Why Every Founder Needs a Startup Budget Template Google Sheets

A startup budget template google sheets is more than just numbers-it’s your financial roadmap for survival and growth. Here’s what it gives you:

Key Benefits of Using a Startup Budget Template:

- Financial clarity – Know where your money is going and how long it will last.

- Investor confidence – Show backers you have a credible plan for their capital.

- Strategic guidance – Make data-driven decisions on hiring, marketing, and product development.

- Cash flow control – Forecast your runway and avoid running out of money.

- Goal tracking – Measure actual performance against your projections.

Most founders don’t know how to calculate the real costs of getting started. Budgeting is “essential for any organization’s financial health. It keeps the lights on, ensures you can still pay your people, and serves as the jumping-off point for accomplishing your goals.”

The harsh reality is that a profitable business can still fail if it runs out of cash. Your budget is a sanity check before you launch and a dashboard once you’re running. It helps you work backward from growth targets to see if your revenue metrics are achievable.

Google Sheets makes this process accessible. It’s free, collaborative, and cloud-based, with formulas that do the heavy lifting. You don’t need to be a CFO to build a budget that works.

I’m Maurina Venturelli. In my career leading go-to-market teams, I’ve seen how a solid Google Sheets budget template for startups helps founders make smarter decisions and secure funding. Now as Head of Go-to-Market at OpStart, I help startups get their financial operations right from day one.

Related resource:

Why a Startup Budget is Your Financial North Star

Think of your budget template in Google Sheets as the GPS for your business journey. It provides clear direction when everything else feels uncertain.

Startup budgets differ from those of established businesses. A mature company’s budget optimizes existing operations. A startup budget is about figuring out what you need to get off the ground and stay airborne. It estimates capital needs, early expenses, and tracks spending against your plan. With limited resources and constant unknowns, this clarity is essential for survival.

A well-crafted budget gives you a complete picture of your financial health. It helps you organize expense categories, project revenue, track funding, and monitor operating expenses. Without this roadmap, you’re making decisions based on gut feelings instead of data-a recipe for running out of runway.

If you’re just getting started with startup finances, our guide on Startup Accounting Services: What Founders Need to Know can help you build a solid foundation.

The Key to Attracting Investors

When meeting with potential investors, your Google Sheets budget is your credibility card. Investors know the difference between founders who’ve done the math and those who are just hoping for the best.

A detailed budget shows you understand the real costs of building your business and proves you’re serious about execution. This fiscal responsibility sets you apart from other founders competing for capital.

Investors don’t expect perfect predictions. They want to see that you’ve thought through your assumptions, understand key financial drivers, and have a realistic plan for their money. Your budget is the foundation for proving your business is viable and showing how you’ll use their investment to hit specific milestones.

Many founders miss that VCs are already looking ahead to your next funding round. Your budget should articulate your growth strategy and show how you’ll reach the metrics needed for future rounds. When you can justify your funding request with solid numbers, you’re inviting investors to join a well-planned journey.

Managing Cash Flow, Burn Rate, and Runway

In the startup world, cash is king. It’s the difference between success and shutting down before you reach product-market fit.

Your budget model is your early warning system for cash problems. It helps you track three critical numbers: cash flow (money in), burn rate (money out), and runway (how long you can operate).

Your burn rate is how much cash you use each month. Tracking it consistently is key. A template lets you monitor every dollar, so you can calculate your monthly burn precisely. Once you know your burn rate, you can forecast your runway-the number of months until you run out of cash.

Even profitable businesses can fail if they run out of cash. This happens when revenue comes in slower than bills go out. Without careful cash flow management, you can be growing and dying at the same time.

By projecting your cash position monthly, you can spot potential shortfalls before they become emergencies. This gives you time to adjust spending, accelerate collections, or raise more capital. For a deeper understanding of how cash moves through your business, check out our article on What is Cashflow?.

This visibility into your runway is essential for you, your investors, and your team. When everyone knows how much oxygen is left, you can make smarter decisions about when to sprint and when to conserve resources.

