Why Small Business Bookkeeping Services Are Essential for Growing Companies

Small business book keeping services offer professional financial management that handles daily transactions, generates accurate reports, and ensures tax compliance. This frees business owners to focus on growth instead of spreadsheets.

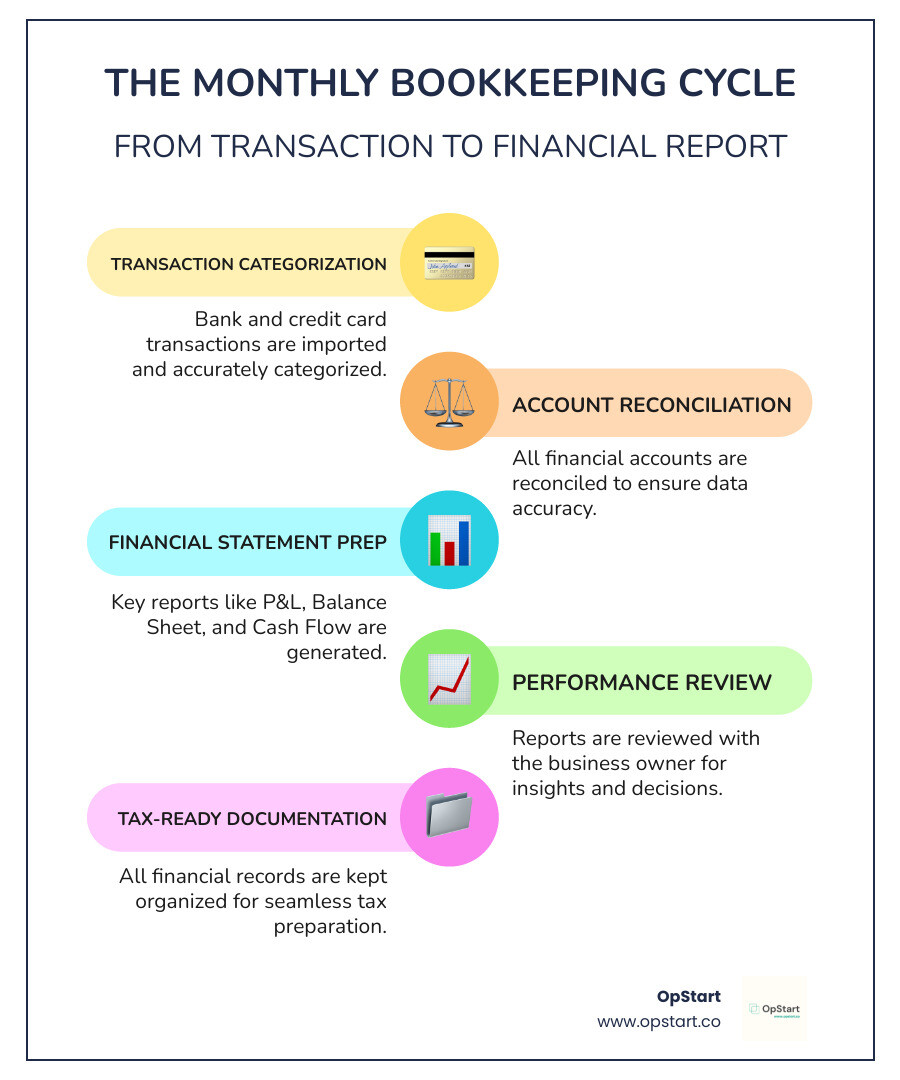

Key services include:

- Monthly transaction categorization and reconciliation

- Financial statement preparation (P&L, Balance Sheet, Cash Flow)

- Accounts payable and receivable management

- Tax-ready documentation and deduction tracking

- Real-time financial reporting and insights

Common pricing models:

- Monthly subscriptions: $200-$500+ based on transaction volume

- Flat-rate packages: Often preferred for predictable costs

- Hourly rates: $50-$150 per hour for project-based work

Small business owners spend an average of 10 hours per month on bookkeeping tasks. The choice between DIY software and professional services often comes down to time versus expertise. While basic accounting tools can handle simple needs, growing businesses benefit from dedicated bookkeepers who provide strategic insights beyond transaction recording.

