Why Your Investor Relations Strategy is Your Competitive Edge

An investor relations strategy is your plan for managing communication with the investment community—shareholders, potential investors, and financial analysts. A strong IR strategy ensures your company’s value is accurately reflected in its market valuation, builds trust, and secures access to capital.

Key components include articulating a compelling equity story, targeting the right investors, maintaining transparent communication, gathering market intelligence, and measuring performance.

While most founders excel at building products, many struggle to communicate their value to investors. Research shows 40% of companies don’t track active shareholders not currently invested in their stock, a massive missed opportunity. A passive approach leaves value on the table, whereas a proactive strategy leads to more stable share prices and a lower cost of capital. Yet only one out of 16 companies has formalized feedback loops between shareholders and strategy teams.

Building an effective IR strategy doesn’t require a huge budget—it requires clarity, consistency, and treating investors as strategic partners.

I’m Maurina Venturelli. I’ve led go-to-market strategy for high-growth companies like Sumo Logic and LiveAction. A strong IR strategy has been critical to my success in securing funding and supporting growth. Now, at OpStart, I help startups build the financial foundation needed to attract and retain the right investors.

The Evolving Role and Goal of Modern Investor Relations

The core goal of an investor relations strategy is to ensure your company’s market value reflects its true intrinsic worth. This isn’t about spinning stories; it’s about creating a clear, honest flow of information so investors can make informed decisions, naturally aligning your valuation with your real value.

The role of investor relations has shifted dramatically from a reactive function to a strategic and proactive one. As The Harvard Business Review notes, modern Investor Relations Officers (IROs) now articulate why a strategy creates shareholder value. IR has become a strategic feedback loop, feeding market intelligence back to management to inform decisions. For more on this, see our article on how the finance function contributes to the business.

From Communicator to Strategic Partner

Think of the modern IRO as an intelligence officer, not just a spokesperson. The real value is in gathering market intelligence and monitoring perception. Your IRO acts as an early warning system, listening to investor sentiment and identifying concerns before they escalate. This transforms IR into what the CIRI (Canadian Investor Relations Institute) calls a “strategic management responsibility.” By providing real-time market insights, the IRO bolsters management credibility and becomes a vital strategic partner.

The Impact of a Proactive IR Approach

A proactive investor relations strategy delivers tangible benefits:

- Stabilizes your share price: Consistent communication reduces volatility and attracts long-term investors.

- Reduces your cost of capital: Clear understanding of your prospects lowers perceived risk, making capital cheaper.

- Diversifies your investor base: A proactive approach attracts the right investors whose goals align with yours.

- Defends against shareholder activism: Strong relationships and a clearly articulated value proposition leave less room for activist campaigns.

Without a proactive approach, you leave a gap between your intrinsic and market value—an invitation for activists and competitors to exploit.

Building Your Core Investor Relations Strategy

An investor relations strategy is the blueprint for telling your company’s story to the financial community. A solid plan begins with management buy-in and clear, measurable goals, such as stabilizing your share price or attracting long-term investors. In a competitive market, your IR strategy is how you differentiate your company, and for startups, this requires effective startup financial planning as a foundation.

Crafting a Compelling Equity Story

Investors hear countless pitches, so a compelling equity story is essential to cut through the noise. A great story is simple, tangible, authentic, measurable, and exciting. It should start with your vision and mission—your “why,” as Simon Sinek says, because people don’t buy what you do, but why you do it. This purpose becomes the thread connecting your financials and strategic pivots into a coherent narrative. While you’ll tailor the details for different audiences, the core message remains consistent, an approach that BCG finds can Supercharge Investor Communications by Adding Story to Strategy.

How to Identify and Target the Right Investors

Avoid the “spray and pray” approach. Instead, identify investors whose style, time horizon, and expertise align with your company. Use behavioral segmentation to analyze patterns like holding periods and industry knowledge. Shareholder monitoring using tools like 13F filings and NOBO lists helps you track who owns your stock and who is watching. It’s 9x more likely that current shareholders will buy more shares than new investors will. By building an ideal investor profile, your outreach becomes far more efficient. For early-stage companies, this discipline includes knowing how to find and meet VCs.

