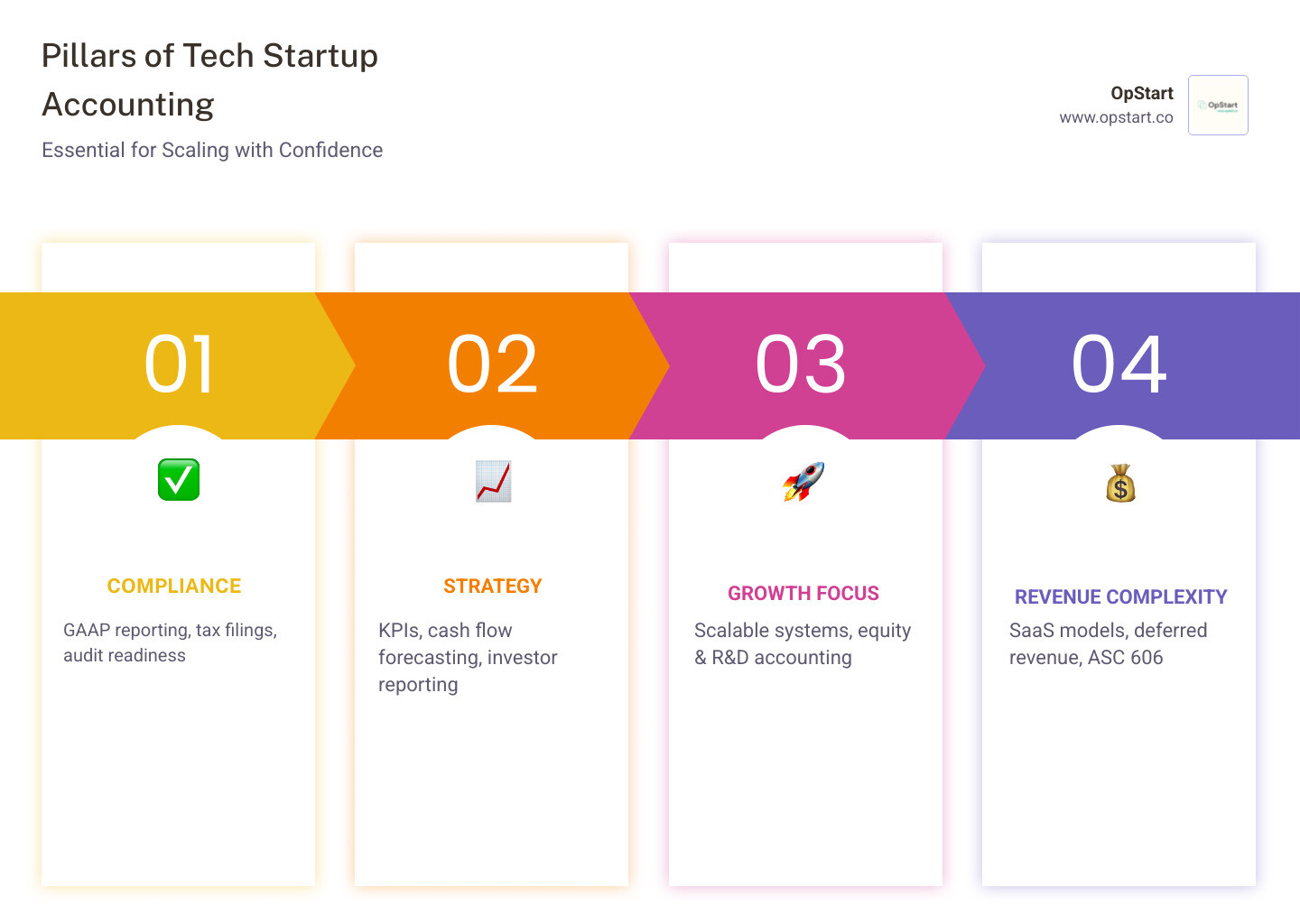

Why Accounting is Mission-Critical for Tech Startup Success

Accounting for tech startups is more than tracking income and expenses—it’s a strategic tool that determines whether your startup scales successfully or becomes one of the many that fail due to cash flow problems.

