Why Growing Startups Need Strategic Financial Leadership

CFO services for startups provide the strategic financial guidance, planning, and oversight necessary to make data-driven decisions, secure funding, and scale effectively. Key services typically include:

- Financial Planning & Forecasting – Budget creation, cash flow projections, scenario modeling

- Fundraising Support – Pitch deck preparation, financial modeling, investor relations

- Strategic Analysis – KPI tracking, unit economics, profitability analysis

- Compliance & Reporting – Financial statements, board reports, regulatory compliance

- Cash Management – Working capital optimization, burn rate monitoring, runway analysis

As Kate Beard, Head of Operations at Wendy, puts it: “The mental load OpStart has taken off our plates is immense. Plus, it’s up leveled our financial presentations for investors.”

Poor cash flow management is the #1 reason startups fail. Yet many founders find themselves buried in spreadsheets instead of focusing on what they do best—building their product and growing their business.

This is where fractional CFO services become a game-changer. Unlike hiring a full-time CFO (which costs $250,000-$500,000 annually), a fractional CFO provides expert financial leadership at a fraction of the cost. They offer the strategic oversight startups need without the prohibitive overhead.

The challenge isn’t just bookkeeping; it’s having a partner who understands your business model, spots financial risks, and helps you make the strategic decisions that drive sustainable growth. I’m Maurina Venturelli, and I’ve helped high-growth companies steer complex financial challenges from startup to IPO. I’ve seen how the right financial partner transforms overwhelmed founders into confident, data-driven leaders.

The Strategic Role of a Fractional CFO in a Startup

Imagine your startup is a rocket ship. You’re the captain, focused on the mission. A fractional CFO is your expert navigator, charting the course, managing fuel (cash flow), and ensuring you avoid financial black holes. They turn complex data into a strategic asset.

The best part? You get this top-tier expertise at a fraction of the cost of a full-time hire, potentially saving your business between $100,000 to $250,000 annually. Our CFO services for startups provide a clear view of your finances, from fundraising to cash runway, so you can focus on building your business, not wrestling with spreadsheets.

Here’s a quick look at how a fractional CFO stacks up against a full-time CFO:

| Feature | Fractional CFO | Full-Time CFO |

|---|---|---|

| Cost | Lower, flexible retainer fees. | High fixed salary plus benefits. |

| Commitment | Part-time or project-based. | Full-time employment. |

| Expertise | Broad, multi-industry experience. | Deep, single-company focus. |

| Flexibility | Scales with your startup’s needs. | A fixed, less adaptable resource. |

| Hiring Time | Fast onboarding, often in days. | Lengthy recruitment process. |

Core Responsibilities: What to Expect from CFO Services for Startups

A fractional CFO is your strategic financial partner, going beyond basic bookkeeping to focus on forward-looking growth. Key responsibilities include:

- Financial Planning & Forecasting: Creating budgets, cash flow projections, and scenario models.

- Fundraising Support: Assisting with pitch decks, financial models, and investor relations.

- Strategic Analysis: Tracking KPIs, analyzing unit economics, and assessing profitability.

- Compliance & Reporting: Preparing financial statements, board reports, and ensuring regulatory compliance.

- Cash Management: Optimizing working capital and managing your burn rate.

These services provide the financial context to avoid surprises and stay on track. For foundational support, explore our startup accounting services.

Outsourcing vs. In-House: Why Startups Choose Fractional

For many growing companies, the benefits of fractional services are clear:

- Significant Cost Savings: Access top-tier talent for a fraction of the cost of a full-time CFO’s salary, benefits, and bonuses.

- Access to Diverse Expertise: Benefit from a team with experience across various industries and growth stages.

- Flexibility & Scalability: Services adapt to your needs, scaling up for a funding round or down during quieter periods. You only pay for what you need.

- Reduced Hiring Time: Onboard an expert in days, not months, avoiding a long and costly recruitment process.

- Focus on Your Core Business: Free up your time and mental energy to focus on product development and customer acquisition.

We bridge the gap between needing strategic guidance and affording a full-time executive. Learn more about the differences between financial roles.

When Should a Startup Hire a Fractional CFO?

Don’t wait for a financial crisis. Bringing in a fractional CFO early can prevent costly mistakes and accelerate growth.

Consider hiring a fractional CFO when you are:

- Securing Funding: They prepare compelling investor materials and provide the objective data VCs want to see.

- Experiencing Rapid Growth: They help manage increasing financial complexity, optimize cash flow, and implement scalable processes.