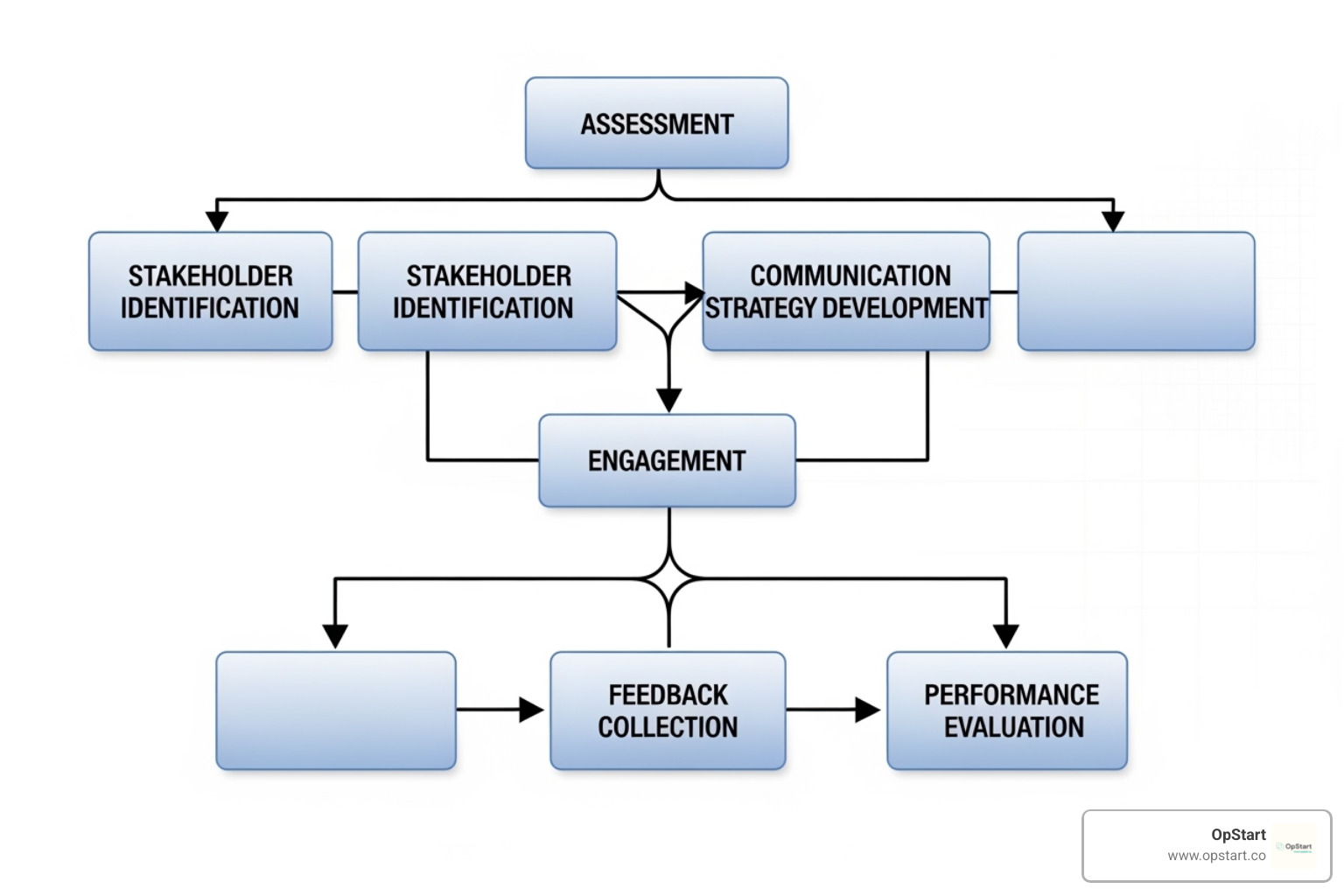

Developing Your Foundational Investor Relations Strategy

With your story and audience defined, you need tactical building blocks. Start with a concise company pitch (your investment proposition) that highlights your differentiators and management quality. Master the key metrics investors speak. For SaaS startups, this includes Annual Recurring Revenue (ARR), churn rate, and Net Revenue Retention (NRR). Also critical are your Customer Acquisition Cost (CAC) to Lifetime Value (LTV) ratio, which proves your business model is scalable. Finally, establish a clear disclosure policy for compliance and an IR calendar for predictable communication. These elements create an IR strategy that doesn’t just communicate value but creates it.

Execution: Communication, Engagement, and Technology

An investor relations strategy is useless without consistent execution. This comes down to clear communication, genuine engagement, and smart use of technology. Transparency is paramount; 83% of investors believe companies that communicate effectively also perform better, and 77% are more likely to offer assistance to those companies. Maintaining a consistent and seamless message across your organization is key to building credibility with both buy-side and sell-side audiences. A deep understanding of your financials, including metrics like those in our guide to cash flow analysis, is fundamental.

Communication Channels and Materials

Your communication channels deliver your equity story. Key materials include:

- IR Website: Your digital front door. It must be comprehensive, current, and mobile-friendly.

- Annual Reports: Fulfill regulatory requirements while educating investors on your strategy and performance.

- Earnings Calls: A quarterly, direct line to discuss results, provide updates, and answer questions.

- Press Releases: For timely dissemination of news and financial results to maintain transparency.

- Investor Presentations: Custom decks for meetings and roadshows to articulate your story visually.

As Nasdaq highlights, regular meetings with key shareholders are essential for keeping them informed and confident.

Leveraging Technology and Data Analytics

