Why Your Investor Update is More Than Just an Email

Investor update templates provide a structured format for startups to communicate progress, financials, and key milestones to their backers on a regular basis. Here’s what you need to know:

- Essential Components: Highlights, Financials & KPIs, Customer wins, Key hires, Asks, and Challenges

- Recommended Frequency: Monthly for early-stage startups, quarterly for growth-stage companies

- Core Purpose: Keep investors informed, build trust, and secure future funding

- Key Metrics: Revenue/MRR, burn rate, runway, user growth, and churn

- Best Format: Concise email (plain text preferred) with clear sections and specific data

Landing your first check is just the beginning. What happens next often determines if you’ll secure another round. Companies that regularly communicate with investors are twice as likely to raise follow-on funding, yet many startups neglect this simple, powerful tool.

Your investor update is more than a report; it’s a strategic tool. It builds trust, demonstrates execution, and turns passive backers into active champions who can provide introductions and make your next fundraise significantly easier. Most successful updates follow a consistent structure: highlights, key metrics, team updates, and specific asks. The challenge is knowing what to include and how to present both wins and setbacks.

This guide provides a proven template, real examples, and best practices to help you create investor updates that get read and drive results.

I’m Maurina Venturelli, and I’ve built and scaled demand engines at companies like Sumo Logic through IPO, where I learned how consistent communication and clear *investor update templates fuel growth.* Today, as Head of Go-to-Market at OpStart, I help founders like you turn financial operations from a burden into a competitive advantage.