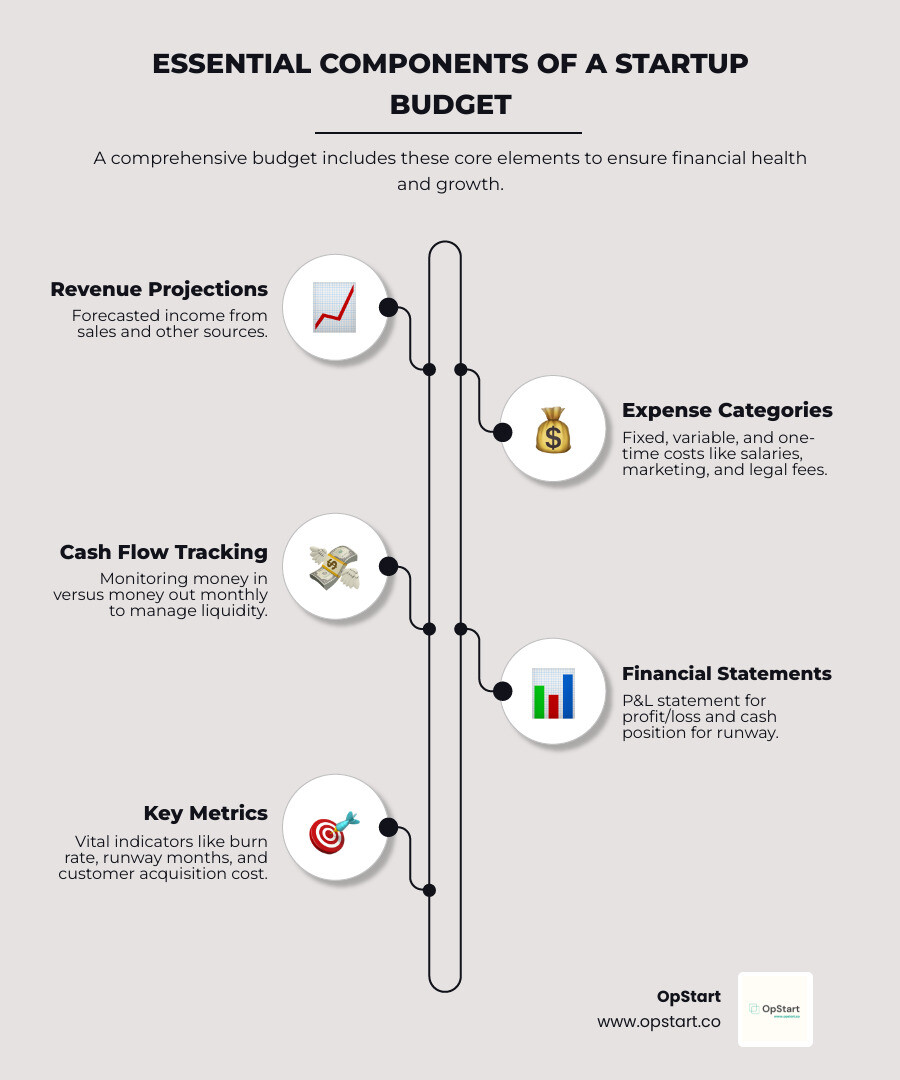

Anatomy of an Effective Startup Budget Template Google Sheets

An effective Google Sheets startup budget template is the control panel for your business’s financial engine. It’s a command center that tells you where you stand and where you’re headed.

A great template brings together several critical components. You need customizable expense categories, realistic revenue and cost projections, and a way to track funding sources. It must capture all operating costs and often-overlooked items like licensing and permits.

The best templates feature automated calculations, a user-friendly interface, and real-time updates. A summary dashboard with charts and graphs gives you an at-a-glance view of your financial health.

