Why Smart Founders Are Turning to the Research and Development Tax Rebate

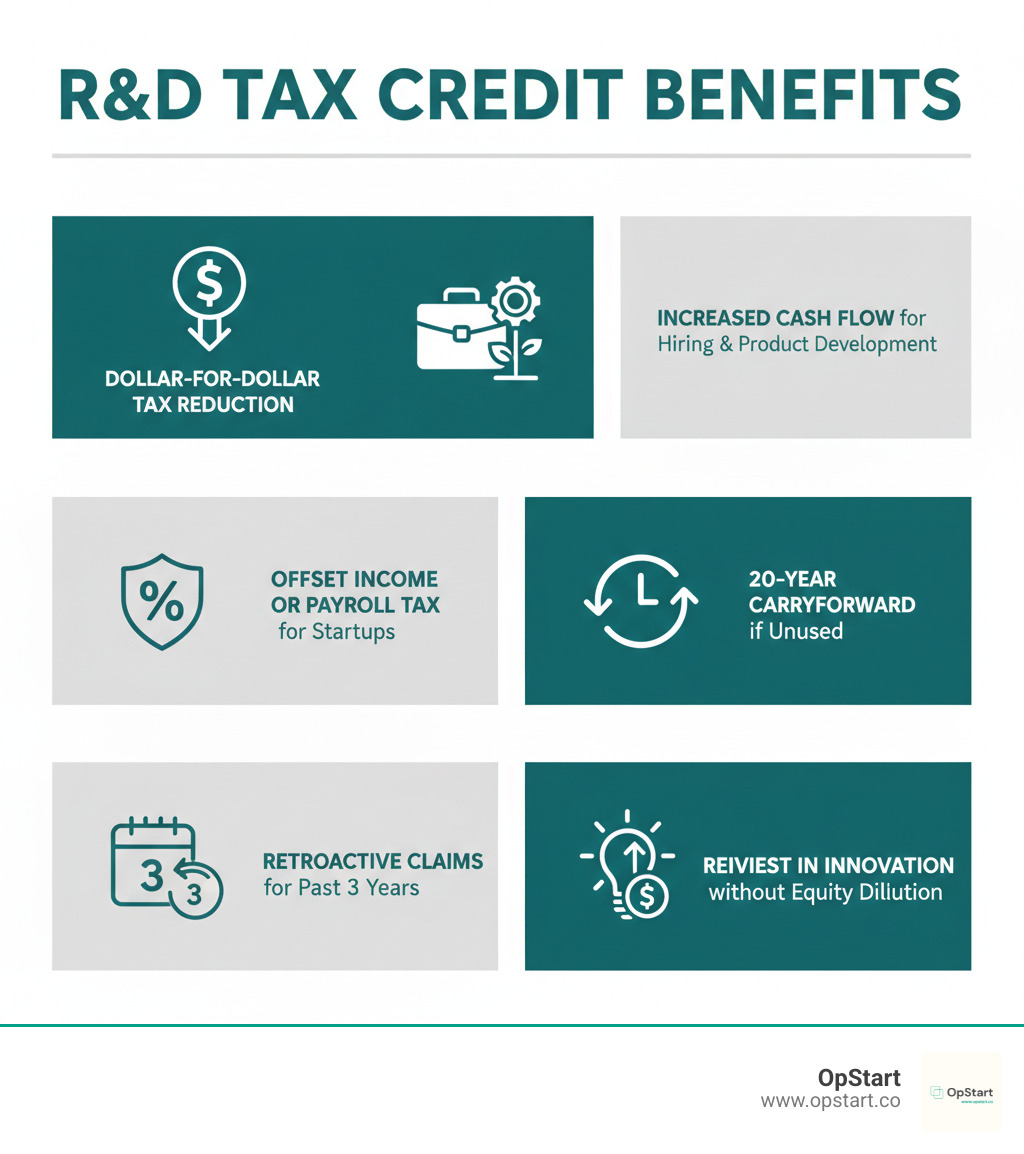

The research and development tax rebate is a federal tax credit under Internal Revenue Code Section 41, offering dollar-for-dollar tax savings for companies with qualifying R&D activities in the U.S. Here’s what you need to know:

- What it is: A tax credit offering up to 12-16% of qualified R&D expenses back as federal and state credits.

- Who qualifies: Any business developing, designing, or improving products, processes, formulas, or software.

- Key benefit: Reduces tax liability or, for qualified startups, offsets up to $500,000 in payroll taxes annually.

- How far back: You can claim credits retroactively for up to three open tax years.

- Made permanent: The PATH Act of 2015 made the credit permanent, expanding access for small businesses.

The R&D tax credit does more than save on taxes; it boosts cash flow, funds innovation, and fuels growth without equity dilution or debt. For cash-burning startups, it can significantly extend their runway.

