Beyond the Numbers: How Finance Drives Business Success

How does the finance function contribute to the business? This question reveals a fundamental shift in modern companies. Today, finance contributes through strategic decision-making, operational efficiency, risk management, and value creation—far beyond traditional bookkeeping.

Key contributions include:

- Strategic Decision Support: Providing data for marketing, expansion, and investment decisions.

- Financial Planning & Forecasting: Creating budgets, cash flow projections, and growth scenarios.

- Risk Management: Identifying financial risks and developing mitigation strategies.

- Operational Efficiency: Streamlining processes and optimizing resource allocation.

- Stakeholder Relations: Managing investor communications and regulatory compliance.

- Value Creation: Evolving from a cost center to a profit driver through strategic insights.

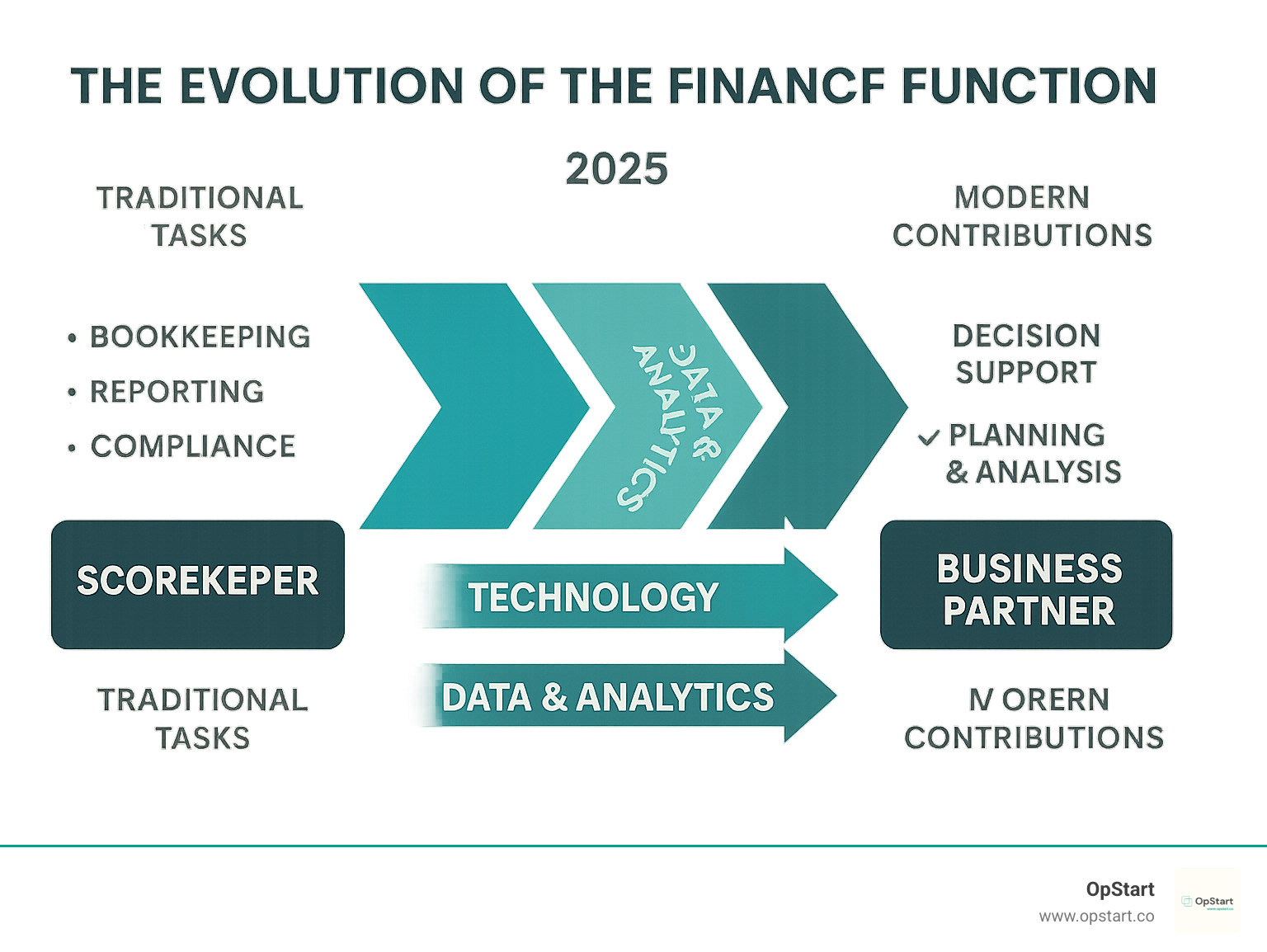

The days of finance as a mere “scorekeeper” are over. Companies with strong financial foundations consistently outperform peers, especially during downturns like the dot-com bubble and the 2008 financial crisis. As one expert notes, “The survivors of market downturns weren’t necessarily the companies with the best products, but those with the strongest financial foundations.”