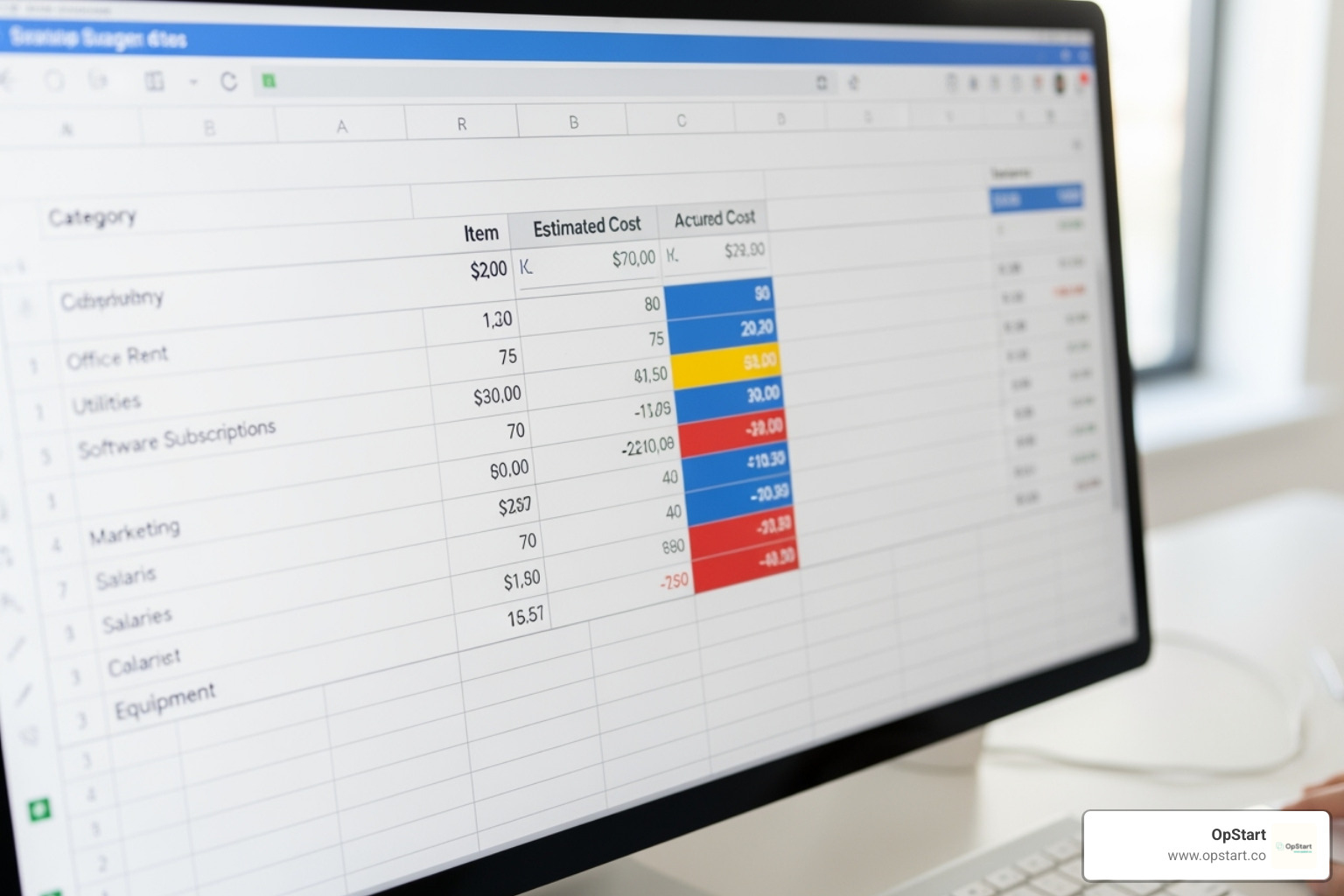

Essential Expense Categories to Include

Being thorough about expenses is smart planning. Your template must capture both one-time investments and recurring costs.

