Why Startup Taxes Outsourced is Your Strategic Advantage

For many rapidly growing businesses, startup taxes outsourced has become a critical strategy. Partnering with external experts to manage financial and tax responsibilities frees founders from complex paperwork and ever-changing tax laws. This allows you to focus on what truly matters: building your product and growing your company.

Key outsourced services include:

- Bookkeeping and Financial Reporting: From daily transactions to investor-ready statements.

- Tax Preparation and Strategic Planning: Handling all tax filings while maximizing deductions and credits like R&D.

- Compliance Management: Managing complex sales tax, payroll, and other regulatory requirements.

- Fractional CFO Services: High-level financial guidance for budgeting, forecasting, and fundraising.

Outsourcing is a strategic move that ensures compliance and provides access to expertise that’s too costly to hire in-house. It allows your startup to move fast and stay lean without compromising financial integrity.

Hello! I’m Maurina Venturelli, Head of Go-to-Market at OpStart. I specialize in turning high-potential companies into market leaders by streamlining complex financial functions like startup taxes outsourced.

Similar topics to startup taxes outsourced:

What is Outsourced Tax and Accounting for Startups?

When we talk about startup taxes outsourced, we mean delegating your financial and tax management to a specialized external provider. It’s like having an entire finance department without the overhead of an in-house team. This service covers a broad spectrum of activities to keep your startup compliant and financially healthy.

Core services include meticulous bookkeeping for accurate financial statements, essential for internal decisions and external reporting. Beyond daily records, providers handle all tax preparation and filing for federal, state, and local returns. This isn’t just about compliance; strategic tax planning helps identify deductions and maximize valuable credits. For instance, startups can claim up to $500,000 in refundable R&D Tax Credits annually, even if unprofitable, significantly extending their runway.

More info about Bookkeeping Services

Other complex areas covered include multi-state sales tax compliance, payroll management, and fractional CFO services for high-level financial guidance and fundraising support.

More info about Fractional CFO Services

The Risks of DIY vs. The Rewards of Outsourcing

While the “do it yourself” mantra works for some things, it’s risky for startup accounting. Managing finances in-house often leads to avoidable challenges.

DIY Risks:

- Wasted Founder Time: Every hour spent on spreadsheets is an hour not spent on product, sales, or customers.

- Compliance Dangers: Complex, evolving tax laws can lead to missed deadlines and hefty penalties (e.g., up to $280 per incorrect 1099).

- Lost Investor Credibility: Inconsistent or delayed financial reports erode investor trust, making future funding difficult. As the Harvard Business Review noted, poor financial management is a key reason “Why Startups Fail.”