I’m Maurina Venturelli, Head of Go-to-Market at OpStart. I’ve helped scale companies from startup to IPO and work daily with founders who find that professional bookkeeping is essential for sustainable growth and investor readiness.

Small business book keeping services definitions:

Why Your Small Business Needs a Bookkeeping Service

It’s a familiar scene for many entrepreneurs: late nights spent hunched over a laptop, trying to make sense of financial records. Small business book keeping services are no longer a luxury; they’re essential for any owner who wants to run their business instead of drowning in paperwork.

You started your business to pursue a passion, not to become a part-time accountant. Yet, the average small business owner spends about 10 hours every month on bookkeeping. Imagine what you could accomplish with that time back—developing products, connecting with customers, or taking a well-deserved break.

Professional bookkeeping services save time and provide the accurate, up-to-date financial data you need to make confident decisions. You’ll know exactly when you can afford a new marketing campaign or hire another team member.

If you’re wondering whether your current approach is working, our guide Is Your Bookkeeping Good Enough? can help you figure that out.

Key Signs It’s Time to Outsource

Here are clear signs it’s time to get professional help with your books:

- You’re spending too much time on books: If bookkeeping eats into your evenings and weekends, it’s time stolen from growing your business.

- Financial records are inaccurate or behind: Playing catch-up is stressful and leads to poor decision-making.

- You lack financial expertise: Terms like depreciation and accrual accounting shouldn’t keep you up at night.

- Your business is growing rapidly: More customers mean more transactions, and complexity grows fast.

- You’re preparing for a loan or investment: Investors and banks require professional, accurate financial statements.

Seeking funding with messy books is like showing up to a job interview in pajamas. First impressions matter enormously when someone is deciding whether to trust you with their money.

The Core Benefits of Professional Bookkeeping

Investing in professional small business book keeping services changes how your business operates.

- Focus on your core business: Free up mental space for big-picture thinking and strategy instead of spreadsheets.

- Access to expertise: Get a professional who understands accounting principles, tax regulations, and best practices, often saving you more than the service costs.

- Scalability: A professional service has systems that grow with you, handling 100 transactions as easily as 1,000.

- Tax season readiness: Your books are always current and compliant, so your tax professional can focus on strategy instead of cleanup.

- Peace of mind: Knowing your financial house is in order allows you to make decisions confidently and sleep better at night.

For a deeper dive into the financial benefits, check out 8 Ways a Great Bookkeeper Pays for Themselves (and Then Some). The return on investment is often much higher than business owners expect.

DIY Bookkeeping vs. Professional Services: Making the Right Choice

When running a small business, the question isn’t if you need bookkeeping—it’s whether you should do it yourself or hire a professional. This decision often comes down to control versus convenience and cost versus long-term value.

The DIY Bookkeeping Route

Many new business owners start with a DIY approach to control costs. This usually means using manual spreadsheets or basic accounting software.

The main appeals are low initial cost and direct control over every transaction. However, this approach becomes expensive when you factor in your time—those 10+ hours per month add up. There’s also a steep learning curve for accounting principles, and the potential for costly errors is high. Basic tools often lack the advanced features you’ll need as you grow.

The Difference Between DIY and Small Business Book Keeping Services

While DIY might save money upfront, small business book keeping services deliver better long-term value. The difference becomes clear when you compare what you’re really getting:

| Feature | DIY Bookkeeping | Professional Services |

|---|---|---|

| Cost | Low upfront, high hidden costs in time and errors | Monthly fee that’s transparent and predictable |

| Time Commitment | Around 10 hours monthly from you | Just 2-4 hours monthly from you |

| Expertise | Limited to what you can learn; error-prone | Trained professionals who know the ins and outs |

| Accuracy Guarantee | You’re on your own if something goes wrong | Many services fix errors at no charge |

| Scalability | Gets harder as you grow | Easily handles increased complexity |

The real game-changer is the human oversight and strategic advice that professional services provide. Software can crunch numbers, but it can’t tell you why your cash flow dipped or suggest ways to improve your profit margins.

