Why Investor Readiness Is Your Golden Ticket to Funding

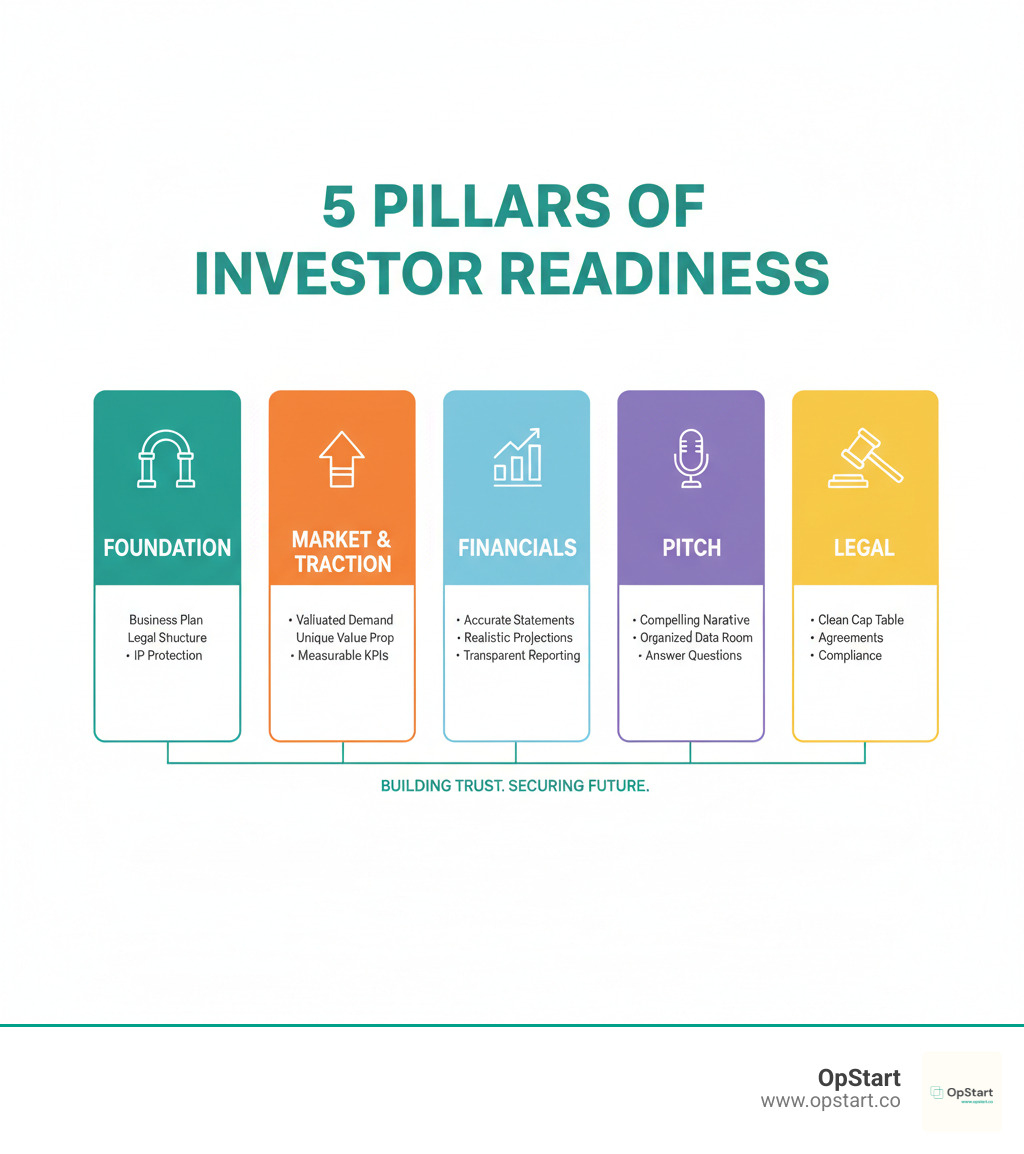

An Investor readiness checklist helps startups systematically prepare for fundraising by ensuring they have the essential elements investors evaluate:

- Foundation: Clear business plan, legal structure, IP protection, and a clean cap table.

- Team: Credible leadership with relevant experience and domain expertise.

- Market & Traction: Validated demand, a unique value proposition, and measurable KPIs.

- Financials: Accurate statements, realistic projections, and transparent reporting.

- Pitch: A compelling narrative, an organized data room, and the ability to answer tough questions.