The Ultimate Investor Update Template: Components and Structure

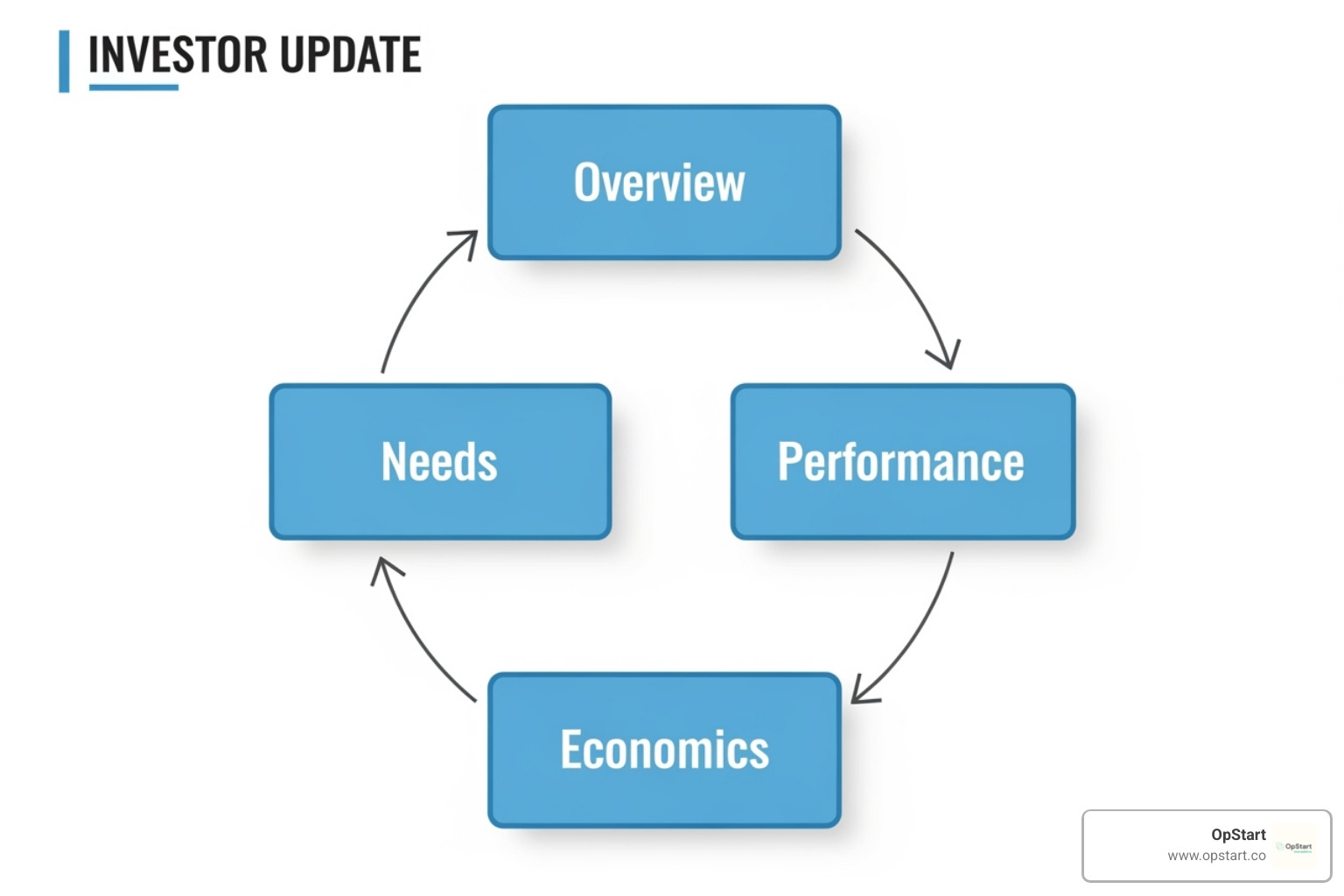

Your investor update should be a clear, honest summary that makes it easy for investors to understand your progress and how they can help. They want to know: (1) how the business is doing, (2) how long it can survive, and (3) how they can offer support. A first-rate investor update template covers four key sections: Overview, Performance, Challenges, and Asks.

Here’s what goes into an investor update template that gets responses.

- Overview (TL;DR / Highlights): An executive summary capturing the essence of the period. Start with your biggest wins. Busy investors often read just this part.

- Performance (Metrics & KPIs): Let the numbers tell the story. Track the same metrics every time so investors can spot trends. We’ll cover specific metrics below.

- Challenges (Lowlights / Problems): Transparency builds trust. Hiding roadblocks makes you look naive or dishonest. Always pair each challenge with your solution or key learning.

- Asks (How Investors Can Help): This turns passive backers into active allies. Be specific. “Can you intro me to the VP of Sales at [Specific Company]?” gets results, while “Let me know if you can help” is ignored.

- Financials: Investors need a clear view of your financial health. Include your cash runway, burn rate, current cash balance, and a high-level revenue and cost snapshot.

- Customer Wins & Product Launches: These stories show momentum and make your metrics come alive. Include new customer acquisitions, testimonials, or features that shipped.

- Key Hires: Announce exceptional new team members and explain their strategic importance. Great hires signal a winning team.

- Future Outlook: Briefly share your strategic priorities for the next period to reinforce your vision and provide context for current activities.

For a ready-to-use structure, you can download this template.

Key Metrics and KPIs to Include

The right metrics prove progress or provide an honest look at what isn’t working. Pick your metrics, then stick with them to enable trend analysis. Align on these with investors upfront.

- For SaaS Companies: Track MRR/ARR (growth rate is key), churn rate (net churn is often more telling), ARPU/ACV, and unit economics like LTV:CAC ratio (aim for 3:1 or better).

- For Marketplace Businesses: Focus on GMV (Gross Merchandise Volume), your take rate (the percentage of GMV you capture as revenue), and the number of active buyers and sellers.

- For E-commerce Companies: Report total revenue and sales volume. Also include AOV (Average Order Value), conversion rate, and repeat purchase rate to show customer loyalty.

- For All Startups: Financial health is universal. Report your gross and net burn rate, cash in bank, and your cash runway—perhaps the most critical number. A high-level P&L summary is also essential. For help, see our guide on How to Read a P&L.

- Engagement Metrics: Show product usage with DAU/WAU/MAU and user retention, which is often more important than acquisition for long-term success.

Always provide context for your metrics. Explain why a number changed compared to the previous period or your goals.

For help managing these numbers, explore our guide on Startup Financial Planning.

The Art of the “Ask”: How to Get Help

Your investors want to help, but they can’t read your mind. Vague asks are ignored; specific asks get action.

- Introductions: Be specific. Instead of “we need customers,” try: “Could you introduce us to the Head of IT at [Specific Hospital System]?” Draft a forwardable email to make it easy for them.

- Hiring: Describe the exact profile. Not “we need a VP of Sales,” but “We need a VP of Sales who has scaled a B2B SaaS team from $1M to $10M ARR. Do you know anyone who fits?”

- Strategic Advice: Ask narrow, time-boxed questions. Instead of “what about growth?” try: “We’re debating feature A vs. B. Could we get your 15-minute take on what customers in your experience care about?”

- Fundraising: Give a heads-up. “We plan to kick off our Series A in Q3. As we build our target list, would you make warm intros where you have relationships?”

The pattern is simple: be specific, make it easy, and respect their time.

For more guidance, check out our guide on How to Find and Meet Investors.

Investor Update Examples and Formats

The best update won’t matter if no one reads it. The format should respect your investors’ time while giving them everything they need.

Email has long been the standard, but more sophisticated options exist.