- Facing Complex Financials: They bring specialized expertise for intricate revenue models, international operations, or M&A preparation.

- Wanting to Prevent Mistakes: They establish best practices early to avoid common pitfalls in cash management and pricing.

- Preparing for an Exit: They guide you through due diligence and optimize your financial position to maximize valuation.

How Fractional CFO Services for Startups Drive Growth and Secure Funding

When you’re pitching investors, you need more than a great product—you need solid numbers to back it up. CFO services for startups transform your financial data into a strategic roadmap that drives growth and attracts capital. We act as your financial co-pilot, helping you steer the complexities of startup finance, including specialized support like 409A valuations for startups, which are crucial for managing equity and attracting top talent.

Navigating Key Financial Challenges

Startup finances can be a minefield. In fact, poor cash flow management is the #1 reason startups fail. It’s not a lack of vision, but running out of money that derails most promising companies.

We help founders avoid common pitfalls like mispricing products, failing to track key performance indicators (KPIs), and mismanaging their burn rate. Our fractional CFOs analyze your unit economics, identify the metrics that matter, and help you optimize spending to extend your runway and hit your next milestone. We act as your financial early warning system, fireproofing your operations so you can grow with confidence.

Acing Fundraising and Investor Relations

Raising capital requires a solid financial foundation. Our CFO services for startups help you build investor confidence through:

- Robust Financial Modeling: We create forecasts and scenarios that investors want to see, articulating your path to profitability.

- Pitch Deck Preparation: We translate complex numbers into clear, persuasive slides that tell a compelling financial story.

- Due Diligence Support: With clean books and detailed documentation, you’ll be ready to answer any investor question with confidence.

- Strategic Investor Communication: We help you craft insightful reports that build trust and maintain strong investor relationships.

- Cap Table Management: We manage your equity structure, including ESOPs, ensuring it’s clean, accurate, and ready for investor review.

For a deeper understanding of the financial statements investors scrutinize, check out our guide on how to read a P&L.

Strategic Planning and Forecasting for Growth

Growth without a plan is chaos. Our CFO services for startups focus on forward-looking strategy:

- Precision Budgeting: We create realistic budgets aligned with your strategic goals, ensuring every dollar is used effectively.

- Scenario Analysis: We model “what-if” scenarios (best-case, worst-case) so you can prepare for multiple outcomes and make proactive decisions.

- Revenue Modeling: We analyze your revenue streams to identify growth drivers and assess the impact of different sales strategies.

- Strategic Resource Allocation: We provide the financial insights needed to decide where to invest next—be it in hiring, product development, or market expansion.

By integrating forecasting and budgeting into your operations, we help you steer challenges and seize opportunities. Stay ahead of the curve by understanding the 2025 fractional CFO trends that will shape financial strategy for growing startups.

Mastering Day-to-Day Finances: Operations, Risk, and Reporting

While a grand vision is vital, day-to-day financial management is where startups either thrive or falter. Our CFO services for startups handle these crucial operational elements, from financial housekeeping to internal controls, freeing you to focus on innovation and growth. For those just starting, our bookkeeping for startups services are the perfect entry point.

Cash Flow Management and Budgeting

Cash flow is the lifeblood of any startup. We help you master it by:

- Monitoring Cash Runway: We track your burn rate and project how long your funds will last, which is crucial for planning.

- Optimizing Working Capital: We streamline accounts payable and receivable to improve cash flow.

- Budget vs. Actuals Reporting: We compare your plan against reality, allowing for quick adjustments to stay on track.

To better understand your business’s financial health, learn how to read a cash flow statement.

Risk Management and Compliance

Navigating business regulations can be complex. A fractional CFO acts as your guide, ensuring your startup is protected.

- Regulatory Compliance: We ensure your financial practices adhere to all relevant regulations.

- Tax Strategy and Compliance: We help simplify your tax strategy, ensuring you meet all requirements and take advantage of opportunities like R&D tax credits. Learn more in our guide to taxes for startups.

- Internal Controls: We implement strong controls to safeguard assets, prevent fraud, and ensure accurate reporting.

- Financial Risk Mitigation: We identify potential risks and develop strategies to minimize their impact.

Financial Reporting and Analysis

Accurate, timely reporting is the foundation for smart decisions and investor confidence. Our CFO services for startups provide clear insights into your financial health.

- Accurate Financial Statements: We ensure your P&L, Balance Sheet, and Cash Flow statements are always accurate, complete, and US GAAP compliant, keeping you “diligence ready.”

- KPI Tracking: We define and track the Key Performance Indicators (KPIs) most relevant to your business.