Technology has transformed investor relations. AI tools and market intelligence platforms can make earnings prep fast and easy. Sentiment analysis helps gauge how your messaging is perceived, allowing you to refine your strategy with data. Investor Relationship Management (IRM) systems centralize interaction tracking and contact management. This technology enables data-driven targeting to identify and prioritize the right investors, freeing up your team for high-value strategic work. For startups, these efforts must be supported by a solid understanding of your company’s worth, such as through 409a valuations for startups.

Integrating IR for Maximum Impact: Governance, ESG, and Measurement

For an investor relations strategy to deliver maximum impact, it must be integrated with corporate governance, ESG factors, and meaningful measurement. Shockingly, only one out of 16 companies has formalized feedback loops between shareholders, IR teams, and strategy teams. Closing this gap is essential for gathering market insights. According to EY, 77% of companies have an IR representative attending board meetings, ensuring the board hears what the market is saying. For more on relevant requirements, see our guide on beneficial ownership information reporting.

The Link Between Investor Relations and Corporate Governance

Strong corporate governance builds investor trust, and IR’s role is to communicate those practices. This symbiotic relationship reinforces credibility. Transparent board communication is foundational. By sharing documents like a Board Diversity Policy, committee charters, and codes of conduct, you signal that leadership is accountable and ethical.

Integrating ESG into Your Investor Relations Strategy

ESG (Environmental, Social, and Governance) factors are now a must-have in investor communications. With ESG assets are projected to cross $50 trillion by 2025, investors are using these criteria to evaluate long-term financial stability and risk. You must articulate how your ESG initiatives drive cash flow and create competitive advantages. This isn’t about greenwashing; it’s about transparently reporting your commitment to ethical and sustainable practices in a way that makes business sense.