It’s worth understanding the different roles: bookkeepers record daily transactions, accountants analyze the bigger picture, and Fractional CFOs provide high-level strategic guidance. To learn more, check out: Fractional CFO vs. Bookkeeper vs. CPA: What’s the Difference?.

The choice ultimately depends on your business journey and what you value most: automation versus expertise. As you grow, professional services become a necessity for sustainable growth.

Key Features and Pricing Models of Small Business Book Keeping Services

When you invest in professional small business book keeping services, you’re not just buying data entry. You’re partnering with financial experts who help you make smarter decisions. But what exactly do you get, and how is it priced?

Unlike DIY software, a quality bookkeeping service becomes an extension of your team, handling the technical details so you can focus on growth.

What to Look for in a Small Business Book Keeping Services Provider

Focus on these key areas to find the right partner:

- Dedicated Support: Look for a service that assigns you a consistent bookkeeper or team who gets to know your business. This continuity is invaluable.

- Software Proficiency: A good service understands industry-standard tools and can integrate smoothly with your existing systems.

- Regular Financial Reports: You should receive clean, easy-to-read monthly reports, including your Profit & Loss, Balance Sheet, and Cash Flow statements. These are your business’s health checkup.

- Bank Reconciliation: This critical process matches your bank statements with your accounting records to ensure accuracy and catch any errors early.

- Accounts Payable and Receivable: Proper management of bills and invoices keeps your cash flow healthy and maintains good relationships with vendors and customers.

For startups, understanding these fundamentals is crucial. Check out our guide on Startup Accounting Services: What Founders Need to Know for more insights.

Understanding Service Pricing Models

Bookkeeping services use several pricing approaches:

- Monthly Subscriptions: This is the most popular option, offering a predictable monthly fee for a defined set of services, often based on your transaction volume.

- Flat-Rate Packages: These offer the ultimate in budget predictability, with tiered packages (e.g., Basic, Standard, Premium) at fixed monthly rates.

- Tiered Pricing Based on Expenses: Some providers scale their fees according to your business activity. As your expenses increase, your fee grows proportionally.

- Hourly Rates: While flexible, hourly rates ($50-$150/hour) can be unpredictable for ongoing services and are better suited for one-time projects like catch-up bookkeeping.

Always ask about potential hidden fees for services like year-end adjustments or catching up overdue books. A trustworthy provider will be transparent about all costs.

How Bookkeeping Services Drive Growth and Simplify Taxes

Your bookkeeper doesn’t just keep records—they build the foundation for your business growth. Professional small business book keeping services transform raw financial data into actionable insights that drive real business decisions.

Every transaction tells a story. When properly organized, these stories reveal patterns that guide your next move. This is the power of professional bookkeeping: it shifts you from recording the past to understanding the future.

Using Financial Reports for Strategic Decisions

Your monthly financial reports are your business intelligence system. A good bookkeeper delivers a roadmap for growth:

- Cash Flow Management: See exactly where money flows in and out, allowing you to plan ahead and spot potential cash crunches.

- Budgeting and Forecasting: Use solid historical data to create realistic budgets and financial plans.

- Key Performance Indicators (KPIs): Track the metrics that matter most, like gross profit margin or customer acquisition cost, and get alerts when something needs attention.

- Profitability Analysis: Get a clear breakdown of your revenue streams to see which products or services are truly profitable, so you can double down on what’s working.

Preparing for a Stress-Free Tax Season

With professional bookkeeping, tax season is no longer a source of stress. Your financial records stay organized throughout the year, not just in the frantic weeks before deadlines.

- Maximizing Deductions: A bookkeeper who understands tax law will properly categorize every expense, catching deductions you might otherwise miss.

- Year-Round Tax Planning: Avoid April surprises by tracking tax obligations throughout the year, allowing for quarterly payments and strategic spending.

- Seamless CPA Collaboration: Your tax preparer receives clean, organized records, which reduces their fees and your stress.

- Compliance: A bookkeeping partner stays current on changing regulations, like the Corporate Transparency Act, so you don’t have to. For specific guidance, you can review the Information on the Corporate Transparency Act.

When you need specialized tax support, having organized books makes everything easier. Consider working with a Startup Tax Firm that understands your unique needs.