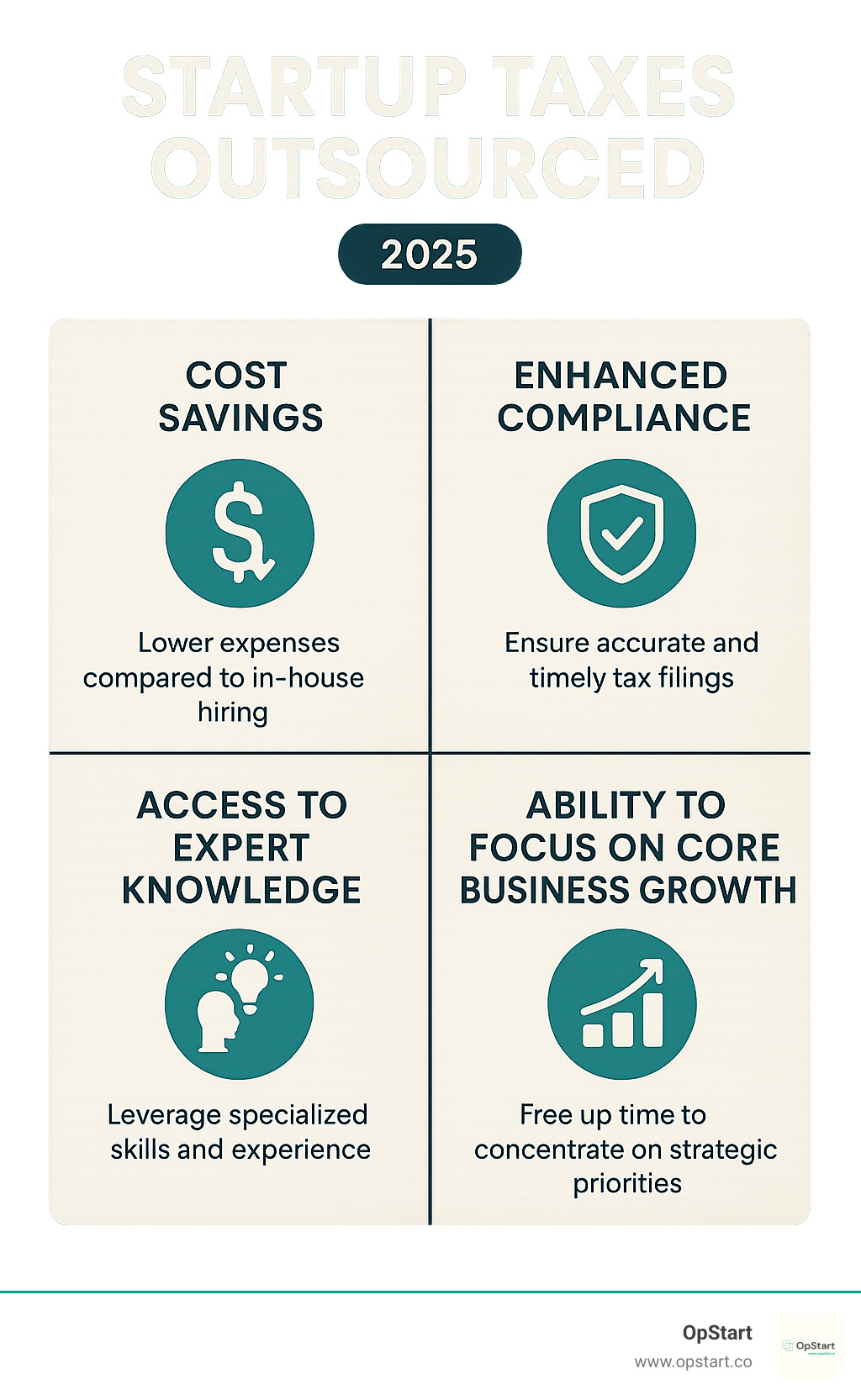

Outsourcing Rewards:

- Cost-Effectiveness: Pay for only the services you need, avoiding the high cost of a full-time in-house accountant.

- Specialized Expertise: Access a team of CPAs and accountants with deep knowledge of tax credits and complex compliance. Our teams average 11 years of experience.

- Scalability: Your financial support grows with you, seamlessly handling increased transaction volumes or multi-state filings without you needing to hire and train new staff.

How Outsourcing Handles Complex Tax Scenarios

A major advantage of having startup taxes outsourced is navigating complex tax situations.

For example, international tax compliance is critical if you have overseas contractors or employees. This involves understanding VAT, avoiding double taxation, and leveraging tax treaties. An expert team interprets these intricate rules to ensure global compliance.

Comprehensive guidance for nonresident and resident aliens on U.S. tax obligations

Multi-state sales tax nexus is another minefield. As you sell across state lines, you may need to collect and remit sales tax based on economic nexus laws, which vary by state. Outsourcing this ensures you stay on top of changing regulations.

Other complex areas expertly handled include:

- International tax implications for remote teams

- Multi-state sales tax compliance

- R&D tax credit maximization

- Tax implications of equity compensation (stock options, RSUs)

- Beneficial Ownership Information (BOI) reporting

- Navigating tax treaties for international payments

Outsourcing provides dedicated specialists who stay updated on the latest changes, use specialized software, and have the experience to mitigate risks an internal team might miss.

5 Signs It’s Time to Outsource Your Startup’s Taxes

Wondering when to shift from DIY finances to professional support? Here are five clear signals that it’s time to accept startup taxes outsourced.

- You’ve secured funding. With investment comes a new level of financial scrutiny. Getting your bookkeeping and tax work handled by experts early on is a strategic move to ensure your financials are spotless and investor-ready for future growth.

- Your team is stretched thin. If you or your key players are spending more time on financial busywork than on core activities like product development or sales, it’s time for a change. Outsourcing frees up your team to focus on what they do best.