One-time startup costs include items like:

- Legal fees (business registration, trademarks)

- Initial equipment (computers, software, furniture)

- Website development (design, hosting, domain)

- Branding and marketing launch

- Initial inventory (for physical products)

- Security deposits (office space, utilities)

Recurring operating expenses keep your business running. Personnel costs are often the biggest line item (25-50% of your budget), including salaries, benefits, and payroll taxes. Other recurring costs include:

- Rent and utilities

- Software subscriptions (CRM, accounting tools)

- Ongoing marketing and advertising

- Travel and entertainment

- Insurance and supplies

- Professional services (accounting, legal)

Understanding fixed vs. variable costs is crucial. Fixed costs (rent, salaries) are constant, while variable costs (materials, commissions) fluctuate with business activity. For product businesses, track Cost of Goods Sold (COGS). For major investments, budget for Capital Expenditures (CapEx).

Keeping track of these categories requires solid bookkeeping. Our guide on Bookkeeping for Start-ups walks you through the fundamentals.

Key Financial Projections and Metrics

A great template helps you understand where your business is going. Projections and metrics transform your budget into a powerful financial model.

Revenue forecasting is your realistic estimate of how much money your startup will bring in. Base forecasts on solid assumptions about sales volume, pricing, and market growth. Avoid overly optimistic hockey-stick projections; ground your numbers in data.

Your Profit and Loss (P&L) statement subtracts costs from revenue to show if you’re making or losing money. It’s a key measure of profitability, but a positive P&L doesn’t guarantee survival if cash flow is poor.

Cash flow projections are critical. They track the actual timing of money moving in and out of your business. You can be profitable on paper but run out of cash if customers pay slowly. Monitor your cash position closely. Our article on Cash Flow Analysis explains why this is so important.

Finally, build in the Key Performance Indicators (KPIs) that matter to your business. Customer Acquisition Cost (CAC) is what you spend to land a customer. Lifetime Value (LTV) is the total revenue a customer will generate. If your CAC is higher than your LTV, your business model is unsustainable.

Other key metrics include Monthly Recurring Revenue (MRR) and churn rate for subscription businesses, and gross margin for product companies. These metrics turn your budget into a forward-looking strategic tool.

How to Create and Use Your Google Sheets Budget

You don’t need a finance degree to create and use a template in Google Sheets. Google Sheets makes financial planning accessible to any founder. Let’s walk through getting started and keeping your budget healthy.

Step-by-Step: Using a startup budget template in Google Sheets

Here’s how to set up your budget template and make it work for you.

