Why Every Startup Founder Needs to Master the Statement of Cash Flows

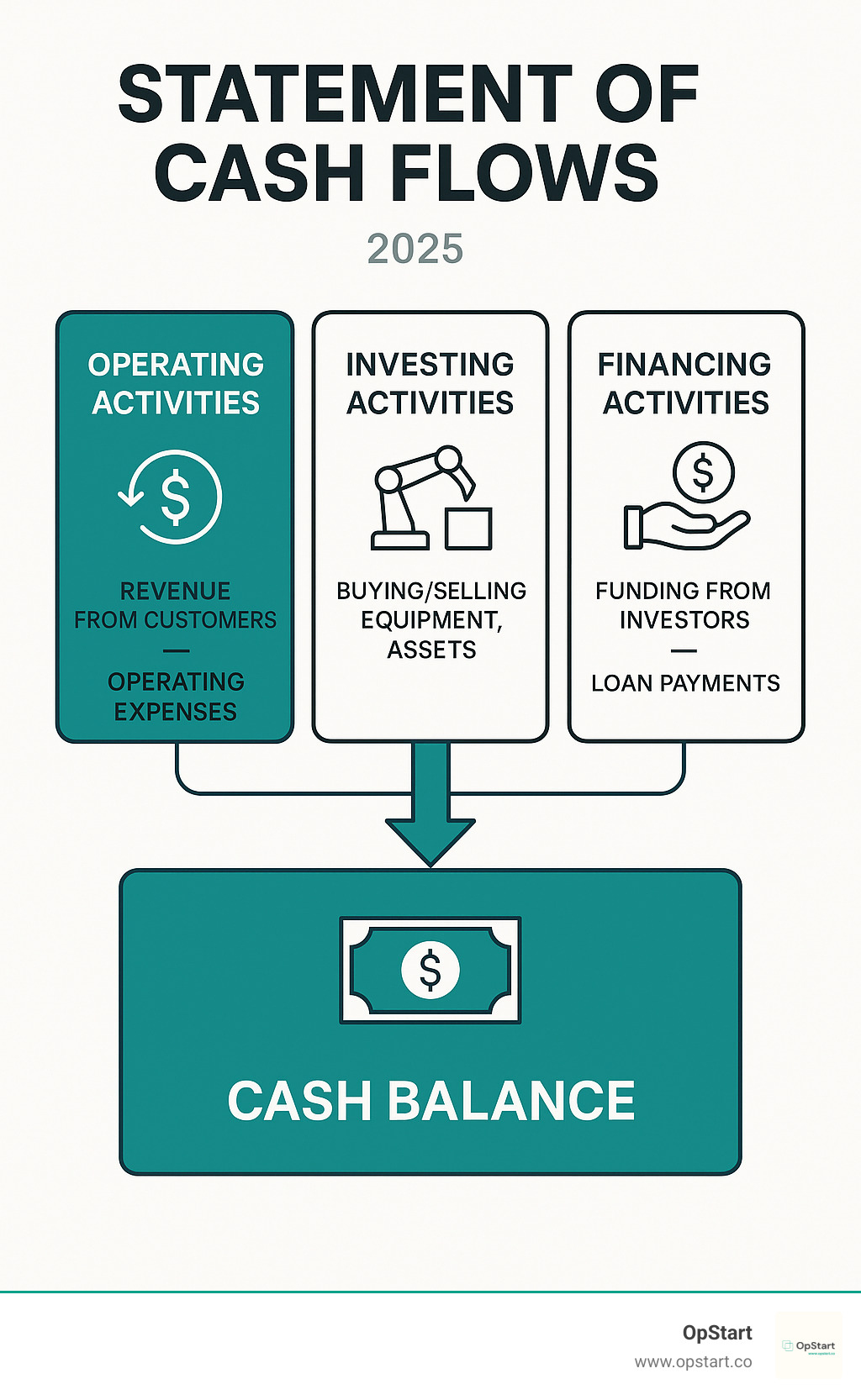

The statement of cash flows is one of three core financial statements that every startup must understand, alongside the income statement and balance sheet. Here’s what you need to know:

What it is: A financial statement that tracks all cash moving in and out of your business during a specific period

Three main sections:

- Operating Activities – Cash from your core business operations

- Investing Activities – Cash spent on or received from long-term assets

- Financing Activities – Cash from investors, loans, or payments to stakeholders

Why it matters: Shows your actual cash position, not just profitability on paper

As the saying goes, “cash is king” – and this couldn’t be more true for startups. According to CB Insights research, running out of cash is the number one reason startups fail. While your income statement might show healthy profits, your statement of cash flows reveals whether you actually have money in the bank to pay bills, invest in growth, or weather unexpected challenges.

Unlike your income statement (which uses accrual accounting), the cash flow statement shows real money movements. A company can be profitable on paper but still struggle with cash flow if customers pay slowly or if too much cash is tied up in inventory.

For startup founders juggling countless priorities, understanding your cash flow isn’t just about compliance – it’s about survival. This statement helps you spot cash crunches before they become critical, plan for growth investments, and communicate your financial health to investors.

I’m Maurina Venturelli, and throughout my career leading growth at companies like Sumo Logic and LiveAction, I’ve seen how mastering the statement of cash flows can make or break a startup’s trajectory. Now as VP of Go-to-Market at OpStart, I help founders steer these critical financial fundamentals to fuel sustainable growth.

The Three Pillars of a Cash Flow Statement

Think of your statement of cash flows as a three-act play that tells the complete story of your startup’s financial life. Each act reveals something different about how your business operates, grows, and funds itself. Understanding these three pillars isn’t just accounting theory – it’s the key to making smart decisions that keep your startup thriving.

Cash Flow from Operating Activities (CFO)

This is where the magic happens – or where you find it’s not happening at all. Cash Flow from Operating Activities shows you the cash your core business operations actually generate. It’s the most important section because it reveals whether your business model works in the real world, not just on paper.

When your CFO is consistently positive, it means your business is self-sustaining. You’re generating enough cash from your main activities to cover your ongoing needs without constantly relying on investors or loans. This is the holy grail for any startup founder.

The inflows here are straightforward: cash from customers who actually pay for your products or services, plus any interest you earn on investments. The outflows tell the story of running your business day-to-day: payments to suppliers for inventory and services, employee salaries that keep your team motivated, taxes that keep the government happy, and all those other expenses like rent and utilities.

Here’s something interesting that trips up many founders: the treatment of interest payments varies depending on which accounting standards you follow. Under U.S. GAAP, interest paid always shows up in operating activities. But under IFRS, companies can choose to classify it as either operating or financing. If you want to dive deeper into these nuances, check out this Literature Review on Cash Flow Statements.

Cash Flow from Investing Activities (CFI)

This section tells the story of your startup’s future growth ambitions. Cash Flow from Investing Activities tracks money spent on or received from long-term assets – the investments you make today hoping they’ll pay off down the road.

Don’t panic if this section shows negative numbers. For growing startups, negative investing cash flow is often a healthy sign. It means you’re reinvesting in growth rather than sitting on your cash pile.

The inflows typically come from selling assets you no longer need: maybe you sold some equipment that became obsolete, or you cashed out some securities you’d invested in earlier. The outflows are usually more exciting – they represent your bets on the future. This includes purchasing new equipment that’ll help you scale, or even mergers and acquisitions if you’re at that stage.

Cash Flow from Financing Activities (CFF)

The final pillar reveals how your company is funded and how you manage relationships with owners and creditors. This section answers the question: where does your money come from, and where does it go when you pay people back?

The inflows here are often the most exciting for startup founders: issuing stock to new investors who believe in your vision, or taking on debt from lenders who trust your ability to repay. These are the cash injections that fuel your growth dreams.

The outflows show your financial maturity: repaying loans when they come due, stock buybacks if you’re buying back shares, or paying dividends to shareholders (though this is rare for early-stage startups focused on growth).