- Plain text email is the gold standard for many. It’s direct, scannable, and requires no downloads. Use clear headings and bullet points.

- PDF attachments work for detailed charts or financials. Always include a concise summary in the email body; the PDF should be optional reading.

- Notion pages and Google Docs allow for a living update hub with embedded charts and comments. You can send a link to the same page each month.

- Presentation decks are best for quarterly updates or major announcements where visuals improve the story. Link to the deck rather than attaching a large file.

- Dedicated investor relations platforms are built for this purpose. These tools can automate metric collection, generate reports, and track engagement (like who opened the update). They also serve as a data room for sensitive documents.

While specialized tools are helpful, they aren’t mandatory. The technology should serve your strategy, not dictate it.

At OpStart, we ensure your financial data is accurate and ready for any format you choose, giving you confidence in the metrics you share.

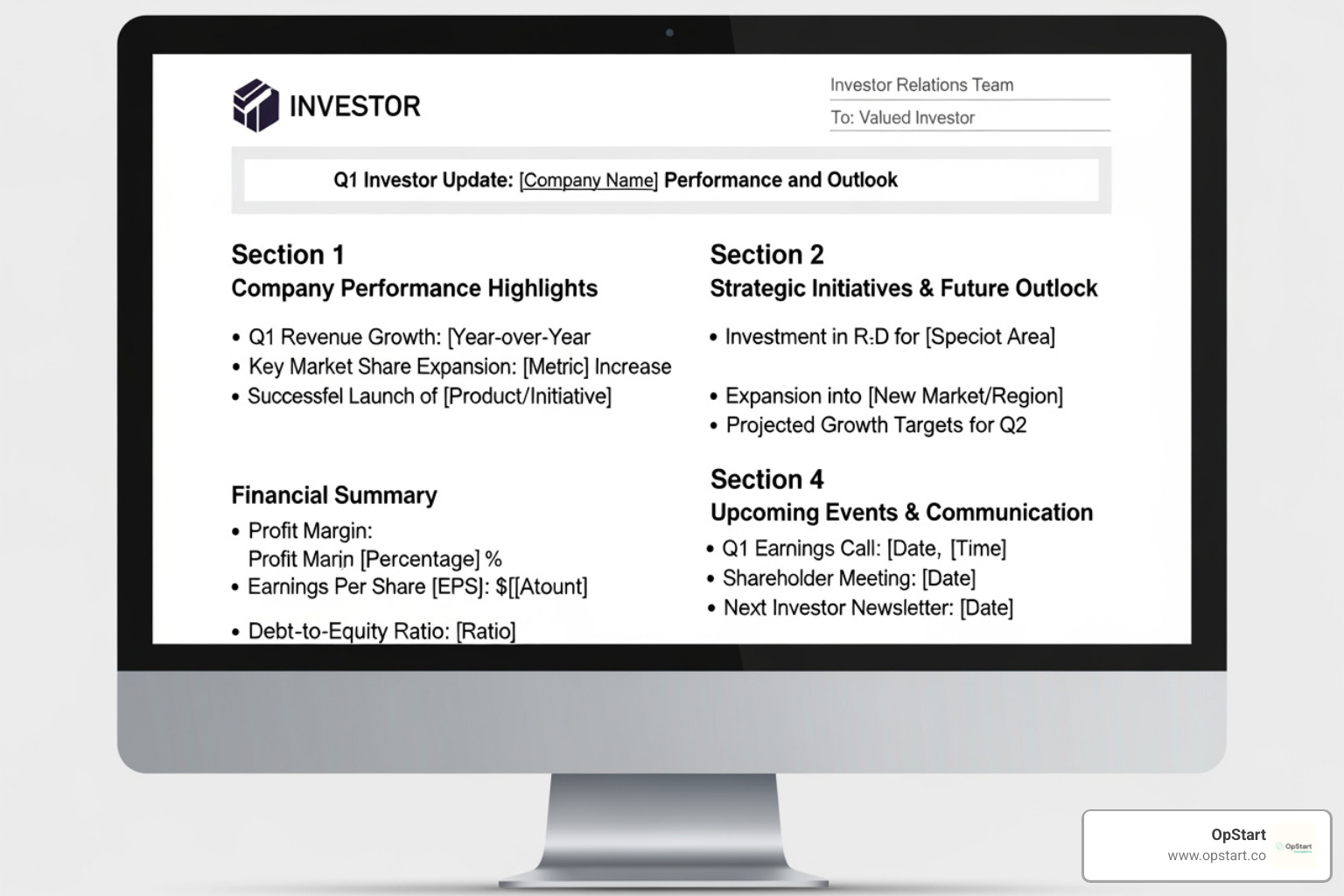

Downloadable Investor Update Template

Here’s a straightforward investor update template that works well as a plain text email:

Subject: [Your Company Name] – Investor Update [Month/Quarter Year]

Hi Team,

TL;DR: [1-2 sentences summarizing the biggest news. Example: “We hit our Q2 revenue target and closed a major partnership, though we faced unexpected supply chain delays. Runway remains strong at 14 months.”]