Investor readiness is about building trust. It demonstrates that your startup is organized, serious, and capable of delivering returns. In today’s market, investors are more data-driven than ever. The “growth at all costs” era is fading; VCs and angels now demand sustainable growth and businesses built to last.

Being investor-ready means you can articulate your market opportunity, prove customer demand with data, show a scalable business model, and present financials that tell a credible growth story. It signals to investors that you’re prepared, committed, and worth their time and capital.

Investor readiness focuses on making your startup attractive to investors, while investment readiness is about your ability to deploy capital effectively after securing it.

Throughout my career leading GTM at high-growth companies, I’ve seen how a strong Investor readiness checklist separates startups that close rounds quickly from those that struggle. At OpStart, we help founders get their financials investor-ready so they can focus on building their business, not drowning in spreadsheets.

The Ultimate Investor Readiness Checklist: Core Business Pillars

Before pitching, you must ensure your startup is built on solid ground. This section of the investor readiness checklist covers the three core pillars investors examine before writing a check.

Pillar 1: A Rock-Solid Business Foundation

Your business plan is your blueprint. It must articulate your mission and vision and demonstrate genuine problem-solution fit. Prove you understand the market opportunity, your competitors, and what makes you distinctively better.

Your legal structure also matters. Investors avoid messy ownership structures. Getting your legal house in order early saves headaches later. Understanding Choosing Your Business Structure: C-Corp vs. LLC is critical for your fundraising trajectory.

Intellectual property protection (patents, trademarks, trade secrets) is your economic moat. It signals you’re thinking long-term about defending your competitive advantage.

Finally, your cap table must be clean and accurate. This document shows who owns what percentage of your company. Any confusion or errors can kill a deal, as transparency is essential for building trust.

Pillar 2: A Credible and Committed Leadership Team

As the saying goes, Investors bet on people, not just ideas. A great team can steer shifts in the market, while a mediocre one will fail even with a brilliant concept.

Investors look for team capacity (the right mix of skills and experience) and founder-market fit (a deep understanding of the problem and customer). They also want to see grit and commitment, often demonstrated by founders having “skin in the game” through personal investment or sweat equity.

Your board of advisors can boost credibility and fill key personnel gaps, especially if they are respected industry veterans. This shows investors that experienced leaders are willing to back your venture.

Pillar 3: A Clear Go-to-Market (GTM) Strategy

A great product doesn’t sell itself. Investors need proof of a realistic plan to acquire customers.

Your target audience must be precisely defined—”everyone” is not a target market. The more specific you are, the more confident investors will be in your strategy.

Identify your GTM channels and show evidence of a repeatable sales process. Your customer acquisition strategy and marketing plan must be more detailed than simply posting on social media. Investors want to see that you have thought through the practical details of generating revenue.

A clear GTM strategy proves you have a roadmap, not just a dream. If you’re ready to approach investors, our guide on How to Find and Meet VCs can help you take that next step.

Proving Your Worth: Market, Traction, and Scalability

Now it’s time to prove your startup is a real business with customers, revenue, and potential. In today’s funding environment, data is your best friend. Concrete evidence that your business has legs is what makes investors lean in.

Validating Market Demand and Your Unique Value Proposition (UVP)

Ideas are common; proof that people want what you’re building is rare. Your job is to show you’ve moved beyond theory and into reality.

Validated market demand de-risks an investment. This can be shown through customer interviews, letters of intent (LOIs), early user engagement data, or successful pilot programs. Showing you already have paying customers or a pipeline of qualified leads speaks volumes.

Next, you must clearly articulate your Unique Value Proposition (UVP) in one or two sentences. What makes your solution faster, cheaper, or fundamentally different in a way that matters to customers?

This leads to your economic moat—your ability to defend against competition. This could be proprietary technology, network effects, exclusive partnerships, or high customer switching costs. Investors want to see defensible advantages that grow stronger over time.

Showcasing Traction and Key Performance Metrics (KPIs)

Traction is the best predictor of future success. This part of your investor readiness checklist is about letting your numbers tell the growth story.

Key metrics depend on your business model, but some are universal:

- Monthly Recurring Revenue (MRR): Shows predictable, growing income for subscription businesses.

- User Growth (MAU/DAU): Demonstrates momentum for consumer apps.

- Customer Retention and Churn: Reveals product-market fit. Low churn means customers love your product.

- Customer Acquisition Cost (CAC) and Lifetime Value (LTV): The LTV:CAC ratio (ideally 3:1 or higher) is a powerful indicator of a sustainable growth engine.

