Why Every Startup Needs a Budget Template to Survive and Thrive

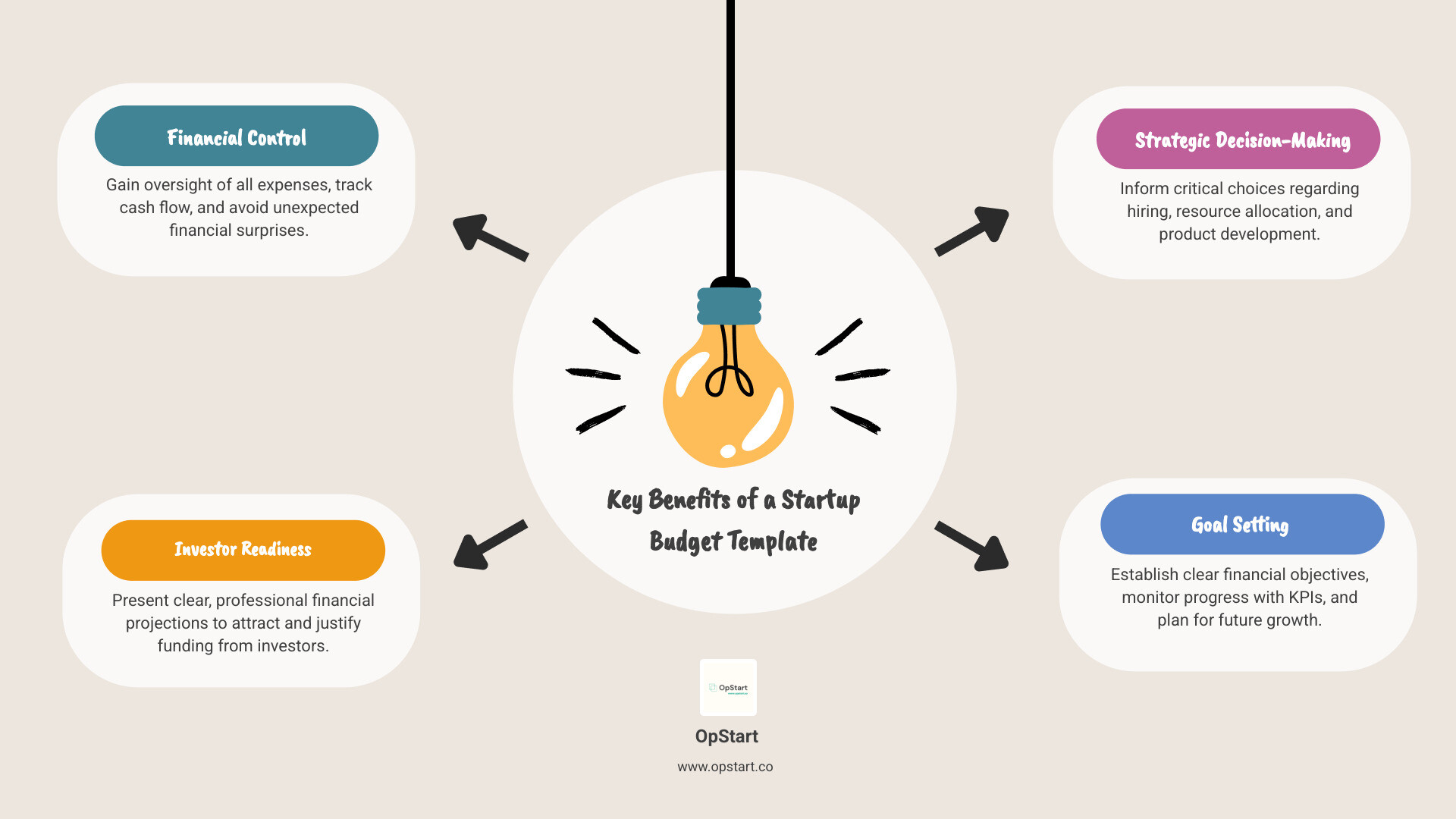

A startup budget template is a financial roadmap for planning expenses, tracking cash flow, and making strategic decisions.