While 76% of CFOs report increasing pressure to drive growth and efficiency, only 16% of finance leaders feel their function delivers best-in-class performance. This gap highlights a massive opportunity for businesses that transform finance from transactional to strategic.

I’m Maurina Venturelli, and I’ve helped companies like Sumo Logic build growth engines that contributed 20% of total ARR through strategic financial planning. Understanding how does the finance function contribute to the business has been central to every successful company I’ve worked with.

The Bedrock: Mastering Core Financial Operations

Before a business can focus on growth, it needs rock-solid financial operations. This is how does the finance function contribute to the business at its most fundamental level—it’s the engine room that powers everything. Without accurate books, compliant processes, and smooth cash flow, even the best ideas fail. This foundational work is managed by two key roles: the Controller and the Treasurer.

The Controller: Guardian of Financial Accuracy

The Controller is your financial truth-teller, ensuring every dollar is tracked and every report is accurate. Their core responsibilities include:

- Financial Reporting: Producing the monthly, quarterly, and annual financial statements that form the basis for all strategic decisions.

- Accounting Activities: Overseeing all transactions, including payroll, to ensure they are recorded properly and consistently.

- Cash Flow Management: Managing accounts payable (what you owe) and accounts receivable (what customers owe you) to maintain healthy liquidity.

- Tax Compliance: Ensuring all taxes—from sales tax to corporate income tax and R&D credits—are calculated, filed, and paid on time.

- Internal Controls: Establishing systems and processes to safeguard assets and prevent fraud. For guidance, see Startup Accounting Services: What Founders Need to Know.

The Treasurer: Manager of Liquidity and Capital

While the Controller looks backward at what happened, the Treasurer looks forward. Their primary focus is ensuring the business has enough liquid assets to meet obligations and seize opportunities. Key duties involve:

- Cash and Liquidity Management: Monitoring cash flow and managing banking relationships to secure favorable terms and lines of credit.

- Capital and Debt Structuring: Finding the best financing terms for operations or expansion and deciding how to fund growth, whether through debt, equity, or retained earnings.

- Investment Strategy: Investing excess funds to ensure idle cash is working for the business. The Treasurer’s expertise in Cash Flow Analysis is vital here.

Business Finance vs. Personal Finance: Why the Difference Matters

Understanding the distinction between business and personal finance clarifies the value of a dedicated finance function. Business finance operates on a much larger scale, managing complex transactions and multiple stakeholder interests. It steers a stricter regulatory environment and accepts a higher risk profile to drive growth. Unlike personal finance, which often has a long-term, conservative focus, business finance must balance immediate operational needs with long-term strategic goals, using sophisticated measurement systems to track performance.

Essential Day-to-Day Contributions

Beyond these strategic roles, the finance function handles countless daily tasks that keep operations running. This includes processing payroll and employee expense claims, managing pension funds, and coordinating tax activities. A constant focus on cost control and process efficiency is paramount. By continuously looking for ways to streamline operations and eliminate waste, the finance function can open up significant savings, reinforcing the value highlighted in 8 Ways a Great Bookkeeper Pays for Themselves (and Then Some). These foundational tasks enable every other part of the business to succeed.

From Scorekeeper to Strategist: How the Finance Function Contributes to the Business

This is where the finance function transforms from a reactive cost center to a proactive driver of value, shaping the company’s future through insight and guidance.

Once the basics are mastered, the real change begins. This is how does the finance function contribute to the business in a way that moves beyond number-crunching. Instead of just reporting on the past, we help decide what happens next, upgrading the business from a rearview mirror to a GPS.

Building the Blueprint: Financial Planning and Budgeting

Every successful business needs a roadmap, which is what financial planning provides. By analyzing historical data, we create pro forma statements and model different scenarios to understand potential outcomes. This process involves a deep dive into your cash flow statements to prepare for variables like sales fluctuations or late payments. As President Eisenhower said, “plans are worthless, but planning is everything.” The value is in the strategic thinking, not a static document.

