Why Finance Is Your Business’s Secret Weapon

What is the role of finance in a business is more than just bookkeeping and taxes. It’s your company’s circulatory system, ensuring capital flows where needed and powering critical decisions from daily operations to major strategic moves.

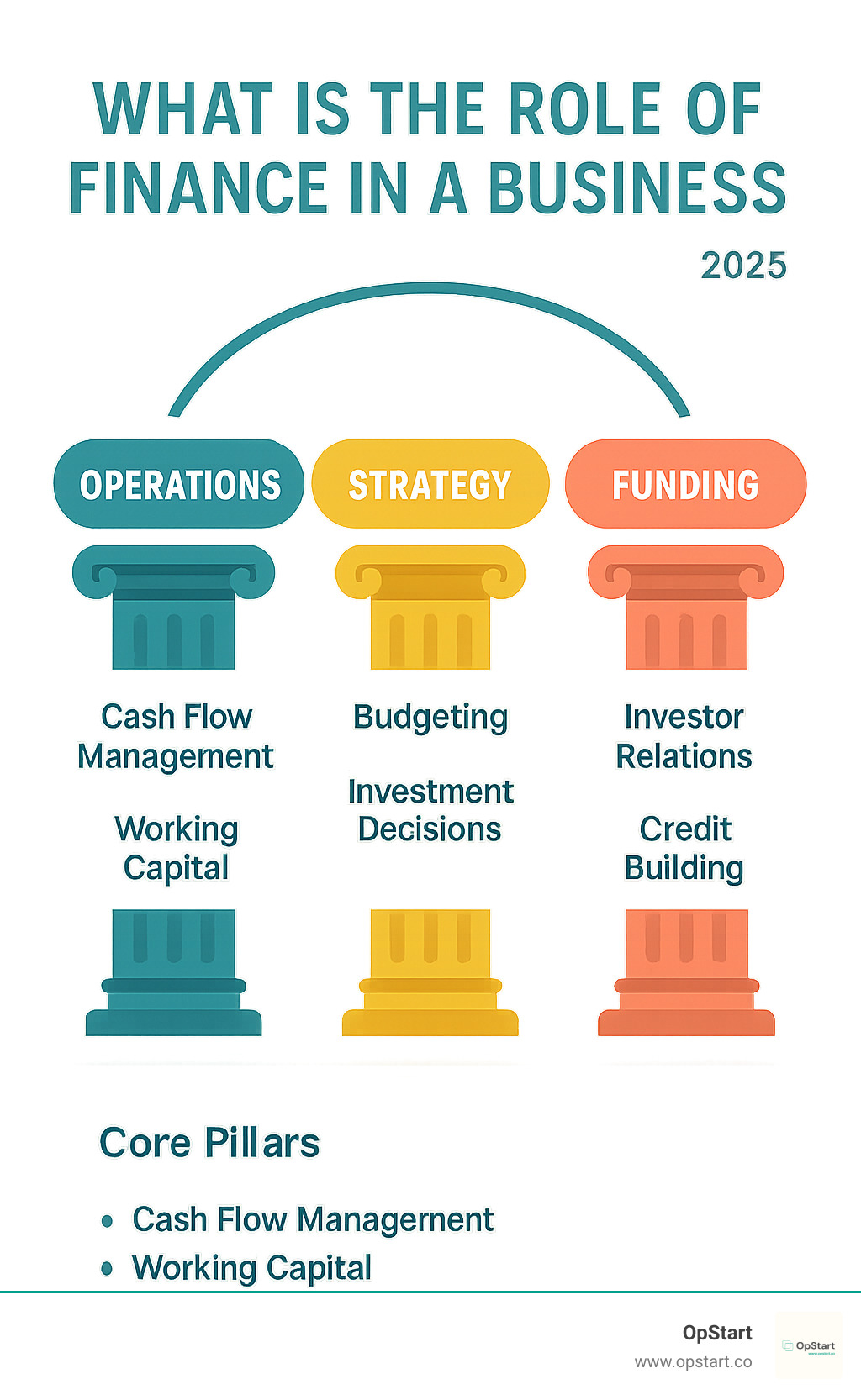

The core roles of finance in business include:

- Operations Management: Managing cash flow, paying suppliers and employees, maintaining liquidity

- Strategic Planning: Budgeting, forecasting, analyzing investments, and driving growth decisions

- Funding & Investment: Attracting investors, securing loans, building creditworthiness

- Risk Management: Identifying financial risks, creating contingency plans, ensuring compliance

- Performance Measurement: Tracking KPIs, analyzing profitability, reporting to stakeholders

As one finance expert puts it: “Finance is critical to the success of all companies. To make money, it must first spend money—on inventory and supplies, equipment and facilities, and employee wages and salaries.”

Finance is your engine, not just a scorekeeper. While accounting tracks the past, finance helps you decide on the future. This proactive approach is what separates thriving companies from those that barely survive.

The numbers back this up. Companies with robust financial frameworks consistently outperform their peers, and those with strategic cash reserves and disciplined capital allocation weather economic storms better than competitors.

I’m Maurina Venturelli, and I’ve seen the impact of finance while leading growth at companies like Sumo Logic (where marketing generated 20% of total ARR) and now at OpStart. Strong financial operations aren’t just about compliance—they create the foundation for sustainable growth.

The Financial Engine: Powering Daily Operations

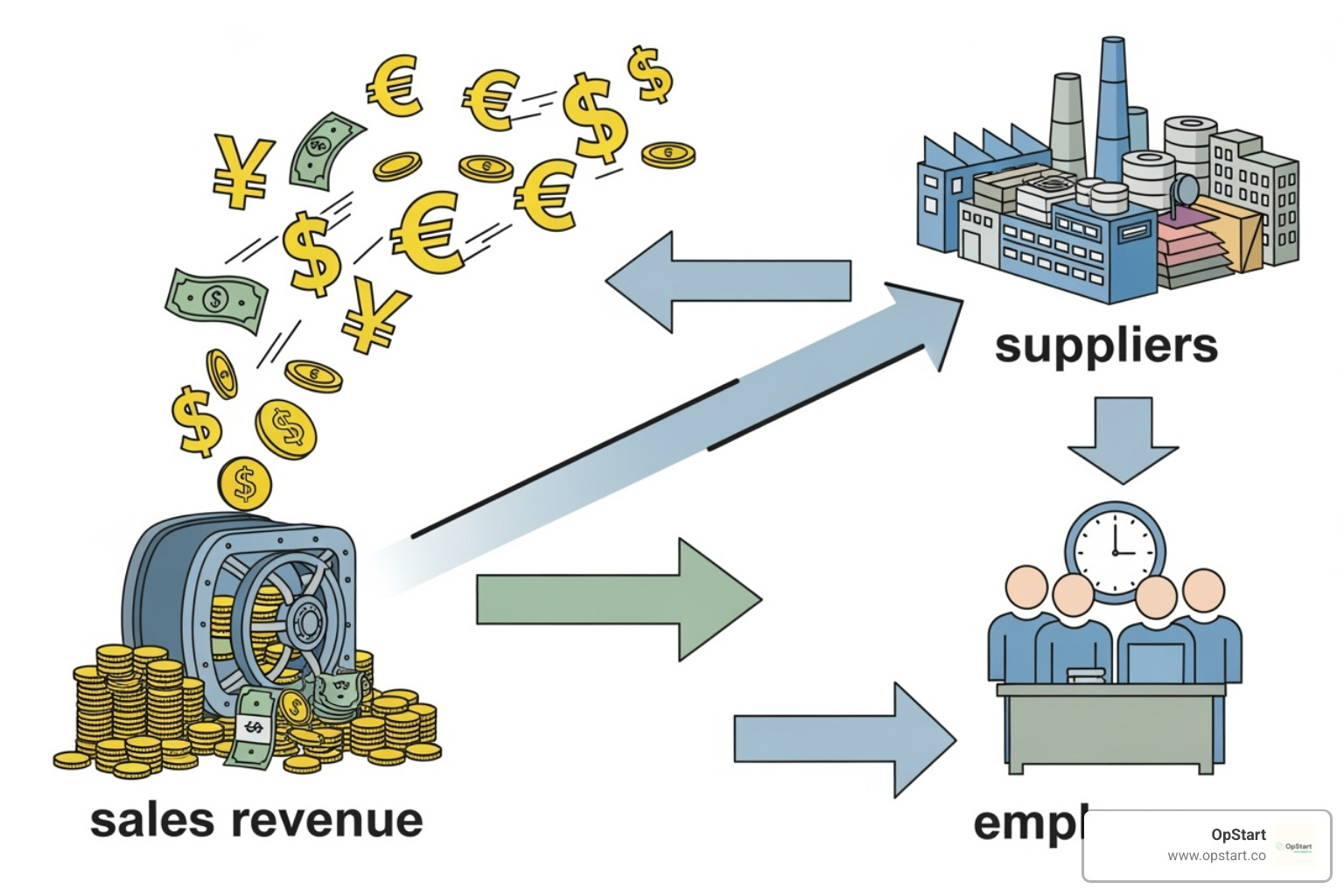

Think of finance as the fuel for your business engine. For daily operations, what is the role of finance in a business is keeping things running smoothly by ensuring money flows where and when it’s needed.

Your finance function handles critical tasks like paying your team, covering rent, and settling supplier invoices. Without this steady financial pulse, even the most brilliant business ideas can fail.

Liquidity management sits at the heart of operational finance. It’s about maintaining enough readily available cash to handle your immediate obligations without scrambling. Think of it as your business’s emergency fund—except you’re using it every single day for planned expenses like inventory purchases, utility bills, and payroll.

Financial stability in daily operations means you’re never caught off guard. Your finance function tracks upcoming expenses, monitors cash reserves, and ensures there’s always a buffer between income and outflow. This stability gives you the confidence to focus on growing your business instead of worrying about whether you can make next week’s payments.