- Board and Investor Reports: We prepare clear, professional reports for your stakeholders to communicate your financial story effectively.

Understanding the nuances of financial reporting, such as cash vs. accrual accounting, is key to accurate analysis.

Choosing and Evaluating Your Fractional CFO Partner

Finding the right fractional CFO is a critical decision for your startup’s financial future. You need a trusted advisor who understands the startup journey—the funding pressures, rapid growth, and the need to do more with less. For a comprehensive list of questions to ask potential partners, check out our guide on hiring a fractional CFO.

Essential Qualities to Look For in a Startup CFO

When evaluating CFO services for startups, look for these key qualities:

- Startup Experience: They should have a proven track record of navigating the unique challenges of early-stage growth and fundraising.

- Strategic Vision: A great CFO sees beyond the numbers to spot opportunities and risks, helping you plan where your money should go next.

- Adaptability: The startup world is dynamic. Your fractional CFO must be able to pivot quickly, adjusting strategies as your business evolves.

- Strong Communication Skills: They must translate complex financial concepts into plain English for you, your team, and your investors.

- A Founder’s Mentality: The best fractional CFOs understand that every dollar matters and that calculated risks are necessary for growth.

Measuring the ROI of CFO Services for Startups

The value of CFO services for startups goes far beyond a simple spreadsheet. Key benefits include:

- Improved Cash Flow: Better management of receivables and payables extends your runway.

- Cost Savings: Avoid the high cost of a full-time hire and benefit from expert expense management.

- Successful Fundraising: A well-prepared financial model and clean books can be the difference-maker in closing your funding round.

- Increased Valuation: Professional financial operations make your company a more attractive and valuable investment.

- Founder Time & Peace of Mind: As one client said, it’s the “peace-of-mind that someone 10x better than us knows what is going on.” Free yourself from financial worries to focus on your core business.

For a deeper dive, explore our analysis of fractional CFO ROI.

Typical Costs and Engagement Models

Fractional CFO services for startups offer flexible and affordable engagement models compared to a full-time hire (which can cost $250,000-$500,000+ annually).

- Retainer Models: A flat monthly fee for ongoing strategic support, providing predictable costs. This is OpStart’s preferred model for its transparency.

- Project-Based Fees: A fixed price for specific needs, like preparing for a funding round or an audit.

- Hourly Rates: Best for ad-hoc tasks, though a retainer often provides better long-term value.

These models allow you to access top-tier financial expertise that scales with your startup’s growth, saving you $100,000-$250,000 annually compared to a full-time CFO.

Frequently Asked Questions about CFO Services

Here are answers to some common questions about CFO services for startups.

How do fractional CFO services adapt as a startup grows?

Our services are designed to scale with you.

- Early Stage: We focus on building a solid financial foundation, including proper bookkeeping, compliance, and initial financial models.

- Growth Stage: As you secure funding and scale, we shift to more complex tasks like analyzing unit economics, advanced forecasting, and optimizing operations for growth.

- Late Stage/Exit: When you’re preparing for a major milestone like an IPO or acquisition, we provide expert support for due diligence, capital structure optimization, and M&A advisory.

The goal is to provide the right level of financial guidance at every stage of your journey.