Understanding how these three sections work together gives you a complete picture of your startup’s financial health. Your operating activities show if your business model works, your investing activities reveal your growth strategy, and your financing activities demonstrate how you’re funding it all.

How to Prepare a Statement of Cash Flows: Direct vs. Indirect Methods

You’ve learned what goes into a statement of cash flows, but how do you actually create one? There are two main approaches, and understanding both will help you choose the right path for your startup. While they both show the same final cash position, they take completely different routes to get there.

Think of it like driving from San Francisco to Los Angeles. You could take the scenic coastal route (direct method) or the faster highway (indirect method). Both get you to your destination, but one gives you a clearer view while the other saves time and effort.

The Indirect Method: The Startup Standard

Here’s the reality: about 99% of companies use the indirect method, and there’s a good reason why. It’s the startup standard because it works with the financial information you already have on hand.

The indirect method starts with your net income from your income statement, then makes adjustments to show what actually happened with your cash. Your income statement uses accrual accounting, which records transactions when they happen, not when cash changes hands. The statement of cash flows needs to bridge that gap.

Here’s how it works step by step:

Start with your net income – that’s your bottom-line profit from your income statement. But since profit doesn’t equal cash in the bank, we need to make some adjustments.

First, add back depreciation and amortization. These are accounting expenses that reduce your profit on paper, but no cash actually left your bank account this period. Your equipment is worth less than last year, but you didn’t write a check for depreciation.

Next, add back stock-based compensation. When you pay employees with equity instead of cash, it shows up as an expense on your income statement. But again, no cash moved, so we add it back.

Now comes the trickier part: adjusting for changes in working capital. This is where the timing differences between earning revenue and collecting cash really show up.

When accounts receivable increases, it means you made sales but haven’t collected the cash yet. That reduces your cash flow, so we subtract the increase. When it decreases, you’ve collected more cash than you sold, so we add it back.

Inventory works similarly. If you bought more inventory than you sold, cash went out the door, so we subtract the increase. If inventory decreased, you sold more than you bought, freeing up cash.

Accounts payable flips the script. When it increases, you’re taking longer to pay suppliers, which helps your cash position. When it decreases, you’ve paid down what you owe, using up cash.

The relationship between cash and accrual accounting is fundamental here. If you want to dive deeper into this concept, check out our guide on Cash vs Accrual Accounting.

The Direct Method: A Clearer View

The direct method takes a completely different approach. Instead of starting with net income and making adjustments, it simply lists the actual cash that came in and went out during operations.

You’ll see line items like “Cash received from customers” and “Cash paid to suppliers.” It’s straightforward and intuitive – exactly what it sounds like. Many people find it easier to understand because it shows the raw cash movements without any accounting gymnastics.

Interestingly, both the FASB and IFRS actually prefer companies to use the direct method. They think it provides clearer information for investors and other users of financial statements.

So why doesn’t anyone use it? Simple: it’s a lot more work. To prepare a direct statement of cash flows using this method, you need to track every single cash transaction and categorize it properly. Most companies find this too time-consuming when the indirect method gives the same end result using information they already have.

For additional insights into operating activities and the indirect method, you can explore this resource: Operating activities section by indirect method.

Key Differences Summarized

| Feature | Indirect Method | Direct Method |

|---|---|---|

| Approach | Reconciles net income to cash flow from operations | Reports gross cash receipts and payments from operations |

| Transparency | Less transparent about actual cash transactions | More transparent, showing actual cash inflows/outflows |

| Ease of Prep. | Generally easier, uses existing financial statements | More time-consuming, requires detailed transaction tracking |

| Regulatory Preference | Accepted by GAAP/IFRS, widely used (especially by US companies) | Preferred by FASB/IFRS, but rarely used in practice |

For most startups, the indirect method is the clear winner. It’s efficient, uses the financial data you’re already collecting, and gets the job done. Unless you have specific reasons to need the granular detail of the direct method, stick with what works for the vast majority of successful companies.