- Your financial records are inconsistent. Errors, delays, or messy data in your reports can lead to bad decisions and erode investor trust. To grow confidently, you need reliable, bulletproof numbers.

- You’re preparing for a funding round or acquisition. During these high-stakes moments, financial transparency is non-negotiable. Investors and buyers dislike finding incorrect or missing tax returns. Outsourced experts ensure your financials are clean and compliant for due diligence.

- You’re expanding operations. Hiring more people, entering new states, or exploring international markets rapidly increases complexity. Managing payroll taxes, multi-state sales tax, and international compliance can quickly become unmanageable internally.

The Real Cost of Not Having Startup Taxes Outsourced

Ignoring these signs comes with serious hidden costs that go beyond late fees.

- Missed Deadlines and Penalties: Forgetting to file or making mistakes leads to hefty fines and interest.

- Inaccurate Financial Reporting: Bad data means you’re making decisions in the dark, which can lead to running out of cash.

- Lost Tax Opportunities: It’s easy to miss out on valuable R&D tax credits or other deductions that could save your startup thousands.

- Strained Investor Relations: Inconsistent data or being unprepared for due diligence can damage trust and jeopardize future funding.

- Founder Burnout: The mental toll of worrying about taxes diverts your energy from strategic thinking and innovation.

Aligning Your Tech with Your Tax Partner

Successful outsourcing requires a seamless technological connection. Your outsourced partner must work with your existing tools, not against them. They should integrate deeply with cloud-based accounting systems like QuickBooks and Xero, as well as expense tracking apps. This integration streamlines the tax filing process by automatically categorizing transactions and providing a clear audit trail, reducing manual entry and errors. Ensuring your provider works with your Startup Stack is key to open uping true efficiency.

How to Choose the Right Outsourced Tax Partner

Finding the right partner for your startup taxes outsourced needs is a strategic decision. You’re choosing a team member who will protect your financial health and help you steer the complex world of startup finance. Here’s what to look for:

- Startup-Specific Experience: The provider must understand the unique needs of a high-growth company, where metrics like burn rate can matter more than traditional profitability.

- VC-Backed Expertise: If you’re venture-funded, your partner needs to speak the language of VCs and understand the rigorous due diligence process.

- Transparent Pricing: Flat-rate pricing provides predictability and helps you manage your runway, avoiding the surprise costs of hourly billing.

- Comprehensive Services: A provider offering everything from bookkeeping to CFO guidance ensures a unified financial strategy, eliminating the need to juggle multiple vendors.

- Team Credentials: Look for experienced CPAs and Enrolled Agents. At OpStart, our account management teams average 11 years of experience.

- Technology Compatibility: Your provider should work seamlessly with your existing tech stack, not force you to change your tools.

Key Questions to Ask a Potential Provider

When interviewing potential partners, ask targeted questions to gauge their fit.

- Industry Experience: “What’s your experience with startups in my specific industry?” Relevant experience helps them spot unique opportunities and pitfalls.

- Proactive Tax Strategies: “How do you handle R&D tax credits and other startup-specific incentives?” This shows if they’re actively looking for ways to save you money.

- Communication Process: “What’s your communication process, and how quickly do you respond?” You need a responsive partner, especially during crunch times.

- Scalability: “Can you scale with us from seed to Series C?” You don’t want to outgrow your provider and repeat the search.

- Pricing: “What exactly is included in your flat-rate fee?” Understand what’s covered to avoid surprise charges.

- References: Ask to speak with other startup clients to get insights.

Understanding Compliance: From 1099s to BOI

Your outsourced partner is your compliance safety net. They handle routine forms and emerging regulations.

Contractor Payments (1099-NEC): If you pay a U.S. contractor $600 or more in a year, you must issue a Form 1099-NEC. Missing the deadline can result in penalties up to $280 per form.

Step-by-step instructions on preparing and filing 1099 forms

Foreign Contractors (W-8BEN): For international talent, you need to collect W-8BEN or W-8BEN-E forms to confirm their non-U.S. taxpayer status and avoid withholding U.S. taxes.