Budgeting translates this plan into actionable, measurable targets for your teams. Forecasting keeps the plan nimble, allowing us to adjust projections as new information comes in, so you always make decisions based on the most current data available. The key elements in a financial plan are living documents that evolve with your business.

How the finance function provides essential information for decision-making

One of the most powerful contributions of the finance function is serving as a trusted advisor for every major decision. We partner with departments to turn ideas into data-driven strategies.

- Marketing Support: We help set campaign budgets, track spending, and calculate Return on Investment (ROI) to provide actionable insights for future initiatives.

- Growth Opportunities: When considering expansion or a new product, we analyze potential costs, break-even points, and sales forecasts. For example, a growing manufacturer might need a mix of loans and credit lines, which we help orchestrate.

- Adapting to Economic Changes: During downturns, we develop survival strategies, identifying cost cuts that don’t harm long-term growth and optimizing cash flow to weather the storm.

- Investment Analysis: For major purchases, we use tools like NPV (Net Present Value), IRR (Internal Rate of Return), and Payback Period to determine if an investment will be profitable. We also conduct make-vs-buy analysis to guide outsourcing or hiring decisions.

How the finance function offers strategic advice

This is where finance becomes a true strategic partner. We provide guidance on the critical financial decisions that shape your company’s future.

- Funding Strategy: We identify the right mix of debt financing (loans) and equity financing (investors) for your growth stage and industry, leveraging experience in fundraising in today’s market.

- Cash Flow Optimization: We develop strategies to improve liquidity, such as negotiating better payment terms with suppliers or offering early payment discounts to customers.

- Cost Reduction: We analyze expenses to find inefficiencies, whether through renegotiating contracts, streamlining processes, or adopting new technology.

- Capital Allocation: We help evaluate competing priorities—new equipment, team expansion, product development—to ensure financial resources are deployed for maximum impact.

- Risk Management: We identify and create frameworks to manage financial risks like market volatility or credit issues, turning risk mitigation into a strategic advantage.

The Modern Finance Team: Strategic Leadership and Value Creation

Leadership in finance is about steering the ship, not just counting the cargo. The CFO and VP of Finance are the strategic architects of the company’s financial future.

Today’s CFOs and VPs of Finance are strategic architects who shape their company’s destiny. They don’t just manage money—they create value, drive growth, and turn financial data into a competitive advantage. They ask not just “How much did we spend?” but “How can we invest this to create the most value?”

The Strategic Role of the CFO and VP of Finance

The CFO is the ultimate financial strategist, setting policy on working capital, capital structure, and major budgeting decisions. Increasingly, the CFO role is evolving into that of a Chief Value Officer (CVO), an orchestrator of value who transforms data into actionable insights and aligns decisions with the organization’s long-term purpose.

The Vice President of Finance (VP-F) reports to the CFO and bridges day-to-day operations with long-term strategy, ensuring alignment between operational tasks like budgeting and strategic advisory work. This balance is crucial because how does the finance function contribute to the business depends on leaders who can manage both immediate needs and future planning.

Both roles are critical in stakeholder engagement and investor relations, telling the company’s financial story to build confidence and attract capital. Yet, only 51% of CFOs believe their company provides relevant reporting on ESG risks, a gap that presents a major opportunity for forward-thinking leaders. Our guide on Fractional CFO vs. Bookkeeper vs. CPA: What’s the Difference? can help businesses find the right level of leadership.

5 Ways Finance Drives Value Creation

Modern finance teams drive real value in five key ways:

- Performance Management: We develop KPIs aligned with strategic goals and collaborate with departments on action plans to drive improvement.

- Insightful Management Reporting: We create reports with deep insights into financial health and profitability trends, empowering leaders to make better decisions.

- Dynamic Planning and Forecasting: We analyze data to forecast performance under various scenarios, helping the business adapt quickly to market changes.

- Cost and Profitability Analysis: By examining costs and revenue streams, we determine true profitability at a granular level to drive better pricing and growth strategies.

- Driving Change: We streamline and automate processes, adopting new technologies to cut costs, improve data quality, and drive organizational efficiency.

As Sachin K Sheoran notes, finance teams that master these areas don’t just support the business—they actively shape its success.

Fueling the Future: The Impact of Technology and Data Analytics

Technology is the catalyst changing the finance function, automating the mundane and empowering teams to focus on high-impact analysis and strategy.

We’re in a finance revolution. Technology is fundamentally reshaping how does the finance function contribute to the business, changing it from a back-office necessity into a strategic powerhouse.