Managing Working Capital and Cash Flow

Here’s where finance gets really hands-on with your day-to-day success. Working capital is simply the money you have available for daily operations—your current assets minus your current liabilities. It’s the financial cushion that lets you operate smoothly even when things don’t go exactly as planned.

Cash flow management is like being the conductor of a financial orchestra. You’re coordinating when money comes in from sales with when it needs to go out for expenses. The goal is creating a harmonious rhythm where cash flows in before it needs to flow out.

Your accounts receivable represents money customers owe you for products or services already delivered. Smart finance management means staying on top of these payments, following up on overdue invoices, and setting clear payment terms upfront. The faster you collect what you’re owed, the better your cash position.

On the flip side, accounts payable involves managing what you owe to suppliers and vendors. Good finance strategy means taking advantage of payment terms without damaging relationships. If a supplier gives you 30 days to pay, you don’t need to pay on day one—that cash can work for your business in the meantime.

This delicate balance prevents those heart-stopping moments when you realize payroll is due but your biggest client hasn’t paid their invoice yet. Ensuring operational smoothness means anticipating these timing mismatches and having plans in place to bridge any gaps.

For deeper insights into managing these critical flows, our guides on What is Cashflow? and the Statement of Cash Flows offer practical strategies you can implement immediately.

Finance vs. Accounting: Clarifying the Core Difference

Let’s clear up a confusion that trips up many business owners. People often use “finance” and “accounting” interchangeably, but they’re actually quite different—and understanding this difference is crucial for grasping what is the role of finance in a business.

Accounting is your business’s historian. It carefully records what happened—every sale, every expense, every transaction. Accounting ensures your books are accurate, your taxes are filed correctly, and you have clean financial statements. It’s about capturing the past with precision and maintaining compliance with regulations.