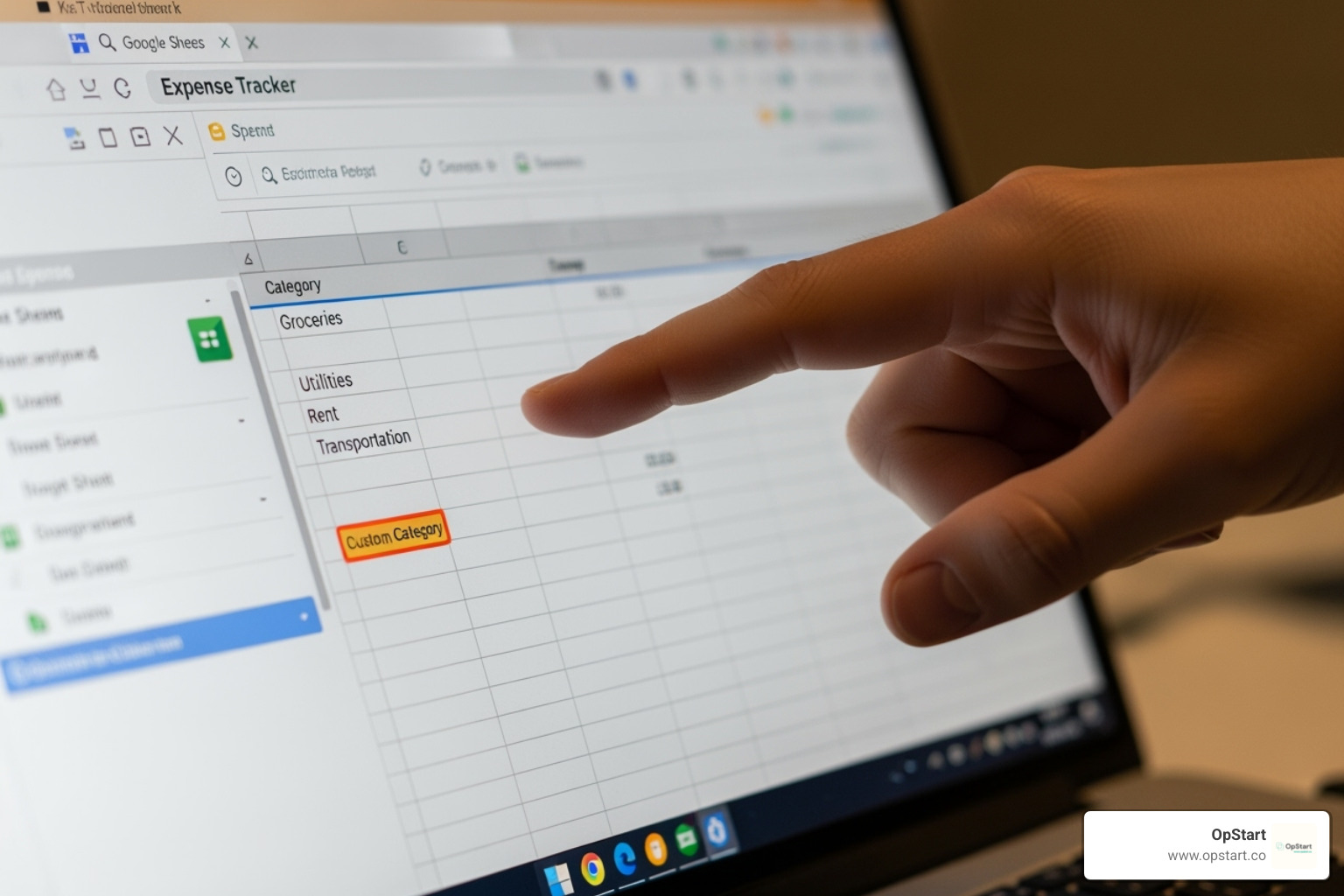

- Get a Template. Find a template online. Most are view-only, so go to File > Make a copy to create an editable version in your Google Drive. If you need one, get your free startup budget template here.

- Customize Categories. Your business is unique, so your budget should be too. Review and change the expense and revenue categories to match your specific needs. A SaaS startup’s costs will differ from a physical product business.

- Input Assumptions. Enter your estimates for costs, sales volumes, and headcount in the designated cells. These assumptions are the foundation of your financial model.

- Estimate Costs. This is a common challenge. List every expense you can think of, both one-time and recurring. Research average costs, remembering that location matters. For new business types, use industry benchmarks. Critically, always add a contingency fund of 10-15% for unexpected costs.

- Track Actuals vs. Budget. Once you’re running, regularly input your real income and expenses. Comparing your plan to reality is where the learning happens. It’s your early warning system for financial trouble.

Best Practices for Your Google Sheets budget template

A budget is a living document, not a one-time task. To get real value from your template, treat it as an ongoing practice.

- Be realistic. Overly optimistic revenue estimates and low expense projections will only hurt you later. Base your numbers on data, research, and conservative estimates.

- Update regularly. Track actuals as they happen and conduct a formal budget-versus-actuals review at least monthly. This keeps your data current for decision-making.

- Use scenario planning. Great budgets include best-case, worst-case, and most-likely scenarios. This prepares you to pivot when reality doesn’t match your plan.

- Involve your team. Ask department heads to help build the budget for their areas. They understand the real costs and will take ownership of the numbers.

- Review budget vs. actuals (BVAs). This practice brings accountability. It shows performance against expectations and highlights areas for course correction.

- Link summary cells. A pro tip for Google Sheets is to link summary cells on a dashboard to your detailed budget tabs. This creates a real-time budget calculator.

As your startup grows, you might need more expertise. Our Fractional CFO Services provide high-level financial strategy without the cost of a full-time executive.