The Tech-Enabled Finance Function

Modern finance functions accept automation to handle tedious tasks like data entry and reconciliations. This frees up professionals to focus on strategic analysis. Data analytics has become a secret weapon, allowing us to spot trends and uncover insights that drive business decisions. For example, one company used a data model to achieve a 36% improvement in EBIT forecasting accuracy.

Artificial Intelligence (AI) and machine learning identify opportunities and risks that humans might miss. A grocery chain used AI to improve its out-of-stock detection by 14 times, directly boosting profitability. The demand for real-time insights is also driving change, enabling immediate process optimization across the organization based on current performance data.

Key Priorities for a Modern Finance Team

Today’s finance teams have moved beyond cost control to value creation. Key priorities include:

- Investing in automation and data analytics as an essential foundation for efficiency and insight.

- Funding growth ambitions by accessing capital markets and managing working capital effectively.

- Establishing finance as a business partner that collaborates with and challenges other departments to drive strategy forward.

- Proactive stakeholder engagement, serving as an “insights center of excellence” that crafts compelling corporate stories for investors and customers.

- Dynamic business planning and scenario testing using rolling forecasts to pivot quickly in response to market changes.

The Evolving Skillset

The finance professional of today is different. Digital skills are now essential, requiring comfort with data analytics tools, AI, and ERP systems. Professionals must think like data scientists, drawing conclusions from complex datasets.

However, tech skills aren’t enough. Strong communication abilities are crucial for explaining complex financial concepts and influencing decisions. Strategic thinking—understanding the broader business and market dynamics—is also a must-have. Finally, with only 51% of CFOs confident in their ESG reporting, skills in this area represent a huge opportunity to add value. The finance professionals who combine traditional expertise with these new capabilities will drive future business success.

Frequently Asked Questions about the Finance Function’s Contribution

When business owners think about how does the finance function contribute to the business, they often have practical questions. Here are the most common ones.

What is the primary role of the finance function in a business?

The finance function wears two hats. First, it’s the guardian of financial health and compliance, handling foundational work like accounting, reporting, and cash management to ensure stability. Second, it’s a strategic partner driving value creation. It analyzes data to support critical decisions, creates financial plans to fuel growth, and provides insights to steer the business. This dual role means finance doesn’t just record what happened—it helps shape what happens next.

How does finance support other departments like marketing or operations?

Finance acts as an internal financial consultant for every department. For marketing, we help set budgets and calculate campaign ROI. For operations, we analyze supply chain costs to find savings and optimize inventory to improve cash flow. For HR, we forecast the total cost of new hires and help structure compensation packages. We provide the financial lens for every major decision, turning gut feelings into data-driven strategies.

Why is the finance function evolving from a support role to a strategic partner?

This evolution is driven by two main forces. First, technology has automated many traditional bookkeeping tasks, freeing up finance professionals to focus on higher-value analysis and strategy. Second, today’s volatile business environment demands sophisticated financial guidance to steer uncertainty and capitalize on opportunities. Companies that leverage finance as a strategic partner adapt faster and make smarter decisions. It’s the difference between driving while looking in the rearview mirror and driving with your eyes on the road ahead. This is why understanding how does the finance function contribute to the business is so critical for modern leaders.

Conclusion: Your Strategic Financial Heartbeat

The question of how does the finance function contribute to the business reveals that finance is no longer just about crunching numbers. It’s about making those numbers work for your strategic goals, turning data into decisions that drive real growth.

Think of your finance function as the strategic heartbeat of your organization. It pumps vital insights and capital to every department, keeping the business healthy and ready for what’s next.

This change begins with operational excellence—accurate books and predictable cash flow—which creates the foundation for strategic thinking. From there, finance evolves into a strategic force, providing the blueprint for growth, helping other departments make smarter financial decisions, and offering trusted advice on everything from product launches to market expansion.

Technology and data analytics are fueling this evolution, automating routine tasks and open uping deeper insights. The result is a finance team that operates more like an internal consulting group than a traditional accounting department.

At OpStart, we’ve seen this change firsthand. We understand that startups need finance as a business partner, not just a compliance function. Our comprehensive financial operations services—including accounting, tax, and CFO support—are designed to give you that strategic edge from day one, enabling growth rather than constraining it.

In today’s market, your finance function is your competitive advantage. It’s what separates companies that merely survive from those that truly thrive. Your business deserves a finance function that acts as its strategic heartbeat, powering growth at every stage.