Highlights:

- [Major Win 1: e.g., “Achieved $X MRR, representing Y% MoM growth.”]

- [Major Win 2: e.g., “Secured partnership with [Company Name], opening up a new market segment.”]

- [Major Win 3: e.g., “Launched [New Product/Feature] to positive user feedback (NPS of X).”]

- [Team Update: e.g., “Welcomed [Name] as our new VP of Engineering from [Previous Company].”]

Key Performance Indicators (KPIs):

- MRR: $X (+Y% MoM)

- Cash in Bank: $Z

- Burn Rate: $A (Net) / $B (Gross)

- Runway: C months

- DAU/MAU: X / Y (+Z% MoM)

- Churn Rate: D% (Net)

Challenges (Lowlights):

- [Problem 1: e.g., “Experienced a 3-day server outage due to [reason], impacting X% of users.”]

- Action/Solution: “Implemented new redundancy measures and migrated to [new provider]. Offering credits to affected customers.”

- [Problem 2: e.g., “Sales cycle for enterprise deals is longer than anticipated, leading to a Q3 revenue forecast adjustment.”]

- Action/Solution: “Hiring a new sales leader with enterprise experience and refining our demo process.”

Asks:

- Introductions: “Looking for intros to decision-makers at [Target Customer Type] companies. Specifically, [Role] at [Company Names].”

- Hiring: “We’re struggling to find a senior data scientist. Any recommendations or intros to recruiters specializing in this field?”

- Feedback: “We’ve developed a new marketing landing page. Would love your candid feedback: [Link].”

Thank you for your continued support!

Best,

[Your Name]

CEO, [Your Company Name]

You can also explore a more formal Investor Update Letter template if it fits your company culture.

Tailoring Your Investor Update Template for VCs vs. Angels

Not all investors are the same, and your updates shouldn’t be either. While the core information is consistent, the emphasis should shift based on the audience.

Angel investors are often personally connected to your journey and appreciate warmth and context. They respond well to team culture wins and behind-the-scenes stories. Explain any jargon, and make specific, actionable asks. Most angels prefer monthly updates in the early stages.

Venture capital (VC) investors are laser-focused on scalability and ROI. They manage large portfolios and need concise, data-driven updates. Lead with your most important metrics and be ready to provide deeper analysis if asked. VCs are valuable for strategic asks like introductions to potential acquirers or executive talent. While quarterly updates can work for growth-stage companies, monthly is still wise for early-stage startups.

You can create a master update and then add a personal note or adjust the level of detail for each audience.

Best Practices for Consistent and Trust-Building Updates

Think of your investor updates as the heartbeat of your relationship with your backers. A steady rhythm of communication signals that you’re in control and committed to transparency.

The magic formula is simple: pick a schedule, stick to it, and be honest about both wins and struggles.

Finding Your Rhythm: Cadence and Timing

Most early-stage startups send monthly updates. As companies mature, quarterly updates become more common. However, consistency matters more than frequency. If you commit to monthly updates, send them every month. Sporadic communication looks disorganized and raises red flags. For timing, mid-week (Wednesday or Thursday) is ideal, as Mondays are chaotic and by Friday afternoon, your email may be ignored.

If you’re actively fundraising, consider increasing your cadence to bi-weekly to maintain momentum. For more on this, see our guide on Fundraising in Today’s Market.

Building Trust Through Transparency

Trust is earned through honest, consistent communication. Your investors expect professionalism and candor, not perfection.

Use a consistent format and metrics in your investor update template. This allows investors to easily track trends. Switching metrics or cherry-picking good news erodes trust. Always provide context—explain why a metric changed. This demonstrates strategic thinking. Finally, be proactive. Address potential concerns before you’re asked and respond promptly to any questions.

How to Present Both Good and Bad News

Investors expect bad news; what they can’t tolerate is being blindsided. The key is pairing transparency with a solutions-oriented approach. Never present a challenge without explaining what you’re doing about it. This demonstrates leadership.

Don’t bury bad news, but don’t lead with it either. Use dedicated sections for Highlights and Challenges. This structure helps investors mentally prepare to put on their problem-solving hat.