Finance is your business’s strategist. It takes that historical data from accounting and uses it to make smart decisions about the future. Finance asks questions like “Should we invest in new equipment?” or “Can we afford to hire three more people?” It’s about using financial information to drive growth and profitability.

| Feature | Accounting | Finance |

|---|---|---|

| Primary Focus | Historical record-keeping | Forward-looking strategy & decision-making |

| Role | Data generation, compliance, reporting | Data interpretation, resource allocation, value creation |

| Time Horizon | Past and present | Future |

| Key Activities | Bookkeeping, tax preparation, auditing | Budgeting, forecasting, investment analysis, risk management |

| Output | Financial statements (P&L, Balance Sheet) | Financial models, strategic plans, funding decisions |

Bookkeeping tasks include recording transactions, reconciling bank statements, and maintaining ledgers. Financial management tasks involve budgeting for next quarter, analyzing which products are most profitable, and deciding how to allocate resources for maximum return.

Think of it this way: accounting tells you how much money you made last month, while finance helps you figure out how to make more money next month. Data generation versus data interpretation—both are essential, but they serve very different purposes in your business ecosystem.

Understanding these roles helps you build the right team and systems. You might start with basic bookkeeping, but as you grow, strategic financial management becomes crucial for sustained success. Learn more about reading your financial statements in our guide How to Read a PL, and explore the different expertise levels in Fractional CFO vs. Bookkeeper vs. CPA: What’s the Difference?.

From Blueprint to Reality: How Finance Drives Strategic Growth

Finance transforms from bean-counting to dream-building. When turning visions into reality, what is the role of finance in a business is to be a strategic partner, figuring out how to fund big ideas and ensure they’re viable.

Think of it this way: anyone can dream of expanding to new markets or launching innovative products. But finance is what turns those dreams into actionable plans with real budgets, realistic timelines, and measurable outcomes.

Strategic decision-making relies heavily on financial analysis. When you’re considering whether to hire ten new employees, open a second location, or invest in new technology, finance provides the framework to evaluate these choices objectively. It’s about long-term planning that considers not just what we want to do, but what we can afford to do and when.

Guided by solid financial principles, resource allocation is key. Finance helps prioritize spending, ensuring limited resources flow toward opportunities with the best returns.

Financial Planning and Analysis (FP&A) for Strategic Decisions

The real magic happens in Financial Planning and Analysis, where budgeting meets crystal ball gazing. FP&A teams create comprehensive budgets that serve as roadmaps for the year ahead. But they don’t stop there—forecasting helps us anticipate what’s coming around the corner.

Scenario planning is where things get really interesting. What happens if sales are 20% higher than expected? What if a key supplier raises prices? What if we lose our biggest client? By running these “what-if” scenarios, we can prepare for various outcomes and make decisions with confidence.

Key Performance Indicators (KPIs) become our North Star, helping us track whether we’re actually achieving our strategic goals. These aren’t just random metrics—they’re carefully chosen indicators that connect operations to financial outcomes. When marketing launches a new campaign, we can trace its impact through lead generation, sales conversion, and ultimately, revenue growth.

The power of this approach is remarkable. One infrastructure company developed sophisticated data models for scenario-based planning and achieved a 36% improvement in EBIT forecasting accuracy. That’s not just better number-crunching—that’s the foundation for making smarter, faster decisions in a competitive market.

What is the role of finance in a business’s capital management?

Capital allocation might sound boring, but it’s actually one of the most exciting parts of business strategy. Every investment decision—from buying new equipment to expanding into new markets—requires careful investment analysis.

Finance helps us evaluate opportunities using proven metrics like Net Present Value (NPV) and Internal Rate of Return. These tools cut through the excitement and emotion to reveal which projects will actually create value over time.

Make-vs-buy decisions become clearer when we analyze the true costs and benefits. Should we hire an in-house marketing team or work with an agency? Should we build our own software or buy an existing solution? Finance provides the framework to evaluate project profitability objectively.

