Why Startups Can’t Afford to Skip Financial Expertise

Virtual CFO for startups gives you senior-level financial leadership without the cost and commitment of a full-time hire.

Key Benefits:

- Cost-effective: 50-75% less expensive than traditional CFOs ($1,000-$5,000/month vs. $150,000-$300,000+ annually)

- Strategic expertise: High-level financial planning, forecasting, and fundraising support

- Scalable engagement: Adapts to your growth stage and changing needs

- Remote accessibility: Works with your team virtually using modern financial tools

Best for startups that are:

- Experiencing rapid growth or preparing for funding rounds

- Struggling with cash flow management and financial complexity

- Founders feeling overwhelmed by financial tasks and reporting requirements

The odds are tough: nearly 90% of startups fail, and 82% of businesses fail due to poor financial management. Early-stage companies rarely can (or should) spend $300,000+ on a traditional CFO, yet going without expertise invites preventable mistakes.

Virtual CFO services fill that gap by delivering strategic guidance that helps you steer growth, secure funding, and make data-driven decisions.

I’m Maurina Venturelli. I’ve supported companies like Sumo Logic and LiveAction as they scaled and went public, and at OpStart I’ve seen how a Virtual CFO for startups turns overwhelmed founders into confident leaders with clear financial roadmaps.

What is a Virtual CFO and Why Do Startups Need One?

A Virtual CFO for startups is a senior finance leader who provides strategic guidance on a part-time, remote basis. You get expert planning, cash flow discipline, and fundraising support without the full-time price tag or overhead. This model has gained significant traction as startups seek to optimize their burn rate while still accessing critical financial expertise.

Founders are great at building products and winning customers, but financial strategy often isn’t their superpower. The complexity of modern startup finance—from SaaS metrics to venture debt, from revenue recognition to stock option accounting—requires specialized knowledge that most founders simply don’t have time to develop. With failure rates high and capital scarce, disciplined financial leadership early on can be the difference between scaling and stalling. Virtual CFOs flex with your needs, ramping up for funding or strategic projects and dialing back during steady periods.

The virtual model also brings unexpected advantages. Your Virtual CFO has seen dozens of startups steer similar challenges, bringing pattern recognition and best practices that a single-company executive might lack. They’ve witnessed both successful exits and painful failures, understanding the subtle warning signs that can make or break a young company.

For how Virtual CFOs differ from other roles, see Fractional CFO vs. Bookkeeper vs. CPA: What’s the Difference?

The Virtual CFO vs. The Traditional CFO

Let’s break down the key differences between traditional and Virtual CFOs:

| Feature | Traditional CFO | Virtual CFO |

|---|---|---|

| Cost | $150,000-$300,000+ annually (salary + benefits) | $1,000-$10,000 per month (50-75% less) |

| Commitment | Full-time, in-house executive | Part-time, remote, project-based |

| Flexibility | Low; fixed overhead | High; scales with business needs |

| Perspective | Single company focus | Broader insights from multiple client experiences |

| Ideal Stage | Established companies, large enterprises | Startups, SMEs, high-growth companies |

| Technology Use | Varies, often traditional | Leverages digital finance tools, cloud-based platforms |

A traditional CFO is a major fixed cost that most startups simply cannot justify until they reach significant scale. Beyond the salary, you’re looking at equity grants, benefits packages, and the opportunity cost of a mis-hire at the executive level. A Virtual CFO gives you similar strategic expertise for a fraction of the price, plus broader perspective from cross-company experience.