Key Components of a Startup Budget Template:

- Revenue projections – realistic estimates of incoming cash

- Expense categories – fixed costs (rent, salaries) and variable costs (marketing, supplies)

- Cash flow projections – monthly inflows and outflows

- Funding sources – VC, loans, grants, personal investment

- Key performance indicators (KPIs) – metrics like burn rate and runway

Many startups underestimate initial costs. A budget acts like the “Yoda of your new business,” ensuring you have enough cash to cover early operating expenses and providing a reality check on your spending.

Without a budget, you’re flying blind. A profitable business can still fail if it runs out of cash. A good budget is a sanity check for your business model and a tool to attract investors.

You don’t need to be a finance expert. The right template helps you build a financial foundation to guide your decisions.

I’m Maurina Venturelli. I’ve helped high-growth companies like Sumo Logic build financial frameworks for scaling. I’ve seen how a solid startup budget template turns financial chaos into a strategic advantage.

Step 1: Choose a Template & List All Expenses

Think of your startup budget template as a roadmap for a cross-country trip. You wouldn’t just drive; you’d plan your route and budget for gas.

You don’t need expensive software. Excel or Google Sheets are perfect for most startups—they’re accessible, customizable, and often free.

Before entering numbers, gather your information. Review your business plan and market research, and list every potential expense. Don’t worry about organization yet; just get it all down. The more thorough you are now, the fewer surprises you’ll face later. For help with initial records, see our guide on Bookkeeping Needs for Startups.