Choosing and Integrating Your Bookkeeping Partner

Finding the right small business book keeping services partner is about finding a good fit. Once you find that match and complete the initial setup, you’ll wonder how you ever managed without them.

Best Practices for Choosing a Service

Choosing the right partner is easier when you know what to look for:

- Assess Your Needs: Are you a solo entrepreneur or a growing business with inventory and payroll? Your needs will determine the right solution. For startups, understanding your unique requirements is key: Bookkeeping Needs for Start-ups.

- Check for Industry Expertise: Some bookkeepers specialize in sectors like e-commerce or tech startups. This expertise can help them spot industry-specific opportunities or red flags.

- Read Reviews and Referrals: Look beyond website testimonials. Check online reviews and ask your network for real-world feedback on reliability and communication.

- Ask Technical Questions: How will they integrate with your bank accounts, payment processors, and other software? Modern services use secure, automated connections that eliminate manual work.

- Understand the Communication Style: Clarify if you’ll have a dedicated contact and how often you’ll connect. Setting expectations early prevents confusion later.

Integrating a Service with Your Operations

A smooth onboarding sets the stage for long-term success.

- Onboarding Process: Most services start by securely connecting your business bank accounts and credit cards to automatically import transactions. This eliminates manual data entry and keeps your books current.

- System Integration: Your bookkeeper needs a full financial picture, so they should connect with your payroll platforms and payment processors for a seamless flow of information.

- Establish Communication: Set up clear channels for communication, whether it’s monthly calls or a dedicated messaging platform. Quick responses to your bookkeeper’s questions keep the process moving smoothly.

- Plan for Cleanup: If your books are behind, be prepared for an initial cleanup period. Being upfront about your situation allows your bookkeeper to plan accordingly.

There’s a short learning curve for both sides as you establish a workflow. Patience and open communication during this adjustment period are key to a successful partnership.

Frequently Asked Questions about Small Business Bookkeeping

Here are answers to the most common questions we hear from small business owners about small business book keeping services.

How much do bookkeeping services for small businesses typically cost?

Costs vary, but you can typically expect to pay $200 to $500+ per month on a subscription basis. The price depends on factors like your monthly transaction volume and the complexity of your business. A retail operation with inventory and multiple bank accounts will require more work than a simple consulting business. Flat-rate packages are also popular because they offer predictable, transparent pricing, which helps with budgeting.

What’s the difference between a bookkeeper and an accountant?

This is a common point of confusion. The roles are distinct but complementary:

- Bookkeepers handle daily financial record-keeping. They categorize transactions, reconcile accounts, manage payables and receivables, and prepare monthly financial statements.

- Accountants focus on the bigger picture. They analyze the data from the bookkeeper, prepare tax returns, and offer strategic financial advice and planning.

A good bookkeeper provides clean, organized data year-round, which makes your accountant’s job easier and often less expensive. For growing businesses, structuring effective Accounting & Finance Departments is crucial.

Can a bookkeeping service help if my books are years behind?

Yes, absolutely. Many business owners find themselves in this situation. Most professional services offer catch-up bookkeeping to reconstruct your financial history from old bank statements and receipts. This process gets your records current and accurate, which is essential for filing back taxes or applying for loans. Think of it as a financial reset that provides a clean slate and a solid foundation for the future.

Conclusion

Building a successful small business is a demanding journey. While it’s tempting to push financial management aside, neglecting your books can hinder your growth. Small business book keeping services transform this burden into a strategic advantage.

Outsourcing your bookkeeping buys back valuable time and, more importantly, provides the financial accuracy needed for smart decision-making. You can answer investor questions confidently, apply for loans, and sleep soundly knowing your tax obligations are handled. That peace of mind is priceless.

The choice is simple: spend your time wrestling with spreadsheets or focus on the vision that inspired your business. When you consider the hidden costs of errors and missed opportunities, the value of professional services becomes clear.

For startups ready for hands-free financial management, OpStart provides expert-managed bookkeeping, tax, and CFO services at a flat rate. We integrate with your existing software, delivering clarity, accuracy, and the confidence that comes from having your financial house in perfect order.

Your business deserves to thrive. It starts with a rock-solid financial foundation.