Why Delaware C Corporations Dominate the Startup World

A Delaware C corporation is a business entity incorporated in Delaware and taxed under Subchapter C of the IRS code. It offers:

- Separate legal identity from its owners (shareholders)

- Limited liability protection for personal assets

- Unlimited shareholders with no ownership restrictions

- Multiple stock classes, including common and preferred stock

- Perpetual existence regardless of ownership changes

- Investor preference, as VCs and angels expect this structure

Key Statistics:

- 67.6% of Fortune 500 companies are incorporated in Delaware.

- 89% of IPOs in 2019 were Delaware C-corporations.

- Most venture capital firms will only invest in Delaware C-corps.

The main tradeoff is double taxation—the corporation pays taxes on profits, and shareholders pay taxes on dividends. However, for growth-focused startups seeking outside investment, the benefits far outweigh this cost.

I’m Maurina Venturelli, and I’ve scaled startups from seed to IPO. I’ve seen how choosing the right Delaware C corporation structure is foundational for fundraising and growth. At OpStart, we help founders steer these critical financial and legal decisions, freeing them to build their business instead of managing compliance.

Handy delaware c corporation terms:

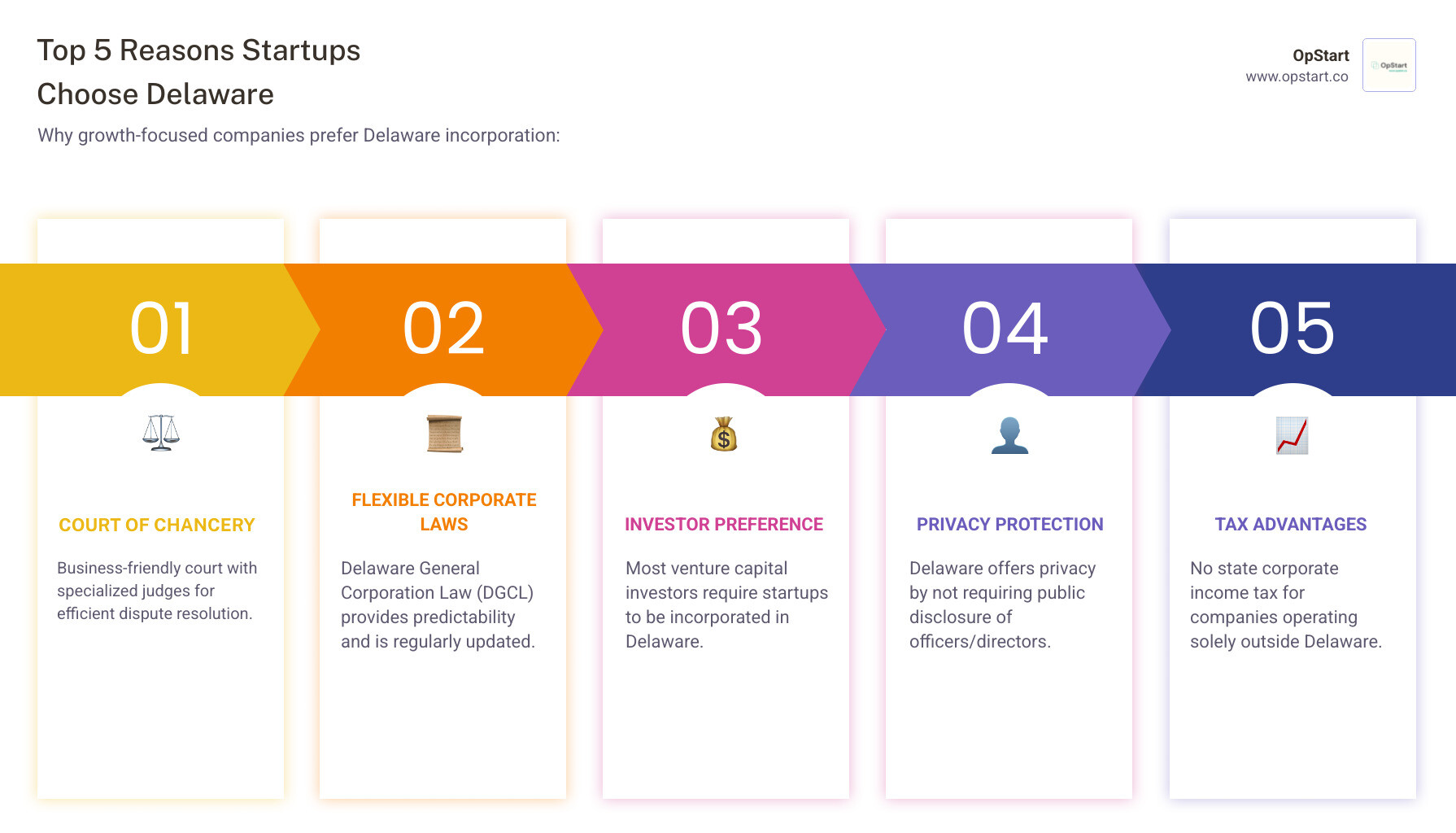

Why Delaware is the Gold Standard for Incorporation

Over two-thirds of Fortune 500 companies are incorporated in Delaware, and it’s not a coincidence. For over a century, Delaware has cultivated the most business-friendly corporate ecosystem in the U.S. If you’re founding a startup with serious growth ambitions, understanding why this small state is a corporate giant is essential.

The state’s business-friendly legal framework is centered on the Delaware General Corporation Law (DGCL). This set of corporate statutes is constantly updated to offer both predictability and flexibility—clear rules you can count on, with the freedom to structure your company in creative ways.

Delaware also offers significant privacy protection, as it doesn’t require public disclosure of officers or directors on formation documents. Furthermore, if your Delaware C corporation operates outside the state, you won’t pay Delaware state corporate income tax. For more information, visit the Delaware Courts website.

The Power of the Court of Chancery

What truly sets Delaware apart is its Court of Chancery, a specialized business court that only handles corporate disputes. There are no juries; instead, cases are heard by judges who are experts in corporate law and fiduciary duties. They understand the nuances of corporate governance, shareholder rights, and complex financial structures in a way general courts cannot.

This expertise has created a deep body of corporate case law, providing clear guidance on how corporate law is interpreted. When making a critical board decision, your lawyer can point to specific precedents, leading to efficient dispute resolution and predictable legal outcomes. This certainty is invaluable when making high-stakes decisions about your company’s future.