Quick Answer: What Makes Tech Startup Accounting Unique?

- Revenue Recognition – SaaS and subscription models require complex deferred revenue tracking under ASC 606.

- Equity Management – Stock options, vesting schedules, SAFEs, and convertible notes complicate your cap table.

- R&D Accounting – Software development costs require specific treatment (capitalize vs. expense).

- Burn Rate Monitoring – Tracking cash runway is critical when growth outpaces profitability.

- Investor Readiness – GAAP compliance and accrual accounting are mandatory for fundraising.

Unlike traditional businesses, tech startups have unique revenue models (like recurring subscriptions), cost structures (high R&D and SG&A), and an intentional cash burn to fuel rapid growth. This makes robust financial tracking essential.

The stakes are high. Investors demand clean financials and meaningful KPIs like MRR, churn rate, and CAC. Without proper accounting, you’ll struggle to close funding rounds, make strategic decisions, or prove your business model is viable.

I’m Maurina Venturelli, Head of Go-to-Market at OpStart. With experience at high-growth tech companies like Sumo Logic and LiveAction, I now help founders steer the complexities of accounting for tech startups. A solid financial foundation provides the visibility and control you need to scale with confidence.

Why Accounting for Tech Startups is a Different Ballgame

As a founder, your focus is on product and growth, but postponing accounting is a critical mistake. Accounting for tech startups is fundamentally different from traditional business accounting, and getting it wrong can sink your company. Cash flow problems are a major reason why nearly half of startups fail within the first five years.

Traditional businesses often have simple transactions: sell a product, collect cash, recognize revenue. Tech startups operate differently, dealing with recurring revenue, intangible assets like software, massive R&D investments, and intentional cash burn to fuel growth. This complexity means you can think you’re succeeding while actually heading for a financial cliff. Proper accounting provides the visibility to see problems coming and course-correct.

Unique Revenue Models and Cost Structures

Consider a SaaS startup with a $1,200 annual subscription. You receive the cash upfront, but you can’t recognize it all at once. That payment is deferred revenue, a liability for the service you still owe. You’ll recognize it gradually, at $100 per month, as you deliver the service. This recurring revenue model requires specialized accounting to track what you’ve earned versus what you’ve collected.

Your costs are also different. Unlike a retailer with high Cost of Goods Sold (COGS), a tech startup’s COGS is usually low (e.g., hosting costs). The biggest expenses are typically Selling, General & Administrative (SG&A) and R&D, such as developer salaries and marketing spend. These high fixed costs mean you might spend heavily on engineering before generating any revenue.

Finally, Customer Acquisition Cost (CAC)—what you spend to land a new customer—is a critical metric. Tech startups invest heavily upfront to acquire customers who will pay off over time. Understanding the relationship between CAC and customer lifetime value is essential to proving your business model works.

For a deeper dive into building financial plans that account for these unique structures, check out our guide on startup financial planning.

The Impact of Rapid Growth and Fundraising

Tech startups aim for rapid growth, which changes the financial narrative. When raising venture capital, investors prioritize scalable growth and compelling unit economics over immediate profitability. Your financial reports must clearly show your burn rate, cash runway, and growth trajectory.

The due diligence process is intense. Investors expect GAAP-compliant accrual accounting, a clean cap table, and proper revenue recognition. Messy books can kill a deal or cause lengthy, costly delays.

Scaling challenges also add complexity. Hiring in new states creates multi-state tax obligations, while international expansion introduces issues like VAT and transfer pricing. What starts as simple bookkeeping quickly demands robust systems and expertise.

Startups that establish strong financial operations early gain a massive advantage. They can answer investor questions confidently, make data-driven decisions, and identify problems before they become crises.

Understanding how your finance function supports these broader business goals is crucial. Learn more in our article on the role of finance in a business.