Analyzing Your Cash Flow Statement for Startup Health

Preparing your statement of cash flows is a fantastic first step, but the real value comes from learning to read the story it tells. Think of your cash flow statement as your startup’s financial heartbeat monitor – it reveals not just whether you’re alive, but how healthy you really are.

The numbers on your statement of cash flows can predict whether you’ll thrive, struggle, or face serious trouble down the road. Let me walk you through what to look for.

What a healthy statement of cash flows looks like

A thriving startup’s statement of cash flows usually tells a specific story across its three sections. Positive operating cash flow is the holy grail – it means your core business generates enough cash to sustain itself without constantly needing external funding. When your operations consistently produce cash, you’ve built something truly valuable.

Negative investing cash flow might sound concerning, but it’s often a great sign for growing startups. It shows you’re reinvesting in growth by purchasing equipment, developing new products, or expanding your team. These investments today fuel tomorrow’s success.

Balanced financing activities reveal smart capital management. You might see cash inflows from investor rounds or strategic loans, but these should support growth initiatives, not just keep the lights on.

One of the most important metrics you can calculate from your statement of cash flows is Free Cash Flow (FCF). This represents the cash your business generates after covering both operations and necessary capital investments. FCF equals your operating cash flow minus capital expenditures.

Strong, growing free cash flow means your business can fund its own growth, pay down debt, or weather unexpected storms. Investors love seeing positive FCF trends because it proves your business model actually works. If you need help optimizing these financial operations, our Startup Accounting Services: What Founders Need to Know guide covers everything you need to get started.

Red Flags: Early Warning Signs for Your Startup

Just as healthy patterns provide comfort, certain warning signs in your statement of cash flows should trigger immediate attention. Negative operating cash flow that persists quarter after quarter suggests your core business isn’t working. If you can’t generate cash from operations, you’re essentially running a very expensive hobby.

Relying on financing for operations creates a dangerous cycle. When your financing section shows constant large inflows just to cover basic expenses, you’re not building a business – you’re buying time. This pattern is unsustainable and will eventually catch up with you.

Selling assets for cash appears in the investing section and signals desperation. When startups start liquidating equipment, intellectual property, or other assets just to generate operating cash, they’re often in serious trouble.

High cash burn rate combined with limited runway creates the dreaded cash-zero scenario. Your statement of cash flows helps you calculate exactly when you’ll run out of money if current trends continue. This projecting cash-zero date becomes critical for fundraising timing and strategic planning.

The key is catching these patterns early. Your statement of cash flows acts like an early warning system, giving you time to adjust your strategy, cut costs, or accelerate fundraising before you hit a wall. Don’t wait until the warning signs become emergencies.

Frequently Asked Questions about the Statement of Cash Flows

As founders dive deeper into their statement of cash flows, certain questions come up again and again. These aren’t just academic curiosities – they’re real concerns that can make or break your startup’s financial strategy. Let’s address the most common ones.

Why can a profitable company run out of cash?

This question hits at the heart of why the statement of cash flows is so crucial. It’s entirely possible – and surprisingly common – for a company to show healthy profits on paper while simultaneously running dangerously low on actual cash.

The culprit? The fundamental difference between accrual accounting (which your income statement uses) and cash reality (which your cash flow statement reveals).

Under accrual accounting, you record revenue when you earn it, not when you receive payment. Similarly, you record expenses when you incur them, not necessarily when you pay them. This creates a timing mismatch that can be deadly for cash-strapped startups.

Here’s how this plays out in real life: Imagine you land a major client and deliver $50,000 worth of services in January. Your income statement immediately shows that revenue, boosting your profits. But if your client’s payment terms are net-90, you won’t see that cash until April. Meanwhile, you still need to pay your team’s salaries, office rent, and supplier invoices – all in real cash, right now.

Accounts receivable delays are just one piece of the puzzle. When you purchase inventory to meet anticipated demand, cash leaves your bank account immediately, but that inventory might sit for months before converting back to cash through sales. Large equipment purchases also drain cash upfront, even though the expense gets spread across multiple years through depreciation on your income statement.