The Critical Need for Financial Expertise in Startups

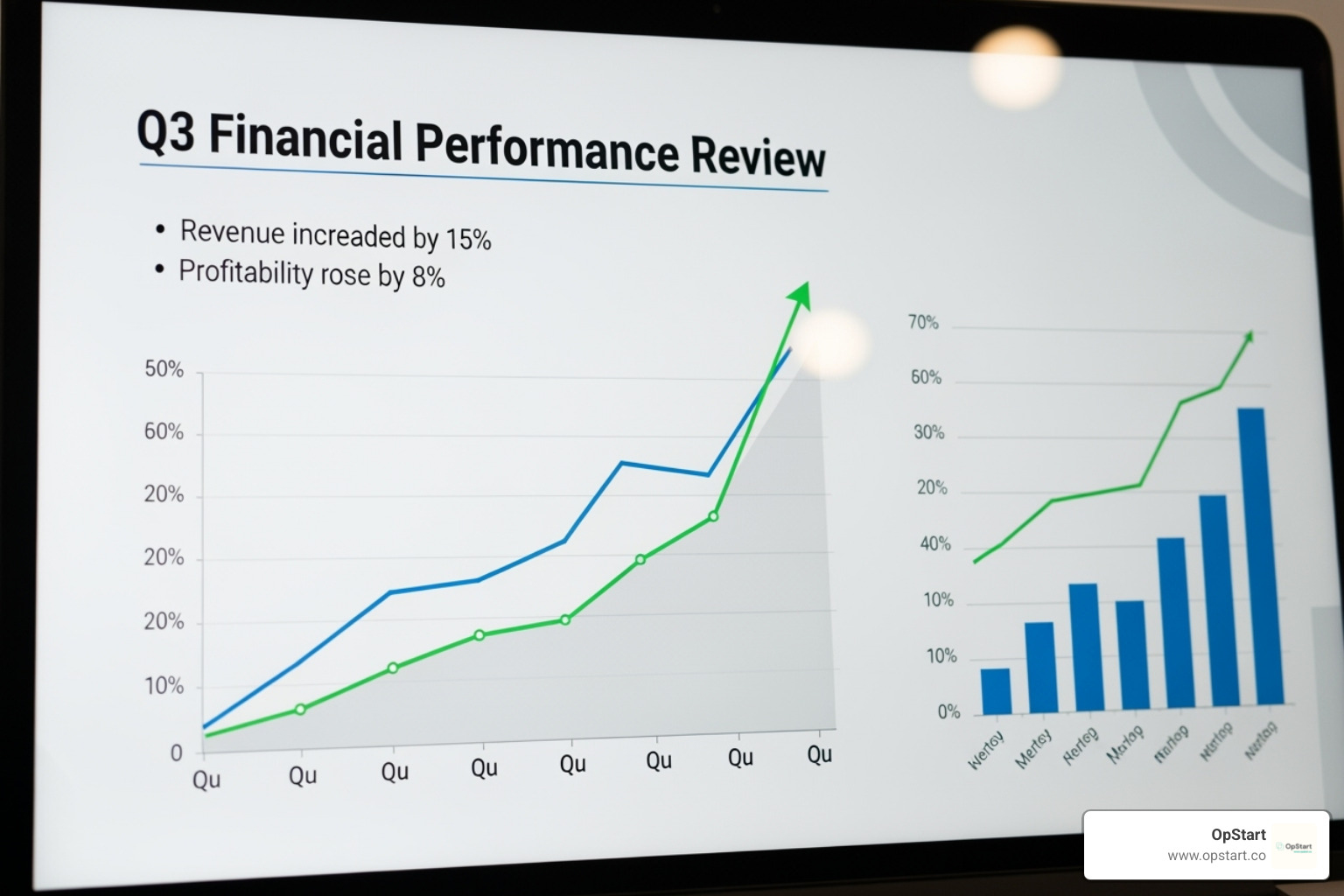

82% of business failures stem from poor financial management. The common culprits: cash flow surprises, guesswork in strategic planning, and limited founder bandwidth. But the problem runs deeper than just these surface issues. Many founders underestimate the complexity of startup finance until they’re drowning in it—managing investor relations, navigating tax implications of different funding structures, optimizing unit economics, and building financial models that actually reflect reality.

A Virtual CFO for startups installs early discipline—robust forecasting, KPI focus, and scenario planning—so you can make confident, data-driven decisions and avoid preventable crises. They help you understand not just where your money is going, but why it’s going there and whether that allocation aligns with your strategic goals. This financial clarity becomes your competitive advantage, allowing you to move faster and more decisively than competitors who are still flying blind.

The Core Benefits of Hiring a Virtual CFO for Startups

A Virtual CFO for startups is more than a cost-saving move—it’s a strategic partnership that clarifies priorities, sharpens execution, and accelerates fundraising and growth.

Achieve Significant Cost-Effectiveness

A full-time CFO can run $150,000-$300,000+ annually. Virtual CFOs typically cost 50-75% less ($1,000-$10,000/month), with no benefits, office, or recruiting overhead. You pay only for what you need and can scale support up or down around key milestones. See the math in our Fractional CFO ROI.

Improve Strategic Financial Planning

Your Virtual CFO turns plans into actionable roadmaps: realistic budgets and forecasts, the right KPIs, scenario modeling, and risk management. The result is clear tradeoffs and faster decisions. Learn more on our Fractional CFO page.

Scale Your Financial Support with Your Growth

As you move from early traction to funding to expansion, needs change quickly. A Virtual CFO scales with you—prepping investor-ready projections, guiding due diligence, and helping deploy capital post-raise. Explore our Fractional CFO Services for Startups.

How a Virtual CFO Drives Growth and Secures Funding

A Virtual CFO for startups builds the financial engine behind your growth and funding story—tight cash control, investor-ready numbers, and decisions grounded in data. They transform your financial operations from a necessary evil into a strategic weapon, helping you spot opportunities and threats before they become obvious.