Setting a Solid Financial Foundation

A brilliant product isn’t enough; without a solid financial foundation, your startup is built on quicksand. Proper accounting for tech startups means understanding core principles that ensure business health, enable smart decisions, and attract investors. The first decision is choosing between cash and accrual accounting.

| Feature | Cash Basis Accounting | Accrual Basis Accounting |

|---|---|---|

| When Revenue is Recorded | When cash is received | When revenue is earned (service delivered/product sold) |

| When Expenses are Recorded | When cash is paid | When expenses are incurred (even if not yet paid) |

| Snapshot of Financial Health | Simpler, shows cash on hand | More accurate picture of long-term financial performance |

| GAAP Compliance | Not GAAP compliant | GAAP compliant (required by investors) |

| Complexity | Simpler, less tracking | More complex, requires tracking receivables/payables |

| Best For | Very small businesses, early stages, personal finances | Growing businesses, external funding, tax planning |

While cash accounting is simple, it’s misleading for subscription businesses. An upfront $12,000 annual payment looks like a huge revenue spike, but you haven’t earned it yet. Accrual accounting provides a more accurate picture by recognizing that revenue as $1,000 per month while you deliver the service. This matching principle is crucial for understanding your true performance and is required by investors. For a deeper dive, see our guide on cash vs. accrual accounting.

Essential Financial Records and Statements

Your financial records tell your startup’s story. Key documents include:

- Balance Sheet: A snapshot of your assets (what you own), liabilities (what you owe), and equity (what’s left for owners). Investors scrutinize this to assess your financial position. Learn more with our guide on how to read a balance sheet.

- Income Statement (P&L): Shows your revenue, expenses, and profit or loss over a period. It helps you understand your unit economics and path to profitability.

- Cash Flow Statement: Tracks all cash moving in and out of your business. This is critical because you can be profitable on paper but still run out of cash.

- Cap Table: An essential document for startups that tracks all company equity, including founder shares, stock options, and investor ownership. A clean cap table is vital for fundraising.

Maintain supporting records like bank statements, invoices, receipts, and payroll details. They are the raw data for all your financial reporting.

The Role of GAAP and Accrual Accounting

For any venture-backable tech company, complying with Generally Accepted Accounting Principles (GAAP) is non-negotiable. GAAP provides a standard framework that allows investors to compare your financials with other companies. The core of GAAP for startups is accrual accounting, which ensures revenue is recognized as it’s earned, giving investors confidence in your numbers.

GAAP also includes specific standards like ASC 606 for revenue recognition, which dictates how to account for complex contracts. Getting this wrong can lead to overstated revenue and serious problems during due diligence. Setting up GAAP-compliant systems from the start is easier than fixing them later. Our guide on bookkeeping for startups can help.

Leveraging Accounting Software for Efficiency

Modern accounting software is a founder’s secret weapon. It automates tedious data entry, integrates with other tools (CRM, payroll), and provides real-time visibility into your finances. This allows you to make decisions based on current data, not outdated reports. Good software also scales with you as your business grows.

For example, AP automation can speed up your financial close by 25% and significantly reduce errors. This isn’t just a convenience; it’s a competitive advantage that frees you to focus on growth.

At OpStart, we help startups implement and integrate these systems into a seamless software stack. Learn more about OpStart’s accounting solutions. Investing in your financial foundation early provides the visibility and control needed to scale with confidence.

Navigating Complex Tech Accounting Challenges

Accounting for tech startups involves complexities that traditional businesses don’t face, from subscription revenue to software development costs and unique equity structures. Mastering these areas is key to building investor confidence and understanding your true financial health.

Revenue Recognition for SaaS and Tech Companies (ASC 606)

For any subscription-based business, revenue recognition under ASC 606 is the most critical accounting challenge. The core principle is to recognize revenue as you deliver value, not just when you get paid. The standard follows a five-step model:

- Identify the contract with the customer.

- Identify the performance obligations (the promised services).

- Determine the transaction price.

- Allocate the price to each performance obligation.

- Recognize revenue as you satisfy each obligation.

For an annual subscription paid upfront, the cash becomes deferred revenue (a liability) on your balance sheet. You then recognize it monthly as you provide the service. This gap between cash and recognized revenue is why understanding your cash flow statement is vital. Getting revenue recognition wrong can derail a funding round.