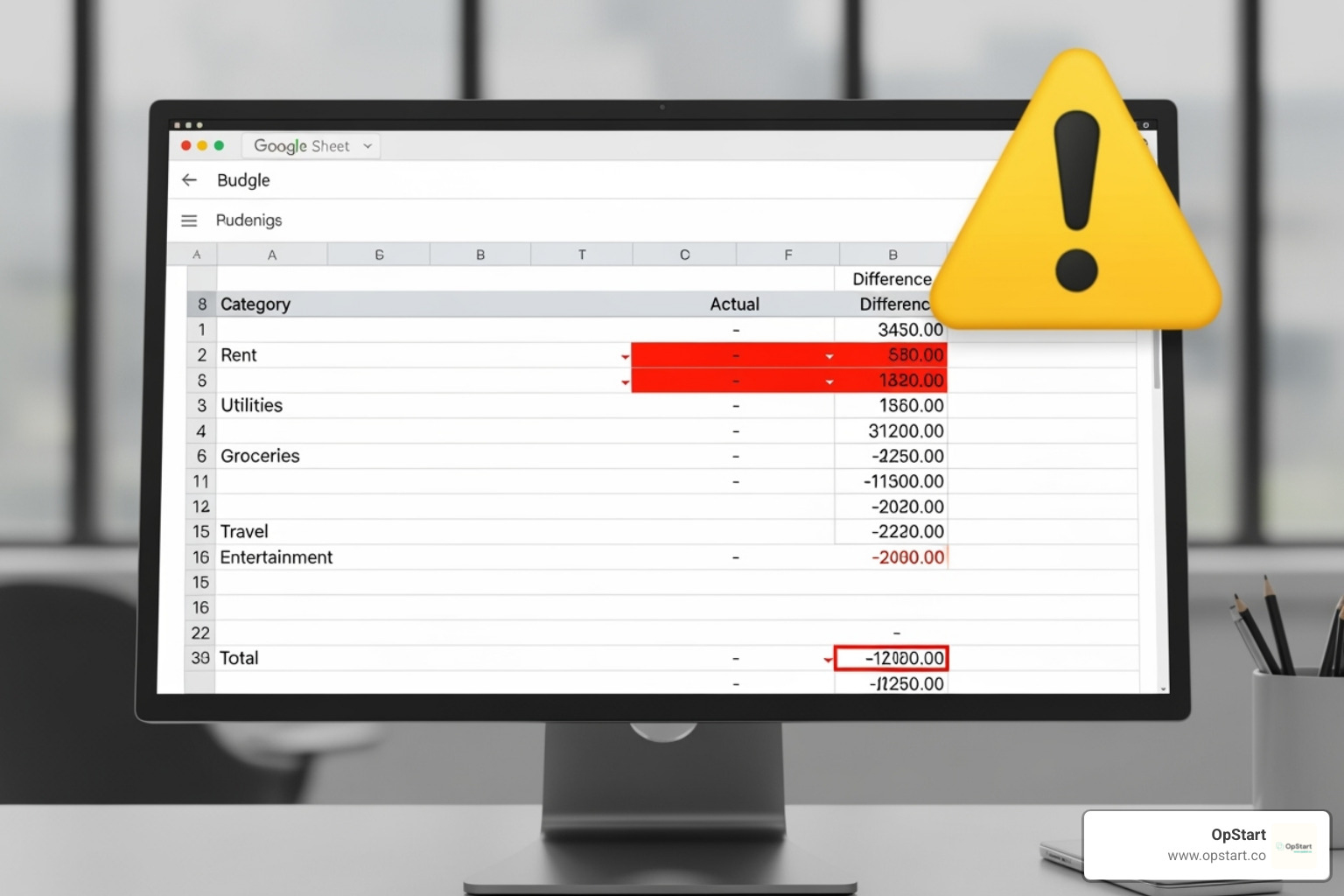

Common Pitfalls and How to Avoid Them

Even with the best template in Google Sheets, founders make avoidable mistakes. Here are the most common pitfalls and how to avoid them.

- Underestimating expenses. This is a classic error. It’s easy to forget smaller costs that add up, like software fees or payment processing. Founders also lowball major expenses like payroll. The fix: Be thorough, get multiple quotes, use industry benchmarks, and add a 10-20% buffer for unexpected costs.

