracts and partnerships. This continuity is essential for building a lasting enterprise.

In the U.S., you create a corporation by filing with a state government. Each state has its own laws, but the principles are similar. Publicly traded corporations must also comply with federal SEC regulations, but most startups begin with state-level requirements. For more on this, see our guide on startup legal entities.

How a Corporation is Distinct from Other Business Structures

The differences between a corporation and structures like sole proprietorships, partnerships, and LLCs impact your operations and growth.

-

Liability Protection: In a sole proprietorship or general partnership, your personal assets (home, savings) are at risk if the business is sued or incurs debt. A corporation provides limited liability, meaning shareholders’ personal assets are generally protected from the corporation’s debts and legal issues.

-

Ownership Structure: A corporation divides ownership into shares of stock. These shares can be easily bought, sold, or transferred, simplifying the process of bringing on new investors or granting employee equity. This flexibility is essential for raising venture capital.

-

Management Formality: Corporations require a formal structure, including a board of directors, regular board meetings, and corporate bylaws. While this adds complexity compared to informal structures, it creates accountability and clear governance that investors value.

-

Taxation Model: Sole proprietorships and partnerships use pass-through taxation, where profits are taxed on your personal return. C corporations face double taxation: the corporation pays taxes on its profits, and shareholders are taxed again on dividends. S corporations and LLCs offer pass-through taxation with liability protection, but S-corps have ownership restrictions that are often unsuitable for venture-backed startups.

Choosing a structure is about planning for the future. Will you raise capital? Offer employee equity? Your answers will guide your decision. Our comparison in Choosing Your Business Structure: C-Corp vs. LLC breaks down these differences in real-world scenarios.

The Corporate Blueprint: Types, Features, and Benefits

Choosing to incorporate is a strategic decision that shapes your startup’s growth, fundraising, and legal protection. Let’s break down the core features and types of corporations.

Key Features and Benefits of Incorporating

The decision to form a corporation typically hinges on these fundamental advantages:

- Limited Liability Protection: This creates a legal wall between your business liabilities and personal assets. If the company is sued or incurs debt, your personal savings, home, and other assets are generally safe.

- Raising Capital: A corporation is structured to issue stock, making it the preferred entity for venture capitalists and angel investors who expect a clear framework for their investment.

- Perpetual Succession: The corporation continues to exist even if founders or shareholders leave. This continuity provides stability for long-term contracts and partnerships.

- Improved Credibility: Being incorporated signals legitimacy to vendors, enterprise customers, and banks, often leading to better terms and more trust.

- Easy Transfer of Ownership: Selling shares of stock is far simpler than restructuring a partnership, making it attractive for investors seeking clear exit options.

- Tax Flexibility: While C corporations face double taxation, they can also offer tax-deductible employee benefits. An S corporation election allows for pass-through taxation, avoiding corporate income tax entirely.

For a deep dive into the most common startup structure, see our guide on What is a C Corporation?.

Common Types of Corporations

Not all corporations are the same. The type you choose impacts taxes, ownership, and fundraising.

- C Corporation: The default for most venture-backed startups. It allows for unlimited shareholders and multiple classes of stock, which is critical for VC deals. It is subject to double taxation.

- S Corporation: This is a tax election that avoids double taxation by passing profits and losses to shareholders’ personal tax returns. However, it’s limited to 100 U.S. shareholders and one class of stock, making it unsuitable for most VC-backed companies. Review the requirements for becoming an S corp before choosing this path.

- B Corporation (Benefit Corporation): A for-profit corporation legally required to consider its impact on all stakeholders (employees, community, environment), not just shareholders. It’s ideal for mission-driven startups.

- Close Corporation: Designed for small groups or family businesses, with fewer formal requirements and restrictions on transferring shares.

- Nonprofit Corporation: Formed for charitable, educational, or scientific purposes, not to generate profit for owners. They can often obtain tax-exempt status.

Here’s how the most common choices stack up for entrepreneurs:

| Feature | C Corporation | S Corporation | Limited Liability Company (LLC) |

|---|---|---|---|

| Legal Status | Separate legal entity | Separate legal entity (tax designation) | Separate legal entity (hybrid) |

| Liability | Limited liability for owners | Limited liability for owners | Limited liability for owners |

| Taxation | Double taxation (corporate and individual) | Pass-through taxation (no corporate tax) | Pass-through taxation (flexible options) |

| Ownership | Unlimited shareholders, various stock classes | Max 100 shareholders, one class of stock, U.S. citizens/residents | Unlimited members, flexible ownership |

| Capital Raising | Easiest to raise venture capital, issue public stock | Can raise capital, but limits on stock/shareholders | Harder to raise institutional capital, cannot issue stock |

| Formalities | High (board, meetings, bylaws) | High (board, meetings, bylaws) | Low (operating agreement, few state-mandated meetings) |

| Perpetual Existence | Yes | Yes | Yes (if operating agreement specifies) |

| Fringe Benefits | Can offer tax-deductible benefits | Limited tax-deductible benefits | Limited tax-deductible benefits |

The right choice depends on your vision. If you plan to raise venture capital, a C-Corp is likely your best bet. For a profitable lifestyle business, an S-Corp or LLC might be better.

Forming and Operating Your Corporation

Once you’ve decided a corporation is right for your venture, the next step is bringing it to life. While specifics vary by state, the process follows a clear path.

The Step-by-Step Registration Process

Forming a corporation involves several key steps. The IRS provides helpful guidance on forming a corporation that’s worth reviewing.

- Choose a business name. It must be unique in your state and should be checked for trademark conflicts. Corporate names typically include an identifier like “Inc.” or “Corp.”