Accounting for R&D and Intellectual Property (IP)

Research & Development is a major expense for tech startups. Under GAAP, R&D costs are typically expensed as incurred, reducing short-term profitability. However, there are key exceptions for software development:

- External-use software (ASC 985-20): Costs can be capitalized (treated as an asset) after “technological feasibility” is established.

- Internal-use software (ASC 350-40): Costs are capitalized during the application development stage.

Capitalizing costs improves reported profitability in the short term, as the costs are moved to the balance sheet and amortized over time. For a deeper dive, KPMG offers a comprehensive handbook. Properly accounting for R&D and IP is also crucial for maximizing tax benefits like R&D tax credits. Learn more about startup taxes.

Equity and Cap Table Management

Equity management is what makes accounting for tech startups truly unique. Key components include:

- Stock Options: Under ASC 718, the fair value of options must be recorded as a compensation expense over the vesting period. This requires a formal 409A valuation to determine your stock’s fair market value.

- 83(b) Election: A critical tax election for anyone receiving restricted stock. It allows you to pay taxes on the stock’s value at grant (when it’s low) rather than at vesting (when it could be much higher). You only have 30 days to file after the grant.

- Convertible Notes and SAFEs: Early-stage funding instruments that convert to equity later. They must be tracked carefully to understand future dilution.

All of this is tracked on your cap table. As Y Combinator CFO Kirsty Nathoo notes, a messy or inequitable cap table is a red flag for investors. Keep it clean and organized from day one.

Key Metrics and Best Practices for Financial Health

Successful tech startups master their key financial metrics and follow disciplined best practices. These numbers are the vital signs of your business, indicating whether you’re on a path to scale or heading for trouble.

Key Financial Metrics and KPIs to Monitor

In growth mode, traditional profitability metrics are less important than KPIs that show scalability. Investors scrutinize these non-GAAP metrics to understand your unit economics.

- Monthly/Annual Recurring Revenue (MRR/ARR): The predictable revenue from subscriptions.

- Churn Rate: The rate at which you lose customers (logo churn) or revenue (revenue churn). High churn is a major red flag.

- Customer Lifetime Value (CLV or LTV) vs. Customer Acquisition Cost (CAC): This ratio shows if your business model is sustainable. A healthy LTV should be at least 3x your CAC.

- Burn Rate & Cash Runway: How fast you’re spending cash and how many months you have until it runs out. Aim for at least 6-12 months of runway.

These KPIs are essential for accounting for tech startups. Learn how they fit into your financial plan in our guide on startup financial planning.

Best practices for accounting in tech startups

Establishing good habits early prevents major headaches later.

- Separate business and personal finances: Open dedicated business bank accounts and credit cards from day one.

- Perform regular bank reconciliations: Reconcile your books with bank statements monthly to catch errors early.

- Establish internal controls: Implement checks and balances, like requiring dual signatures for large payments, to reduce fraud risk.

- Maintain an audit trail: Keep meticulous digital records of every transaction and approval for due diligence.

- Document your processes: Create clear procedures to ensure consistency as you scale.

For more on building these practices, see our resources on bookkeeping needs for startups.

Common mistakes in accounting for tech startups and how to avoid them

Most accounting pitfalls are avoidable if you know what to look for.

- DIY bookkeeping for too long: The opportunity cost of a founder doing bookkeeping quickly outweighs the savings.

- Not filing an 83(b) election: A costly mistake. You have only 30 days from receiving restricted stock to file this tax election.

- Ignoring tax deadlines: This invites penalties and legal issues. Tax complexity grows with your business. Avoid common tax land mines for startups.

- Choosing the wrong accounting method: Investors require accrual accounting. Sticking with cash basis for too long will require a costly restatement of your financials.

- Poor cash flow management: A top reason for startup failure. Monitor your burn rate and runway obsessively.

- Waiting too long for professional help: Proactive engagement with experts saves time, money, and stress, especially before a funding round.

Scaling Your Finance Function: When to Hire or Outsource

At some point, the DIY accounting approach will stop working. Whether you’re drowning in transactions, facing an investor’s request for GAAP-compliant financials, or simply losing valuable time to bookkeeping, you’ll need to scale your finance function. The key question is whether to hire in-house or outsource to experts in accounting for tech startups.