New Regulations: Experts also stay on top of new rules like the Beneficial Ownership Information Reporting requirement, which mandates that most small businesses report their beneficial owners to FinCEN.

Beneficial Ownership Information Reporting

Having startup taxes outsourced means experts are tracking these changes so you can focus on your business.

Why Your Growing Business Needs Startup Taxes Outsourced

As your business grows, getting your startup taxes outsourced is a strategic move that boosts financial health, ensures compliance, and fuels growth.

- Achieve Financial Efficiency: Experts spot tax savings through deductions and credits that an in-house team might miss, extending your runway.

- Ensure Bulletproof Compliance: A dedicated team handles all federal, state, and local tax rules on time, reducing the risk of penalties and audits.

- Fuel Sustainable Growth: By offloading financial management, your team can focus on core activities like product development and sales. Our clients at OpStart have collectively raised over $15 billion in VC funding, a testament to how expert support boosts ambition.

- Build Investor Confidence: Accurate, investor-ready financial reports are essential for fundraising. Outsourced experts ensure your financials are professional and consistent, making due diligence a breeze.

- Free Up Founder Focus: This is perhaps the most valuable benefit. Outsourcing lets you dedicate your energy to your vision, not deciphering tax forms.

Key Considerations for Startup Taxes Outsourced

To ensure a successful partnership, think through these key points.

- Data Security: Ensure any potential provider has top-notch security protocols, including strong encryption and confidentiality agreements.

- Communication: Clarify how often you’ll receive reports and have strategic discussions. A great partner is proactive, not just reactive.

- Strategic Value vs. Cost: Look beyond the lowest price. Consider if the provider can deliver long-term value through tax savings and strategic insights.

- Onboarding: A well-defined onboarding process ensures a smooth, stress-free transition.

- Partnership Feel: The best providers act as a true extension of your Accounting & Finance Department, understanding your goals and being highly responsive.

Frequently Asked Questions about Outsourcing Startup Taxes

As a founder considering startup taxes outsourced, you likely have questions. Here are straight answers to the most common concerns.

Do unprofitable startups need to file a tax return?

Yes, absolutely. All corporations must file tax returns, regardless of profitability. Filing when you’re unprofitable allows you to capture your Net Operating Losses (NOLs), which can be carried forward to offset taxable income in future profitable years, saving you significant money. Additionally, many states impose minimum taxes and fees regardless of profit, and failing to file can result in penalties.

How much does it cost to outsource accounting and tax services?

The cost for startup taxes outsourced services typically ranges from $500 to $5,000+ per month. The price depends on factors like transaction volume, business complexity (e.g., international contractors, multi-state sales tax), and the scope of services needed. Basic bookkeeping is at the lower end, while strategic services like fractional CFO support are at the higher end. At OpStart, we use flat-rate pricing for predictability, so you can manage your budget without surprise invoices.

What’s the difference between a contractor and an employee for tax purposes?

The key difference is control. With an employee, you control how, when, and where the work is done, and you are responsible for withholding income tax, Social Security, and Medicare taxes. For a contractor, you care about the end result, but they control the process. You don’t withhold taxes, but you must issue a Form 1099-NEC if you pay them $600 or more in a year.

The risks of misclassification are severe, including back taxes, penalties, and issues under the Fair Labor Standards Act (FLSA). When you have startup taxes outsourced, experts handle these classifications correctly, protecting you from these risks.

Conclusion

Throughout this guide, we’ve seen that startup taxes outsourced is more than delegating paperwork—it’s a core strategy for open uping your startup’s potential. By partnering with financial experts, you invest in compliance, cost savings, and the freedom to focus on growth.

Every hour you spend on tax forms is an hour stolen from building your product or connecting with customers. Outsourcing is an investment, not an expense. It’s about recognizing that your expertise lies in solving problems for your customers, not in becoming a tax expert.

The results are clear: when your financials are pristine and your focus is sharp, investors take notice. Our clients have raised over $15 billion in VC funding because they were prepared, professional, and focused on what matters.

At OpStart, we’ve designed a complete, hands-free financial operations solution that grows with you. With flat-rate pricing, an expert team, and seamless software integration, we handle the financial complexities so you can get back to what you do best: building your dream, not filing paperwork.

Learn how our expert team can handle your startup’s complete financial operations.