- Appoint a registered agent. This person or company must have a physical address in your state of incorporation to receive official legal and state documents.

- File Articles of Incorporation. This document, filed with your state’s Secretary of State, officially creates your corporation. It includes the company name, address, registered agent, and details on authorized shares.

- Draft corporate bylaws. This internal operating manual outlines rules for governance, meetings, and director elections. While not filed with the state, it’s crucial for internal clarity.

- Hold an initial board meeting. The board adopts bylaws, elects officers, and formally issues stock to the initial shareholders. Keep detailed minutes of this meeting.

- Obtain an Employer Identification Number (EIN). This nine-digit number from the IRS is your business’s tax ID, needed for banking, taxes, and hiring.

- Apply for licenses and permits. Depending on your industry and location, you may need federal, state, or local licenses to operate legally.

Keep essential documents organized, including your Articles of Incorporation, bylaws, stock records, board minutes, and EIN confirmation.

Operating, Maintaining, and Dissolving a Corporation

A corporation requires ongoing maintenance to remain in good standing.

- Hold Annual Meetings: Most states require annual shareholder meetings and regular board meetings. Document all decisions with detailed minutes to maintain legal protection.

- Maintain Meticulous Records: Keep organized financial records, corporate minutes, and stock ledgers. This is essential for taxes, legal defense, and attracting investors. This is an area where our Back Office Administration services can be a lifesaver.

- File Annual Reports: You must file reports with your state to update information about your directors and officers. In Canada, Corporations Canada requires a similar annual return online.

- Amend Articles as Needed: If you change your corporate name, address, or share structure, you must file Articles of Amendment with the state.

- Formal Dissolution: Closing a corporation is a formal process. You must get shareholder approval, settle all debts, and file Articles of Dissolution with the state to properly wind down the business and protect owners from future liability.

The administrative burden of a corporation can be significant. OpStart was created to handle these financial and compliance tasks, so you can focus on building your business.

The Legal & Financial Obligations of a Corporation

Operating a corporation comes with legal and financial responsibilities that are the price of admission for its powerful benefits. Understanding these obligations is key to protecting your business and personal assets.

Directors and officers owe fiduciary duties to the corporation, meaning they must act in its best interests. This includes the duty of care (making informed decisions) and the duty of loyalty (avoiding conflicts of interest). Shareholders have rights, too, such as voting on major decisions and electing directors.

A critical concept is “piercing the corporate veil.” This legal doctrine removes your limited liability protection if you fail to treat the corporation as a separate entity, such as by commingling funds or failing to keep proper records. It’s a reminder that the corporate structure only protects you if you respect its boundaries. New rules like Beneficial Ownership Information Reporting add another compliance layer that founders must manage.

How Limited Liability Protects Owners and Directors

Limited liability means that if your corporation is sued or can’t pay its bills, creditors are generally limited to the corporation’s assets. This protection from business debts and lawsuit protection keeps your personal assets separate and safe, allowing you to take calculated business risks.

However, this protection isn’t absolute. Key exceptions to liability include:

- Personal Guarantees: Lenders or landlords may require you to personally guarantee a loan or lease, making you personally liable if the corporation defaults.

- Piercing the Corporate Veil: As mentioned, courts can ignore the corporate structure if you fail to maintain it properly or use it for fraudulent purposes.

- Fraud or Illegal Acts: Your liability shield will not protect you from personal responsibility for illegal activities conducted through the corporation.

- Director Liability for Taxes: Directors can be held personally liable if the corporation fails to remit certain taxes, especially payroll taxes. The IRS and other tax authorities (like those under Canada’s Income Tax Act) take this very seriously.

Key Tax Implications for a Corporation

Your choice of corporate structure has major tax consequences.

A C corporation pays federal income tax on its profits at the corporate tax rate. This can lead to double taxation: the corporation pays tax on its profits, and then shareholders pay personal income tax again on any dividends they receive. Many startups mitigate this by reinvesting profits back into the business or paying reasonable salaries to owner-operators. Salaries are a deductible expense for the corporation, though they are subject to payroll taxes.

An S corporation uses pass-through taxation. The business itself pays no federal income tax; instead, profits and losses are passed through to the owners’ personal tax returns. This avoids double taxation. Owners who work in the business must pay themselves a “reasonable salary,” but additional profits can be distributed without being subject to self-employment taxes. However, the ownership restrictions (e.g., 100-shareholder limit, one class of stock) make S-Corps impractical for most startups seeking venture capital.

Understanding tax strategy is crucial for saving money and staying compliant. OpStart’s team can help you determine What Taxes Does My Startup Need to File This Year? and provide the Startup Accounting Services: What Founders Need to Know to keep your finances optimized and protected.

Conclusion

We’ve explored how the corporation has become the backbone of modern business. It’s a strategic tool that protects your personal assets, attracts serious investors, and provides the structure needed to scale.

The benefits are clear: limited liability, the ability to issue stock for capital, and perpetual existence. But these advantages come with responsibilities, including formal meetings, meticulous record-keeping, and tax compliance. For startups with ambitious growth plans, it’s often the right choice, but it’s not one to be made lightly.

Your choice must align with your long-term goals. A C corporation is the standard for raising venture capital, while an S corporation or LLC might better suit a business focused on simpler operations. The structure you choose today will define your financial management and growth trajectory for years.

You don’t have to steer this alone. At OpStart, we help founders with these exact decisions, from choosing between a C-Corp vs. LLC to managing ongoing compliance. We exist to take the complexity of financial operations off your plate so you can focus on building your business.

Ready to set your corporation up for success? Let’s talk about how OpStart can provide hands-free, expert-managed accounting, tax, and CFO support for your journey.