When to Hire an Accountant or Outsource

It’s time to get professional help when you hit certain triggers:

- After fundraising: Seed or Series A investors expect sophisticated, GAAP-compliant financial reporting.

- High transaction volume: If you’re spending too much time on data entry and reconciliations, your time is better spent elsewhere.

- Preparing for an audit: An audit requires clean, well-documented books that an expert can help prepare.

- Growing complexity: Expanding internationally or hiring in multiple states introduces complex tax and compliance challenges.

- Opportunity cost: When the hours you spend on accounting exceed the cost of professional help, it’s time to make a change.

For a detailed comparison of financial roles, see our guide on the difference between a Fractional CFO, Bookkeeper, and CPA.

Evaluating Your Options: In-House vs. Outsourced

Hiring In-House: This gives you a dedicated, fully integrated team member. However, it comes with high fixed costs (salary, benefits) and a single person rarely has the full range of expertise a startup needs (e.g., tax, ASC 606, equity accounting).

Outsourcing: This provides access to a full team of specialists—bookkeepers, accountants, tax experts, and fractional CFOs—for a flexible, often lower, monthly rate. This model scales with your needs and brings experience from working with hundreds of other startups. While it requires proactive communication, the combination of expertise, scalability, and cost-effectiveness makes it the preferred choice for most early and growth-stage startups.

Outsourcing allows you to build a sophisticated finance function from day one without the overhead of a full-time team. Explore how this works with our startup accounting services.

Frequently Asked Questions about Accounting for Tech Startups

What is the difference between bookkeeping and accounting for a startup?

Bookkeeping is the daily recording of financial transactions—categorizing expenses, logging invoices, and reconciling accounts. It’s the foundation of your financial data.

Accounting is the high-level process of interpreting, analyzing, and summarizing that data. Accountants prepare financial statements, ensure GAAP compliance, and provide strategic guidance. In short, bookkeeping records what happened, while accounting explains why it matters and what to do next. Both are essential for effective accounting for tech startups. Learn more about accountancy and bookkeeping services.

When should a startup switch from cash to accrual accounting?

You should switch to accrual accounting before you seek external funding (like a Series A). Investors require GAAP-compliant financials, and accrual accounting provides a more accurate picture of performance, especially for subscription businesses. It matches revenue to the period it was earned, not just when cash was received. Don’t wait until due diligence begins; make the transition proactively to ensure your financials are investor-ready.

How can tech startups manage cash flow effectively?

Effective cash flow management is critical for survival. You can be profitable on paper but still run out of cash.

- Monitor burn rate and runway: Know exactly how much cash you spend monthly and how many months you have left.

- Forecast cash flow: Project your cash inflows and outflows for the next 3-6 months to anticipate shortfalls.

- Manage receivables and payables: Invoice promptly and follow up on late payments. Negotiate reasonable payment terms with vendors.

- Secure a line of credit: Get a credit line before you desperately need it as an insurance policy.

- Maintain a cash reserve: Keep at least six months of operating expenses in the bank as a buffer.

For more detailed strategies, our guide on cash flow analysis offers practical frameworks.

Conclusion

Navigating the landscape of accounting for tech startups is complex, but getting it right is a strategic advantage. Proper accounting moves beyond compliance to provide the financial clarity needed to fuel growth, attract investors, and make data-driven decisions.

You now understand the unique challenges of tech accounting, from ASC 606 revenue recognition to equity management. You’ve also seen the importance of a solid foundation built on accrual accounting, key metrics, and best practices. When done right, your finance function is a strategic weapon; when ignored, it can lead to cash flow crises and failed funding rounds.

You don’t have to steer this alone. Getting expert help can transform your finance function from a headache into a competitive advantage.

At OpStart, we specialize in these unique challenges. We provide hands-free, expert-managed finance and accounting services for tech startups. Our team of bookkeepers, accountants, tax experts, and fractional CFOs delivers a complete financial operations solution at a flat rate that scales with you. We integrate with your software stack and apply proven frameworks to build the financial clarity and control you need for sustainable growth.

The best time to get your financial house in order was yesterday. The second-best time is now.