Best Investor Appeal

Most venture capitalists will insist on a Delaware incorporation. This isn’t an arbitrary preference; it’s a practical requirement in the startup world. Most VC firms will only invest in Delaware C corporations for several key reasons.

First, there’s familiarity for investors. The entire startup ecosystem—lawyers, investors, and financial institutions—knows Delaware corporate law. This familiarity speeds up fundraising and reduces legal costs during due diligence.

Second, Delaware’s flexible stock structures are essential for venture deals. The law allows for multiple classes of stock, making it easy to issue preferred stock with special rights like liquidation preferences and anti-dilution provisions. Structuring these complex deals is straightforward in Delaware, whereas other states can create complications.

Finally, Delaware provides a straightforward path to IPO. Public markets, underwriters, and securities lawyers all expect Delaware corporations. The state’s robust legal framework gives public investors confidence and smooths the transition from a private to a public company.

Incorporating in Delaware signals to investors that you understand how serious startups operate and removes potential friction from future fundraising.

How to Form and Maintain Your Delaware C Corporation

Deciding on a Delaware C corporation is a great first step. Now for the practical part: forming the company and keeping it in good standing. The process is well-established and straightforward with the right guidance.

Step-by-Step Formation Process

Here’s a roadmap to get your Delaware C corporation running:

- Choose a unique name. Check for availability on the Delaware Division of Corporations website and consider reserving it.

- Appoint a Delaware registered agent. Delaware law requires every corporation to have a registered agent with a physical address in the state to receive legal documents. You’ll likely hire a service for this.

- File your Certificate of Incorporation. This is your company’s birth certificate, filed with the Delaware Secretary of State. It includes your name, registered agent, and authorized shares. Find forms and instructions on the Delaware Division of Corporations website.

- Draft corporate bylaws. These are your internal operating rules for governance, meetings, and board responsibilities. They are not filed with the state but are legally crucial.

- Appoint initial directors and officers. Formally appoint your board and officers (CEO, CFO, Secretary), who will have fiduciary duties to the corporation.

- Issue founder stock. This step formalizes ownership by documenting who owns what percentage of the company, typically in exchange for cash, IP, or services.

- Get an Employer Identification Number (EIN). This is your company’s federal tax ID number, necessary for banking, taxes, and hiring. You can apply for free on the IRS website.

If you operate in other states, you must also comply with their local regulations through a process called foreign qualification.