Many founders mistakenly believe this credit is only for labs or aerospace firms. However, if you’re solving technical problems, experimenting, or improving processes, you likely qualify.

As Maurina Venturelli, a growth leader who helped take companies like Sumo Logic public, I’ve seen this rebate fuel sustainable growth. Now at OpStart, I help founders leverage financial advantages like this one daily.

Simple guide to research and development tax rebate:

What Qualifies? The Four-Part Test for Eligibility

A common question about the research and development tax rebate is, “Does my work actually qualify?” Many founders picture scientists in labs, but the credit rewards a broad range of innovation. If you’re solving technical problems or improving products or processes, you likely qualify.

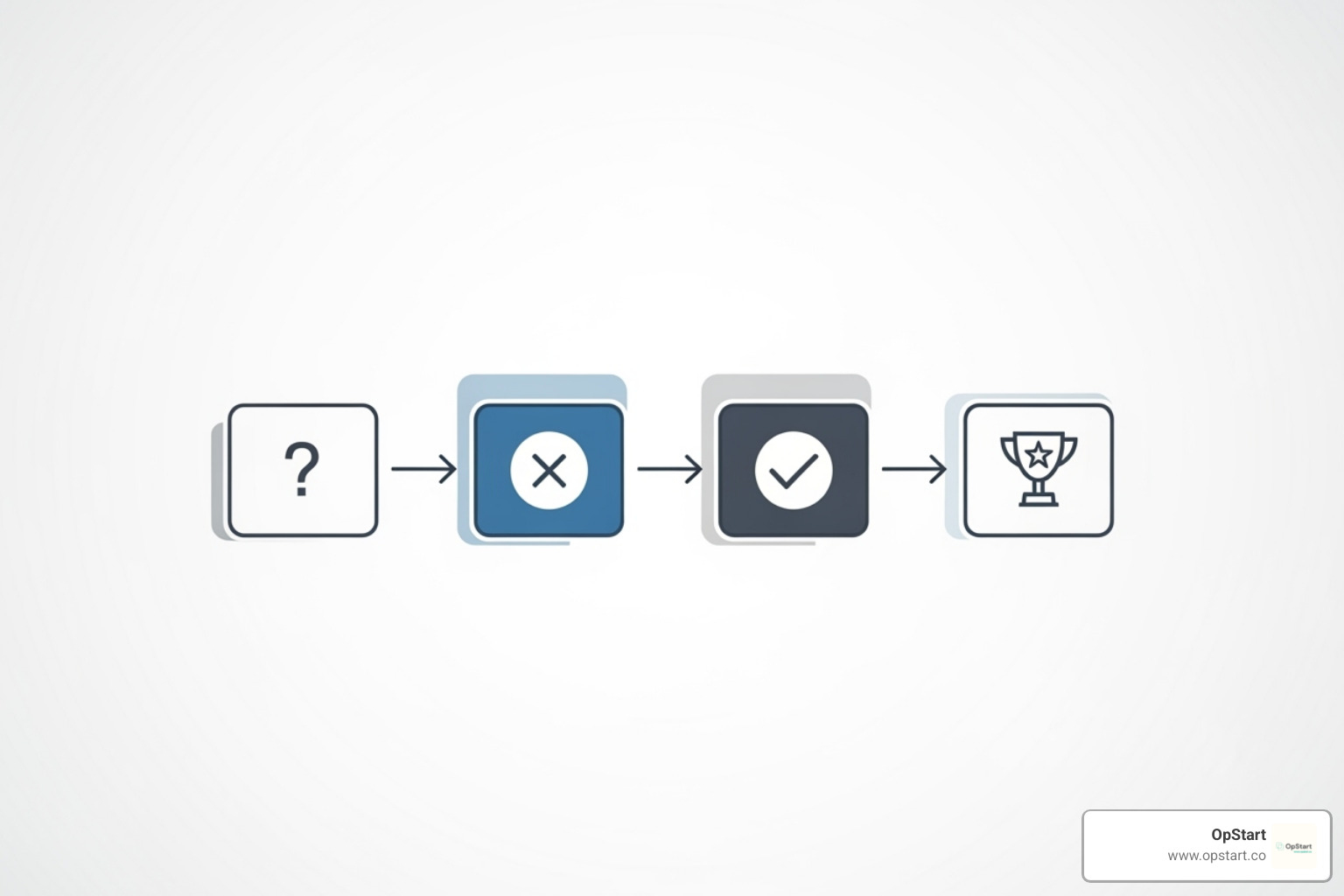

The IRS focuses on the nature of the work, not your office setup. Eligibility is determined by the “Four-Part Test,” a checklist for qualified research.

The Four-Part Test Explained

For each business component (product, process, software, etc.) you’re developing or improving, you must meet all four criteria.