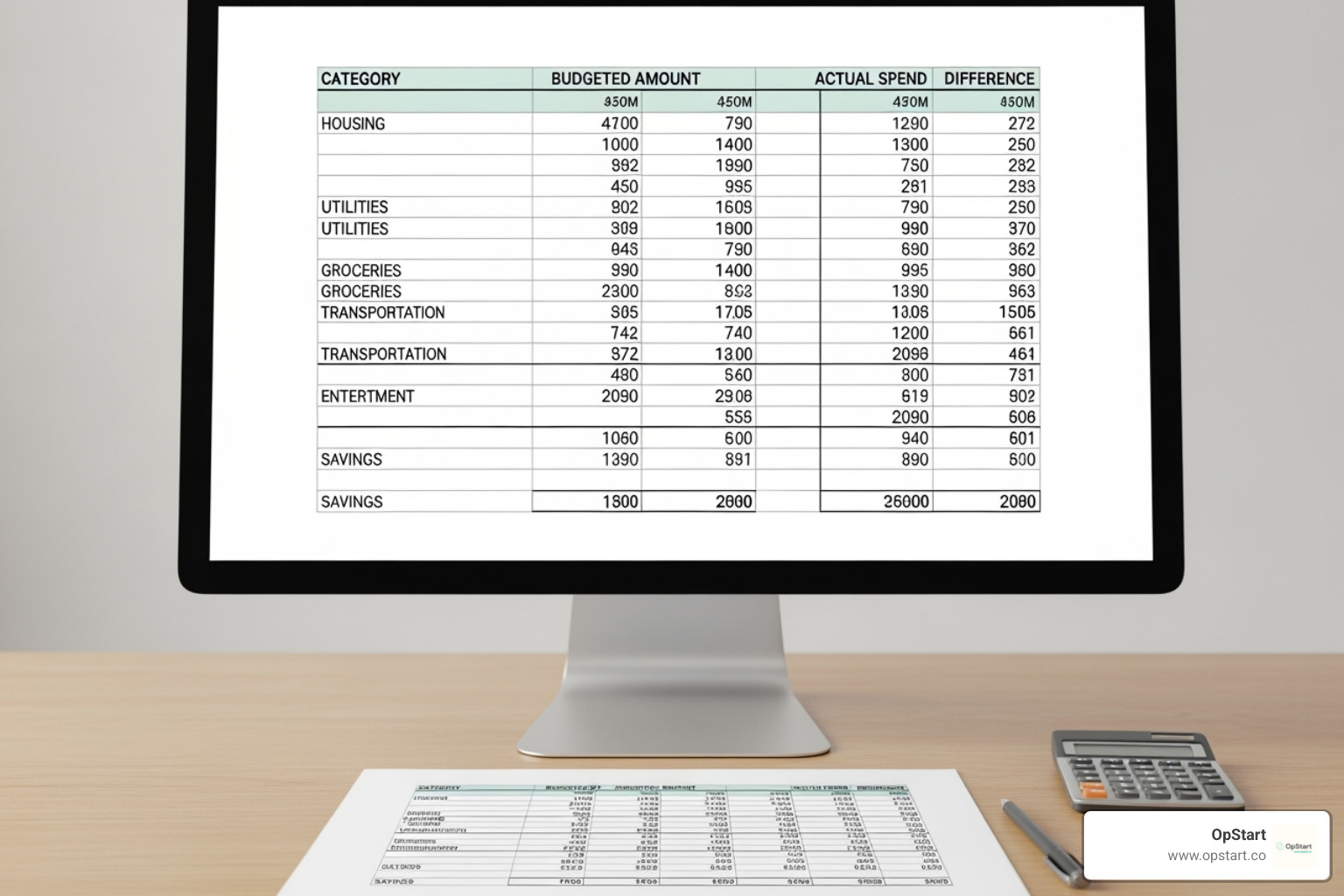

Next, differentiate your cost types. Fixed costs (like rent) stay the same, while variable costs (like advertising) change with business activity. One-time costs are initial investments, and recurring costs are your monthly bills.

Types of Startup Budget Templates

- A static budget template provides a big-picture, annual view, ideal for businesses with multiple revenue streams.

- An overhead budget template focuses on indirect costs like utilities and insurance, which are easy to forget but add up. It’s especially useful for service-based businesses.

- The cash flow budget template tracks the timing of money in and out, which is crucial for avoiding cash shortages. It’s valuable for businesses with seasonal or irregular income.

- Startup-specific templates are best for most new entrepreneurs. They focus on the first year and include launch-specific costs. You can use this Simple Startup Budgeting Template or, for more detail, this Startup Expenses Template.

A Checklist of Common Startup Costs

Many founders forget small expenses that accumulate. Here are the common categories:

- Legal and administrative fees: Business registration, licenses, permits, and legal advice. Business insurance is also crucial.

- Technology and software costs: Website hosting, accounting software, CRM, and hardware. Your old college laptop may not be sufficient.

- Office space and utilities: Even if you start at home, plan for future dedicated space. Business utilities can cost around $2 per square foot.

- Salaries and labor: Often 25-50% of your total budget. Remember to budget for your own salary, payroll taxes, benefits, and any freelancers.

- Marketing and sales expenses: Investments in growth, from logo design to digital ads. Customers can’t buy if they don’t know you exist.

- Inventory and cost of goods sold: For product businesses, this includes raw materials, manufacturing, packaging, and shipping.

- Professional services: Accounting and bookkeeping are essential for compliance and informed decisions. At OpStart, we handle these operations so you can focus on your business. Also, check our guide on Business Startup Tax Deductions for potential savings.

Step 2: Project Revenue & Identify Funding Sources

After mapping out expenses, we turn to revenue and funding. This step requires a balance of optimism and realism. Avoid creating hockey-stick projections that investors will see right through.

A solid approach is key. Top-down forecasting, which starts with the total market size and estimates your share, is often unreliable for early-stage planning.

Bottom-up forecasting is more trustworthy for your startup budget template. It builds projections from specific metrics like customer acquisition channels, conversion rates, and pricing. For example, if you can acquire 50 customers per month at a 3% conversion rate, and each pays $100 monthly, you have concrete numbers.

How to Realistically Project Your Revenue

Make educated assumptions based on research, not wishful thinking.

First, understand your revenue model. SaaS businesses focus on MRR and churn. E-commerce companies project sales volume and average order value. Service businesses consider billable hours and client retainers.

Use industry benchmarks to gain perspective on what’s achievable. Research similar businesses to understand their sales cycles and early growth.

Base growth targets on your marketing efforts and operational capacity. Don’t expect viral growth from minimal effort. For insights on modern revenue metrics, see our article on ARR in the Age of AI: A Metric Mirage. It’s better to project conservatively and exceed expectations.

Accounting for All Funding Sources

Your startup budget template must map out where every dollar will come from.

- Venture capital and equity funding provides growth capital but requires giving up ownership.

- Traditional loans offer capital without diluting equity but often require collateral and steady income projections.

- Grants are non-dilutive funding, great for businesses with social impact or innovative tech.