This is why savvy founders never rely solely on profit margins to gauge their company’s health. Your statement of cash flows tells the real story of whether you have enough money in the bank to keep the lights on.

Where do dividends appear on the cash flow statement?

For most startups, dividends aren’t an immediate concern, but understanding their treatment helps you grasp how the statement of cash flows categorizes different types of transactions.

Dividends paid to shareholders appear as a cash outflow under financing activities. This makes intuitive sense – when you pay dividends, you’re returning capital to your company’s owners, which falls squarely into how you manage your funding structure.

The classification can get slightly more nuanced depending on your accounting standards. Under U.S. GAAP, dividends paid almost always land in financing activities. However, IFRS allows more flexibility – companies could theoretically classify dividend payments as operating activities if they’re somehow central to their revenue-generating process, though this is extremely rare in practice.

Dividends received from investments in other companies typically show up as operating activities under U.S. GAAP, but IFRS gives companies the option to classify them as either operating or investing activities.

Is negative cash flow always a bad sign?

This might be the most important question for startup founders, and the answer is a resounding “it depends.” Context is absolutely everything when interpreting your cash flow numbers.

Negative investing cash flow is often a fantastic sign for growing startups. It means you’re actively reinvesting in your future – purchasing new equipment, developing technology, or even acquiring other companies. These strategic investments are essential for long-term growth, even though they create short-term cash outflows.

For early-stage startups, negative operating cash flow can be part of a healthy growth trajectory. Many successful companies burn cash initially as they scale their operations, acquire customers, and build infrastructure. The key is ensuring this burn is strategic and funded by smart financing activities like venture capital rounds.

Short-term versus long-term trends matter enormously. A single quarter of negative cash flow might result from a one-time equipment purchase or major debt repayment – not necessarily cause for alarm. But consistent negative operating cash flow over multiple quarters, especially without a clear path to profitability, signals deeper operational issues.

The bottom line? Don’t panic over a single negative number. Instead, analyze each section of your statement of cash flows separately, consider your business stage and strategic goals, and look for patterns over time. That’s where the real insights live.

Conclusion: From Numbers to Narrative

Your statement of cash flows isn’t just another financial document to file away – it’s the heartbeat of your startup’s financial story. While your income statement might paint a rosy picture of profitability and your balance sheet shows what you own, the statement of cash flows cuts through the accounting noise to reveal what’s really happening with your most precious resource: actual cash.

Think of it this way: if your startup were a movie, the statement of cash flows would be the director’s commentary. It explains the behind-the-scenes reality of how money moves through your business. The operating activities section reveals whether your core business can sustain itself day-to-day. The investing activities section shows how boldly you’re betting on your future growth. And the financing activities section tells the story of how you’re funding your dreams.

Throughout this guide, we’ve walked through the nuts and bolts of preparing your cash flow statement using the indirect method – the approach most startups rely on. But more importantly, we’ve explored how to read between the lines of these numbers. A healthy statement of cash flows tells a story of positive operating cash flow (your business is working), strategic investing outflows (you’re planning for tomorrow), and balanced financing activities (you’re funding growth smartly).

The red flags we discussed – like consistently negative operating cash flow or excessive reliance on external funding just to keep the lights on – aren’t just numbers on a page. They’re early warning signals that can help you course-correct before you become another startup casualty.

Here’s the truth: mastering your statement of cash flows is about survival and growth in equal measure. It helps you spot cash crunches months before they hit, plan investments that actually move the needle, and communicate your real financial health to investors who’ve seen it all.

At OpStart, we’ve watched too many brilliant founders struggle not because their ideas weren’t good enough, but because they didn’t have a clear picture of their cash reality. That’s why we provide comprehensive financial operations services that go beyond just preparing your statements – we help you understand what they mean and how to use them strategically.

Your financial story doesn’t have to be a mystery. With the right tools and expertise, your statement of cash flows becomes your roadmap to sustainable growth. Ready to take control of your financial narrative? Learn more about how to read a cash flow statement and find how OpStart can help you master the art of cash flow management.