Measuring Success and ROI

Measuring IR success requires a scorecard approach that blends financial metrics with engagement indicators. Look beyond just stock price to get a complete picture.

| IR KPIs: Financial | IR KPIs: Non-Financial / Engagement |

|---|---|

| Share price performance (relative to peers) | Analyst coverage (number and quality) |

| Valuation ratios (P/E, EV/Sales) | Shareholder composition (long-term vs. short-term, institutional vs. retail) |

| Cost of capital | Investor meeting quantity and quality (feedback, follow-up) |

| Earnings forecast variance | Perception audits (investor surveys) |

| Share price volatility | IR website traffic and engagement |

| Liquidity of shares | Media sentiment and coverage |

Use perception audits to understand how your company is perceived, analyze your shareholder base to spot trends, and track analyst coverage to manage expectations. Combining these metrics provides a comprehensive view of your IR effectiveness, allowing you to refine your approach and ensure your valuation reflects your true worth.

Navigating Challenges and Special Situations

No investor relations strategy is immune to challenges like market volatility or unexpected crises. Your strength is measured by how you handle these moments. With the right preparation, you can strengthen investor relationships rather than damage them. For context, see our guide on fundraising in today’s market.

Preparing for Capital-Raising Events

Capital-raising events like an IPO or Series A are where your IR strategy is put to the test. During an IPO, the IR function is mission-critical. You must craft a compelling S-1 narrative, coordinate intensive roadshows with consistent messaging, and manage a rigorous due diligence process. For earlier-stage companies, the same principles apply, as detailed in our Series A Fundraising Guidelines. This work doesn’t just secure funding; it builds the foundation for your long-term investor relationships.

Managing Crises and Challenging Times

During a crisis, transparency is your lifeline. Don’t hide or sugarcoat bad news—“run to the fire.” When you miss your numbers, long-term investors care more about why you missed than the miss itself. The story behind the numbers carries significant weight.

Your approach should be centered on open, honest communication:

- Take Ownership: Acknowledge the issue promptly and clearly.

- Provide Context: Explain what happened, why, and the potential impact. Don’t leave investors guessing.

- Outline Your Action Plan: Detail the specific steps you’re taking to fix the problem and prevent recurrence.

- Maintain Consistency: Ensure your entire leadership team tells the same story to avoid eroding trust.

Rebuilding trust is a marathon that requires sustained honesty and follow-through. Companies that handle crises well often emerge with stronger investor relationships because they’ve proven their trustworthiness under pressure.

Frequently Asked Questions about Investor Relations Strategy

What is the primary goal of an investor relations strategy?

The primary goal of an investor relations strategy is to ensure a company achieves a fair valuation that accurately reflects its true worth. This is done by effectively communicating the company’s strategy, financials, and vision to the investment community, which builds confidence, stabilizes the shareholder base, and supports access to capital.

What are the most common pitfalls to avoid in investor relations?

Common pitfalls include inconsistent messaging across leadership, a lack of transparency (especially during bad news), poor targeting of investors, and failing to manage expectations. The most fundamental mistake is viewing IR as a purely administrative or compliance function rather than a strategic one that provides valuable market intelligence.

How has the role of investor relations evolved?

Investor relations has evolved from a reactive, communications-focused function to a proactive, strategic one. Modern IROs act as intelligence agents, providing market feedback to management, contributing to strategy, and building deep relationships with the financial community. The emphasis has shifted from explaining what the strategy is to articulating why it creates shareholder value.

Conclusion

An investor relations strategy is not a compliance exercise; it’s the bridge between the value you create and how the world perceives it. A strong bridge makes it easier to raise capital, attract partners, and build a lasting company. The art of attraction in IR comes down to building trust through clear, open, and consistent communication.

Modern IR is a strategic powerhouse that transforms from a cost center into a value driver. By engaging investors proactively, leveraging data, and integrating ESG, companies create sustainable competitive advantages.

For startups, a solid financial foundation is crucial for any IR strategy. You need clean books and strategic guidance to tell a credible story. OpStart provides hands-free, expert-managed financial operations so founders can focus on growth. Our fractional CFO services for startups deliver the leadership needed to build investor confidence from day one.

To stay ahead, download our 2025 US Fundraising Trends Report and learn what investors are looking for now. Your IR strategy is about attracting the right capital from partners who believe in your vision. Build that foundation now to open up what’s possible.