- Personal investments and founder contributions (bootstrapping) maintain full control but limit initial capital.

- Crowdfunding platforms raise capital from many individuals, often requiring a compelling story.

Track all funding sources against your expenses to ensure you have enough runway. For more on the current landscape, read our guide on Fundraising in Today’s Market. A clear runway projection is what investors want to see.

Step 3: Forecast Cash Flow & Key Metrics (KPIs)

This is where your start up budget template comes to life. We’re combining expenses and revenue into your cash flow projection—a crystal ball for your startup’s survival.

You might have a great idea, but if you run out of cash before customers pay, it’s game over. A profitable business can still fail if it runs out of cash. Your cash flow projection is your oxygen monitor.

It helps you track your burn rate (how fast you spend money) and runway (how long your cash will last). These are survival metrics. To learn more, read our guide on What is Cashflow?.

Building Your Cash Flow Projection

Create a month-by-month movie of your money, tracking when it moves.

Cash inflows include revenue, but sales don’t equal instant cash. If customers pay on net-30 terms, a January sale won’t hit your bank until February. This timing difference is critical. Inflows also include funding from investors, loans, or grants—timing matters here, too.

Cash outflows cover all expenses, from salaries to software. Again, timing is everything. You might incur an expense one month but pay the bill the next.

Subtract total outflows from total inflows each month to find your net cash position. A negative number means you’re burning cash and need to cover the gap. Monthly projections act as an early warning system, giving you time to cut costs, accelerate collections, or raise funds. Our guide on How to Read a Cash Flow Statement can help you master this.

Key Metrics to Track in Your Start Up Budget Template

Your budget should include KPIs that tell the story of your business health.

- Customer Acquisition Cost (CAC): How much you spend to get a new customer. A high CAC is a major red flag.

- Lifetime Value (LTV): The total revenue you expect from a customer. Your LTV should be significantly higher than your CAC. We’ve written about common mistakes with this metric in Why I Hate LTV:CAC.

- Gross Margin: The money left after direct costs. This covers all other expenses like marketing and salaries.

- Monthly Recurring Revenue (MRR): For subscription businesses, this is the predictable revenue you earn each month.

- Churn Rate: The rate at which you lose customers. High churn is like trying to fill a leaky bucket.

- Burn Rate & Runway: How fast you’re spending cash and how many months you have until it runs out.

Build these metrics into a dashboard in your start up budget template to see your startup’s health at a glance.

Step 4: Stress-Test Your Budget & Avoid Common Pitfalls

Now it’s time to stress-test your startup budget template. This means putting it through a financial obstacle course to see how it holds up.

Scenario planning is your best friend here. Create three versions of your budget:

- Best-case scenario: Shows your maximum potential if everything goes perfectly.

- Worst-case scenario: Identifies breaking points if sales are slow or costs are high.

- Most-likely scenario: Your primary budget, based on realistic assumptions, for day-to-day decisions.

A key part of stress-testing is padding your budget with a cushion. This isn’t wasteful; it’s a financial airbag for inevitable bumps in the road.

Top 5 Budgeting Mistakes to Avoid

Startups often fall into predictable traps. Here are the biggest ones:

- Underestimating expenses: Founders often forget smaller costs like legal fees and software subscriptions that add up. Always model your own compensation, even if deferred.

- Overestimating revenue: Rosy projections lead to poor decisions, like hiring too fast. Be realistic about your market size, conversion rates, and sales cycle.

- Ignoring seasonality: Your cash flow needs to reflect your business’s natural busy and slow periods.

- Neglecting cash flow timing: Remember: a profitable business can fail without cash. Track when money actually moves, not just when sales are made.

- Failing to review and adjust: An outdated budget is useless. Markets shift and costs change. For more on financial pitfalls, see our guide on Six Tax Land Mines for Startups.

The Importance of a Contingency Fund

A contingency fund is your financial emergency kit.

The 10-15% rule is a good starting point: add about 10% to startup expenses and 15% to monthly operating costs. This creates a financial safety net for unpredictable events, like equipment breaking or a marketing campaign costing more than quoted.

This fund isn’t for careless spending; it’s insurance against the unknown. It provides the breathing room to handle problems professionally instead of panicking. Smart founders build contingency funds because they know business is messier than a spreadsheet.