A powerful framework is to rate key categories (Runway, Team, Product) on a scale of 1 to 5, but leave out 3’s. This policy, popularized by the Founder Institute, forces you to take a stand: is something going well (4 or 5) or poorly (1 or 2)? This eliminates wishy-washy assessments and encourages honesty. Read why the Founder Institute has a “no threes allowed” policy here. When facing a challenge, use your Asks section to turn a vulnerability into an opportunity for investors to add value.

Common Mistakes to Avoid

Avoid these common mistakes that can sabotage investor relationships:

- Inconsistency: Sending updates only when you need something makes your communication feel transactional. Stick to a regular schedule.

- Vague Asks: “Let me know how you can help” creates work for the investor. Make specific, easy-to-fulfill requests.

- Overly Technical Jargon: Write for a general business audience. If you must use a technical term, briefly explain it.

- Wrong Length: Updates that are too long won’t get read, while those that are too sparse feel like you’re hiding something. Aim for a 5-minute scan, with optional links for deeper dives.

- Forgetting Gratitude: A simple “thank you” goes a long way. Acknowledge specific help from investors to encourage future engagement.

This all becomes easier with accurate financial data. Our Startup Accounting Services: What Founders Need to Know ensures your numbers are always ready, so you can focus on your story.

Frequently Asked Questions about Investor Updates

Here are answers to some of the most common questions founders ask about investor updates.

How frequently should I send investor updates?

While there’s no single answer, follow these guidelines:

- Early-Stage (Pre-seed/Seed): Monthly updates are best. Things change quickly, and this keeps investors engaged.

- Growth-Stage (Series A+): Quarterly updates often suffice as business cycles are longer.

- During Active Fundraising: Increase frequency to bi-weekly or even weekly to maintain momentum and stay top-of-mind.

The golden rule: Consistency is more important than frequency. Pick a schedule you can maintain and stick to it.

How can investor updates help with future fundraising?

Investor updates are a strategic tool for future fundraising. They:

- Create a Track Record: Regular updates build a documented history of execution, which is powerful proof for new investors.

- Demonstrate Professionalism: They show you can set goals, measure progress, and communicate transparently—key traits investors fund.

- Keep Investors Warm: If a VC passed but said “come back later,” updates let them watch you hit your milestones, potentially turning a “no” into a “yes.”

- Prime Existing Investors: Informed and confident backers are more likely to reinvest in your next round and make valuable introductions.

For more on this, see our Series A Fundraising Guidelines.

Are there legal requirements for investor updates?

It depends on your agreements. While no blanket federal law requires private companies to send regular updates, you are likely bound by contractual obligations.

- Information Rights: Most investment agreements, especially with VCs, include “information rights” clauses that specify what information you must provide and how often. Failing to comply can be a breach of contract.

- State Law: If you’re a Delaware C-Corp, state law gives shareholders rights to inspect books and records upon reasonable request.

- Fiduciary Duty: As an officer, you have a fiduciary duty to shareholders. Withholding material information or misleading investors could create legal liability.

Public companies face much stricter SEC reporting requirements (10-Qs and 10-Ks), but private companies must still honor their contracts. Always review your investment documents with legal counsel to understand your obligations. When in doubt, over-communicate.

Also, stay aware of evolving regulations like Beneficial Ownership Information Reporting, which is part of the broader compliance landscape.

At OpStart, we ensure your financial data is always accurate and report-ready, so you can meet your obligations with confidence.

Conclusion: Turn Your Updates into a Strategic Advantage

Investor updates are a strategic tool, not a chore. When done right, they can double your chances of raising follow-on funding, build unshakable trust, and create a documented history of execution that speaks louder than any pitch deck.

Using an investor update template is more than a reporting exercise; it’s a forcing function that sharpens your strategic thinking. It requires you to regularly assess what’s working, articulate challenges, and ask for specific help. This rhythm keeps you accountable and makes you a better leader.

We’ve covered the essentials: a clear overview, data-driven KPIs, transparent challenges paired with solutions, and specific asks. The foundation for all of this is solid financial data. If you’re scrambling to figure out your burn rate each month, your updates will suffer.

At OpStart, we handle the heavy lifting of your financial operations. Our hands-free, expert-managed finance and accounting services ensure you always have accurate, up-to-date numbers. We provide the financial clarity that makes investor updates straightforward rather than stressful, so you can focus on building your business.

Your investors have bet on you. Give them the information they need to become your biggest advocates.

Ready to strengthen your investor relationships? Explore our CFO Services for Startups to see how we can support your growth. For a look at the fundraising landscape, download our 2025 US Fundraising Trends Report.