The Permitted Purpose Test asks if your goal is to create a new or improved product or process by enhancing its functionality, performance, reliability, or quality.

The Technological in Nature Test requires the work to be based on principles of physical or biological sciences, engineering, or computer science. This includes applying existing principles, like writing code or designing a manufacturing process.

The Elimination of Uncertainty Test means you must be trying to eliminate uncertainty about the capability or method of developing or improving something. If the solution is known beforehand, it’s not research.

The Process of Experimentation Test requires a systematic process, such as modeling, simulation, or prototyping, to evaluate alternatives. This trial-and-error process is key to demonstrating research.

These four tests come from the R&D Tax Credit regulations under 26 U.S. Code §41. While the framework is clear, application can be nuanced, making documentation and expert guidance crucial.

Qualifying Activities and Industries

What does qualifying work look like in practice? Common activities include product development, process improvement, software development (designing, coding, testing), and prototyping (building models, testing early versions).

The credit isn’t limited to specific industries. While software and pharmaceutical firms are common, we’ve seen claims from software, manufacturing, agriculture, engineering, aerospace, pharmaceutical, and food & beverage industries. Eligibility depends on the activity, not the industry label. A winery experimenting with new grape varieties faces the same kind of technical uncertainty as a software company building a new algorithm.

Common Exclusions and Non-Qualifying Activities

It’s also crucial to know what doesn’t qualify. The IRS provides a detailed description of excluded activities. Common exclusions include:

- Research after commercial production.

- Simple adaptation of existing products for a customer.

- Reverse engineering.

- Routine testing, quality control, market research, or data collection.

- Research conducted outside the U.S.

- Research funded by another party (grants, contracts).

- Most internal use software (e.g., for HR or accounting), which has a very high bar for qualification.

When in doubt, the key question is: Are you solving a technical problem with an uncertain outcome through systematic experimentation? If so, you’re likely in qualifying territory for the research and development tax rebate.

The Financials: Your Guide to the Research and Development Tax Rebate

Understanding which expenses qualify and how the credit is calculated is key to maximizing your research and development tax rebate. This is where innovation translates into dollars back in your business.

What are Qualified Research Expenses (QREs)?

The credit is calculated from your Qualified Research Expenses (QREs)—the direct costs of your innovation work. The IRS defines qualified research expenses as in-house and contract research costs.

In-house research expenses include:

- Employee wages for those directly performing, supervising, or supporting R&D. Under the 80% rule, if an employee spends at least 80% of their time on qualified research, 100% of their wages can be included as QREs.

- Supply costs (tangible items consumed during research) and cloud computing costs for R&D activities also qualify.

Contract research expenses are costs for third-party R&D. Typically, 65% of the cost is includable as a QRE, provided you retain substantial rights to the research results.

Accurate tracking and meticulous record-keeping of these expenses are foundational for a successful claim.

How to Calculate Your Research and Development Tax Rebate

There are two methods for calculating the credit, and choosing the right one is crucial.

The Regular Credit (RC) Method offers a 20% credit on current QREs that exceed a “base amount.” This base amount calculation is complex, involving historical spending and recent gross receipts, making it difficult for newer companies.

The Alternative Simplified Credit (ASC) Method is simpler. It provides a 14% credit on current QREs that exceed 50% of the average QREs from the past three years. If there are no prior-year QREs, the credit is 6% of the current year’s QREs. The ASC method is often preferred by newer companies or those seeking a simpler calculation.

Our advice: calculate the credit using both methods to ensure you maximize your return. For detailed guidance, check out our comprehensive R&D services.

How to Claim the Credit and Look Back

To claim the credit, file IRS Form 6765, Credit for Increasing Research Activities, with your annual corporate tax return.

A key feature is the look-back period. You can claim the research and development tax rebate retroactively for up to three years by filing amended returns. This ability to amend past returns can be a game-changer for companies that previously overlooked the credit.

Unused credits don’t expire immediately; they can be carried forward for up to 20 years or back one year to offset tax liability.

While the process may seem daunting, the financial benefit is substantial. OpStart helps startups steer these complexities to capture every available dollar.

Key Considerations for Startups and Small Businesses

The PATH Act of 2015 made the research and development tax rebate permanent and created new opportunities for startups, making it a powerful growth tool, especially for pre-profit companies.

The Payroll Tax Offset: A Game-Changer for Startups

Previously, the R&D tax credit only offset income tax, making it unusable for many pre-profit startups. The payroll tax offset changed this, allowing Qualified Small Businesses (QSBs) to apply the credit against their FICA payroll tax liability for immediate cash savings.

To be a QSB, a company must have:

- Less than $5 million in gross receipts for the current tax year.

- Gross receipts for no more than five years.