- Overestimating revenue. Optimism can be dangerous. Aggressive sales projections rarely materialize in the first six months. Build your forecasts on actual data, confirmed pipelines, and conservative market research. Hope is not a strategy.

- Ignoring cash flow timing. You can be profitable on paper but fail if cash comes in slower than bills go out. This disconnect has killed many businesses. Your budget must account for these timing gaps by modeling your working capital carefully.

- Forgetting a contingency fund. Unexpected events are guaranteed in a startup. You need a safety net for emergencies. Set aside enough to cover 3-6 months of operating expenses.

- The “set-it-and-forget-it” mentality. A budget created once and never reviewed is useless. Your business environment changes constantly. Review your budget monthly, compare actuals to projections, and adjust your assumptions as you learn.

For more detailed guidance on avoiding these mistakes, read this business startup budget guide.

The bottom line is that your budget template is only as good as the discipline you bring to it. Avoid these common traps and treat your budget as the living document it needs to be.

Frequently Asked Questions about Startup Budgeting

Here are answers to common questions about using a Google Sheets startup budget template.

What’s the main benefit of using Google Sheets over other tools?

The main advantages of using Google Sheets for your budget template are accessibility and collaboration. It’s free, cloud-based, and allows multiple people to work on it simultaneously. You don’t have to worry about version control or losing data.

Google Sheets has powerful formulas and an intuitive interface, making it ideal for founders without a finance background. It’s the perfect starting point before you need more complex accounting software.

How often should I update my startup budget?

Budget updates have two parts. You should log actual income and expenses weekly to keep records current. Then, at least monthly, conduct a formal review of your budget versus actuals.

This monthly review lets you spot trends, catch overspending, and adjust forecasts based on real-world performance. This regular rhythm gives you the accuracy needed for smart strategic decisions and allows you to course-correct before a problem becomes a crisis.

Can a simple budget template really help get funding?

Yes, absolutely. A well-prepared budget from a simple Google Sheets template can be powerful when raising money.

Investors look for proof that you’re organized, serious, and understand your business’s financial realities. They want to see that you’ve thought through how you’ll spend their capital, how long it will last, and what milestones you’ll achieve.

A clear budget demonstrates financial discipline and shows you understand your key financial drivers. When filled out thoughtfully with realistic projections, it signals to investors that you can be trusted with their money and sets you apart from the competition.

Conclusion: Take Control of Your Startup’s Financial Future

Building a startup is an exhilarating but financially uncertain journey. A budget template in Google Sheets isn’t just helpful-it’s essential for changing how you manage your finances.

A solid budget provides financial clarity in the chaos. It shows where your money comes from, where it goes, and how long it will last. This visibility empowers you to make data-driven decisions instead of relying on gut feelings.

As we’ve explored, a budget is crucial for attracting investors, managing burn rate and runway, and avoiding cash flow traps. It’s your financial north star, guiding strategic decisions and resource allocation. Your budget keeps you grounded in reality while supporting your ambitions.

Google Sheets is accessible even if you’re not a financial expert. Its customizability and collaborative features make it a powerful tool for any founder. A budget is a living document, not a one-time task. Successful founders treat their budgets as dynamic tools, updating them regularly to inform every major decision.

Proactive financial management means reviewing your budget monthly, adjusting forecasts, and planning for multiple scenarios. This discipline-being realistic about expenses, conservative with revenue, and keeping a contingency fund-positions you for sustainable growth.

As your startup scales, financial complexity grows. When you need more than a spreadsheet, specialized expertise becomes invaluable. At OpStart, we provide comprehensive financial operations services-from accounting and tax to strategic CFO support-at a flat rate for growing companies.

When you’re ready to move beyond DIY financial management, OpStart offers expert-managed finance and accounting that integrates with your software stack. Get expert guidance with CFO Services for Startups and take your financial operations to the next level.

Your startup’s financial future is too important to leave to chance. With the right budget and support, you can build a business that doesn’t just survive-it thrives.