The risk-return trade-off is always at the heart of these decisions. Higher potential returns usually come with higher risks, and finance helps us find the sweet spot that aligns with our company’s risk tolerance and strategic goals.

Effective capital management is about maximizing shareholder value—making sure every dollar we invest generates more value than it costs. This disciplined approach to resource allocation is what separates companies that grow sustainably from those that burn through cash without building lasting value.

Securing Capital and Building Trust: The External Role of Finance

You have a great product and happy customers, but you need money to scale. This is where understanding what is the role of finance in a business becomes critical for engaging the external world.

Finance acts as your business’s ambassador to investors, lenders, and partners. It’s not just about having good numbers; it’s about presenting them in a way that builds trust and demonstrates your company’s potential. When done right, strong financial management opens doors to funding opportunities that can transform your business from a promising startup into a market leader.

Solid financial practices massively boost your creditworthiness and investment appeal. Clean books, transparent reporting, and strategic financial planning signal to the outside world that you’re a professional and worthy investment.

How Finance Helps Attract Investors and Partners

When it comes to attracting investors, your financial story is everything. It’s not enough to simply say “we’re profitable” or “we’re growing fast.” Smart investors want to see the details—they want to understand your cash flow forecasts, review your profit and loss statements, and examine your balance sheets with a fine-tooth comb.

Your finance team becomes your storytelling partner, crafting compelling narratives around the numbers. They help you demonstrate not just where you’ve been, but where you’re headed. A well-prepared financial section in your pitch deck can be the difference between a “thanks, but no thanks” and a term sheet.

There’s approximately US$3.2 trillion in private capital “dry powder” waiting to be invested. The challenge isn’t finding investors—it’s proving your business deserves their capital.

The key is financial transparency and professionalism. When you can clearly show your unit economics, demonstrate predictable revenue streams, and present realistic growth projections backed by solid data, you become the kind of investment opportunity that gets funded. For practical tips on making your pitch irresistible, check out our guide on 5 Hacks to Raise Money from VCs.

What is the role of finance in a business’s ability to secure funding?

Securing funding is like building a bridge between your current reality and your future potential. Finance provides the blueprints, materials, and construction expertise to make that bridge strong enough to carry your ambitions.

First, let’s talk about building your credit profile. This isn’t just about paying bills on time (though that’s important). It’s about establishing a track record that lenders can trust. Every payment you make, every financial statement you file, every tax return you submit becomes part of your business’s financial reputation.

The world of business funding isn’t one-size-fits-all. You’ve got debt financing options like traditional bank loans and SBA loans, which let you keep full ownership while taking on repayment obligations. Then there’s equity financing, where you trade ownership stakes for capital—a popular choice for high-growth startups that need significant funding to scale quickly.

The choice between short-term and long-term financing depends on your specific needs. Need to cover payroll while waiting for a big client payment? Short-term working capital might be perfect. Planning a major expansion or product development? Long-term funding could be the way to go.

Your finance function helps steer these choices by understanding lender requirements, preparing loan applications, and presenting your business in the best possible light. They know that different funding sources look for different things—what excites a venture capitalist might bore a bank loan officer, and vice versa.

The current fundraising environment presents both challenges and opportunities. Understanding market conditions and timing your funding efforts strategically can make all the difference. For insights into navigating today’s funding landscape, explore our thoughts on Fundraising in Today’s Market.

The Modern Finance Department: People, Processes, and Technology

The finance department has undergone a remarkable change. Gone are the days when finance teams hid away in back offices, crunching numbers in isolation. Today’s finance professionals are strategic partners, sitting at the executive table and helping shape the future of our businesses.

This evolution is perhaps most visible in how the CFO role has expanded. Modern CFOs don’t just report what happened last quarter—they help predict what’s coming next quarter and guide the company toward its long-term vision. They’ve become trusted advisors to CEOs, translating complex financial data into actionable business insights.