Qualifying businesses can apply up to $500,000 of their R&D tax credit against payroll taxes annually. The credit is applied quarterly, a process managed with your payroll provider. The IRS provides guidance on the payroll tax credit to help. This provision is transformative, allowing early-stage companies to monetize the credit and improve cash flow. Find out if you qualify for R&D tax credits and start putting money back into your business.

Navigating Section 174 Amortization and Other Rules

The Tax Cuts and Jobs Act (TCJA) of 2017 introduced a significant complexity. Since 2022, Section 174 requires R&D expenditures to be capitalized and amortized over five years (for domestic research) or 15 years (for foreign), rather than being immediately expensed. This has increased tax bills for many innovative companies.

While there is a legislative push to reverse this, companies must currently steer its interaction with the R&D tax credit. Under Section 280C, you cannot get a double tax benefit. You must either reduce your amortized R&D deduction by the amount of the credit claimed or elect to take a reduced credit. Choosing the best option requires strategic guidance. Learn more in our article on Changes to the R&D Tax Credit: What Founders & CEOs Need to Know.

Also, explore state R&D credits, which can provide additional savings on top of the federal benefit.

Documentation and Avoiding Common Pitfalls

Proper documentation is critical, as many legitimate claims are denied due to poor record-keeping. The IRS requires a clear link between claimed expenses and qualifying R&D activities.

Good, contemporaneous documentation includes:

- Project records: R&D objectives, technical challenges, and the experimental process.

- Payroll data: Timecards and job descriptions linking employees to R&D.

- Financial records: Invoices for supplies, contracts, and cloud computing.

- Technical documents: Blueprints, patents, designs, and test results.

Common pitfalls to avoid include:

- Lack of nexus: Failing to link expenses to specific R&D activities.

- Claiming excluded activities: Such as routine quality control.

- Insufficient proof of technical uncertainty and a process of experimentation.

These requirements are manageable with the right systems. Our R&D Tax Edge service helps you build and maintain the robust documentation needed to support your research and development tax rebate claims.

Frequently Asked Questions about the Research and Development Tax Rebate

Here are answers to some of the most common questions we hear from founders about the research and development tax rebate.

How far back can I claim the R&D tax credit?

You can claim the research and development tax rebate retroactively for up to three open tax years. This is done by filing amended returns, such as IRS Form 6765, Credit for Increasing Research Activities, within the statute of limitations. If you performed qualifying R&D in recent years but didn’t claim the credit, you can still recover those funds by amending past tax returns.

Is the R&D tax credit only for tech companies?

No, this is a common myth. The R&D tax rebate is available to a wide range of industries, not just tech. While tech companies are frequent users, so are businesses in manufacturing, agriculture, architecture, food and beverage, aerospace, and pharmaceuticals.

Eligibility hinges on the activity, not the industry. If your work meets the Four-Part Test—solving technical problems through experimentation—you likely qualify, regardless of your field. The focus should always be on the qualifying activity itself.

What is the difference between an R&D deduction and the R&D credit?

Understanding the difference between a deduction and a credit is key for tax planning. A deduction reduces your taxable income, while a credit provides a dollar-for-dollar reduction of your tax bill. A credit is generally more valuable.

The Section 174 R&D deduction (now an amortization) lowers your taxable income. For example, a $50,000 deduction in a 21% tax bracket saves you $10,500. In contrast, a $50,000 research and development tax rebate under Section 41 reduces your tax bill by the full $50,000.

You can’t double-dip. Section 280C requires you to either reduce your R&D deduction by the credit amount or take a reduced credit. The best strategy depends on your specific situation, but claiming the full credit is often more beneficial. We help startups steer these rules to maximize savings. Learn more about changes to the R&D tax credit or see if you qualify for R&D tax credits.

Maximize Your Innovation and Your Return

The research and development tax rebate is a powerful, long-standing tool designed to fuel American innovation. It’s more than a line item on a tax return; it’s a strategic asset for growth.

This guide covered the key requirements: the Four-Part Test, qualified expenses, calculation methods, the startup payroll tax offset, and complex rules like Section 174 amortization. Despite its value, this incentive is widely underused. Founders often mistakenly disqualify themselves, overlook the three-year look-back period, or try to steer the complex rules alone, leaving significant capital on the table.

This rebate extends your runway without equity dilution, funds new hires and tools, and provides the financial breathing room to innovate.

At OpStart, we understand startup challenges. Our hands-free, flat-rate financial operations service lets you focus on your product and customers, not tax code. We manage the complexities for you, integrating with your preferred software.

Our team does more than file forms. We identify all qualifying activities, maintain audit-proof documentation, and calculate the maximum possible credit, handling the entire process so you can focus on growth.

If you’re innovating, you’re likely eligible for unclaimed tax credits. Don’t leave capital on the table that could fuel your growth.

See if you qualify for R&D tax credits and find how much you could be saving. Your innovation deserves every advantage—and the research and development tax rebate is one of the most significant advantages available.