Investor expectations for these metrics evolve. At the seed stage, they look for early signs of traction ($5k-$20k MRR, 10-20% month-over-month growth) that prove the concept. By Series A, the bar is higher: investors expect clear growth trajectories ($100k+ MRR), scalable acquisition channels, and a data-backed understanding of unit economics to prove you can scale profitably. Our Series A Fundraising Guidelines detail these expectations.

Designing a Clear and Scalable Business Model

Investors seek businesses that can become massive. Your business model must demonstrate scalability—the ability to grow revenue much faster than costs.

Your revenue streams and pricing strategy must be clear. Investors will analyze your unit economics (the profit and loss on a single customer) to see if your model is sound. If unit economics are broken at a small scale, they’ll only worsen with growth.

Finally, you must articulate a credible path to profitability. While not expected to be profitable immediately, you need a roadmap showing how revenue will accelerate while costs grow more slowly. This proves you’re pitching a scalable business, not just a product, which is what gets investors to commit capital.

Nailing the Numbers: Your Financial Investor Readiness Checklist

For most investors, the financials are the moment of truth. If the numbers don’t add up, the conversation ends. Financial transparency is essential; it shows you’re serious about managing capital responsibly and builds the trust needed to close deals.

At the core of your investor readiness checklist is the three-statement model: your income statement, balance sheet, and cash flow statement. Together, they provide a complete picture of your startup’s financial health. Getting these accurate and up-to-date is critical. If you’re struggling, our Startup Accounting Support can get your financial house in order.

Crafting Believable Financial Projections

Investors have seen countless unrealistic hockey-stick growth curves. Your projections must be believable—grounded in data and built from the ground up. This bottom-up forecasting is the gold standard.

Your revenue build-up should be specific, breaking down streams by channel or segment. Show the math behind your projections. The same detail is needed for your expense modeling, accounting for team growth, marketing spend, and operational costs.

Use documented assumptions for everything (e.g., conversion rates, churn, pricing). When assumptions are tied to data or industry benchmarks, your projections become credible. It’s also wise to include scenario analysis (base, upside, and downside cases) to show you understand the risks and have planned for different outcomes. This demonstrates strategic maturity.

Avoid unrealistic growth pitfalls. Projecting growth far beyond industry benchmarks without extraordinary evidence makes you look naive, not ambitious. For help understanding your statements, see our guide on How to Read a Balance Sheet.

Justifying Your ‘Ask’ and Use of Funds

State your target funding amount and justify your pre-money valuation. A proper 409a Valuations for Startups is essential here, as it establishes the fair market value of your company’s stock.

Equally important is a detailed use of funds breakdown. Where is the money going? Be specific: 60% to product development, 25% to marketing, 15% to market expansion. Vague answers are red flags. This detail shows you have a strategic plan for deploying capital to hit specific growth milestones.

Finally, present your runway calculation. How long will the new funding last? Connect the dots: show how much you’re raising, how you’ll spend it, and what milestones you’ll achieve before needing more capital. This complete, compelling story is what gets deals done.

The Final Mile: Pitching, Due Diligence, and Modern Expectations

You’ve built the foundation, proven traction, and organized your financials. The final stretch of the investor readiness checklist involves telling your story effectively and surviving the scrutiny that follows.

Creating an Effective Pitch Deck and Narrative

People remember stories, not just stats. A compelling narrative connects with investors on an emotional level. Your pitch deck is your startup’s story arc—a concise, visually clean conversation starter.

Key slides should include: a strong opening hook, the problem, your solution, market opportunity, business model, traction/metrics, team credibility, financial projections, and your “ask.” Your opening hook is crucial for grabbing attention and summarizing the opportunity.

Practice your pitch until it’s conversational and confident. Be prepared for tough questions about your market, competitive advantage, customer acquisition costs, and key risks. Choosing the right investor is also critical. Look for partners who align with your vision and can offer strategic guidance, not just capital. Our guide on How to Find and Meet VCs can help you target the right partners.

Preparing for the Due Diligence Gauntlet

Once an investor is interested, they’ll begin due diligence—a comprehensive investigation to verify your claims and identify risks. Your job is to make this process smooth with a professional data room: a secure, well-organized virtual space for all relevant documents.

Investors will scrutinize:

- Financials: Historical statements, detailed projections, and documented assumptions.

- Legal: Articles of incorporation, shareholder agreements, SAFE notes, licenses, and board minutes.