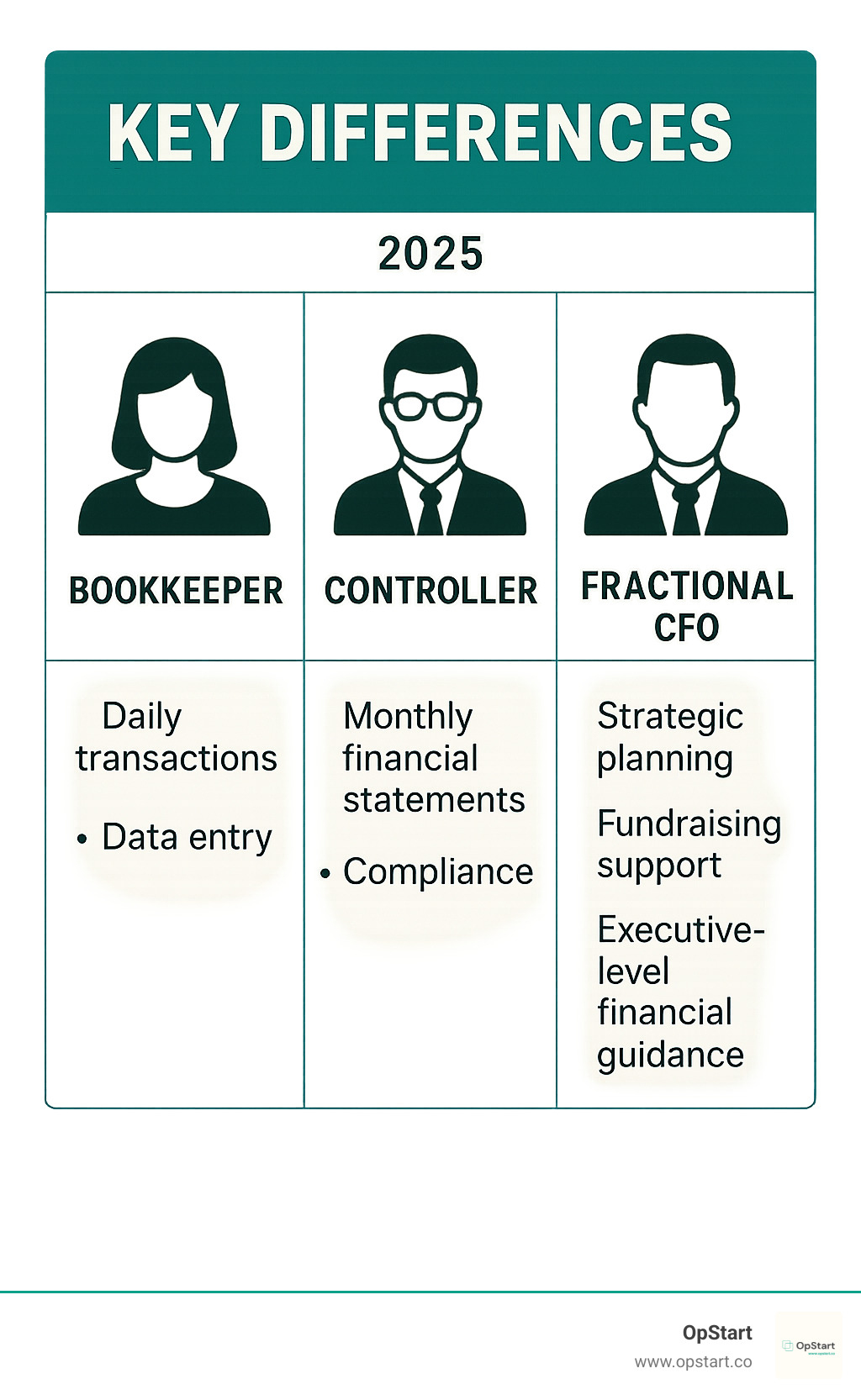

How does a fractional CFO differ from a CPA or bookkeeper?

Think of it this way:

- Bookkeeper: Records past transactions.

- CPA: Audits past transactions and ensures tax compliance.

- Fractional CFO: Uses financial data to shape the future. They focus on strategic planning, fundraising, and high-level decision-making to drive growth.

While all three roles are important, a fractional CFO provides the forward-looking strategic leadership that startups need to succeed. Learn more about the differences between these financial roles here.

How can a fractional CFO help optimize a startup’s capital structure?

Optimizing your capital structure means finding the right mix of debt and equity to fund your growth. A fractional CFO is key to this process by:

- Analyzing Debt vs. Equity: Helping you decide whether to take on loans or sell ownership stakes.

- Structuring Funding Rounds: Advising on the timing and terms of fundraising to maximize valuation and protect founder interests.

- Managing Your Cap Table: Ensuring your capitalization table is accurate and managing employee stock option plans (ESOPs).

- Supporting Valuation: Providing the data and analysis needed to justify your company’s valuation to investors.

- Planning for an Exit: Guiding you through the financial complexities of an acquisition or IPO to maximize your return.

In short, a fractional CFO helps build a strong financial foundation that supports ambitious growth while maintaining flexibility and control.

Conclusion

Building a successful startup requires a strong financial foundation. CFO services for startups provide the strategic advantage you need to manage cash flow, secure funding, and make data-driven decisions that accelerate growth.

By outsourcing this critical function, you free yourself from complex financial tasks and gain the peace of mind that comes from having an expert on your team. As one of our clients said, “The mental load OpStart has taken off our plates is immense.”

At OpStart, we provide comprehensive financial operations that scale with you—from bookkeeping to board-level strategy—all for a flat rate. We integrate with your existing tools to provide a seamless experience.

Ready to take control of your startup’s financial future? Get expert bookkeeping and financial guidance for your startup and see what it’s like to have true financial clarity.