But let’s be honest: this change hasn’t been without its growing pains. Finance departments everywhere are wrestling with rapid technological changes, struggling with limited access to real-time data, and trying to balance the competing demands of strict compliance requirements with the pressure to drive profitability. It’s a challenging balancing act that requires both strategic thinking and operational excellence.

Key Functions and Roles within the Finance Team

Understanding what is the role of finance in a business means recognizing the diverse talents that make up a modern finance team. Each role brings unique expertise to the table, working together to create a comprehensive financial framework.

The Chief Financial Officer (CFO) serves as the financial visionary, responsible for overall financial policy, capital structure decisions, and long-term strategic planning. They’re the ones translating ambitious business objectives into realistic financial roadmaps and designing funding strategies that fuel growth.

The Controller keeps the day-to-day financial operations running smoothly, overseeing accounting activities, financial reporting, payroll processing, and managing both accounts receivable and payable. They ensure accuracy in every transaction and maintain compliance with all regulatory requirements.

Our Treasurer manages the company’s relationship with money itself—cash flow optimization, banking relationships, external financing arrangements, and smart investment of excess funds. They’re essentially our primary liaison with financial institutions and capital markets.

Financial Analysts dive deep into the numbers, creating sophisticated models and providing the insights that support critical decision-making. Whether we’re evaluating investment projects or looking for ways to improve operational efficiency, they provide the analytical backbone.

For startups and growing businesses, accessing this level of expertise doesn’t always mean hiring full-time staff. Fractional CFO Services for Startups can provide high-level financial leadership and strategic guidance without the full-time commitment, ensuring growing companies have the expertise they need to scale successfully.

Overcoming Challenges with Technology and Data Analytics

Here’s a sobering statistic: only 16% of finance leaders surveyed describe their finance function as delivering best-in-class performance. That means there’s enormous room for improvement across the industry, particularly in how we leverage modern tools and technologies.

The good news? Technology is revolutionizing how finance departments operate. Automation of routine tasks is freeing up finance professionals to focus on higher-value activities like strategic analysis and creative problem-solving. Instead of spending hours on manual data entry, teams can now concentrate on interpreting data and providing actionable insights.

Artificial Intelligence and Machine Learning are making forecasting more accurate and agile than ever before. These tools can identify patterns in financial data that humans might miss, helping us make better predictions about future performance and market conditions.

Data analytics allows us to gain deeper insights into financial performance, identify emerging trends early, and improve our risk management capabilities. Real-time dashboards and automated reporting mean we can respond to changes quickly rather than finding problems weeks later.

Cloud-based expense management software and integrated financial systems are helping teams automate processes while ensuring compliance and providing real-time visibility into financial performance. This technology-driven approach helps balance the competing demands of regulatory compliance and profitability goals more effectively.

The journey toward a truly best-in-class finance function requires embracing these technological advances while maintaining the human insight and strategic thinking that make finance teams invaluable business partners. For comprehensive guidance on building this foundation, explore Startup Accounting Services: What Founders Need to Know.

Frequently Asked Questions about the Role of Finance

How does the role of finance differ for a startup versus a large corporation?

The difference between startup and corporate finance is like comparing a scrappy garage band to a full symphony orchestra—both make music, but the scale and complexity are worlds apart.

For startups, finance is all about survival and growth. You’re laser-focused on cash burn rate, extending your runway, and securing that next round of funding. Every dollar counts, and you’re constantly asking: “How long can we keep the lights on?” The financial team is usually lean—often starting with the founder juggling spreadsheets, then growing to include a bookkeeper and maybe a fractional CFO as things get more complex.

Large corporations play a different game entirely. They’re managing complex organizational structures, optimizing existing capital across multiple divisions, and implementing sophisticated risk management strategies. Their focus shifts to maximizing shareholder value through dividends, stock buybacks, or strategic acquisitions. The regulatory environment is more demanding, and the stakes are higher.