Ongoing Compliance for a Delaware C Corporation

Incorporation is just the beginning. Ongoing compliance is essential to protect the limited liability shield your corporation provides.

- File an annual report by March 1st. This updates your company’s basic information with the state.

- Pay the Delaware Franchise Tax by March 1st. The minimum is $400 plus a $50 filing fee, but it can be much higher depending on your authorized shares. Use Delaware’s online calculator to estimate this cost.

- Maintain your registered agent. You are required to have a registered agent in Delaware at all times.

- Hold board meetings and keep minutes. This paperwork demonstrates that your corporation is a separate legal entity, which is critical for maintaining limited liability protection.

- Foreign qualify where you do business. If your Delaware C corporation operates in other states, you must register as a foreign corporation in those jurisdictions.

- File your Beneficial Ownership Information Report. The Corporate Transparency Act requires most corporations to report information about their beneficial owners to FinCEN. Learn more about this at Beneficial Ownership Information Reporting.

Keeping up with these requirements can be overwhelming. That’s why OpStart’s services are designed to handle these compliance tasks, allowing founders to focus on building their companies, not on corporate formalities.

C-Corp vs. Other Business Structures

Choosing the right legal structure is like picking a foundation for a house—it must support your current needs and future growth. While the Delaware C corporation is the standard for venture-backed startups, it’s not the only option. Understanding the alternatives helps you make an informed decision. For a deeper dive, explore our guide on Startup Legal Entity.

Delaware C-Corp vs. LLC

The Limited Liability Company (LLC) is popular for businesses not seeking venture capital. Both offer liability protection, but key differences lie in taxation, management, and ownership.

- Taxation: A Delaware C corporation faces double taxation (at the corporate level and again on shareholder dividends). An LLC offers pass-through taxation, where profits pass directly to owners’ personal tax returns without a corporate-level tax.

- Management & Ownership: C-corps have a formal structure of shareholders, directors, and officers. They can issue multiple classes of stock, which is ideal for investors. LLCs are more flexible but use membership interests instead of stock, which complicates raising capital.

- Fundraising: If you plan to raise venture capital or go public, a C-corp is essentially required. VCs are structured to invest in corporations with preferred stock, a feature LLCs don’t easily accommodate.

- Formalities: C-corps require annual meetings, minutes, and other administrative tasks. LLCs have a much lower compliance burden.

The bottom line: An LLC may be perfect for a lifestyle business. But for rapid growth, venture capital, or an IPO, the Delaware C corporation is the clear choice. Learn more in our guide on Choosing Your Business Structure: C-Corp vs. LLC.

Delaware C-Corp vs. S-Corp

An S-Corp is not a legal entity but a tax designation an eligible corporation can elect. Its main appeal is pass-through taxation, avoiding the C-corp’s double taxation.

However, S-Corps come with strict restrictions that make them unsuitable for most startups:

- Shareholder Limits: You are limited to 100 shareholders, who must generally be U.S. citizens or residents. This restricts foreign investment and large employee stock pools.

- Single Class of Stock: S-Corps can only issue one class of stock. This is a dealbreaker for VCs, who require preferred stock with special rights.

Because of these limitations, venture capital firms will not invest in S-Corps. If you plan to raise institutional money, you must be a Delaware C corporation. While S-Corps can work for small, U.S.-based businesses with no plans for outside equity, the C-corp structure is built for ambitious startups.

Financial and Governance Deep Dive

Once you’ve formed your Delaware C corporation, you must understand the financial and governance responsibilities that come with it. Getting these fundamentals right early saves significant headaches later. For comprehensive support, see our Startup Accounting Services: What Founders Need to Know.

Key Tax Implications for a Delaware C Corporation

Let’s address double taxation. A Delaware C corporation pays federal corporate income tax (currently 21%) on its profits. If those profits are distributed as dividends, shareholders pay personal income tax on them. However, this is often not a deal-breaker for startups.

First, legitimate business expenses—including salaries, rent, and marketing—are deductible, reducing taxable income. C-Corps can also deduct the full cost of employee benefits like health insurance, a significant advantage.

More importantly, most early-stage startups don’t issue dividends. They retain earnings to reinvest in growth, such as product development, hiring, and expansion. These retained earnings are only taxed at the corporate level. This means double taxation is often more theoretical than practical in the early years.

While a Delaware C corporation that doesn’t operate in Delaware generally won’t owe state income tax there, you will owe taxes in the states where you have a physical presence or “nexus.” Even pre-revenue companies must file annual federal and state tax returns. Our Taxes for Startups services can handle these complexities for you.