Step 5: Use Your Start Up Budget Template for Strategic Growth

Your startup budget template is more than a spreadsheet; it’s your business’s GPS, guiding every major decision.

When deciding on a new hire or a marketing campaign, your budget is your reality check. Headcount is typically the largest expense, so your budget determines who you can hire and when. It also influences product development—can you afford that new feature, or should you perfect the current one? Marketing spend becomes clearer when you know how much you can invest while maintaining healthy cash flow. For more on how finance integrates with strategy, see our guide on Startup Accounting Services: What Founders Need to Know.

Best Practices for Regularly Updating Your Budget

An outdated budget is useless. Regular updates are key.

- Monthly reviews are your financial health checkups. Compare your plan to what actually happened (“budget vs. actuals”) to catch variances early.

- Quarterly reviews are for the bigger picture. Re-evaluate your assumptions and make strategic pivots if the market has shifted.

- Involve your team in the process. They have valuable insights into departmental costs and take ownership of their budgets.

- Use automation as you grow. Modern accounting software can feed real-time data into your budget, saving time. Many startups build a Startup Stack of integrated tools.

How to Use Your Budget to Attract Investors

Your startup budget template is a powerful fundraising tool that tells a compelling story with numbers.

- Demonstrate fiscal responsibility. A detailed, realistic budget shows investors you understand the financial levers of your business.

- Prove your unit economics work. Show that acquiring a customer or delivering your service is profitable and can scale.

- Justify your funding request. Instead of asking for a lump sum, your budget allows you to say, “We need $2 million to cover 18 months of operations and achieve these specific milestones.” This turns a request into a strategic plan.

Your budget translates your vision into numbers, showing investors how you’ll turn their capital into growth. For tips on presenting your financial story, see our article on 5 Hacks to Raise Money from VCs. Lenders also require these projections, and you can add credibility with tools like the Downloadable government startup cost calculator.

Frequently Asked Questions about Startup Budgeting

When building your first startup budget template, questions are normal. Here are the most common ones we hear from founders.

How often should I review my startup budget?

Think of your budget as a GPS that needs regular updates.

- Monthly reviews are essential. Compare your plan (“budget”) to reality (“actuals”) to catch problems early.

- Quarterly reviews are for strategy. Step back to look at overall trends and adjust your long-term plan if market conditions have changed.

- Annual reviews are for setting major goals for the next year based on what you’ve learned.

Regular reviews are the key to proactive management.

What’s the difference between a budget and a financial forecast?

This trips up many founders.

- Your budget is your plan—it’s what you want to happen. It’s a set of targets and goals that remains relatively stable.

- Your forecast is your prediction—it’s what you think will actually happen based on current data. It’s updated frequently.

They work together. Your budget is the benchmark, and your forecast shows how you’re tracking against it. If they diverge significantly, it’s a signal to adjust your strategy.

Can I create a budget without any historical data?

Yes, every startup faces this. You can still create a solid startup budget template.

- Start with market research to form realistic revenue projections.

- Use industry benchmarks from reports and case studies to estimate costs like marketing spend.

- Analyze competitors to validate your assumptions about pricing and growth.

The key is to make educated assumptions and document them. Your first budget won’t be perfect. The goal is to start with reasonable estimates and refine them as you gather real data.

Conclusion: Turn Your Budget Into Your Strategic Advantage

We’ve covered the five essential steps: listing expenses, projecting revenue, forecasting cash flow, stress-testing your numbers, and using your start up budget template for strategic growth.

Your budget isn’t a static document; it’s your compass, sanity check, and roadmap to success. It enforces financial discipline, helping you make informed decisions based on data, not just gut feelings. When challenges arise, your budget is your safety net.

Most importantly, a strong budget empowers you to tell your story with confidence to investors. You’re not presenting hopeful guesses but a thoughtful financial plan that proves you understand your business.

At OpStart, we see how the right financial foundation transforms startups. Our hands-on financial operations services—from accounting and tax to fractional CFO support—are designed to take the financial burden off your shoulders. You can focus on building your business.

The financial uncertainty that keeps founders up at night doesn’t have to be your reality. Get expert help building your financial roadmap with Fractional CFO Services and turn your budget into your most powerful strategic advantage.