Master Your Cash Flow and Improve Operational Efficiency

Cash is oxygen for startups, and running out is fatal. Your Virtual CFO prevents surprises with robust cash flow forecasting, clear burn and runway visibility, and tighter working capital management. They’ll help you understand the difference between profitable growth and growth that’s actually destroying value—a distinction that’s not always obvious when you’re in the trenches.

Beyond basic cash management, they optimize your entire financial operation. This means improving AP/AR timing to maximize float, negotiating better payment terms with vendors, and automating key processes to free both cash and time. They’ll identify where you’re leaving money on the table—whether through inefficient billing processes, poor collections, or suboptimal pricing strategies.

For fundamentals, see Startup Accounting Services: What Founders Need to Know.

The Role of a Virtual CFO for Startups in Fundraising

Raising capital is as much about storytelling as it is about numbers, but those numbers better be rock solid. Your Virtual CFO helps you win investor confidence with clean, compliant financials that pass due diligence scrutiny. They build credible financial models that tell your growth story with defensible assumptions, not fantasy projections.

The fundraising support goes deeper than just preparing documents. Your Virtual CFO helps you understand what investors are really looking for—the unit economics that prove your model works, the cohort analyses that show improving retention, the path to profitability that demonstrates you won’t need endless capital. They prepare comprehensive due diligence files before you need them, manage cap table complexities, and guide you through the tax implications of different funding structures.

Importantly, they also help you avoid common fundraising pitfalls—overoptimistic projections that destroy credibility, messy financials that scare off investors, or structural mistakes that create problems down the road. More at Taxes for Startups.

Ensure Data-Driven Decision-Making

Gut instinct has its place, but building a scalable business requires metrics that matter. Your Virtual CFO shifts your organization from gut feel to data-driven decisions with accurate reporting, KPI tracking (MRR, CAC, LTV, and the ratios between them), and live dashboards that give you real-time visibility.

They help you build a culture of measurement, where every team understands their numbers and how they ladder up to company goals. This means establishing clear metrics ownership, regular reporting cadences, and accountability systems that keep everyone aligned. The result is faster decision-making, quicker pivots when something isn’t working, and the ability to double down on what is.

For background, see Financial analysis and What Taxes Does My Startup Need to File This Year?.

Choosing and Engaging Your Ideal Virtual CFO

The right Virtual CFO for startups understands your model, stage, and speed—and turns complexity into simple actions.

When is the Right Time to Hire a Virtual CFO?

Great guidance helps at any stage, but key triggers include:

- Pre-seed/seed capital to set strong processes

- Rapid growth and rising financial complexity

- Preparing for Series A and beyond

- Founder time spent on finance instead of product and growth

Key Considerations When Choosing a Virtual CFO for Startups

Prioritize industry experience, stage fit, clear communication, and familiarity with your tech stack. Validate with references and ensure cultural alignment so they operate like part of your leadership team. See Finding Your Ideal Fractional CFO Service Provider.

Understanding Costs and Collaboration

Expect $1,000-$10,000 per month depending on scope and complexity. Pricing is flexible—retainer or project-based—and scales as needs evolve. Integration is remote and seamless, with a cadence of recurring check-ins and on-demand support. Before you decide, review 10 Questions to Ask Before Hiring a Fractional CFO (and Why They Matter).

At OpStart, our flat-rate model bundles hands-free accounting, tax, and CFO guidance, integrated with your preferred software stack.

Frequently Asked Questions about Virtual CFO Services

What’s the difference between a virtual CFO and a fractional CFO?

They’re effectively the same in practice. “Virtual” highlights remote delivery; “fractional” highlights part-time engagement across clients. Both provide senior financial strategy without a full-time hire.

How much does a virtual CFO for a startup typically cost?

Most startups invest $1,000-$5,000 per month; complex needs can reach $10,000+. Costs vary by scope, complexity, and hours. Even at the high end, it’s typically 50-75% less than a $150,000-$300,000+ full-time CFO.

When should a startup transition from a virtual CFO to a full-time CFO?

Common triggers: $5-10M in annual revenue, Series B or later, and operational complexity that requires daily executive oversight. A virtual CFO can help you time and execute the transition smoothly.

Conclusion

A Virtual CFO for startups delivers strategic finance leadership at a fraction of the cost, with flexibility to scale as you grow. You’ll get investor-ready financials, clear forecasts, and the insight to make faster, better decisions—so you can focus on product, customers, and revenue.

OpStart provides complete, hands-free financial operations—accounting, tax filings, and CFO-level support—at a flat rate that integrates with your preferred software stack.

Financial mismanagement is a leading cause of startup failure. Put the right structure in place now so growth doesn’t outpace your finance function. Start building the foundation your startup deserves and make the right foundational choice for your business.