Both need strong financial planning, but what is the role of finance in a business varies dramatically based on size. Startups need agility and cash preservation, while corporations need optimization and risk management across vast operations.

What are the first financial steps a new business should take?

Starting a business without proper financial foundations is like building a house on sand—it might look good initially, but it won’t last long. Here’s what every new business owner should prioritize from day one.

Open a separate business bank account immediately. This single step will save you countless headaches during tax season and makes tracking business expenses infinitely easier. Mixing personal and business finances is one of the fastest ways to create a bookkeeping nightmare.

Set up a simple bookkeeping system next. It doesn’t have to be fancy—even a well-organized spreadsheet works initially. The key is tracking every penny that comes in and goes out. This becomes the foundation for understanding your financial health and making informed decisions.

Understanding your tax obligations is crucial. Research federal, state, and local tax requirements for your specific business type. This prevents those stomach-dropping moments when unexpected tax bills arrive. Consider consulting with a professional early—it’s much cheaper than fixing mistakes later.

Finally, create a basic budget and cash flow projection. Know how much money you expect to earn and spend over the next few months. This helps you manage your runway and avoid those panic moments when bills are due but cash is tight.

Can a business survive without a dedicated finance function?

Technically? Yes, for a while. Realistically? It’s like trying to steer a ship without a compass—you might stay afloat initially, but you’re sailing blind toward potential disaster.

In the very beginning, founders often manage everything themselves. You’re wearing multiple hats, juggling customer calls with invoice tracking. This works when you’re just getting started, but as soon as revenue starts flowing or you’re seeking external funding, the game changes completely.

Without proper financial management, you risk inaccurate reporting that can mislead investors, poor strategic planning that wastes precious resources, compliance issues that can result in penalties, and missed growth opportunities because you don’t have clear visibility into your numbers.

The good news? A dedicated finance function doesn’t mean hiring an expensive full-time team right away. You can start with outsourced bookkeeping, add fractional CFO services as you grow, or use a combination of solutions that fit your budget and needs.

The key is having expert support for accurate financial reporting, strategic planning, and compliance management. This frees you up to focus on what you do best—building and growing your core business. Because ultimately, what is the role of finance in a business if not to provide the solid foundation that lets entrepreneurs focus on innovation and growth?

Build a Strong Financial Foundation for Your Startup

Throughout this guide, we’ve explored what is the role of finance in a business—and the answer is clear: finance is your strategic partner, not just a necessary evil. It guides every decision you make, from choosing which supplier to pay first to deciding whether that big expansion opportunity is worth the risk.

The finance function has undergone a remarkable change over the past decade. It’s evolved from being the department that just tracks what happened last month to becoming the team that helps you figure out what should happen next month. This shift from scorekeeper to value creator is what separates thriving businesses from those that struggle to survive.

The importance of a robust financial framework for survival and growth goes beyond just having clean books. Companies with strong financial foundations weather economic storms better. They attract investors more easily. They make smarter decisions about where to spend their precious resources. Most importantly, they build the kind of sustainable growth that creates lasting value.

But here’s the challenge many founders face: building a best-in-class finance function without breaking the bank or getting bogged down in the weeds. You started your company to solve a problem or chase a dream—not to become an expert in cash flow forecasting or tax compliance.

That’s where the right partnership makes all the difference. At OpStart, we understand the unique challenges startups face. We’ve seen too many brilliant founders get overwhelmed by financial complexity when they should be focusing on what they do best: building their vision into reality.

We manage the complexities of your financial operations, from daily bookkeeping to strategic planning, so you can focus on growing your business. Our expert-led approach means you get the strategic insight of a seasoned CFO combined with the operational excellence of a dedicated accounting team—all at a predictable flat rate that scales with your needs.

Ready to give your business the strategic financial foundation it deserves? Get your hands-free accounting and finance department with OpStart and turn your financial operations from a headache into a competitive advantage.