Raising Capital and Structuring Ownership

This is where the Delaware C corporation truly excels and why most venture-backed founders choose it. Its structure is built for raising capital.

Ownership is divided into shares of stock, making it simple to bring on new investors. C-Corps can issue both common stock (typically for founders and employees) and preferred stock (the standard for VCs).

Preferred stock comes with special rights that protect investors, such as liquidation preferences (getting their money back first in an exit) and anti-dilution provisions. Delaware law allows for “Blank Check Preferred Stock,” enabling your board to create new series of preferred stock with custom terms without needing a shareholder vote each time, which streamlines fundraising.

An employee stock option pool is another key tool for attracting talent by offering equity. All of this ownership data is tracked on a capitalization table (cap table), a critical document for fundraising and strategic planning.

The C-corp structure is what investors expect and trust. It provides a familiar, flexible framework for growth. Our Fractional CFO Services for Startups provide expert guidance on these matters without the cost of a full-time executive.

Frequently Asked Questions about Delaware C-Corps

Founders often have the same questions when considering a Delaware C corporation. Let’s clear up the most common concerns.

Do I need to live or do business in Delaware to form a corporation there?

No. You do not need to live, work, or have any physical presence in Delaware to incorporate there. This geographic flexibility is a major advantage.

The only in-state requirement is to maintain a registered agent with a physical Delaware address. This agent acts as your official point of contact for legal documents. However, you must still “foreign qualify” (register your Delaware entity) in any state where you conduct business to remain compliant.

What is a registered agent and why do I need one?

A registered agent is a person or company designated to receive official legal documents on behalf of your Delaware C corporation, such as court summons or tax notices. Delaware law requires every corporation to have one.

The agent must have a physical street address in Delaware and be available during business hours. This ensures your company can always be reached for legal purposes. Most startups operating outside Delaware hire a professional registered agent service, which typically costs $50 to $200 per year.

Is a Delaware C-Corp expensive to maintain?

Maintaining a Delaware C corporation costs more than an LLC, but whether it’s “expensive” depends on your goals. The primary costs include:

- Delaware Franchise Tax: Due annually by March 1st, this has a minimum of $400 plus a $50 filing fee but can be significantly higher based on your authorized shares.

- Registered Agent Fee: Typically $50 to $200 annually.

- Compliance Costs: Professional legal and accounting support is often needed to maintain corporate formalities like board minutes and annual reports.

- Foreign Qualification Fees: Each state where you operate will have its own registration and annual fees.

While an LLC is cheaper, these C-corp costs are a necessary investment for startups planning to raise venture capital. The ability to attract investors and scale effectively typically far outweighs these annual expenses. OpStart helps manage these requirements at a predictable flat rate, turning compliance into a manageable part of your operations.

Is a Delaware C-Corp Right for Your Startup?

After exploring the legal framework, formation process, and compliance requirements, the final question is: is a Delaware C corporation the right choice for your startup?

The structure is a powerful tool built for a specific purpose: helping ambitious startups raise capital, scale rapidly, and achieve a successful exit through acquisition or IPO. If you’re building a lifestyle business you plan to bootstrap, an LLC’s simplicity is likely a better fit. But if you’re aiming to disrupt an industry with the help of outside funding, the Delaware C corporation is almost certainly your best bet.

The ideal founder for a Delaware C-Corp is one who:

- Plans to seek venture capital or angel investment.

- Wants to offer equity compensation to attract top talent.

- Needs multiple classes of stock for different investors.

- Is prepared for the corporate formalities and compliance requirements.

Investors expect it, the legal system supports it, and the structure is designed for growth. The double taxation and administrative costs are the price for access to venture funding, strong liability protection, and a clear path to scale.

Expert guidance is critical. I’ve seen founders make costly mistakes by choosing the wrong structure or failing to maintain compliance. At OpStart, we provide comprehensive financial operations—from accounting and tax to CFO support—at a flat rate. We handle the back office so you can focus on building your product.

Think of us as your financial co-pilot. We’ll help you make the right choice, manage compliance, and provide strategic guidance as you scale. We’ve helped hundreds of startups steer this journey and know the pitfalls to avoid.

Ready to decide? Explore our guide on Choosing Your Business Structure: C-Corp vs. LLC for a deeper comparison. If you’re ready to discuss your specific situation, we’re here to help set your startup on the path to success.