- Contracts: Key customer, vendor, and employee agreements.

- Cap Table & Equity: A clean cap table and any 409a Valuations for Startups.

- Intellectual Property: Patents, trademarks, and invention assignment agreements.

- Team: Org charts, key personnel resumes, and hiring plans.

- Strategy: Market research, competitive analysis, and product roadmaps.

For a comprehensive list, this legal checklist for startups is a great resource. Avoid red flags like inconsistent financial reporting or disorganized documentation. Be transparent about challenges; surprises kill deals, but honesty builds trust.

Understanding the Modern Investor Landscape

The fundraising world has shifted. The “growth at all costs” era is gone. Today’s investors are more disciplined and data-driven, focusing on sustainable growth.

This means you need a clear path to profitability and strong unit economics. Capital efficiency—how much runway you get per dollar raised—is paramount. Investors are backing resilient, adaptable founders building businesses that can last.

There’s also a growing emphasis on ESG (Environmental, Social, and Governance) factors. Investors are looking at whether your startup operates responsibly, has diverse leadership, and considers its environmental impact. Adapting to these evolving expectations is crucial for positioning your startup effectively.

Frequently Asked Questions about Investor Readiness

What are the most common pitfalls startups face when preparing for investment?

Many brilliant founders stumble over the same common mistakes. The biggest pitfalls include:

- Underestimating financial preparation: Incomplete financial models and messy statements raise serious questions about your ability to manage capital.

- Unclear value proposition: If you can’t simply explain why customers will choose you, investors won’t understand your differentiation or “economic moat.”

- Weak team presentation: Investors bet on people. A team that lacks relevant experience, shows little commitment (“skin in the game”), or has obvious skill gaps is a major red flag.

- Unrealistic projections: Hockey-stick growth without data-backed assumptions undermines your credibility. Investors know what realistic growth looks like.

- Poorly organized data room: A chaotic data room during due diligence signals operational disorganization and can kill a deal.

How can I assess my own startup’s investor readiness?

Honest self-evaluation is the first step. Use these methods to gauge your readiness:

- Self-assessment tools: Systematically go through an investor readiness checklist like the one in this guide to identify strengths and weaknesses.

- SWOT analysis: Conduct an honest analysis of your Strengths, Weaknesses, Opportunities, and Threats to reveal blind spots.

- Seek feedback from mentors: Talk to experienced entrepreneurs and advisors who have been through fundraising. They can spot issues you might miss and offer valuable connections.

- Engage external advisors: A professional review can provide an expert, unbiased opinion. Services like Fractional CFO Services can ensure your financials and strategy meet investor expectations.

What are the top 3 things investors look for at a Seed round?

At the Seed stage, investors understand you’re early, but they focus on three non-negotiables:

- A strong, committed team: Investors are betting on you. They look for founders with domain expertise, resilience, and “skin in the game.” A cohesive team with complementary skills is paramount.

- Evidence of a large market with a real problem: You must show you’re targeting a market large enough for venture-scale returns (TAM, SAM, SOM). More importantly, you need to prove you’re solving a genuine, pressing problem for which customers will pay.

- Early signs of product-market fit or traction: You don’t need massive revenue, but you need momentum. This can be a compelling MVP, strong user engagement, a growing waitlist, positive customer feedback, or initial revenue. Traction, even in its earliest form, is the best predictor of future success.

Conclusion: You’re Ready to Raise

Becoming investor-ready is about building a stronger, smarter, more resilient business. The work you’ve done using this investor readiness checklist has prepared you not just for investors, but for the real challenges of scaling.

You’ve established a solid foundation, proven market demand, and organized your financials. You’ve built a compelling narrative backed by data and prepared for the scrutiny of due diligence.

Investor readiness is a continuous process. Markets shift and your business will evolve. Regularly updating your materials and metrics will keep you agile and ready for future opportunities.

This preparation builds your most valuable asset: confidence. When you walk into a pitch meeting knowing your numbers, ready for tough questions, and able to tell your story with conviction, investors take notice. They begin to see themselves as partners in your journey.

At OpStart, we believe founders should focus on their vision, not spreadsheets. We provide hands-free, expert-managed finance and accounting services at a flat rate, handling the financial complexities so you can build something remarkable.

You’ve done the work. You’re prepared. You’re ready to raise.

Want to stay ahead of the curve? Get the latest insights to guide your fundraising journey by downloading our 2025 US Fundraising Trends Report.